Have A Realistic Understanding Of When You Want To Retire

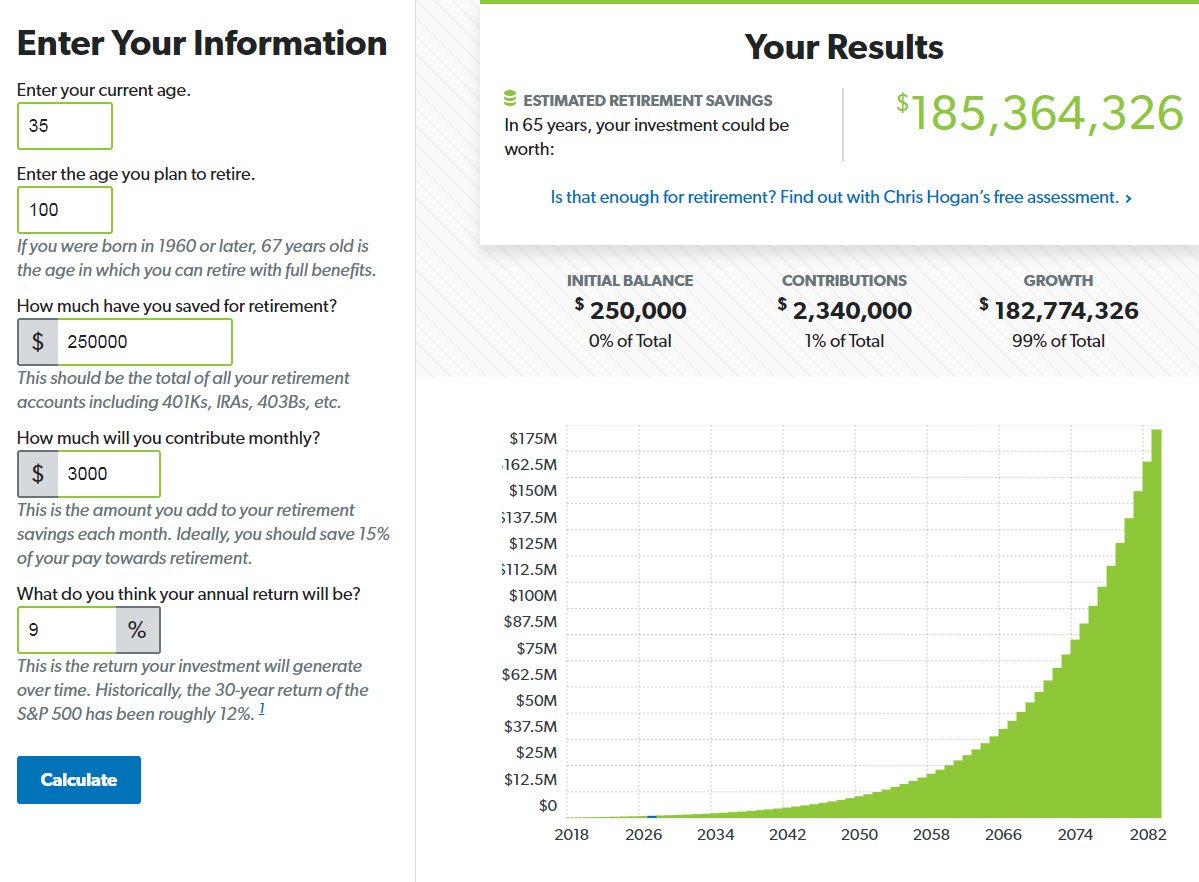

Having clearly defined goals will help you determine how much you should have saved based on your personal goals. Your savings objectives will be different if you plan to retire at 50 than if you plan to continue working past 70. Additionally, its important to determine as accurately as you can what your cost of living will be in retirement. How much do you need to spend per year to maintain the lifestyle that you want for the rest of your life? Have a good sense of what your costs will be so you can factor that into your overall retirement strategy. Really evaluate how long you want to continue working, and what retirement age is realistic for you based on your income and your current level of savings.

How Do I Invest 15% For Retirement

The first place to start investing is through your workplace, especially if it offers a company match. If your employer offers a Roth 401 or Roth 403, then you can invest the entire 15% of your income there and youre done. With a Roth option, you contribute after-tax dollars. That means your money grows tax-free, plus you dont pay taxes on that money when you take it out at retirement . Talk about making investing super easy!

