Move Your Retirement Savings Directly Into Your Current Or New Qrp If The Qrp Allows

If you are at a new company, moving your retirement savings to this employers QRP may be an option. This option may be appropriate if youd like to keep your retirement savings in one account, and if youre satisfied with investment choices offered by this plan. This alternative shares many of the same features and considerations of leaving your money with your former employer.

Features

- Option not available to everyone .

- Waiting period for enrolling in new employers plan may apply.

- New employers plan will determine:

- When and how you access your retirement savings.

- Which investment options are available to you.

Note: If you choose this option, make sure your new employer will accept a transfer from your old plan, and then contact the new plan provider to get the process started. Also, remember to periodically review your investments, and carefully track associated paperwork and documents. There may be no RMDs from your QRP where you are currently employed, as long as the plan allows and you are not a 5% or more owner of that company.

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

How Much Do I Contribute

The amount you contribute is based on your employment income. Starting in 2019, the amount you contribute will be affected by the CPP enhancement.

You make contributions only on your annual earnings between minimum and maximum amounts. These are called your pensionable earnings. The minimum amount is frozen at $3,500.

The earnings ceiling in the CPP is set each January, based on increases in the average wage in Canada. In 2022, the CPP earnings ceiling is $64,900. The contribution rate on these pensionable earnings is 11.4% , the contribution rate is split equally between you and your employer.

If you are self-employed, you pay the full 11.4%. Your contributions are based on your net business income . You do not contribute on any other type of income, such as investment earnings. If, during a year, you contributed too much or earned less than the set minimum amount, your contributions will be refunded when you file your income taxes.

The maximum contribution to the base CPP for employers and employees in 2022 is $3,499.80.

If you are self-employed, the maximum contribution is $6,999.60.

For more information on contribution rates in the base CPP, visit CPP contribution rates, maximums and exemptions.

Recommended Reading: What Happens To Your 401k When You Die

Understand The Value Of An Employer Match

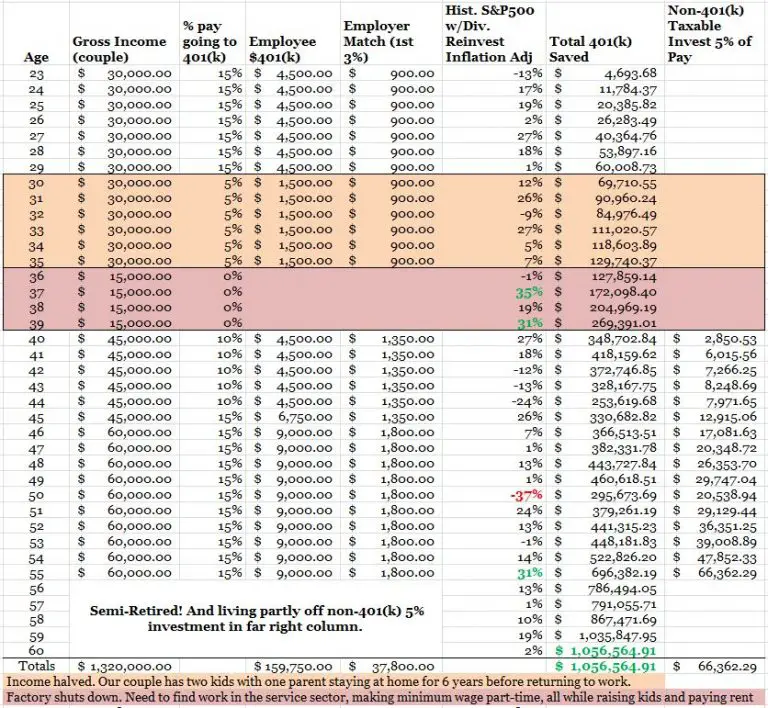

A 401 or similar employer-sponsored retirement plan can be a powerful resource for building a secure retirementand an employer match can add a substantial amount to your nest egg. Lets assume you are 30 years old, make $40,000 and contribute 3 percent of your salary$1,200to your 401. And, for the sake of this example, lets assume you continue to make the same salary and the same contribution each year until you are 65. After 35 years, you will have contributed $42,000 to your 401.

Now lets assume you get a match from your employer. One of the most common matches is a dollar-for-dollar match up to 3 percent of the employees salary. Taking full advantage of the match literally doubles your savings, even assuming no increase in the value of your investments: Instead of having set aside $42,000 by the time you retire, you will have set aside $84,000, with $42,000 in free contributions. Look at it this way: its a no-cost way for you to increase your contributions by 100 percent.

In reality though, the impact will be even bigger than that. Thats because when you invest money its value compounds. Check out The Time Is Now: The True Value of Time for Young Investors to learn how taking full advantage of a match early in your career can add up.

