Contact Your Former Employer

The first place you should look is your prior employer. Contact their human resources department. There, they should have all of the information as to the whereabouts of the 401 account you had with them.

They should send you the proper paperwork and be able to facilitate the transfer of your funds to whatever account you choose.

If they are unable to locate any information on your account, they should be able to provide you the contact information of the administrator who handled your 401 on their behalf.

Let the administrator know your situation, and just like the HR department, should be able to assist you in moving your money properly.

Us Department Of Labor

Even if your former employer abandoned its retirement plan, your money isnt lost forever. The U.S. Department of Labor maintains records for plans that have been abandoned or are in the process of being terminated. Search their database to find the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Federal Insurance For Private Pensions

If your company runs into financial problems, you’re likely to still get your pension.

-

Insures most private-sector defined-benefit pensions. These are plans that typically pay a certain amount each month after you retire. These are single-employer plans. Multi-employer plans have different coverage.

-

Covers most cash-balance plans. Those are defined-benefit pensions that allow you to take a lump-sum distribution.

-

Does not cover government and military pensions, 401k plans, IRAs, and certain others.

Don’t Miss: What Is The Difference In An Ira And A 401k

Option : Move The Money To An Ira

If you’re not able to transfer the funds to your current 401 or you don’t want to, you can roll over the funds to an IRA instead. The process is the same as doing a rollover to a new 401, and you still have the choice between a direct or indirect rollover.

You’ll need to set up a new IRA with any broker if you don’t already have one. Make sure you choose an IRA that’s taxed the same way as your old 401 funds. Most 401s are tax-deferred, which means your contributions reduce your taxable income in the year you make them, but you pay taxes on your withdrawals in retirement. You want a traditional IRA in this case because the government taxes these funds the same way.

If you had a Roth 401, you want a Roth IRA. Both of these accounts give you tax-free withdrawals in retirement if you pay taxes on your contributions the year you make them.

In most cases, losing track of your old 401 doesn’t mean the money is gone for good. But finding it is only half the challenge. You must also decide where to keep those funds going forward so they’ll be most useful to you. Think the decision through carefully, then follow the steps above.

Find Your 401s With Your Social Security Number

If you don’t have any of the information mentioned above, you’re not out of luck just yet. You can use your social security number to search for and find old 401s.

When you join a 401 at work, you’ll provide your social security number. This ties your 401 to any tax responsibilities you may have but also permanently stamps your 401 to your identity.

There are a couple of places to search for your old 401s using your social security number.

Read Also: Can I Use My 401k To Invest In A Business

If Your Spouse Was Over Age 72 And You Are Over Age 72

If your spouse was over age 72 and had already started taking required minimum distributions at the time of death, and you are also over your RMD age, the rule is that you must continue to take out at least the required minimum distributions. This could happen in a few ways.

- You can roll the funds over to your own IRA, called a spousal IRA. With this option, you would take required distributions based on your age and the Uniform Lifetime Table. If you wish, you can take out more than this amount, but not less. You would name your own beneficiaries with this option. For most people, this is the best option.

- You can leave the money in the plan, continuing the distributions according to the required minimum distribution schedule that applied to your spouse. If you choose, you can take out more than this amount, but not less. The beneficiary designations set up by your spouse continue to apply.

- You can roll the funds over to a specific type of account called an inherited IRA. With an inherited IRA, you would take required distributions based on your single life expectancy table. If you want, you can take out more than this amount, but not less. You would name your own beneficiaries with this option.

If you and your spouse were about the same age, the choices above would result in about the same required distribution. However, rolling it over to your own IRA may provide additional options for your future beneficiaries.

Look At State Unclaimed Money Websites

While youre looking for your retirement money, you might as well check for any other lost dough. When Florida nurse Mary Pitman ran a random search on Missingmoney.com, a database maintained by the National Association of Unclaimed Property Administrators, she found $2,500 in stocks left behind when her father died.

I became a believer real quick, says Pitman, who wrote The Little Book of Missing Money to help others find lost cash. The unclaimed property administrators group also maintains unclaimed.org, which points users to databases of missing cash turned over to individual state treasuries.

Run a search based on states where you once lived or worked to find money owed to you. Most missing 401 plans wouldnt be turned over to a state, officials say, but vested company stocks, forgotten bank accounts, uncashed paychecks or utility deposits are commonly turned over to state treasuries. In 2015 alone, $7.8 billion in missing money was turned over to states, according to the NAUPA.

