When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

Ask Your 401 Plan For A Direct Rollover Or Remember The 60

These two words direct rollover are important: They mean the 401 plan cuts a check directly to your new IRA account, not to you personally.

Here are the basic instructions:

Contact your former employers plan administrator, complete a few forms, and ask it to send a check or wire for your account balance to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include and where it should be sent. You can opt for an indirect 401 rollover instead, which essentially means you withdraw the money and give it to the IRA provider yourself, but that can create tax complexities. We generally recommend a direct rollover.

If you do an indirect rollover, the plan administrator may withhold 20% from your check to pay taxes on your distribution. To get that money back, you must deposit into your IRA the complete account balance including whatever was withheld for taxes within 60 days of the date you received the distribution. .)

For example, say your total 401 account balance was $20,000 and your former employer sends you a check for $16,000 . Assuming youre not planning to go the Roth route, youd need to come up with $4,000 so that you can deposit the full $20,000 into your IRA.

At tax time, the IRS will see you rolled over the entire retirement account and will refund you the amount that was withheld in taxes.

Recommended Reading: What Happens To Your 401k When You Leave A Company

Use A Roth Ira Before Retirement For Other Purposes

The ability to tap money in a Roth IRA without penalty before age 59 1/2 allows for flexibility to use the Roth IRA for other purposes. In essence, this account can act as an emergency fund and could be used to pay off significant unexpected medical bills or cover the cost of a childs education.

But its best to only tap into these funds if its absolutely necessary. And if you must withdraw any money from a Roth IRA before retirement, you should limit it to contributions and avoid taking out any earnings. If you withdraw the earnings, then you could face taxes and penalties.

Dont Miss: What Is 401a Vs 401k

Read Also: How To Protect 401k From Market Crash

Eligibility Tax And Investment Considerations

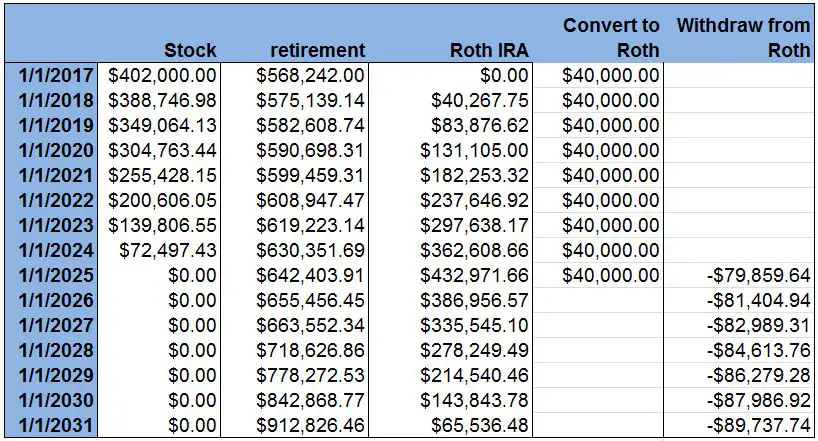

A Roth conversion is an optional decision to change part or all of an existing tax-deferred retirement plan, such as a 401 or a traditional IRA, to a Roth IRA. Converting makes sense if you believe that the benefit from your money growing tax-free will be greater than the immediate cost of paying the taxes due at the time of the conversion.

A Roth conversion of an existing retirement account is a major decision, particularly in a year when your income might be at least marginally off-track due to circumstances beyond your control. Making the right call for your circumstances can be easier when you understand the logistics and the tax implications of such a move.

You May Like: How To Open Up A 401k

Can I Roll Over Just The After

No, you cant take a distribution of only the after-tax amounts and leave the rest in the plan. Any partial distribution from the plan must include some of the pretax amounts. Notice 2014-54 doesnt change the requirement that each plan distribution must include a proportional share of the pretax and after-tax amounts in the account. To roll over all of your after-tax contributions to a Roth IRA, you could take a full distribution , and directly roll over:

- pretax amounts to a traditional IRA or another eligible retirement plan, and

- after-tax amounts to a Roth IRA.

You May Like: What Happens To My 401k When I Change Jobs

Understand How Taxes Work Before You Make A Move

The main difference between traditional retirement accounts and Roth IRAs are when taxes are paid. For example, a traditional IRA typically allows you to take an up-front tax deduction and pay your tax bill during retirement. However, if you convert your traditional IRA to a Roth IRA and you already received a tax deduction, youâll have to pay income taxes for the year.