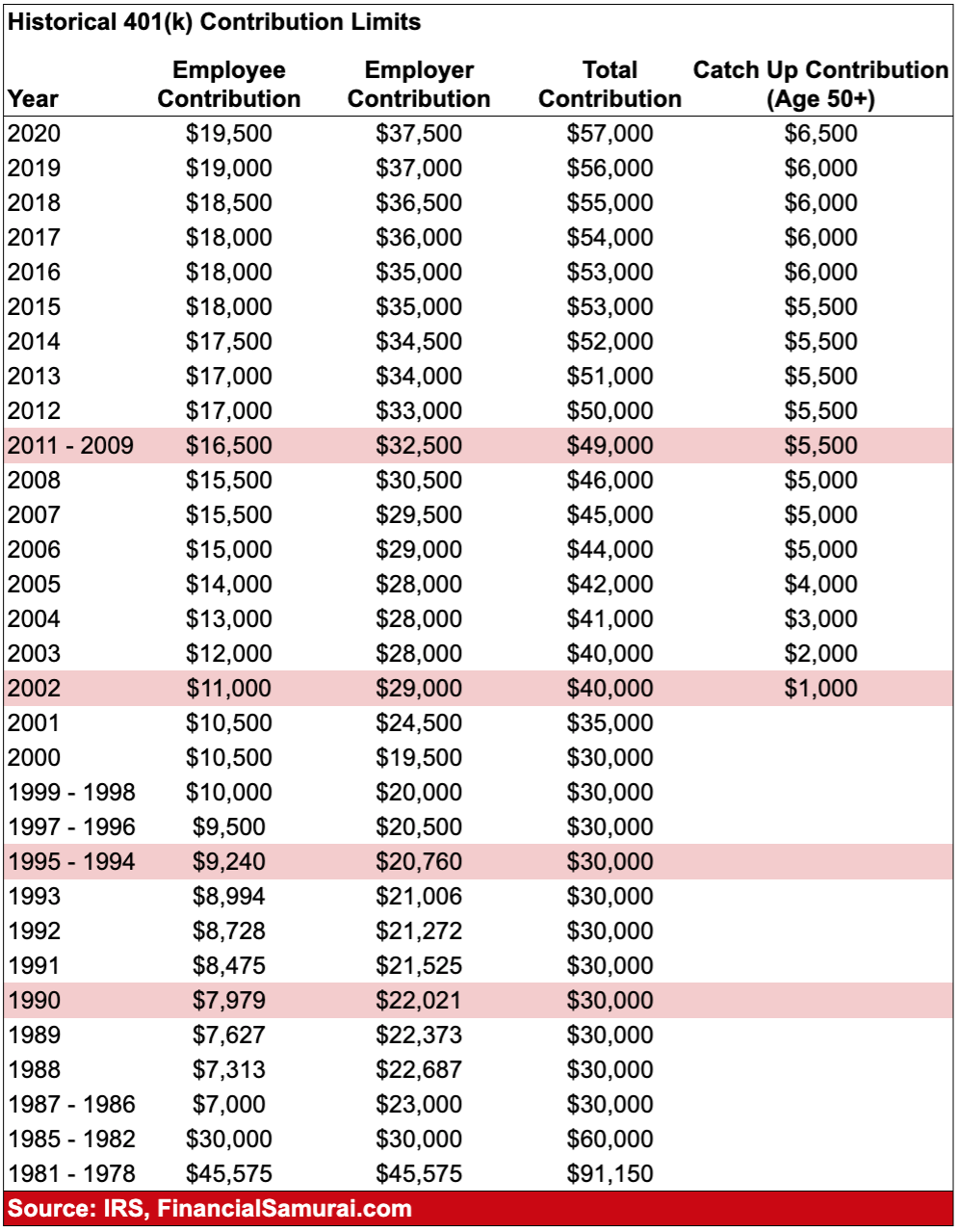

What Is The Maximum 401k Contribution For 2022

That depends on your employer’s plan. The maximum the IRS allows for 2022 rose by $1,000 from last year. Currently, the cap sits at $20,500, but your employer may cap the amount below that. For people over 50, the maximum increases to help them “catch up” before their retirement. They can contribute an additional $6,500 a year.

Recommended Reading: How To Collect Your 401k

The Effect Of A Few Percentage Points Over Time

When determining what to contribute, dont set your sights too low: A couple of percentage points can make a big difference.

Even if you start small, its important to start saving as early as you can and let time do the work of accumulating interest for you. Make a goal to increase your contribution each year and stick to it.

For example, this graph shows how much someone earning $60,000 annually would save after 30 years, investing at different levels. In this example, a couple of percentage points can be worth more than $150,000 in the end.

