Getting Your Solo 401 Started

Once you have established the type of plan you want, you will need to create a trust that will hold the funds until you need them or you reach retirement age. You can select an investment firm, online brokerage, or insurance company to administer the plan for you.

You also need to establish a record-keeping system, so that your investments are accounted for properly.

What’s So Great About 401 Accounts

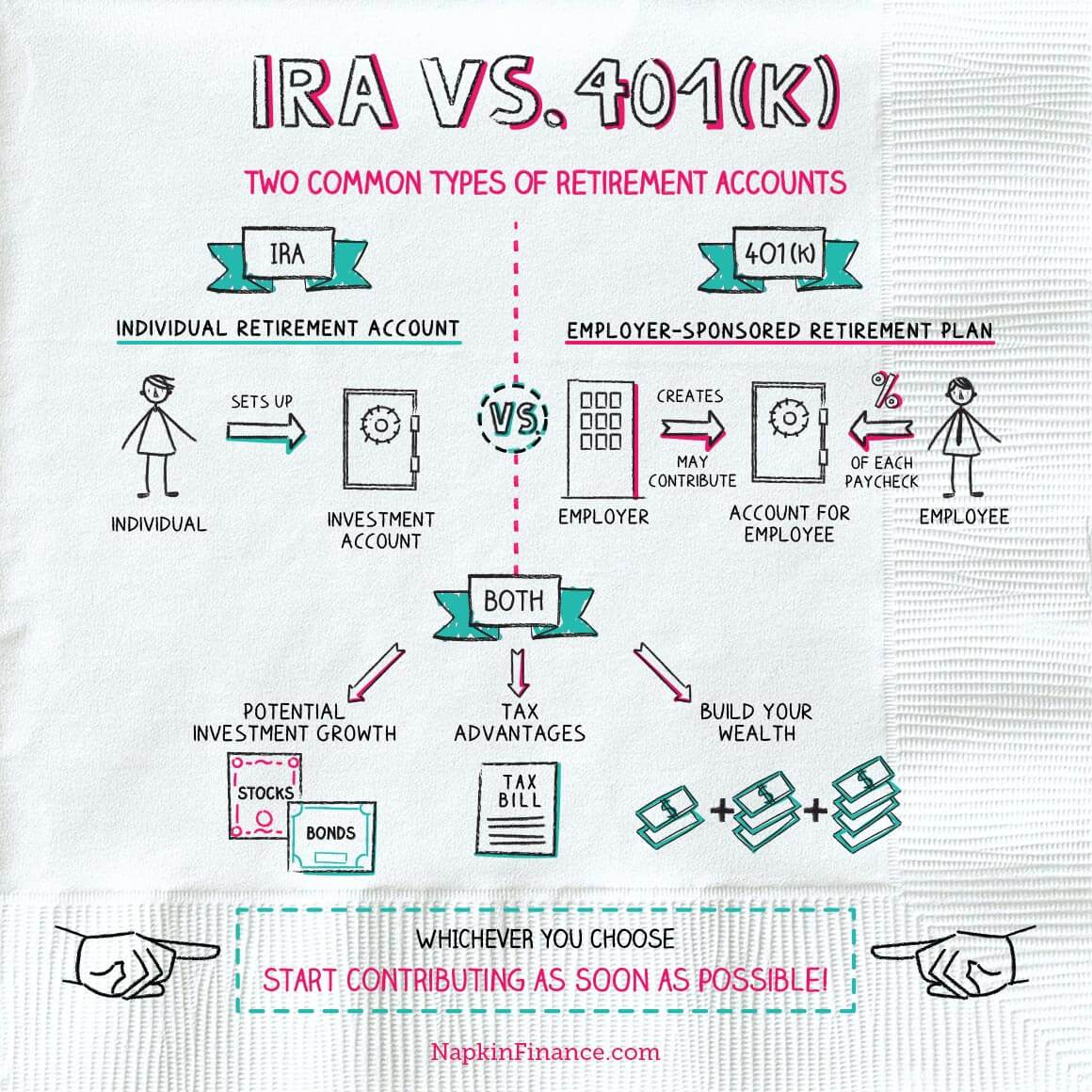

A 401 is a popular type of employer-sponsored retirement plan that’s available to all employees 21 or older who have completed at least one year of service with the employer, usually defined as 1,000 work hours in a plan year. Some employers enable new employees to join right away, even if they haven’t met this criterion yet.

In 2021 you’re allowed to contribute up to $19,500 to a 401 or up to $26,000 if you’re 50 or older. In 2020, those amounts rise to $20,500 and $27,000. These limits are much higher than what you find with IRAs, and they enable you to set aside a fairly large sum annually.

Most 401s are tax deferred, so your contributions reduce your taxable income each year. You must pay taxes on your distributions in retirement, but you may be in a lower tax bracket by then, in which case you would save money. Some employers also offer Roth 401s. You pay taxes on contributions to these accounts now, but you’ll get tax-free withdrawals in retirement.

Some employers also match a portion of their employees’ 401 contributions, which can make the task of saving for retirement a little easier. Each company has its own rules about matching, so consult with your HR department to learn how yours works.

What Happens To Your 401k When You Quit Or Fired

Shawn Plummer

CEO, The Annuity Expert

If you are considering quitting your job or have been recently fired, its important to know what will happen to your 401k. What happens to your 401k when you quit? What should you do with it? Can I cash out my 401k if I quit? What if I dont have a 401k account at all? Well answer these questions and more in this guide!

Dont Miss: When I Leave My Job What Happens To 401k

Read Also: How To Transfer My 401k To My Bank Account

Why Your Employer Doesnt Offer A 401

The most common reason an employer doesnt offer a 401 is that most of their jobs are entry-level or part-time. The average worker in these positions is either very young or living paycheck to paycheck, so saving for retirement is difficult most would pick getting more money upfront instead of a retirement plan anyway.