There are ways around a hefty tax bill, but it can be tricky if you contribute to other traditional IRA assets like a . You should seek the help of a professional to determine if a backdoor Roth IRA is the best strategy for you before making a move.

Recommended Reading: What Is An Ira Account Vs 401k

Should I Convert My Current 401 Into A Roth 401

If you already have a traditional 401 at your current job and the company just introduced a Roth 401 option, converting that 401 into a Roth might sound like a good idea. But is a conversion your best option? It depends on your situation.

The main drawback of converting a traditional 401 into a Roth 401 is the tax bill that comes with making the switch. Youre going to have to pay taxes on that money because it hasnt been taxed yet.

Lets say you have $100,000 in your traditional, pretax 401 and you want to convert the account into a Roth, after-tax 401. If youre in the 22% tax bracket, that means youd be paying $22,000 in taxes. Thats a lot of cash!

If you convert your 401 into a Roth 401, you need to have the cash on hand to cover the tax billno exceptions. Do not use money from the investment itself to pay the taxes. If you do, youll lose a lot more than $22,000. You could get charged a 10% early withdrawal penalty if youre under age 59 1/2. And youll also miss out on years of compound growth on that $22,000, which is typically about 11% a year.

For example, after 30 years, a $100,000 account could grow to about $2.67 million. An account with a starting point of $78,000 would grow to $2.08 million. Thats a difference of $587,000!

Want to run the math on your retirement account balance? Try our investment calculator that will do the calculations for you.

Don’t Miss: How To Get Money From 401k Early

How To Roll Over Your 401

If your company or former employer allows 401 to Roth IRA conversions, take the following steps.

In some cases, you may get a check of your 401 assets to deposit with the financial institution holding your Roth IRA. If so, you need to deposit it into your Roth IRA within 60 days or you may face an early withdrawal penalty. The process may involve some paperwork from your 401 plan administrator and the financial institution that manages your Roth IRA account.

What Are The Benefits Of A Roth Ira

A major benefit of a Roth individual retirement account is that, unlike traditional IRAs, withdrawals are tax free when you reach age 59½. You can also withdraw any contributions, but not earnings, at any time regardless of your age.

In addition, IRAs typically offer a much wider variety of investment options than most 401 plans. Also, with a Roth IRA, you dont have to take required minimum distributions when you reach age 72.

Read Also: Can I Open A 401k On My Own

Also Check: How To Check For 401k

Youll Pay Higher Tax Rates Later

Theres also a rule of thumb for when a conversion may be beneficial, says Victor. If youre in a lower income tax bracket than youll be in when you anticipate taking withdrawals, that would be more advantageous.

The reason you might be in a higher tax bracket could be anything: living in a state with income taxes, earning more later in your career or higher federal taxes later on, for example.

Lets say that you are a Texas resident and you convert your IRA to a Roth IRA and then in retirement, you move to California, says Loreen Gilbert, CEO, WealthWise Financial Services in Irvine. She points to high-tax California and no-tax Texas as examples. While the state of California will tax you on IRA income, they wont be taxing you on Roth IRA income.

In this example you avoid paying state taxes on your conversion in Texas and then avoid paying income taxes in California when you withdraw the funds at retirement.

Should You Roll Over Your 401

To start, its worth knowing that you dont have to make a 401-to-IRA rollover, even if you do leave your job. You have the option of leaving the money youve invested in the plan at your old company. You cant keep contributing to it, but it will stay invested and if your investments go up, youll continue to see your account grow. This is called an orphan account.

Do you like the way your money is invested currently? If so, you may want to consider keeping your money in the existing plan. If you currently arent working but anticipate taking a new job soon, you could leave your money at your old plan temporarily and put it into your new companys plan once you have access to it.

For those who dont think theyll end up in another 401 plan but still want to save more for retirement, it might make sense to do a 401-to-IRA rollover. Remember, even though you still have your account at your old companys 401, you wont have the ability to make more contributions.

You May Like: Can You Take A Loan From Your 401k

How Can I Manage Taxes On A Roth Conversion

Tax deductions can also help offset the tax cost of a Roth IRA conversion. For example, you may be able to take a tax deduction for donations to qualified charities. In general, by making charitable contributions, you can deduct up to 60% of your adjusted gross income .3 The deduction is usually limited to 30% of AGI for donations to some private foundations and some other organizations, as well as for contributions of non-cash assets. Note, however, that if your itemized deductionsâwhich include charitable contributionsâdo not exceed the standard deduction, there wouldn’t be any tax benefit from those charitable contributions. So be sure to consult with your tax advisor to plan your charitable strategyâthere are techniques that can help ensure you enjoy the potential tax benefits of your charitable giving.

