Keep Your 401 With Your Former Employer

If youre satisfied with the performance of your 401 under your former employer, you may choose to keep it with your old company, provided the account has at least $5,000 in it. Its important to note that a 401 with less than $5,000 may automatically be deposited into an IRA in your name by the plans administrator, depending on the plan. If the account has less than $1,000, the plans administrator may send you a check for that amount.

While you wont be permitted to make new contributions to the 401 if you keep it with your previous employer, your earnings will remain tax-deferred until you take a distribution. Youll also preserve the ability to roll it over in the future.

When comparing your former companys plan to what your new employer offers, lower fees and better investment options may also lead you to keep your 401 with your old company and forgo a rollover.

What Type Of Ira Should I Open

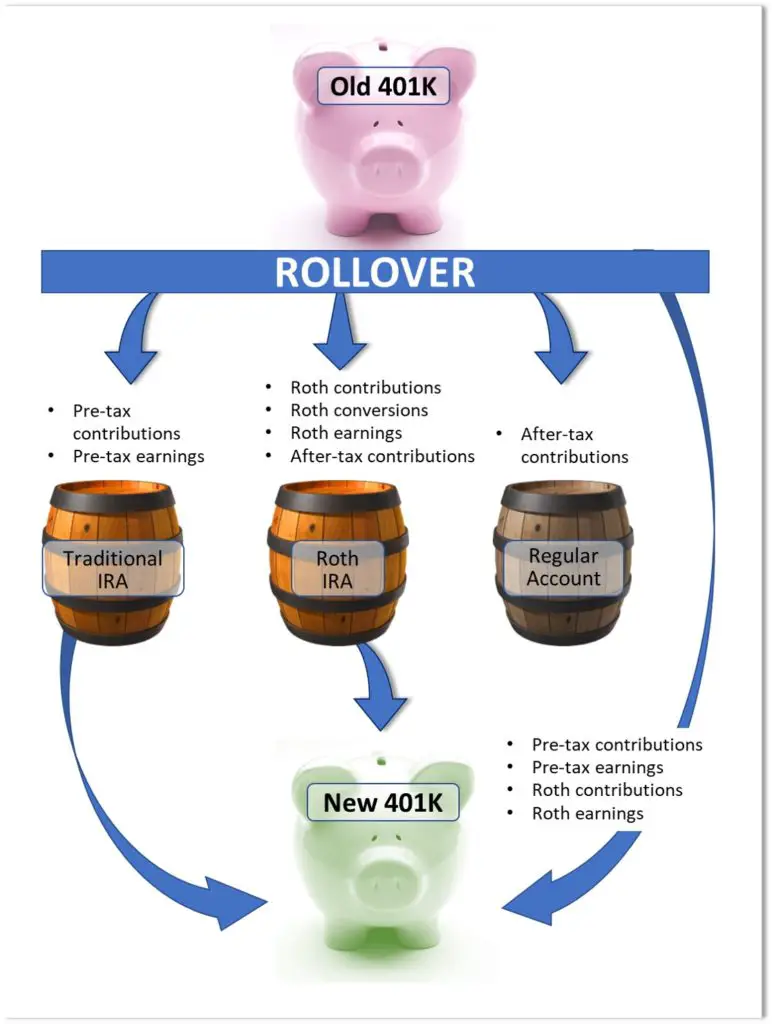

During the process of opening your new account, you may get asked which type of IRA youd like to open. You might see the following options: Rollover IRA, Traditional IRA, or Roth IRA. Heres how to pick the right one:

- If you had a Traditional 401 pick a Rollover IRA or, if thats not available, Traditional IRA or, if thats not available, just IRA. The only exception would be if youre considering a Roth conversion, but this is an advanced tax planning strategy that most people dont need to worry about.

- If you had a Roth 401 pick a Roth IRA. Youll need to match the Roth 401 to a Roth IRA for tax reasons.

- If your 401 has mixed assets youll need to open two IRAs, one Roth and one Traditional to for their respective assets.

