Can A Couple Retire On 1 Million Dollars

Is a million dollars enough money to ensure a financially secure retirement today? A recent study determined that a $1 million retirement nest egg will last about 19 years on average. Based on this, if you retire at age 65 and live until you turn 84, $1 million will be enough retirement savings for you.

Average And Median 401 Balance By Age

These are the average and median balances for specific age groups at the end of 2020, according to Vanguard, which gathered data from 4.7 million defined contribution plan participants across its recordkeeping business.

| Age |

|---|

- Average 401 balance: $6,718

- Median 401 balance: $2,240

The median balance for people just getting started in their careers is $2,240. That means half of 401 plan participants in this age group have less than that amount saved and half have more. Thats a start and offers plenty to build on. The average balance is quite a bit higher, skewed by those who are able to save more in their 401.

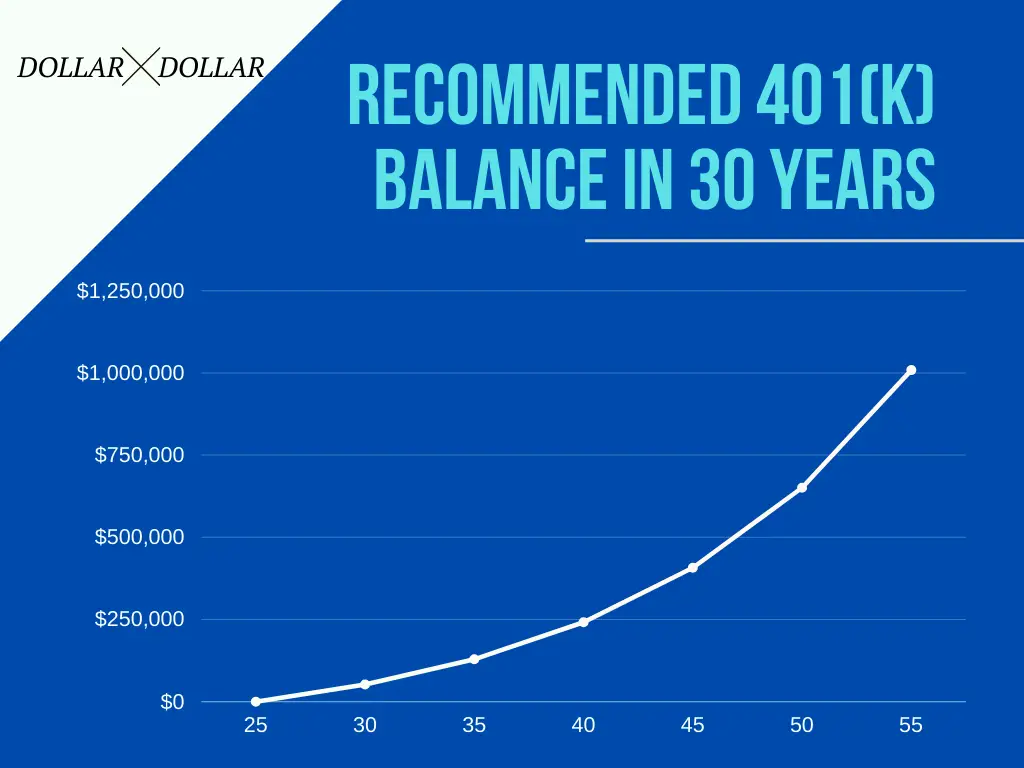

How much should you strive to save for retirement? Fidelity, which manages employee benefits programs for more than 22,000 businesses and offers a variety of financial planning services, suggests saving at least 10 times your annual salary by age 67. The firm also advocates following another metric: Save 15 percent of your pretax income from the time you begin your career including any company match. So, if your employer matches 3 percent of your salary, youd need to save 12 percent. If current expenses preclude this possibility, work toward that amount as a goal.

How Much Should You Contribute To Your 401

The easy answer is as much as you can. However, the IRS sets 401 plan contribution limits each year. In 2022, you can contribute a maximum of $20,500, or $27,000 if youre at least 50 years old.

401 plan contributions are factored as an annual percentage of your annual income. Many financial planners suggest you should aim for 10% to 15%. But according to the Vanguard study, 41% of plans that auto enroll participants do it with a 3% contribution. It typically makes sense to contribute at least as much as your company 401 employer match, otherwise you are leaving money on the table.

Knowing how much you should contribute depends on your current income, your expected retirement date and how much you think youll need to support the retirement you want.