Potential value after 30 years

$ thousands

Example is for illustration purposes only. Assumes $60,000 salary, bi-weekly contributions, 3% annual pay increase, and a 7% rate of return. Investments will fluctuate and when redeemed, may be worth more or less than originally invested. Balances shown are pre-tax and are subject to income taxes upon distribution. Values do not account for fees and expenses.

This information is a general discussion of the relevant federal tax laws provided to promote ideas that may benefit a taxpayer. It is not intended for, nor can it be used by any taxpayer for the purpose of avoiding federal tax penalties. Taxpayers should seek the advice of their own advisors regarding any tax and legal issues specific to their situation.

What Is The Main Benefit Of A 401

A 401 plan lets you reduce your tax burden while saving for retirement. Not only are the gains tax-free but it’s also hassle-free since contributions are automatically subtracted from your paycheck. In addition, many employers will match part of their employee’s 401 contributions, effectively giving them a free boost to their retirement savings.

You May Like: How Do I Set Up A 401k Plan

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck – no effort required. The money that doesn’t go to the employee’s take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.

What Is A 401 Account

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

Recommended Reading: When Do You Have To Take 401k Distributions

Why Do Employers Match 401s Anyways

401s and other defined contribution plans are more cost-effective for the employer than managing a traditional pension plan funded entirely by the company, and are also preferred by most private-sector employees.

While an employer match is not required by the IRS, this company match can be a selling point for recruiting employees particularly if competing firms are offering a generous 401 matching plan.

Employers also get tax benefits for contributing to 401 accounts employer matches can be deducted on their federal corporate income tax returns, and theyre often exempt from payroll taxes and state taxes as well.

Taking Withdrawals From A 401

Once money goes into a 401, it is difficult to withdraw it without paying taxes on the withdrawal amounts.

“Make sure that you still save enough on the outside for emergencies and expenses you may have before retirement,” says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas. “Do not put all of your savings into your 401 where you cannot easily access it, if necessary.”

The earnings in a 401 account are tax-deferred in the case of traditional 401s and tax-free in the case of Roths. When the traditional 401 owner makes withdrawals, that money will be taxed as ordinary income. Roth account owners have already paid income tax on the money they contributed to the plan and will owe no tax on their withdrawals as long as they satisfy certain requirements.

Both traditional and Roth 401 owners must be at least age 59½or meet other criteria spelled out by the IRS, such as being totally and permanently disabledwhen they start to make withdrawals.

Otherwise, they usually will face an additional 10% early distribution penalty tax on top of any other tax they owe.

Some employers allow employees to take out a loan against their contributions to a 401 plan. The employee is essentially borrowing from themselves. If you take out a 401 loan, please consider that if you leave the job before the loan is repaid, you’ll have to repay it in a lump sum or face the 10% penalty for an early withdrawal.

Don’t Miss: How To Find Your 401k Plan

Ira Rollover Without An In

You can roll over after-tax contributions to a Roth IRA, and it is possible to do that before age 59½. There is a big catch though: Not all plans allow withdrawals while youre still with the company and your retirement plan may have some rules around the requirements for rolling out of the plan. In-service withdrawals come with some potentially complicated rules so its important to understand the rules the IRS has and those of your retirement plan.

In general, to roll after-tax money to a Roth IRA, earnings on the after-tax balance must, in most cases, also be withdrawn. You may have a few options.

If you have both pre-tax and after-tax contributions, you may be able to take a partial distribution from your retirement plan, consisting of just one or the other, if the plan separately tracks the sources of all of your contributions. In that case, you may want to roll out only the after-tax source balances and associated earnings directly into a Roth IRA.

The pre-tax contributions, along with the earnings from both the pre-tax and the after-tax contributions, can be rolled to a traditional IRA, incurring no current income tax.

Alternatively, you can roll everything into a Roth IRA, but you would need to pay income taxes on the pre-tax contributions and all of the earnings.

Important note: Any partial withdrawals or in-plan conversions may affect eligibility for net unrealized appreciation treatment on appreciated employer stock held in the plan.

Be Sure To Consider All Your Options

Making after-tax contributions and then converting to Roth may seem complicated, but the long-term benefits can make it worthwhile. But bear in mind: there can be benefits to keeping your money in the workplace savings plan. Balances in your workplace retirement account may be available for loans, if your plan allows them, while balances in an IRA are not. On the other hand, IRAs have certain advantages as well. For instance, you may be able to get a broader range of investment choices. So it’s a good idea to check with your financial advisor and tax advisor before choosing a strategy.

Don’t Miss: Is Roth Better Than 401k

How Is An Ira Different From 401k

401k accounts are associated with your employment, as contributions are taken out of your wages before taxes. A traditional IRA is similar to a 401k in that contributions aren’t taxed , but the key difference is that they are independent of your employer.

