How Does A Hardship Loan From 401k Work

A hardship distribution is a withdrawal from a participant’s elective deferral account made because of an immediate and heavy financial need, and limited to the amount necessary to satisfy that financial need. The money is taxed to the participant and is not paid back to the borrower’s account.Apr 30, 2021

Eligibility For A Hardship Withdrawal

Even if your employer offers the measure, you should be cautious about using it. Financial advisors typically counsel against raiding your retirement savings except as an absolute last resort. Indeed, with new rules now in place that make hardship withdrawals easier, some advisors fear a run on retirement funds at the expense of using options that are less damaging to long-term financial health.

The Internal Revenue Service ‘s immediate and heavy financial need stipulation for a hardship withdrawal applies not only to the employee’s situation. Such a withdrawal can also be made to accommodate the need of a spouse, dependent, or beneficiary.

Immediate and heavy expenses include the following:

- Certain medical expenses

- Home-buying expenses for a principal residence

- Up to 12 months worth of tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence

You wont qualify for a hardship withdrawal if you have other assets that you could draw on to meet the need or insurance that will cover the need. However, you needn’t necessarily have taken a loan from your plan before you can file for a hardship withdrawal. That requirement was eliminated in the reforms, which were part of the Bipartisan Budget Act passed in 2018.

Penalties For Home And Tuition Withdrawals

Under U.S. tax law, there are several other scenarios where an employer has a right, but not an obligation, to allow hardship withdrawals. These include the purchase of a principal residence, payment of tuition and other educational expenses, prevention of an eviction or foreclosure, and funeral costs.

However, in each of these situations, even if the employer does allow the withdrawal, the 401 participant who hasn’t reached age 59½ will be stuck with a sizable 10% penalty on top of paying ordinary taxes on any income. Generally, youll want to exhaust all other options before taking that kind of hit.

In the case of education, student loans can be a better option, especially if they’re subsidized.

You May Like: Should I Rollover My Old 401k To An Ira

Employers Have Options Under Latest Law

Although the Consolidated Appropriations Act temporarily relaxes rules for eligible individuals to access their retirement funds, businesses dont necessarily have to include these provisions in their plan provisions. Businesses that had to layoff workers due to business slowdowns also have more time to restore their workforce to at least 80 percent to avoid partial plan termination rules relating to their retirement plan. The partial retirement plan termination rule would be relaxed during a plan year that includes the period between March 13, 2020, and March 31, 2021, deferring assessments until March 2021.

Many workers count on their 401s for the lions share of their retirement savings. Thats why these employer-sponsored plans shouldnt be the first place you go if you need to make a major expenditure or are having trouble keeping up with your bills.

But if better options are exhaustedfor example, an emergency fund or outside investmentstapping your 401 early may be worth considering.

You May Like: Can I Set Up My Own 401k Plan

Can Medical Bills Be Forgiven

Yes. Sometimes you can get your bills reduced or forgiven by the medical provider or hospital. You may be able to negotiate for a lower bill or work out a payment plan.

In some cases, you can apply to have your debt fully forgiven. Your chance of success will depend on your overall financial situation, how much money you owe, and the healthcare providers rules.

As of July 1, 2022, will wait a year before adding unpaid medical debt to your credit report but remember that providers will still try to collect it.

Recommended Reading: What Happens To 401k When You Quit

How Do You Apply For A Hardship Withdrawal From Your 401

You start with an application to your plan administrator. That may be your employers human resources department, but its more likely to be a third-party custodian. For instance, your plan may be administered by a major brokerage firm like Fidelity or Vanguard. Every plans process will be a little different.

Youll need to do some additional paperwork, too. For medical hardship withdrawals, you may be asked to submit documentation or perhaps a letter of explanation. In that case, you may have to lay out cash for your bills first, and then submit the actual receipts.

The plan administrator is likely to follow up with you. Thats because both the plan administrator and the IRS need to be convinced that you have a true hardship and that a withdrawal is your best means of getting the money you require. However, you can self-certify your need and decide for yourself whether a loan or a withdrawal is right for you.

Under What Circumstances Can A Participant Get A Hardship Distribution From A Retirement Plan

A retirement plan may, but is not required to, provide for hardship distributions. Many plans that provide for elective deferrals provide for hardship distributions. Thus, 401 plans, 403 plans, and 457 plans may permit hardship distributions.