You May Like: How Do You Find An Old 401k

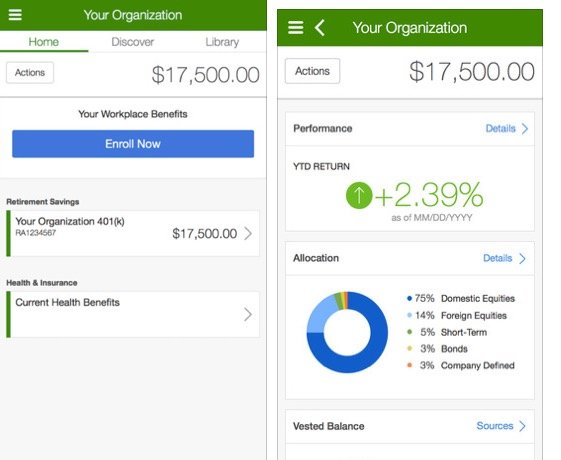

How Do I Manually Enter 401 Transactions

- Created by , last modified on

If you set up a tax-deferred investment account to track your 401, you can manually enter 401 transactions in the investment transaction list, just as you would for a regular investment account. This is the most time-consuming way to track a 401. You must enter each Buy/Sell transaction for each individual security, either from your statement or from transaction-level information posted to your financial institution’s website.

If you want this kind of transaction-level detail, investigate whether your financial institution provides online account services through Quicken.

Other Ways To Find Lost Money

If you are hoping to find lost money, you might want to start by creating a comprehensive and detailed retirement plan. This enables you to:

- Document what you have right now.

- Take stock and think about what might be missing.

- Learning about what you need for a secure retirement is a great way organize your financial life.

- Discover opportunities to make more out of what you have. People who use the NewRetirement retirement planner typically improve their plans by thousands of dollars in their first session with the tool.

Don’t Miss: How To Find A Deceased Person’s 401k

How To Track Down That Lost 401 Or Pension

Can’t Find your old 401 or that old pension? Here is how to track your money down. Shutterstock

At least once every few months a long-term client brings in a retirement account statement and says, I forgot I had this retirement account. Can you help me with it? Sometimes these accounts are tiny but other times they hold a substantial amount of money. All of them are old, and havent been looked at in years. If you find yourself in this position, follow these steps to locating your 401 or other retirement accounts from previous employers.

Do you ever feel like you know you saved more for retirement than your statements indicate? Are you certain you must have forgotten about an old retirement account or pension with a previous employer? You likely arent crazy, and youre definitely not alone.

Americans lost track of more than $7.7 billion worth of retirement savings in 2015 alone by accidentally and unknowingly abandoning their 401.– USA Today, February 25, 2018

The days of graduating college, getting a corporate job and staying with the same employer until the retirement age of 65 are long gone. Today, people are jumping from job to job which often leaves a trail of old retirement accounts and even a few pensions. Because of this, a surprising number of people lose track of these old accounts. Forgetting about these accounts can really hurt your overall retirement security when you factor in compounding interest.

How to Start Your Search for Lost Retirement Assets

Looked For Unclaimed Money

“Ghosted” 401 money certainly qualifies as missing money, and it could be uncovered on digital money-funder platforms like missingmoney.com.

The site, run by the National Association of Unclaimed Property Administrators, runs free searches for not just retirement funds, but for money in old bank accounts, safe deposit boxes, escrow accounts, and insurance policies. According to the website’s directions, if you get a “hit” on the site, just claim the property and fill out the requested details, then submit and you will receive instructions on the next steps from the state where you made the claim.

Also Check: Can 401k Be Transferred To Another Company

How Do I Find Out About Deceased Fathers Accounts 401k Retirement

- Posted on Jan 17, 2012

In order to be considered your fathers heir, you are going to have to start some sort of heirship proceeding in North Carolina where at the end of the day, you are declared the sole heir of your fathers estate. Before even going to that expense, I would see what kind of assets he has. Some private investigators do this type of work. There used to be a web site.. www.missingmoney.com that would search all the states unclaimed property databases for a specific name to see if something was being held. In any case you are going to want to talk to a local probate attorney and get some ideas on which way to head.

Hope this helps. If you think this post was helpful, please check the asnwer was a good answer tab below.Thanks.Mr. Geffen is licensed to practice law throughout the state of Texas with an office in Dallas. He is authorized to handle IRS matters throughout the United States and is licensed to practice in US Tax Court as well as The Court of Claims.This answer is provided as a public service and as a general response to a general question, it is not meant, and should not be relied upon as specific legal advice, nor does it create an attorney-client relationship.