A Roth IRA is also independent, but contributions are made after taxes. Withdrawals from your Roth IRA are tax-free, which makes them a smart choice if you think taxes will be higher in the future.

Look For Contact Information

If you don’t know how to contact your former employer — perhaps the company no longer exists or it was acquired or merged with another company — see if you have any old 401 statements. These should have contact information to help put you in touch with the plan administrator.

If you don’t have an old 401 statement handy or yours doesn’t tell you what you need to know, visit the U.S. Department of Labor website and look up your employer. There you should find your old retirement account’s tax return, known as Form 5500. That will most likely have contact information for your 401’s plan administrator.

Don’t Miss: How Does 401k Match Work

What Is A Roth Ira

A Roth IRA is a type of individual retirement account similar to traditional IRAs in many ways, but with some significant differences. One of the main differences is in the tax breaks. With a traditional IRA, the money you put in isn’t taxed with a Roth IRA, the money you take out isn’t taxed. Roth IRAs also have no requirements on when the money must be taken out, so they can be a good tool to pass along wealth to your beneficiaries if you find you don’t need the money in retirement.

Locate Where Your 401s Are

Before you can check how much is in your 401 account, you need to know where your 401s are.

The first place to look is the company with whom you’re currently working. Many companies have implemented auto-enrollment into their 401 plans, ensuring that most of their employees contribute to their retirement. Otherwise, participation may drop because they simply forgot or didn’t know it was available.

Contact your human resources department to get information on if you’re contributing to their 401 and your account information.

Additionally, if you’ve changed jobs a few times in your career, you may have old 401 outstanding in different places. Locating old 401s can be a tricky process as it requires much coordination and hunting down various entities and contacts.

If you’re unsure if you have outstanding 401s with old companies, we can help. Beagle will find any old 401s you have, identify any hidden fees, and provide options to consolidate into one, easy-to-manage account. Sign-up only takes a couple of minutes and Beagle will help you find all your 401 accounts!

Even misplacing one 401 from a previous employer could cost you thousands in potential retirement funds.

Read Also: How Does 401k Work In Divorce

Related Codes Used For W

If you are filing taxes on your own, you should understand the various W-2 box 12 codes. The common codes used for Box 12 include:

D: Elective deferrals under section 401 plan. Deferrals under a SIMPLE 401 are also recorded in this section. If an employee contributes to a 401, enter code D and write the amount contributed.

E: The amount of salary deferred under section 403 salary reduction agreement. If an employee contributes to a 403, enter Code E and write the amount contributed.

F: The amount of salary deferred under section 408 salary reduction agreement. If an employee contributes to a 408 account, including a, write F and enter the amount contributed in Box 12.

G: Elective and non-elective deferrals made to a section 457 compensation plan. A 457 retirement plan is used for government-owned businesses such as hospitals. If an employee contributes to a 457, write G and record the amount contributed to the plan.

H: The amount of salary deferred to a section 501 tax-exempt organization retirement plan. If an employee contributes to a 501 account, enter H and record the amount contributed in Box 12 and Box 1 .

S: The amount of salary deferred under section 408 SIMPLE IRA retirement plan. If an employee contributes to a SIMPLE IRA, enter S and record the amount contributed in Box 12.

BB: Amount of salary deferred to a Roth 403 retirement plan. If an employee contributes to a Roth 403 account, record the amount contributed in Box 12.

K Search Find And Claim Missing 401 Retirement Plan Benefits

The U.S. Department of Labor estimates each year 2.8 million workers fail to claim or rollover $155 billion in 401k retirement plan assets when they change jobs. In total, 24 million participants are owed unclaimed funds totaling $1.33 trillion. A disproportionate share of the missing are family members of deceased employees who fail to claim pension benefits stemming from employment that may have ended years earlier.

Another increasingly common problem: former employees of bankrupt companies unable to locate their 401 accounts, because many insolvent businesses fail to provide for the administration of 401k plan assets when they cease operations. Participants in defined-contribution retirement plans such as the 401 are protected when their employers fail or otherwise cease operations, because they individually own the assets in their accounts.

This differs from employees with traditional pension plans, which are subject to the solvency of the employer but may be protected against loss by the Pension Benefit Guaranty Corporation, the federal agency responsible for the regulation of private pension plans.

Note: For assistance with a missing defined-benefit pension, go to: Unclaimed Pension Search. For assistance with a lost IRA, go to: Unclaimed IRA Search.

If you have reason to believe you are entitled to claim a missing 401k, either as the employee, spouse or rightful heir, but have not received payment, complete the form below to initiate a search.

Also Check: When Can I Rollover My 401k