STEP 3

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

You May Like: How To Get Money Out Of 401k Without Penalty

Taking The Cash Distribution May Cost You

Avoiding cash distributions can save you from taxes and penalties, because any amount you fail to roll over will be treated as a taxable distribution. As a result, it would also be subject to the 10% penalty if you are under age 59 1/2.

Since the taxable portion of a distribution will be added to any other taxable income you have during the year, you could move into a higher tax bracket.

Using the previous example, if a single taxpayer with $50,000 of taxable income were to decide not to roll over any portion of the $100,000 distribution, they would report $150,000 of taxable income for the year. That would put them in a higher tax bracket. They also would have to report $10,000 in additional penalty tax, if they were under the age of 59 1/2.

Only use cash distributions as a last resort. That means extreme cases of financial hardship. These hardships may include facing foreclosure, eviction, or repossession. If you have to go this route, only take out funds needed to cover the hardship, plus any taxes and penalties you will owe.

The CARES Act, enacted on March 27, 2020, provided some relief for those who need to make withdrawals from a retirement plan. It lifted penalties for withdrawals made through December 2020 and provides three years to pay back any early withdrawals.

Make Sure Your Ira Is Being Invested Appropriately

Remember there are two goals of rolling over an old 401 into an IRA the first is to consolidate your 401 assets, and the second is to grow those assets by allocating them into investments that will increase in value over time.

Your very last step in executing a rollover is to make sure that second goal is being met and that the funds in your IRA are being appropriately invested. If you chose an automated IRA then this should happen automatically. Thats because as soon as your funds arrive theyll be allocated into a portfolio that was created for you during the sign-up process for your new IRA account. You should still log in and check to make sure thats the case, but usually theres nothing more for you to do.

If you choose a self-directed account then youll have to invest the money yourself. Often the simplest option is to purchase a target-date retirement fund this is an investment vehicle that puts your money into a combination of higher-risk, higher-return stocks and lower-risk, lower-return bonds. The exact mix changes as you age so that you have more stocks when youre younger and less as you get older: because stocks generate higher returns but are more volatile we should own more of them early on when we can withstand their fluctuations in order to achieve their higher long-term returns.

Otherwise you can assemble a portfolio on your own by making trades.

Also Check: How To Take Money Out Of Your 401k Fidelity

You Can Keep It Where It Is Roll It Over Into A New 401 Roll It Into An Ira Or Cash It Out Heres How To Decide

Choosing what to do with a 401 when leaving an employer can be one of the biggest financial decisions an investor makes.

Across the board, 401s have taken big hits in recent months. While many investors have heeded the general advice to stand pat and give markets time to recover, there are times when investors are forced to make decisions regarding their accounts.

One of those moments is when you leave your employersomething many people are being forced to do these days. What you do with your 401 as you depart can have a big impact on your financial future.

Distributions From Your Rolled

Although it is typically not advisable to tap retirement funds before you leave the workforce, in tight times, the undesirable option may become the only option. If you must withdraw money from your Roth at the time of the rollover, or soon after that, be aware that the timing rules for such withdrawals differ from those of traditional IRAs and 401s. Some of these requirements may also apply to Roth’s that are rolled over when you are at or close to retirement age.

Specifically, to make distributions from these accounts without incurring any taxes or penalties, the distribution must be qualified, which requires that it meets what is known as the five-year rule. Also applied to inherited retirement accounts, this rule requires that funds had remained intact in the account for a five-year period to avoid or at least minimize taxes and penalties.

Though this may sound relatively simple, the five-year rule can actually be tricky, and careful consideration of how it applies to your situationand perhaps a good tax advisoris recommended.

Also Check: What Can I Roll My 401k Into

Reasons To Keep Your Money In A 401

Money in a 401 is typically protected from creditors, bankruptcy proceedings, and civil lawsuits, whereas IRAs have more limited protections. Also, you can sometimes take out loans against your 401 but theres no such thing as IRA loan.

401s and traditional IRAs both make you take required minimum distributions at age 72, or youll face penalties. With a 401, though, you can push off your RMDs if youre still working. Also, you can start withdrawing your money from a 401 as early as age 55 if you retire from the same company that provides that 401. Roth IRAs, on the other hand, dont have RMDs, and contributions can be withdrawn at any age without taxes or penalties.