Determine If Your 401 Account Was Rolled Over To A Default Ira Or Missing Participant Ira

One possibility is your employer rolled the funds over into a Default IRA.

If your employer tried to contact you for instructions as to what to do with your account balance, and you fail to respond, you may be deemed a non-responsive participant.

If they are unable to locate you altogether, you may be deemed a Missing Participant.

In either scenario, if the plan is being terminated, your employer may have put the funds in a Missing Participant Auto Rollover IRA.

This is an IRA account set up on your behalf to preserve your retirement assets until they are claimed by you or your beneficiaries under Department of Labor regulations.

To qualify for a Missing Participant or Default IRA, the account balance must be greater than $100 but less than $5,000 unless the funds are coming from a terminated plan, then the $5,000 ceiling is waived.

Finding a Missing Participant IRA

If your money has been transferred to a Missing Participant IRA, you should be able to find it by searching the FreeERISA website.

This search is slightly more time consuming than the national registry. Registration is required to search the database, which contains 2.6 million ERISA form 5500s, covering 1.3 million plans and 1 million plan sponsors.

If you know your money has been transferred to one of these default accounts, you should get it out into a standard IRA account.

Typically, these accounts must be interest-bearing, bear a reasonable rate of return, and be FDIC insured.

Here’s the bad part:

Also Check: Should I Transfer 401k To Roth Ira

If You Find The Money

What to do with your 401 funds when you find the account largely depends on where you find it.

If the account resides in your employer’s plan, you do have the option to leave the money and the account there — just note you can no longer contribute money to it.

To get back in the game with your sidelined 401, roll it over into an individual retirement account or a current employer’s 401 plan. That way you can put the fund money to work by investing in stocks, bonds and funds that appreciate in value and accumulate more money for your retirement, on a tax-efficient basis.

How Do I Know If My Retirement Savings Is On Track

Asked by: Aiden Heller

To find your savings benchmark, look for your approximate age, and consider how much you’ve saved so far for retirement. Compare that amount with your current gross income or salary. For example, a 35-year-old earning $60,000 would be on track if she’s saved about one year of her income, or $60,000.

Also Check: How To Claim 401k From Previous Employer

How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

How Many Americans Are Behind On Retirement Savings

To that point, 52% of working Americans feel they are behind on their retirement savings, according to a new survey from Bankrate.com. They may be on to something. There’s a $4 trillion difference between the retirement savings workers will need and what they have actually accumulated, T. Rowe Price estimates.

You May Like: When Can You Take Out Your 401k Without Penalty

Tracking Down Your Plan

If you think youve lost track of a savings plan, search your files for old retirement account statements. These should provide some key data to help your search, such as your account number and contact information for the plan administrator. If you dont have any statements, contact your former employers human resources department.

If your employer filed for bankruptcy, your 401 balance is protected from creditors and is likely still held at the investment company that administered your plan. In the case of a pension, it was either taken over by an insurance company or the federal Pension Benefit Guaranty Corp., which protects traditional pensions. You can track down your pension at pbgc.gov/search-all.

Its also possible that your employer turned over your 401 balance to your states unclaimed property fund. Your states treasury department should offer an online service that lets you search for your money. You can also check the National Registry of Unclaimed Retirement Benefits.

Roll Over The Old 401 Account Into Your Current Employers Plan

By rolling the old account into your current employers plan, youll be able to keep all your 401 accounts in one place, making it easier to keep track of them. However, most 401 plans have a limited number of investment offerings, so if youre not happy with your current plans options, youre probably better off rolling the old account into an IRA.

Don’t Miss: How To Invest 401k In Stocks

What Is A 401 Account

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

Next Steps For Your Money

If your old 401 plan is still with a former employer, one option is to leave the money there. But you may not pay as much attention to the account, which could lead to a portfolio thats not appropriate for your age and risk tolerance.

If youre still working and have a 401 at your new job, another option is to roll over the funds into your existing plan, assuming your employer allows it. Another option is to roll the money into an IRA. Having your savings in one place will make it easier to manage your investments.

If youve lost track of a pension, request a pension benefits statement from the plan administrator. Give the administrator your address and phone number so it can reach you to begin payments. You may need to prove your work history and eligibility for the pension you can do so by providing the plan administrator with old W-2 forms or an earnings statement from Social Security, which you can get by filing Form SSA-7050. You can get this form at www.socialsecurity.gov/online/ssa-7050.pdf or by calling Social Security at 800-772-1213.

Also Check: How Do You Find Out Your 401k