If a 401 plan provides for hardship distributions, it must provide the specific criteria used to make the determination of hardship. Thus, for example, a plan may provide that a distribution can be made only for medical or funeral expenses, but not for the purchase of a principal residence or for payment of tuition and education expenses. In determining the existence of a need and of the amount necessary to meet the need, the plan must specify and apply nondiscriminatory and objective standards.-1)

If your 401 plan made hardship distributions that didnt follow the plan language, or if your plan doesnt have hardship language, find out how you can correct this mistake.

The rules for hardship distributions from 403 plans are similar to those for hardship distributions from 401 plans.

If a 457 plan provides for hardship distributions, it must contain specific language defining what constitutes a distribution on account of an “unforeseeable emergency.”)

You May Like: When Can I Get My 401k Without Penalty

Avoid Hardship Withdrawals If You Can

A hardship is just thata hardship. It won’t be something you planned. Often, it will be an emergency or dire situation, and you may be out of options, but if other options remain, exhaust those first.

Many Americans are behind on retirement savings and risk severe financial shortfalls when they can no longer work. Taking out money from your savings before retirement might solve your current issue, but it might create or add to a future problem that could be even harder to solve.

Before making a hardship withdrawal, talk to a financial planner, and explore all of your other options first.

Who Is Jeff Rose

Jeff Rose, CFP® is a Certified Financial Planner, founder of Good Financial Cents, and author of the personal finance book Soldier of Finance. Jeff is an Iraqi combat veteran and served 9 years in the Army National Guard. His work is regularly featured in Forbes, Business Insider, Inc.com and Entrepreneur.

You May Like: How To Move 401k From Old Job

Most People Have Two Options:

Whether youre considering a loan or a withdrawal, a financial advisor can help you make an informed decision that considers the long-term impacts on your financial goals and retirement.

Here are some common questions and concerns about borrowing or withdrawing money from your 401 before retirement.