Learn more at FidelityCharitable.org

Figure Out How Much You Owe In Taxes

You can estimate those taxes by multiplying the amount you plan on converting by your income tax rate based on your tax bracket. When you get your number, set aside the money or come up with a plan to save up the cash you need to pay those taxes when tax season arrives without dipping into the money from your 401.

For example, if youre converting $100,000 and your tax rate is 12%, youd need to set aside $12,000 for taxes.

You May Like: When Can You Roll Over 401k To Ira

The Difference Between A Roth Ira And Tax Sheltered Accounts

Roth IRAs are already taxed investment accounts. This means the money you put into the account has already had taxes taken out, so when you withdraw from the roth in the future you do not need to pay tax.

In contrast, 401k and traditional IRA account contributions are not taxed by federal income tax . You will pay taxes when money is withdrawn in the future. In the meantime, you receive a tax break for contributions you make each year.

Make Sure You Understand These Rules Before Converting Your Retirement Savings

A 401 is a smart place to keep your retirement savings, especially if your company offers a matching contribution. But as some people look toward retirement, they find the Roth IRA’s tax-free distributions more appealing. Contributing funds to a Roth IRA is always an option, but you could also do a 401 to Roth IRA conversion with your existing savings.

This lets you reclassify your 401 funds as Roth savings by paying taxes on the amount you’d like to convert. Here’s a closer look at how 401 to Roth IRA conversions work and how to decide if they’re right for you.

Also Check: Can I Rollover 401k To Ira

A High Percentage Of After

In general, the decision, “To convert, or not to convert,” is one that is driven by the expected change in a clients marginal income tax rate over time. To that end, if marginal tax rates will be lower in the future, it rarely makes sense to pull forward additional income and pay income tax at a higher current tax rate, sooner than otherwise necessary.

That calculus, however, can be changed by the presence of after-tax dollars in an individuals retirement account. Simply put, the greater the percentage of after-tax dollars in the account , the more it makes sense to convert all or a portion of the account now, even if todays marginal tax rate is higher and in some cases, substantially higher than is expected to be the case in the future.

But why? Why pay tax now, at a higher rate, when you can wait and pay taxes in the future, at a lower rate?

In a word earnings.

Recall that while the after-tax dollars in a Traditional IRA are tax-free when distributed, the earnings on those amounts will be taxable in the future. By contrast, if the after-tax amounts are converted to a Roth IRA, the future earnings will be tax-free .

And when a conversion is made from an IRA containing both pre-tax and after-tax dollars, for every $1 of taxable income generated due to the conversion , there is future tax-free growth in the Roth IRA on some amount greater than $1 !

Limitations Of Using Qcds To Isolate Nondeductible Basis Of A Traditional Ira

Using QCDs to isolate of basis in an IRA has two notable drawbacks compared to isolating basis via a rollover to an employer-sponsored retirement plan.

First, while there is no limit on the amount of pre-tax dollars that can be rolled from an IRA to an employer plan , QCDs are limited to no more than $100,000 annually.

Second, and probably a bigger issue for most, a rollover from an IRA to an employer plan is merely a cosmetic change when it comes to an individuals accounts assets are simply being relocated from one account to another with no change in ownership taking place. By contrast, when an individual makes a QCD, the QCD amount is lost to charity. Because it really is a charitable donation!

Thus, while using QCDs to isolate basis can be an effective strategy for the charitably inclined, particularly when an individual is willing to be flexible with their gifting schedule, for those savers with no charitable goals, its not a viable strategy .

In general, Roth IRA conversions are best completed in years when retirement savers find themselves with a relatively low marginal income tax rate. The existence of after-tax amounts in a Traditional IRA account, however, can alter that general Roth conversion guidance.