How To Rollover An Employer 401k To The Solo 401k

Have funds at a current or previous employer 401k? Learn how you can rollover those funds to your Solo 401k and get them into your control. If you are an independent thinker, the Solo 401k is probably the best retirement account for you. Itâs definitely the best retirement plan for the self-employed and freelancers. Saving for retirement doesnt involve a one-size-fits-all plan. Since every situation is unique, its important to look for the retirement account that best lines up with your job situation and future goals. The Solo 401k offers the most flexibility and highest contributions allowed under the tax laws. That makes it the right choice for the person wanting full control of their future and especially control of their retirement future.

There are several ways to open and/or fund your Solo 401k. A rollover from an employer 401k is among the fastest and easiest. When you rollover funds from a current or previous employer to your Solo 401k, itâs important that it be done correctly to avoid taxes and penalties. If the rollover is done wrong, you can trigger an accidental distribution . To assure all of the forms are filled out correctly, we provide an easy-to-use rollover request generator that creates a customized rollover to transfer funds from another existing account into your Solo 401k.

Don’t Miss: How To Find Out Your 401k Balance

How To Roll A Roth 401 Into A Roth Ira

Roth IRA contributions can be withdrawn at any time, tax-free and penalty-free, regardless of age. However, the rules for distributions of earnings vary. A qualified distribution from a Roth IRA is one that meets the five-year rule and is also made after age 59½, after death, or as the result of a disability or a first-time home purchase. These qualified distributions are free of both taxes and penalties.

If these conditions are not met, withdrawals from the account will be subject to both selective income taxes and a penalty. If you do make a non-qualified distribution, income taxes will be levied pro-rata on earnings on your contributions, and a 10% penalty may apply to part of the distribution.

Funds from a Roth 401 rolled into another such account are subject to favorable treatment with respect to the five-year holding period. However, the same treatment does not apply to the timing of a Roth 401 that’s rolled over to a new Roth IRA. On the other hand, if you already have a Roth IRA account, the holding period for that account applies to all of its funds, including those rolled over from a Roth 401 account.

To illustrate this impact, let’s assume your Roth IRA opened in 2010. You worked at your employer from 2016 to 2019 and were then let go or you resigned. Because the Roth IRA that you are rolling the funds into has been in existence for more than five years, the full distribution rolled into the Roth IRA meets the five-year rule for qualified distributions.

How Can I Find Old 401 Accounts

If you forget about an old 401 altogether, or If you believe you have a 401 that’s been lost , you can take steps to find it. If your old employer is still in business, you can contact them directly for any information. You can also try reaching out to the plan holder. Another option includes using your state’s database of unclaimed 401 plans.

Don’t Miss: How Can I Check How Much Is In My 401k

Opening An Ira Account

If you cant roll your old 401 into a new 401 and you dont already have an individual retirement account, now is the time to get one set up.

Youll want to keep in mind the conditions of a 401 rollover from your previous employer and your own financial situation when selecting an account: Does the provider allow for a direct rollover to a different financial companys traditional IRA as in, can you do a direct rollover from a Principal retirement account to an account from Fidelity? If not, are you able to front 20% of the actual value of the account? Would a Roth 401 make more sense based on your potential future income, despite the bigger tax bill this year?

With all of these in mind, you then need to decide what type of IRA youd like and where you want to open an account. But some may have high minimum initial deposits and fees or have limited options for allocating your money between stocks, bonds, mutual funds and ETFs. You can learn more about IRA options here: What Is an IRA?

Begin The Rollover Process

Youll have to fill out paperwork to conduct your rollover, and it may require some back-and-forth conversations with your providers. You have several options to actually move the money from the old provider to the new one, but your best option is a direct rollover.

In a direct rollover, the funds are sent straight from your 401 into your new account without you touching the funds. Its important that you specify a direct rollover so that you dont have the check made payable to you. You could trigger a mandatory 20 percent withholding for taxes, and the IRS charges a 10 percent bonus penalty on withdrawals made before age 59 1/2.