You can use our 401 calculator to determine how much you should contribute to your plan in order to generate the amount you need to support the retirement you want. In addition, our Social Security calculator can help you visualize how much you can expect in benefits.

But even if you contribute as much as you can into a well diversified portfolio, another factor that can take a major chunk out of even the strongest investment returns is high fees.

Also Check: How Do I Access My 401k Account

How To Save For Retirement

The key to saving for retirement is focusing on the elements you can control. Develop a discipline of saving at your target savings rate, and then use cost-effective and diversified investment strategies to help those savings grow.

The best place to start saving for retirement is often your employer-sponsored retirement plan because it offers a streamlined way to save and often provides lower-cost options than you can get elsewhere.

With a 401 account, you set up automatic contributions that ensure a portion of every paycheck goes into your retirement savings.

Both Shamrell and Stinett say to save around 15% of your salary each year. If thats too much, at the very least, contribute enough to get your full employer matching contribution, if you have one. Otherwise, you could be leaving free money on the table.

You can increase your savings rate by 1% to 2% each year until you reach the target of 12% to 15% per year, Shamrell says.

And you neednt stop at 15%. If you can save more, do it. The more you put away for retirement today. The faster retirement can come.

Calculate How Your 401k Balance Compares To Others Your Age

See if youre on track to the retirement you want with this free 401k calculator.

Tip: Get a handle on your money with Personal Capitalsfree financial dashboard. You get a quick overview of your net worth, cash flow, investment allocation, and more. You can also plan for long-term goals like retirement.

Don’t Miss: Can I Borrow Against My 401k To Pay Off Debt

What Do Average 401 Balances Tell Us

According to Mike Shamrell, vice president of thought leadership at Fidelity Investments, the latest data shows that despite economic uncertainty, retirement savers stayed the course and didnt make significant changes to their retirement savings habits.

Shamrell said that the total savings rate across all Fidelity managed 401 plans, including contributions from both employees and employers, reached a record 14% in the first quarter of 2022.

Individuals did not make significant changes to their asset allocation, he says. Only 5.6% of 401 savers made a change to the asset allocation within their account, and of those people that made a change, more than 80% made only one.

This trend aligns with expert advice that long-term investors should always resist the temptation to let market conditions impact their investing strategy. Instead, they should focus on the things they can control, such as their individual contribution rate.

What Factors Affect Your 401 Returns

Its very important to look at the expense ratio, or fees, associated with your investments which can eat away invisibly at your earnings. You wont always see these fees. Instead, youll just get a lower return, which can amount to thousands of dollars over the lifetime of your investments. Thats why its important to choose investments with low expense ratios.

Diversification is also key. Diversification means spreading out your investments among hundreds or thousands of companies instead of a select few. Think about diversification, says Ouellette. Certain types of investments or certain companies can be volatile.