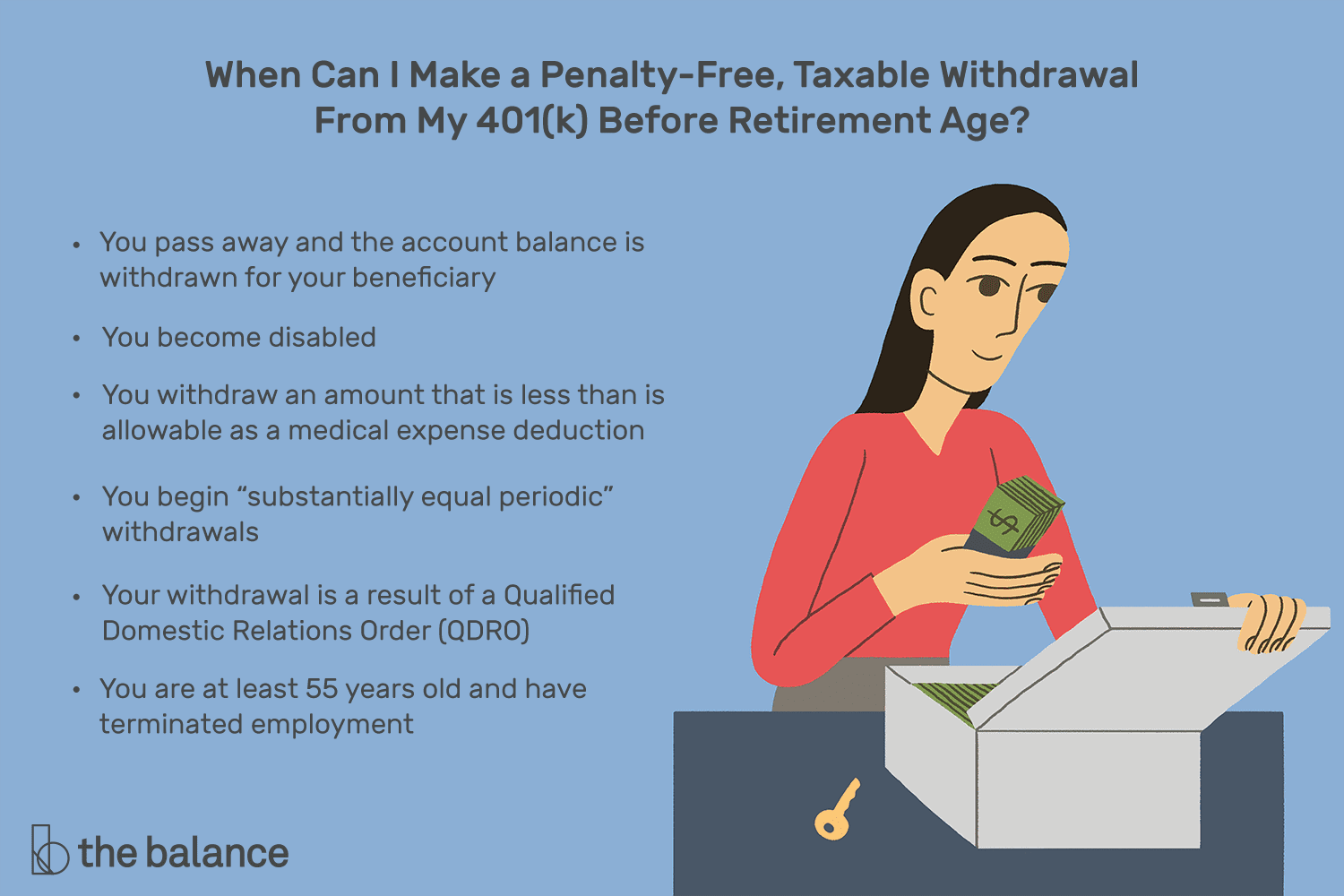

How Can I Avoid Paying Taxes On My 401k Withdrawal

Here’s how to minimize 401 and IRA withdrawal taxes in retirement:Avoid the early withdrawal penalty.Roll over your 401 without tax withholding.Remember required minimum distributions.Avoid two distributions in the same year.Start withdrawals before you have to.Donate your IRA distribution to charity.More items…

Read Also: Is A 401k A Defined Contribution Plan

Can I Withdraw From My 401k If I Have An Outstanding Loan

Most 401 plans allow participants to tap into their retirement savings. Find out if you can withdraw from your 401k if you have an unpaid 401 loan.

When contributing to a 401 plan, most people have every intention of accumulating a sufficient retirement nest egg that they can live off in retirement. However, when heavy financial emergencies occur and you do not have an emergency fund, you could be forced to raid your retirement savings to settle the urgent financial needs.

Most 401 plans allow you to take a 401 loan against your retirement savings, or a hardship withdrawal if you are below 59 ½. However, there are circumstances when you can withdraw from your 401 if you have an unpaid loan. For example, if you leave your job or are fired, you could rollover your 401 to an IRA or the new employerâs 401 even if you have an outstanding 401 loan. When this happens, the outstanding 401 balance will not be rolled over, and you will have until the tax due date to pay off the loan balance.

Whats The Difference Between A 401k Loan And Withdrawal

If you are eyeing your 401 money, you can decide to take a 401 loan or a 401 withdrawal. Here is the difference between a 401 loan and withdrawal.

When you contribute part of your paycheck for retirement, you expect to use these savings in retirement. However, there are situations when you may need quick cash and you have no other options apart from your 401 savings. In this case, you could consider making a 401 withdrawal or taking a 401 loan to meet your financial needs. Before deciding how to take money out of your 401, you should consider the financial implications of each option.

A 401 loan lets you borrow against your retirement savings, and you must pay back this money over a five-year period. In contrast, a 401 withdrawal permanently removes money from your 401, and you wonât be required to pay back the money. However, a 401 withdrawal is subject to income taxes, and a potential penalty if you are below 59 ½. A 401 loan is not subject to income taxes or early distribution penalties unless you default on the loan.

Don’t Miss: When Can I Take Out 401k

After You Take A 401 Hardship Withdrawal

Under prior law, for six months after you took a 401 hardship withdrawal, you were not allowed to make contributions to your 401 plan. That six-month pause has been eliminated, effective January 1, 2020. You are not allowed to pay back the amount of the hardship withdrawal, but, you can continue to contribute up to the maximum 401 allowable contribution limit for the year.