Read Also: How To Avoid Penalty On 401k Withdrawal

Rollover Into A Traditional Ira

A rollover into a traditional IRA is another strong choice, because youll still enjoy substantial tax benefits. Youll be able to defer taxes on any gains, and you can continue to add to your IRA, up to $6,000 annually and enjoy the tax breaks on any income you stash there.

Another advantage is that youre able to invest in whatever you want, so you can pick a top-performing low-cost index fund or opt for a risk-free IRA CD. Some might see the flexibility of a traditional IRA as a disadvantage, because it requires them to make investment decisions, and so many people will need the advice of a financial professional.

But the traditional IRA has disadvantages, too, including required minimum distributions when you reach age 72 an issue that plagues 401 plans, too meaning youll have to withdraw money whether you want to or not.

If you opt for a traditional IRA, youll want to be careful that you make the transition exactly how you intended it. Money from a traditional 401 can go into a traditional IRA, but it could also go into a Roth IRA . If you decide to move from a traditional 401 to a traditional IRA, youll avoid any immediate tax liability from the rollover. But youll incur a tax liability if you move money from a traditional 401 to a Roth IRA.

Recommended Reading: Where Should I Put My 401k Money

No Penalty Free Access At Age 55

Your personal retirement timeline is a crucial goal to consider when deciding between a 401 and IRA. Both accounts allow you to take penalty free distributions at age 59 ½ to avoid the 10% early distribution tax. With 401s you can access retirement funds even sooner without penalty thanks to the Rule of 55. If youre laid off or retire in the calendar year you turn 55 or after, you can access your current 401 without the 10% early withdrawal penalty. There may be other specific rules youll need to follow to ensure you avoid the 10% penalty, but this presents an intriguing option to consider if your retirement timeline is before age 59 ½. IRAs have no such feature.

You May Like: How Do I Get My 401k

How The Rollover Is Done Is Important Too

Whether you pick an IRA for your rollover or choose to go with your new employers plan, consider a direct rolloverthats when one financial institution sends a check directly to the other financial institution. The check would be made out to the bank or brokerage firm with instructions to roll the money into your IRA or 401.

The alternative, having a check made payable to you, is not a good option in this case. If the check is made payable directly to you, your employer is required by the IRS to withhold 20% for taxes. As if that wouldnt be bad enoughyou only have 60 days from the time of a withdrawal to put the money back into a tax-advantaged account like a 401 or IRA. That means if you want the full value of your former account to stay in the tax-advantaged confines of a retirement account, youd have to come up with the 20% that was withheld and put it into your new account.

If youre not able to make up the 20%, not only will you lose the potential tax-free or tax-deferred growth on that money but you may also owe a 10% penalty if youre under age 59½ because the IRS would consider the tax withholding an early withdrawal from your account. So, to make a long story short, do pay attention to the details when rolling over your 401.

Move Your Old 401 Assets Into A New Employers Plan

You have the option to avoid paying taxes by completing a direct, or “trustee-to-trustee,” transfer from your old plan to your new employer’s plan, if the employer’s plan allows it.

It can be easy to pay less attention to your old retirement accounts, since you can no longer contribute. So, transferring old 401 assets to your new plan could make it easier to track your retirement savings.

You also have borrowing power if your new retirement plan lets participants borrow from their plan assets. The interest rate is often low. You may even repay the interest to yourself. If you roll your old plan into your new plan, youll have a bigger base of assets against which to borrow. One common borrowing limit is 50% of your vested balance, up to $50,000. Each plan sets its own rules.

Here are a few important steps to take to successfully move assets to your new employers retirement plan so as not to trigger a tax penalty:

Step 1: Find out whether your new employer has a defined contribution plan, such as a 401 or 403, that allows rollovers from other plans. Evaluate the new plan’s investment options to see whether they fit your investment style. If your new employer doesn’t have a retirement plan, or if the portfolio options aren’t appealing, consider staying in your old employer’s plan. You could also set up a new rollover IRA at a credit union, bank, or brokerage firm of your choice.

The instructions you get should ask for this type of information:

Read Also: What Age Can You Collect 401k