If your employer matches your contributions to your 401, 403 or Thrift Savings Plan , you can reach your 15% goal by following these three steps:

For example, if your company will match 3% of your 401 contributions, invest 3% in that account and then put the remaining 12% in a Roth IRA. If that remaining 12% would put you over the annual contribution limit for a Roth IRA , max out the Roth IRA and then go back to your workplace 401 to finish out investing 15%.7

Here are two key takeaways: First, you need to invest 15% of your gross salary, not your take-home pay. Second, do not count the company match as part of your 15%. Consider that extra icing on the cake!

Provisions For Changing Jobs

Most 401 plans permit the employee who terminates employment the options of receiving the 401 balance in a lump sum or to receive periodic payments or to roll over the proceeds to an IRA or other employer-sponsored retirement plan. Additionally, some 401 plans permit the terminated employee to retain their 401 balance in their former employer’s plan. Amounts that are retained in a former employer’s 401 plan or transferred to another employer’s plan or IRA postpone the taxation until amounts are subsequently distributed from the plan or IRA the money was rolled into.

When receiving funds from a 401 with the intention to roll the amount to an IRA:

- The rollover must be completed in 60 days.

- Employers must withhold 20% of the proceeds as a withholding tax. It is up to the participant to make up this 20%, or it will be treated as a distribution. The money withheld will be used as a credit against any income tax liability.

- Neither the 60-day rule nor the 20% withholding apply to amounts directly transferred to an IRA or other qualified plan.

Don’t Miss: How Do I Invest In My 401k

How Do I Start A 401

If you work for a company that offers a 401 plan, contact the human resources or payroll specialist responsible for employee benefits. You’ll likely be asked to create a brokerage account through the brokerage firm your employee has selected to manage your funds. During the setup process, you’ll get to choose how much you want to invest as well as which types of investments you want your 401 funds invested in.

Can I Use My 401k To Buy Cryptocurrency

If your employer offers a self-managed 401 , you may be able to purchase cryptocurrencies directly through that account. These types of accounts are not as common as traditional or Roth IRAs, so you will need to do some research to find out which brokers offer them.

Can I roll my 401k into Coinbase? The platform, called Alt 401 , will allow workers in participating companies to transfer up to 5% of their account balances to a Coinbase-traded cryptocurrency window. They will have over 50 cryptocurrencies to choose from as investment cars.

Recommended Reading: Should I Roll My Old 401k Into My New 401k

How Much Can I Contribute To My 401k And Roth Ira In 2021

For 2021 and 2022, you can contribute up to $ 6,000 to a Roth or traditional IRA. If you are 50 or older, the limit is $ 7,000. The most you can contribute to a 401 in 2021 is $ 19,500, or $ 26,000 if you are 50 or older.

Can I max out 401k and Roth IRA in same year?

Contribution Limits Contributions for Roth IRAs and 401 plans are not cumulative, which means that you can max out both plans as long as you qualify to contribute to each.

Can you contribute to a Roth IRA and a 401k at the same time?

You can contribute to both a Roth IRA and an employer -sponsored retirement plan, such as a 401 , SEP, or SIMPLE IRA, subject to income limits. Contributions to Roth IRAs and employer -sponsored retirement plans can allow for saving as much in a tax -beneficial retirement account as is permitted by law.

How much can I contribute to both a 401k and Roth IRA?

You can contribute up to $ 19,500 in 2020 to a 401 plan. If you are 50 or older, the maximum annual contribution jumps to $ 26,000. You can also donate up to $ 6,000 to the Roth IRA in 2020. That jumps to $ 7,000 if youre 50 or older.

Leave Your 401 With The Old Employer

In many cases, employers will permit a departing employee to keep a 401 account in their old plan indefinitely, though the employee can’t make any further contributions to it. This generally applies to accounts worth at least $5,000. In the case of smaller accounts, the employer may give the employee no choice but to move the money elsewhere.

Leaving 401 money where it is can make sense if the old employer’s plan is well managed and you are satisfied with the investment choices it offers. The danger is that employees who change jobs over the course of their careers can leave a trail of old 401 plans and may forget about one or more of them. Their heirs might also be unaware of the existence of the accounts.

Read Also: Can You Cash Out 401k After Leaving Job

Contribution Limits Rules And More

Chip Stapleton is a Series 7 and Series 66 license holder, passed the CFA Level 1 exam, and is a CFA Level 2 candidate. He, and holds a life, accident, and health insurance license in Indiana. He has eights years’ experience in finance, from financial planning and wealth management to corporate finance and FP& A.

David J. Rubin is a fact checker for The Balance with more than 30 years in editing and publishing. The majority of his experience lies within the legal and financial spaces. At legal publisher Matthew Bender & Co./LexisNexis, he was a manager of R& D, programmer analyst, and senior copy editor.