What Is A 401 Loan

A 401 loan entails borrowing money from your personal 401. This means youre borrowing from yourself to help cover mortgage payments, bills or any other urgent debts. In turn, you must pay back every bit of the money that you take out of your account.

To initiate a 401 loan, you must meet three major IRS requirements:

- Apply for the loan through your plan administrator

- The loan must be for no more than 50% of the vested account balance or $50,000, whichever is less

- You must make payments at least quarterly and repay the loan fully within five years

For example, lets say that John has a 401 account with a $60,000 balance. He may borrow up to $30,000 from this account, as this is 50% of his total balance. On the other hand, Robert has a $200,000 401 account. While 50% of his balance would be $100,000, he can only take out $50,000, as per the IRS borrowing cap.

A borrower can take out multiple loans at the same time, as long as theyre collectively below the borrowing limit. Note that these stipulations differ if your account balance is below $10,000. In this situation, the IRS allows the 401 plan to lend up to the full amount of the borrowers account.

The specifics of your repayment terms are up to your 401 plan. In most cases, these will call for full repayment within five years and at least quarterly payments. Some exceptions include:

- If the employee is actively serving in the military

- A leave of absence of up to one year

Also Check: When Can I Rollover 401k To Ira

K Hardship Withdrawal Rules

Jeff Rose, CFP® | July 11, 2022

For many Americans struggling to make ends meet, a 401k hardship withdrawal appears to be a viable option.

When job loss, unexpected health issues, or recession hit, you may find yourself in dire need of help.

House or rent payment. Utility bills. Late credit cards notices. Debt collectors calling you every hour on the hour.

Read on to decide whether or not to pursue a 401k hardship withdrawal to alleviate the burden.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: What Happens With 401k When You Quit

Talk With A Financial Advisor

Still have questions about your 401 and what a 401 loan would mean for your financial future? The best thing you can do is talk to a qualified financial advisor you can trust.

Our SmartVestor program can connect you with a financial advisor you can turn to for sound advice. That way, you dont have to make these huge financial decisions on your own.

How You Can Use Hardship Loans

People use hardship loans in a variety of different ways.

They can cover emergency expenses. They can also pay for medical bills, mortgage payments, and other necessary expenses.

This is where hardship loans come in handy.

The interest rates on these loans are usually much lower than traditional bank rates.

This makes them an attractive alternative for people who need a little help getting back on their feet financially.

Read Also: How Do You Pull From Your 401k

You Become Too Dependent On Your Employer

Remember: If you leave your job for whatever reason, you have until next years tax filing deadline to pay back the entire balance of your 401 loan. That means when you take out a 401 loan, youre all of a sudden very dependent on your job and your paycheck to pay back that loan.

Many people choose to repay their 401 loans over the course of five years. Meanwhile, many workers say theyve been at their jobs less than five years.6 Do you see the problem here? You might be happy at your job now, but what about a year from now? Or two years from now?

Heres the bottom line: Debt limits your ability to choose. And a 401 loan can leave you feeling tied financially to your job . . . even if you desperately want to leave or have an exciting job opportunity in front of you. Dont give your boss that kind of power over you.

Pros And Cons Of 401 Loans And Hardship Withdrawals

Taxes are a major differentiating factor when it comes to deciding between a 401 loan and a hardship withdrawal. For hardship withdrawals, your money will be taxed penalty-free under ordinary income taxes.

401 loans avoid income taxes, as the money technically isnt income. However, you must pay the loan back in full and on time, and failure to do so will typically trigger the 10% early withdrawal penalty on top of the standard income tax. At this point, your loan will become a deemed distribution.

Unlike hardship withdrawals, the purpose of a 401 loan is completely irrelevant. As long as your plan allows for a loan and you meet all of the requirements, you can borrow money. Theres no need to justify this decision because, in the end, youll be paying every dime back.

401 loans dont come without consequences, though. Because you must repay what you borrow, there might be interest, depending on your plan. The good news is that, because youre borrowing from yourself, the interest ultimately gets paid back to you. Still, because the interest is not pre-tax , this interest is a contribution that doesnt benefit from the usual favorable tax treatment of a 401 contribution.

Youll also be on the hook for payments even if you leave your employer. If you cant, the plan will consider the loan an early distribution and report it to the IRS as such.

Also Check: How To Borrow From 401k