Maximize Your 401k Returns And Fees

Are you getting the most for your fees? Most people dont know what theyre paying in 401k fees. By some estimates, the average fees for 401k plans are between 1% and 2%, but some outliers can have up to 3.5%. Fees add upeven if your employer is potentially paying the fees, youll have to pay them if you leave the job and keep the 401k.

Essentially, if an investor has $100,000 in a 401 and pays $1,000 or more in fees, the fees could add up to thousands of dollars. Any fees you have to pay can chip away at your retirement savings and reduce your returns.

Its important to ensure youre getting the most for your money in order to maximize your retirement savings. If you are currently working for the company, you could discuss high fees with your HR team. One of the easiest ways to lower your costs is to find more affordable investment options. Typically, the biggest bargains can be index funds, which often charge just 0.3% to 0.5 %

If your employers plan offers an assortment of low-cost index funds or institutional funds, you can invest in these funds to build a diversified portfolio.

If you have a 401 account from a previous employer, you might consider moving your old 401k into a lower fee plan. Its also worth examining what kind of fund youre invested in and if its meeting your financial goals and risk tolerance.

Contributing To Your 401 Plan

As part of enrolling in a 401, you must decide how much you are going to contribute to the plan each year. There are some limits on the upper end, and your employer may require a minimum contribution if you want to join the plan.

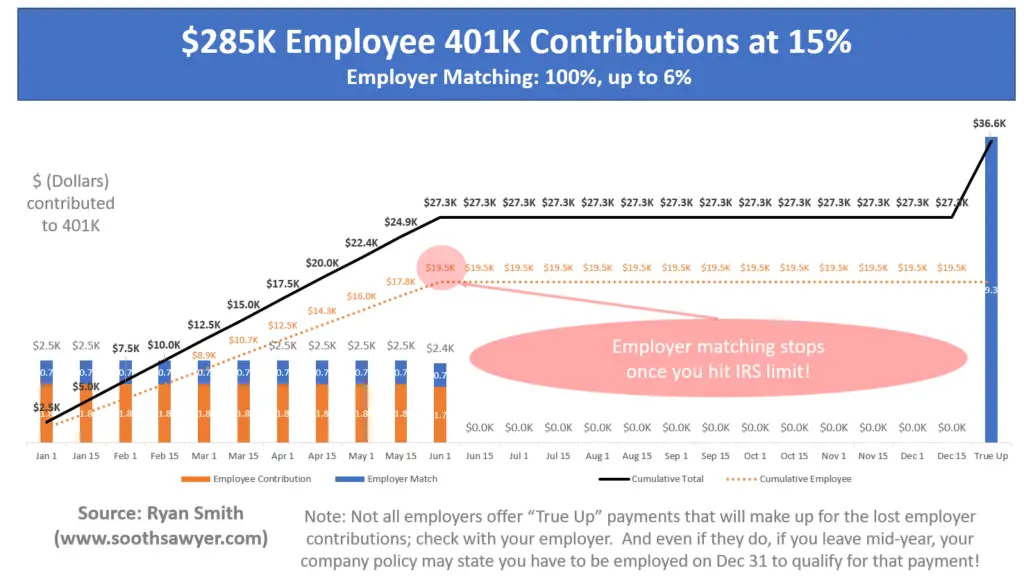

But you may find that the critical question is what percentage of your earnings you are willing to commit to retirement savings. Many experts in the retirement field believe a ballpark amount is somewhere around 10 percent of your earnings. But it can be more or less, depending on your personal circumstances. If your company offers a match, you should contribute at least enough to get the full benefit of the match, otherwise you are leaving money on the table. And keep in mind that even if you are automatically enrolled at a certain level , this is often a minimum amount to save for a secure retirement. Consider increasing this amount, perhaps significantly, to give yourself a better shot at accumulating a robust retirement nest egg.