Read Also: How To Buy Stock With 401k

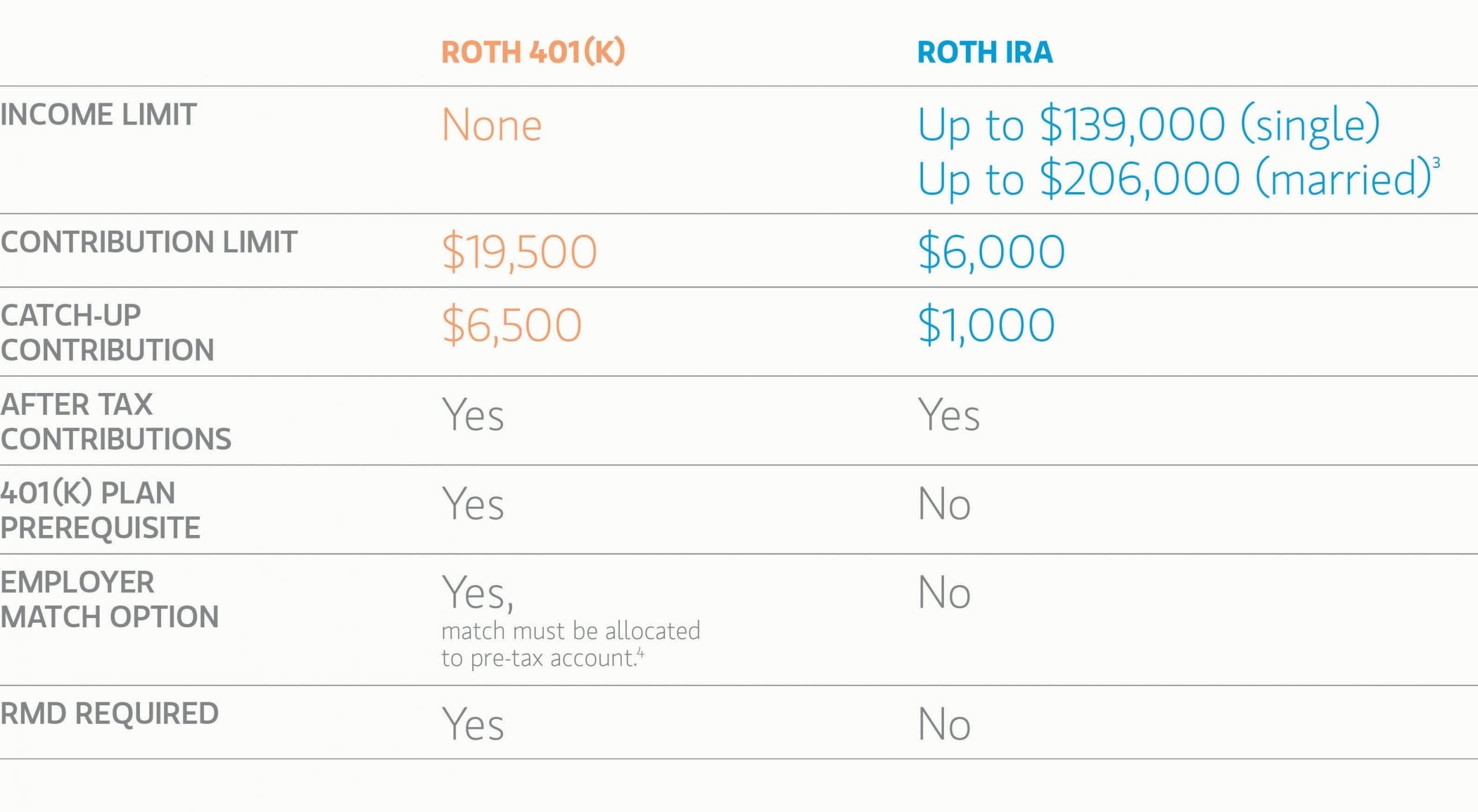

Benefits Of A Roth 401

There are certain financial motivations as to why employees may want to consider contributing into a Roth 401. Here are a few:

- Retirement account grows tax-free

- Employee pays taxes now while in an assumed lower tax bracket than during retirement

- The possibility that Federal, State and Local income tax rates will continue to rise

- Ability for future tax diversification

- Qualified distributions are tax-free

These reasons can be particularly appealing for high-income earners, high-net worth individuals, and younger employees who seek the flexibility offered through Roth diversification.

During times of market volatility or a recession, similar to our current economic environment, participants may consider taking their lower account values as a conversion opportunity, since they would owe less taxes on the smaller account basis. For specific participants, the long-term tax advantages, growth potential of assets, and investable time horizon could be a valuable retirement, tax and estate planning strategy.