The Balance / Hilary Allison

Your 401 contribution limits are made up of three factors:

- Salary-deferral contributions are the funds you elect to invest out of your paycheck.

- Catch-up contributions are additional money you may pay into the plan if you are age 50 or older by the end of the calendar year.

- Employer contributions consist of funds your company contributes to the plan also known as the “company match” or “matching contribution,” they may be subject to a vesting schedule.

There are two types of limits. One is a limit on the maximum amount you can contribute as a salary deferral. The other limit is on the amount of total contributions, which includes both your and your employer’s contributions.

Where Should I Invest After Maxing Out A Roth Ira And A 401

If you have access to a health savings account , this is a great and lesser-known third option for retirement investing. If you accumulate more money than you need for medical expenses in your HSA, you can withdraw this money for any reason with no penalty after age 65. Youll just pay ordinary income tax on your withdrawals if you dont use them for medical expenses. After that, you might want to look into standard, taxable investment accounts.

You know, of course, what a 401 is and what an IRA is. But ever since the Roth versions of these tax-advantaged vehicles came on to the scene , allocating retirement-planning dollars has gotten more complicated. Heres the lowdown on both Roths. The good news is that, unlike the Roth IRA, the Roth 401 functions nearly identically to the traditional 401 as far as contributions go.

Don’t Miss: Can I Change My 401k Contribution At Any Time

Fund Types Offered In 401s

Mutual funds are the most common investment options offered in 401 plans, though some are starting to offer exchange-traded funds . Both mutual funds and ETFs contain a basket of securities such as equities.

Mutual funds range from conservative to aggressive, with plenty of grades in between. Funds may be described as balanced, value, or moderate. All of the major financial firms use similar wording.

How Much Should I Have In My 401k Based On My Age

There are a few different schools of thought on how much a person should have saved in their 401k based on their age.

Every financial expert has a different opinion. When deciding what the right number is for you, I think one thing to keep in mind is that its better to have more saved than less.

Creating a potential post-retirement budget as a guideline will help you determine how much money youll spend after youre retired.

In an ideal world, you will be completely debt free by the time you retire and have minimal housing and other expenses.

Youll want to be prepare for these costs:

- Utility bills

A persons income and expenses can make a difference when it comes to how much they should have saved at each interval age, but here are some general guidelines.

Use these guidelines in conjunction with your projected post-retirement budget to find out if you should have more or less saved by the time you retire than what is suggest ed here.

Do you have a 401k from an old employer that you need to rollover? Check out Capitalize which is free and will help take out the hassle of rolling over your 401k!

You May Like: How Do I Get 401k Money Out

Working With Your Financial And Tax Professionals

A 401 plan can become the cornerstone of a personal retirement savings program, providing the foundation for future financial security. Consult your financial and tax professionals to help you determine how your employer’s 401 and other savings and investment plans could help make your financial future more secure.

Important NoteEquitable believes that education is a key step toward addressing your financial goals, and we’ve designed this material to serve simply as an informational and educational resource. Accordingly, this article does not offer or constitute investment advice and makes no direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Your needs, goals and circumstances are unique, and they require the individualized attention of your financial professional. But for now, take some time just to learn more.

Please be advised that this material is not intended as legal or tax advice. Accordingly, any tax information provided in this material is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transactions or matter addressed and you should seek advice based on your particular circumstances from an independent advisor.

What’s the next step for you?

A financial professional can help you decide. Let’s talk.

How Much Can I Invest In 401k

401k plans are a great way to save for retirement, but its important to understand how much you can contribute. The IRS sets annual contribution limits for 401k plans, and these limits can change from year to year.

According to most retirement planners, you should put 10% to 15% of your earnings into your 401 each year. Determine the optimum contribution rate by working with a financial adviser.

Read Also: How Do You Know If You Have A 401k Plan

How Much Should I Have In My 401k At Age 50

Are you close to age 50 and wondering how much should I have in my 401k at age 50? The 401k amount by age 50 depends on whether you are average or above average. The average 401k amount by age 50 is about $150,000.

But for the above-average 50 year old, he or she should have between $500,000 $1,200,000 in his or her 401k.

After all, the above-average 50 year old has been able to save and invest for at least 25 years in the greatest bull market of all time.

The above average 50 year old is also personal finance enthusiastic who subscribes to the free Financial Samurai newsletter with 100,000 other people. He or she has been diligently tracking their finances for a while.

To put things in perspective, the average 401k balance as of August 2021 is around $130,000 according to Fidelitys 12 million accounts. Thanks to an incredible rise in the S& P 500 since 2009, the average 401k balance for a 50 year old is at its highest level ever.