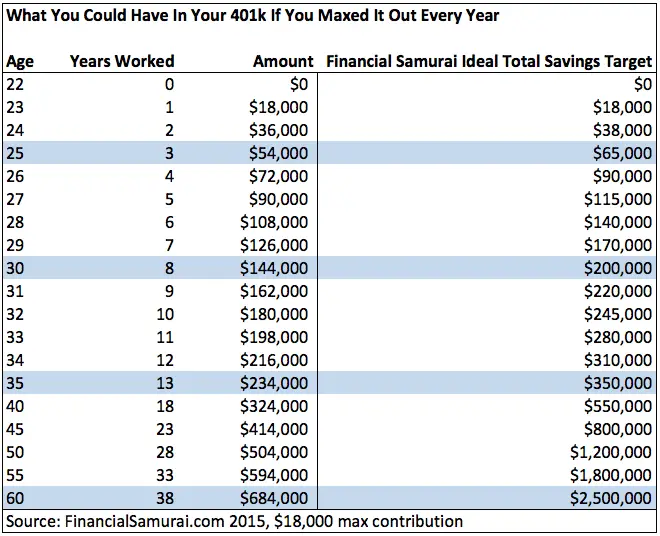

How Much Should You Contribute To Your 401

Most retirement experts recommend you contribute 10% to 15% of your income toward your 401 each year. The most you can contribute in 2021 is $19,500 or $26,000 if you are 50 or older. In 2022, the maximum contribution limit for individuals is $20,500 or $27,000 if you are 50 or older. For both years, those those age 50 and older can contribute an extra amount of $6,500. Consider working with a financial advisor to determine the best contribution rate.

Don’t Miss: Can You Borrow From 401k To Buy A House

How Much Can You Contribute To 401

Before determining how much to contribute to a 401, you should understand the annual IRS contribution limits. If you are younger than 50, you can contribute to the 401 account up to $19,500 in 2021. If you are above 50, you can contribute up to $26,000, which includes $19,500 plus an additional $6,500 in catch-up contributions.

If your employer offers a company match, it will make additional contributions to your 401 above the employeeâs limit. For 2021, the combined employee-employer contribution limit is $58,000 if you are below 50, or $64,500 for individuals who are above age 50.

Allocating Employee Contributions Question:

In short yes. It is important to first understand the total contribution limit to a solo 401k cannot exceed $58,000 for 2021, not counting the catch-up contributions for those age 50 and over. The contributions made to the Roth solo 401k designated account will reduce the amount of contributions that you can make to the pretax solo 401k designated account. Only employee contribution may be made to the Roth solo 401k therefore, if you make the full $19,500 employee contribution to the Roth solo 401k for 2021, then you wont be able to make any employee contribution to the pretax solo 401k because you will have exhausted the full $19,500 employee contribution on the Roth solo 401k. Note that you can also split up the $19,500 employee contribution between both the pretax solo 401k and Roth solo 401k designated accounts. Lastly, you also have an additional $6,500 of catch-up contributions to work with if you are age 50 or older in 2021 since the catch-up contribution falls under the employee contribution umbrella and can thus be allocate between the Roth solo 401k and the pretax solo 401k designated account.

You May Like: Can I Transfer My Roth Ira To My 401k

How Much Should You Save For Retirement

To start, invest 15% of your gross income into retirement savings accounts like a Roth 401 and Roth IRA. Spread your money evenly across four types of mutual fundsgrowth and income, growth, aggressive growth, and internationalinside of those retirement accounts.

And listen, we know youre eager to start saving money for your retirement future . . . but if youre still getting out of debt or need to get a solid emergency fund in place, now is not the time to save for retirement. Your income is your number one wealth-building tool, and you cant take full advantage of it if its tied up in credit card or student loan payments.

So lets say youre out of debt with a fully funded emergency fund and you have an annual salary of $75,000. That means your goal is to save $11,250 each year for retirement. Where do you start? Lets walk through it step-by-step.

How Much Should You Save For Retirement In A 401

Experts recommend that workers save at least 15% of their income for retirement, including any employer match. For instance, if your employer contributes 3%, you would need to save an additional 12%.

If you arent saving that much right now, increase your contribution each year until you reach that goal. For example, if you are saving 3% now, increase that to 5% in 2022 then bump that up to 7% in 2023 and so on until you reach 15%. Many companies will even do it for you by automatically increasing the percentage you contribute each year. Of those companies, more than a third have auto-escalation caps of at least 10%.

Read Also: How To Find Out Your 401k Balance

Maximum 401 Contribution Limits

Many employers offer 401 matching contributions as part of their benefits package. With a 401 match, your employer agrees to duplicate a portion of your contributions, up to a certain percentage of your salary. In addition to matching contributions, some employers may share a percentage of their profits with employees in the form of non-matching 401 contributions.

While an employers 401 match and non-matching contributions dont count toward your $19,500 employee deductible contribution limit , they are capped by total contribution limits.