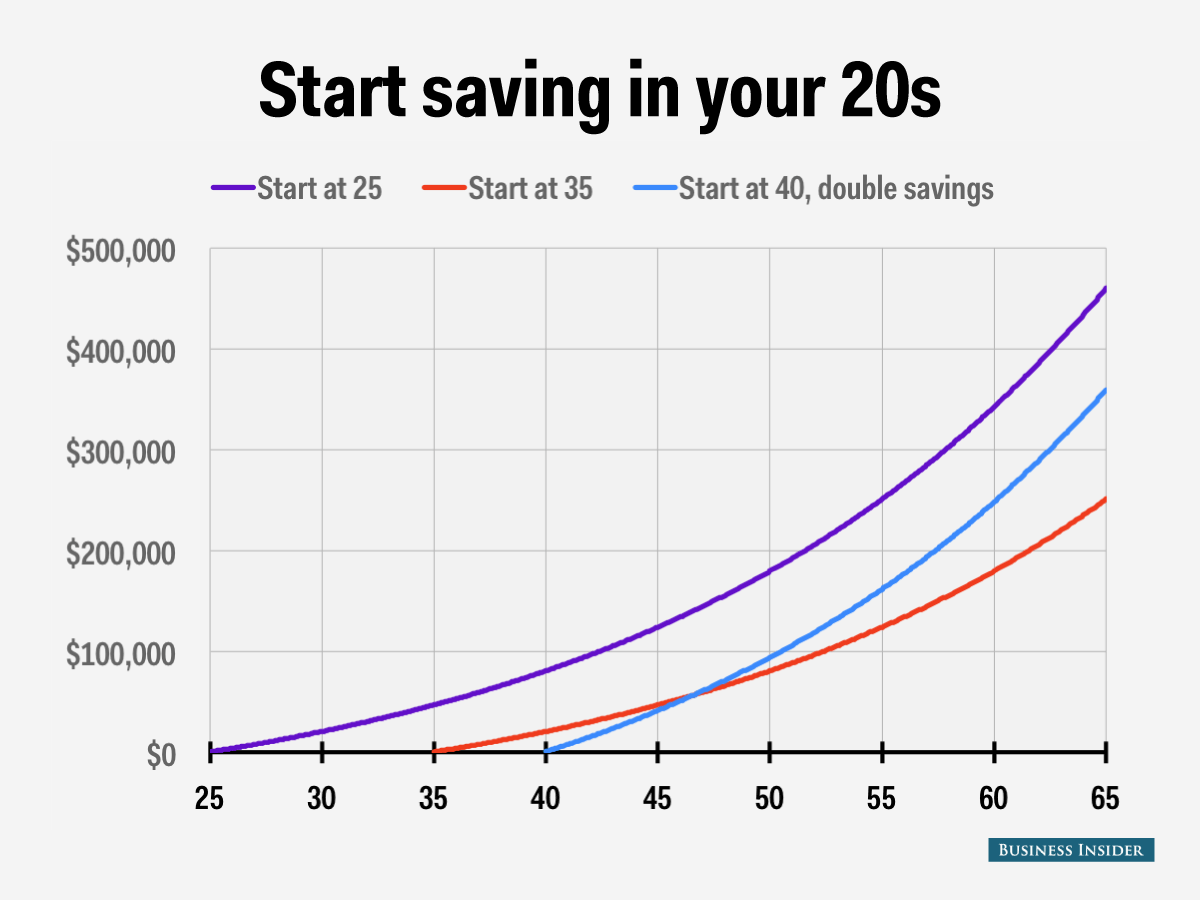

Age is also a big factor that affects your returns. You can also think of this as time in the market. The younger you start, the longer compound interest gets to work its magic on your balance. Starting even a few years later can mean losing thousands of dollars down the line, so getting started as soon as you can is the single factor that can produce the best returns.

Don’t Miss: How Much Should I Have In My 401k At 55

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

What Is The Average Rate Of Return On A 401

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

If your employer offers a 401 plan, you may have wondered if its really where you want to put a portion of your hard-earned money every month.

Youve likely been told that the earlier you start saving for retirement, the better off youll be. But how can you know that the average rate of return on your 401 investments will be the same or more than other available options?

The average rate of return on 401s from 2015 to 2020 was 9.5%, according to data from retirement and financial service provider, Mid Atlantic Capital Group.

Keep in mind, returns will vary depending on the individual investors portfolio, and 9.5% is a general benchmark.

Heres what you should know to help you make an informed decision.

Recommended Reading: How To View My 401k Account

Can Your 401 Return Be Higher If Actively Managed

One might logically assume that if you take a more active roll in your 401 account, then your returns will increase.

The opposite of this logic appears to be true, an actively managed plan actually seems to be outperformed by passively managed 401 plans.

Although actively managed funds can outperform passively managed funds on a year to year basis, it is very unlikely that an actively managed fund can consistently outperform a passively managed fund.

Remember, the actively managed fund would need to outperform the passively managed fund over the course of multiple years and decades.

Since you will likely be saving for retirement for multiple decades, the passively managed fund seems like the better option.

You might get lucky if you choose to actively manage your account, but growth will be more predictable through a passively managed plan.

Unless you feel comfortable working in the realm of less predictable gains, then it is probably better to stick to a passively managed 401 plan.

What Is A Good Rate Of Return On Investments In 2021

Wealthy Americans are pretty optimistic about their long-term investment returns, expecting to earn average annual returns of 17.5% above inflation from their portfolios. That’s according to a new survey from Natixis that surveyed households that have over $100,000 in investable assets in March and April of 2021.

You May Like: What Happens To A 401k When You Leave A Company

What Interest Rate Can I Expect In Retirement

If you want to be conservative, you can go from 1% to 3%. If you feel more optimistic, you can choose 6% to 8%. Now take the expected annual income and divide it by the interest rate.

How much interest do retirement accounts earn?

In addition, Roth IRA accounts have historically delivered between 7% and 10% of average annual revenue. Lets say you open a Roth IRA and enclose the maximum amount each year. If the contribution limit remained at $ 6,000 per year for those under the age of 50, you would earn $ 83,095 after 10 years.

What is the average retirement interest rate?

The average yield of 401 in 2020 was 15.1%, according to Vanguard data. In the past three years, the average yield was 9.7%, and in the last five years 11%. To increase your account, achieve full compliance, make sure your account is invested, and save more.