Even so, $130,000 is an incredibly low amount given the median age of an American is 36.5. Further, the median 401k amount is closer to only $30,000.

As an educated reader who is logical and believes saving for retirement is a must, Ive proposed a table that shows how much each person should have saved in their 401ks at age 25, 30, 35, 40, 45, 50, 55, 60, and 65.

Where To Invest If You Don’t Have A 401

Don’t worry if your employer doesn’t offer a 401 there are still ways you can save for retirement on your own.

Many big banks and brokerages offer Individual Retirement Accounts, or IRAs, that allow you to put your retirement money into a range of investments, such as individual stocks, bonds, index funds, mutual funds and CDs. Just like with a 401, you can set up automatic contributions into your IRA from a checking or savings account.

When shopping around for an IRA, choose an account that has no minimum deposits, offers commission-free trading and provides a variety of investment options. Taking these factors into account, Select narrowed down our favorites for every type of retirement saver.

Also Check: When Can You Pull Money From 401k

So How Much Should You Invest In Your 401k

Okay. So, while investing is highly personal and financial goals should be personalized, you are here so we can teach you to be rich. We have some advice to get you started.

How much you should actually be investing each month depends on a system we call the Ladder of Personal Finance. Check out this video, or read about the Ladder below:

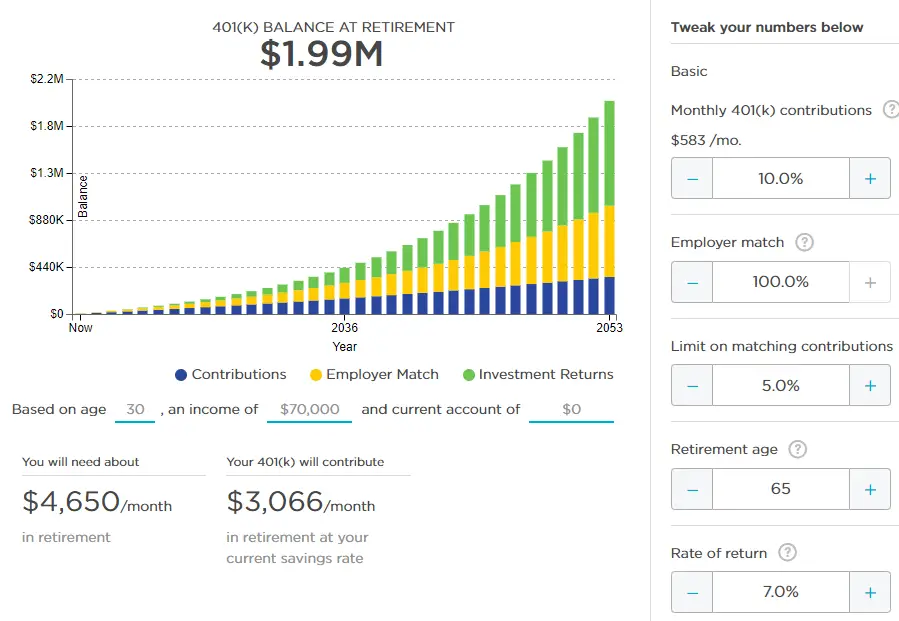

1. Your employers 401k match. Each month you should be contributing as much as you need to in order to get the most out of your companys 401k match. That means if your company offers a 5% match, you should be contributing AT LEAST 5% of your monthly income to your 401k each month.

Weve already discussed the importance of this dont throw away free money and the returns from that free money.

2. Whether youre in debt. Once youve committed yourself to contributing at least the employer match for your 401k, you need to make sure you dont have any debt. Remember, if you have employee matching, you are effectively earning a 100% return on every penny you invest in your 401k that is significantly more than the interest you would save by paying down your debt.

If you dont, great! If you do, thats okay. You can check out my system on eliminating debt fast to help you.

Tips For Contributing To Your 401

- If youre struggling to get started or stay on track, consider working with a financial advisor. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If you switch jobs, you can no longer contribute to a previous employers 401 plan. You dont want to lose the hard work you did to save that money, so you should look to make a direct 401 rollover to your new employers plan.

- A traditional IRA and a 401 offer similar tax benefits. You might wonder whether one is a better option for you. Heres an article to help you think about an IRA vs. a 401.

- You should always avoid early withdrawals from your 401. Not only will you have to pay the income tax, youll have to a pay 10% penalty. There are a couple of ways you could avoid that big penalty though. If you really think you need to withdraw money early, heres more information on 401 withdrawals.

Read Also: Can I Use My 401k To Buy Investment Property