Total 401 plan contributions by both an employee and an employer cannot exceed $58,000 in 2021 or $61,000 in 2022. Catch-up contributions for employees 50 or older bump the 2021 maximum to $64,500, or a total of $67,500 in 2022. Total contributions cannot exceed 100% of an employees annual compensation.

Take Advantage Of Catch

401 catch-up contributions allow investors over age 50 to increase their retirement savingswhich is especially helpful if theyre behind in reaching their retirement goals. Individuals over age 50 can contribute an additional $6,500 for a total of $27,000 for the year. Putting all of that money toward retirement savings can help you truly max out your 401.

As you draw closer to retirement, catch-up contributions can make a difference, especially as you start to calculate when you can retire. Whether you have been saving your entire career or just started, this benefit is available to everyone who qualifies.

And of course, this extra contribution will lower taxable income even more than regular contributions. Although using catch-up contributions may not push everyone to a lower tax bracket, it will certainly minimize the tax burden during the next filing season.

Recommended Reading: Is It Good To Have A 401k

Can I Contribute 100 Percent Of My Salary To A 401

If your earnings are below $20,500, then the most you can contribute is the amount you earn. It should also be noted that a 401 plan document governs each particular plan and may limit the amount that you can contribute. This applies especially to highly compensated employees, which in 2022 is defined as those earning $135,000 or more or who own more than 5 percent of the business.

Sponsors of large company plans must abide by certain discrimination testing rules to make sure highly compensated employees dont get a lopsided benefit compared to the rank and file. Generally, highly compensated employees cannot contribute higher than 2 percentage points of their pay more than employees who earn less, on average, even though they likely can afford to stash away more. The goal is to encourage everyone to participate in the plan rather than favor one group over another.

There is a way around this for companies that want to avoid discrimination testing rules. They can give everyone 3 percent of pay regardless of how much their employees contribute, or they can give everyone a 4 percent matching contribution.

How Much You Can Afford To Contribute

Despite contribution limits, often times employees will contribute what they can afford to set aside for retirement. Financial experts generally recommend that everyone contribute 10% of their paycheck to a 401, but this may not be doable for all. Plus, often times we think about other ways we’ll need to use that money now.

Your life expenses can play a role in how much of your paycheck you feel comfortable contributing to your 401. If you tend to have high monthly costs or someone who relies on your financial support, you may feel like contributing a higher percentage to your 401 may mean having less in your paycheck to meet your monthly expenses.

If attempting to max out your 401 means putting yourself in a financially stressful situation, it’s okay to just contribute what you feel comfortable with.

In this case, a good rule of thumb that still has a profound positive impact on your retirement savings is to contribute just enough to receive the full employer match. So if your employer will match up to 7% of your contributions, only contribute 7% so you can take full advantage of that extra money. Your employer match is essentially “free money” so you don’t want to leave any sitting on the table.

You May Like: Can I Rollover From 401k To Roth Ira

How To Use The Contribution Calculator

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. The Growth Chart and Estimated Future Account Totals box will update each time you select the “Calculate” or “Recalculate” button.

Pre-filled amountsBased on our records, the following information may be pre-filled:

Salary

- Pay period. If the information is not available, the default pay period is weekly.

Contribution

- Your contribution rate. Note that we will use 8% as a default value if your contribution rate is not available or if your contribution is a dollar amount rather than a percentage.

Investment

- Years invested

- Your initial balance

You may change any of these values.

Using the calculator

In the following boxes, you’ll need to enter:

Salary

- Your expected annual pay increases, if any.

- How frequently you are paid by your employer.

Contribution

- The amount of your current contribution rate .

- The proposed new amount of your contribution rate. Be sure to verify the maximum contribution rate allowable under your plan. Also, pre-tax contributions are subject to the annual IRS dollar limit.

Pre-tax Contribution Limits 401, 403 and 457 plans |

|

|---|---|

| 2022 | |

| After 2022 | May be indexed annually in $500 increments |

Employer Match

Investment

- The length of time that you anticipate you will invest this money.

- The amount of your current account balance.

- Your hypothetical assumed annual rate of return.

Change In Business Name Affect On Contributions Question:

You can still setup the solo 401k in 2021 under your sole proprietor business. Next year in 2022, we can update the plan to list the new self-employed business. All else would remain the same . The 2022 annual solo 401k contributions would be based on your new self-employment income and you would have until 2023 to make those contributions.