Factors That Can Impact Your 401 Returns

How your 401 performs depends on several factors, from how consistent you are with your contributions to what you invest in. Here are some factors to consider:

You May Like: How Do I Invest In My 401k

Tips On Maximizing Your Retirement Savings

- It can be difficult to put a light on what affects 401 returns. And you dont want to be left in the dark, especially when you reach retirement and need your savings the most. A financial advisor can help you understand retirement and all of its moving parts. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- 401s are not only reliable retirement savings vehicles, but they also offer plenty of tax breaks, including some you may not know about. To help, we published a report on the 401 tax rules you need to know to make the most out of your plan.

- You may find your companys 401 plan may not be the best option for you. And you may get better investment choices and tax breaks if you open an IRA or a Roth IRA. To help you decide, we published studies on the best IRAs and the best Roth IRAs.

What Income Is Too High For Roth Ira

To contribute to the Roth IRA 2022, individual taxpayers must have a modified adjusted gross income of $ 144,000 or less, compared to $ 140,000 in 2021. If they are married and claiming together, your joint MAGI must be below $ 214,000 .

Does Roth IRA make sense for high income earners?

A Roth IRA can be a good option for those who expect to be in the high tax bracket once withdrawals begin. However, unlike traditional IRAs, there are limits to contributing to Roth income-based IRAs. For married couples, the phasing out is $ 198,000 to $ 208,000.

What income is too high for Roth?

In 2021, if you pay more than $ 140,000 individually or $ 208,000 as a married couple, you will not be able to make any contribution to the Roth IRA.

Also Check: How To Choose Fidelity 401k Investments

Can I Have A Roth Ira If I Make Over 200k

Roth IRA contributions are prohibited for high-income earners thats anyone with an annual income of $ 144,000 or more if they file a tax as a single or head of household in 2022 , or with an annual income of $ 214,000 or more if they get married together .

Can you contribute to a traditional IRA if you earn over 200,000? Earning income is a condition for contributing to a traditional IRA, and your annual contributions to the IRA cannot exceed what you earned that year. Otherwise, the annual contribution limit is $ 6,000 in 2021 and 2022 .

Get More Out Of Your Retirement Savings

All of this 401 gawking is only worthwhile if it inspires you to look more closely at your own retirement savings. Ultimately, its all about answering one key question: Am I saving enough, and in the right accounts? .)

A retirement calculator will crunch your numbers and provide a personalized recommendation for how much youll need for retirement and how much to save each month to achieve that goal.

About the author:Dayana Yochim is a former NerdWallet authority on retirement and investing. Her work has been featured by Forbes, Real Simple, USA Today, Woman’s Day and The Associated Press.Read more

You May Like: Can I Roll My Old 401k Into A Roth Ira

It’s All About The Asset Allocation

How your 401 account performs depends entirely on your asset allocation: that is, the type of funds you invest in, the combination of funds, and how much money you’ve allocated to each.

Investors experience different results, depending on the investment options and allocations available within their specific plansand how they take advantage of them. Two employees at the same company could be participating in the same 401 plan, but experience different rates of return, based on the type of investments they select.

Different assets perform differently and meet different needs. Debt instruments, like bonds and CDs, provide generally safe income but not much growthhence, not as much of a return. Real estate or real estate mutual fund or ETF) offers income and often capital appreciation as well. Corporate stock, aka equities, have the highest potential return.

However, the equities universe is a huge one, and within it, returns vary tremendously. Some stocks offer good income through their rich dividends, but little appreciation. Blue-chip and large-cap stocksthose of well-established, major corporationsoffer returns that are steady, though on the lower side. Smaller, fast-moving firms are often pegged as “growth stocks,” and as the name implies, they have the potential to offer a high rate of return.

It sounds like an advertising cliché, but it bears repeating anyway: Past returns of funds within a 401 plan are no guarantee of future performance.

How Will You Invest Your Portfolio

Stocks in retirement portfolios provide potential for future growth, to help support spending needs later in retirement. Cash and bonds, on the other hand, can add stability and can be used to fund spending needs early in retirement. Each investment serves its own role, so a good mix of all threestocks, bonds and cashis important. We find that asset allocation has a relatively small impact on your first-year sustainable withdrawal amount, unless you have a very conservative allocation and long retirement period. However, asset allocation can have a significant impact on the portfolio’s ending asset balance. In other words, a more aggressive asset allocation may have the potential to grow more over time, but the downside is that the “bad” years can be worse than with a more conservative allocation.

You May Like: What Is A Solo 401k Plan