You May Like: Who Is The Plan Administrator For 401k

Maximize Your 401k Through Fixed Contributions

If your company allows contributions of a flat dollar amount per month or per check, then simply contribute that amount from your paycheck. If you are under age 50, then you would be able to contribute up to $1,708.33 per month, or $854.16 each check if you are paid twice each month.

If you are age 50 or over, you can contribute up to $2,250 per month, or $1,125 per check if you are paid twice per month.

Remember, those are the numbers to max out your contributions. You can contribute less than that amount if that is what works with your budget.

Build Your Emergency Fund

You want to save as much as you can for retirement, but you shouldnt put all of your savings toward retirement. You should always have enough cash reserves to cover necessary expenses like food and rent. Its also a good idea to create an emergency fund.

An emergency fund will protect you from unexpected expenses or difficult financial situations. What would you do if you lost your job or didnt have a regular salary for a month? What if a family member got sick and you had medical bills to pay? A strong emergency fund allows you to get through tough times. Withdrawing money from your retirement accounts should be an absolute last resort. Just as importantly, an emergency fund will ease your mind by providing a sense of security. Its always nice to know that you have a backup plan in case something goes wrong.

Again, there is no perfect answer for how much you should have in an emergency fund. It depends on your situation. In general though, you want enough to cover at least a few months of expenses. That may sound like a lot if currently have no emergency fund, but you can build your fund over time by adding a little each week or month.

Recommended Reading: How Much Will My 401k Be Worth When I Retire

Best Places For Employee Benefits

SmartAssets interactive map highlights the counties across the country that are best for employee benefits. Zoom between states and the national map to see data points for each region, or look specifically at one of four factors driving our analysis: unemployment rate, percentage of residents contributing to retirement accounts, cost of living and percentage of the population with health insurance.

Recommended Reading: Where Can I Cash A 401k Check

Other Important Financial Goals To Consider

You should keep a few other things in mind as you decide how much to contribute to your 401 based on your own unique financial situation.

- Do you have a formal estate plan with a will and other critical papers ?

- Can you cover health care expenses? Make sure you’re putting enough into your health savings account , both now and in the future, to cover medical expenses if you have a high-deductible health plan with an HSA combo.

- Do you have proper disability insurance coverage to protect you and your family if you miss work for six months or more due to illness or injury?

- Do you have long-term care plans in place if you’re nearing retirement?

Don’t Miss: How To Transfer 401k From Fidelity To Vanguard

Mega Backdoor Roth Solo 401k Ban Question:

Since the Build Back Better bill did not pass in 2021, yes the solo 401k participant can still make voluntary after-tax solo 401k contributions for both 2021 and 2022 and subsequently convert the contributions to the Roth IRA or the Roth solo 401k. Since congress was not able to pass the BBB in 2021 which would have banned both the backdoor and the mega backdoor starting in 2022, if the bill is passed in 2022 it would be effective at the earliest starting in 2023 as this is how retirement regulation generally works .

Why Contribute To An Ira

Why Contribute to an IRA?: For the most part, IRAs have similar tax rules as 401k plans, but with different contribution limits.

While IRAs have similar tax benefits to 401k plans, they do have a few important benefits namely, they are more flexible, as you control how and where your investments are made. This allows you more freedom and control over investment types, and more importantly, investment costs .

Roth IRAs also dont have Required Minimum Distributions , which exist in all 401k plans, including the Roth 401k.

If you can afford to maximize both investments, then go for it! If you can maximize both an IRA and a 401k, then you should read this article to help decide how to invest after maxing out your retirement accounts. You may still have options, such as investing through an HSA, a taxable investment account, peer to peer loans, real estate, and more.

Read Also: What Does It Mean To Rollover 401k

Tips For Contributing To Your 401

- If youre struggling to get started or stay on track, consider working with a financial advisor. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If you switch jobs, you can no longer contribute to a previous employers 401 plan. You dont want to lose the hard work you did to save that money, so you should look to make a direct 401 rollover to your new employers plan.

- A traditional IRA and a 401 offer similar tax benefits. You might wonder whether one is a better option for you. Heres an article to help you think about an IRA vs. a 401.

- You should always avoid early withdrawals from your 401. Not only will you have to pay the income tax, youll have to a pay 10% penalty. There are a couple of ways you could avoid that big penalty though. If you really think you need to withdraw money early, heres more information on 401 withdrawals.