There are other reasons why your employer might not offer a plan. An employer might not have the experience or time to create an individually designed plan or have a go-to financial or trust institution. In these cases, plenty of employers make the decision not to offer benefits rather than spending time and money chasing a good sponsor.

What Is The Tax Penalty For Withdrawing Money From A 401

It depends on when you make the withdrawal. If you are age 59 1/2 or older, then there is no tax penalty. However, if you make a withdrawal before reaching this age, you will be charged an extra 10% penalty on top of your regular income taxes that you pay on the funds. In some cases, you might be able to take a withdrawal without being required to pay the penalty. Some situations include hardship withdrawals, unreimbursed medical expenses, education related expenses, qualified reservists, and death. This is not an exhaustive list, and you should contact your financial planner to discuss your specific situation to see if you can qualify for a penalty-free withdrawal.

Also Check: What Happens To 401k When You Leave Company

While You Cant Invest In A 401 That Isnt Sponsored By Your Employer There Are A Couple Of Exceptions To The Rule

Photo: 401kcalculator.org via Flickr.

A 401 is the most common type of retirement plan private-sector employers offer. However, many employers dont offer a 401, or any type of retirement plan at all. If you are in this group, can you still take advantage of the many benefits of a 401?

The short answer: not really By definition, a 401 is an employer-sponsored retirement plan designed to encourage employees to save money for retirement and employers to help them do it. So to take advantage of this type of an account, you need to have an employer, and the employer needs to be the sponsor of the plan.

Some specific rules:

- You cant invest in a 401 if youre unemployed.

- You cant invest in a 401 if your employer doesnt offer one, or you dont meet the qualifications for your employers plan .

- You cant invest in an employers 401 if you arent that employers employee.

But just as with many other topics in finance, there are exceptions. Here are two major exceptions to the 401 rules.

Exception 1: You are the employerIf your income comes from self-employment, you can start a retirement savings account known as a Solo 401 or Individual 401.

Essentially, this gives you all the benefits of an employer-sponsored 401, as well as the ability to invest in any stocks, bonds, or mutual funds you want not just in a small, specific basket of funds such as those that most employer-sponsored 401 plans offer.

You May Like: Can I Roll My Roth 401k Into A Roth Ira

How Many Employers Offer 401 Matches

Most companies with 401 plans today offer some kind of employer match. Vanguard, which administers plans for many large organizations, reported that in 2020, 86% of its clients provided an employer match. Of those, 50% offered the employer match only, while 36% provided both an employer match and nonmatching contributions. Nonmatching or nonelective contributions are made by employers regardless of whether the employee contributes to their account. Another 10% provided nonmatching contributions only.

Some matches are more generous than others, and how they are computed varies from one plan sponsor to another. For example, Vanguard counted more than 180 distinct matching formulas among its clients. Of those plans, 72% used a single-tier match formula, such as 50 cents on the dollar on the first 6% of pay. Less common, but used by 21% of plans, were multitier match formulas, such as $1 for $1 on the first 3% of pay plus 50 cents per $1 on the next 2% of pay. Other employers used even more complex matching formulas.

Overall, the Vanguard study showed that most 401 plans offered a match of 3% to 6% of the employees pay, with the estimated average being 4.5%.

In cliff vesting, an employee may have to attain a certain minimum number of years of service for their employers matching contributions to vest. For example, they may be 0% vested for the first two years, then 100% vested after three years.

Recommended Reading: Can I Use My 401k To Start A Business

Creating A Retirement Savings Strategy When You Dont Have A Company Match

Even though you should still participate in a 401 plan even without a company match, it may still require a different strategy.

For example, if you do have a company match, the strategy is simple.

Youll want to maximize your contributions to the plan, as well as to maximize the employer match.

But if there is no match, the following approach is recommended:

Solo 401 Withdrawals And Details

As with all qualified retirement plans, there are rules to when you can and must start taking withdrawals from your Solo 401 plan. You must begin taking the minimum required distribution no later than age 72 . There is a 10% early withdrawal penalty for distributions take before age 59 1/2, but exceptions may apply.

Please refer to the IRS page on individual 401s and review our Solo 401 Guide for additional details.

Recommended Reading: What Is The Penalty For Taking Money Out Of 401k

What To Do If Your Job Doesnt Offer A 401

A lot of people use 401s to invest for retirement, which is why you hear so much about them. But actually, more than one-third of working adults dont have access to a 401 at their job including many part-time workers, self-employed people, and people whose employers just dont offer them.

If youre in that situation, your employer might offer a different kind of retirement plan, like a payroll deduction IRA or a SIMPLE IRA. But if not, no sweat you arent out of luck. Here are some other types of accounts you can use to build up that nest egg for Future You instead.

Dont Miss: What Is A Pension Vs 401k

Exceptions For Solo 401 Early Distribution Penalties

The IRS may waive the 10% penalty for early withdrawals in certain circumstances. Youll still owe taxes on any contributions or earnings that havent been taxed. The exceptions include:

Medical expenses that exceed 10% of your adjusted gross income

Permanent disability

Certain military service

A Qualified Domestic Retirement Order issued as part of a divorce or court-approved separation

In the case of a distribution paid to an ex-spouse under a QDRO, the 401 owner owes no income tax and the recipient can defer taxes by rolling the distribution into an IRA.

Unlike an IRA or SEP IRA, a Solo 401 doesnt allow penalty-free withdrawals for higher education expenses or first-time homebuyers.

Don’t Miss: What Happens To My 401k When I Quit My Job

How To Set Up A Solo 401

There are specific steps that must be taken to properly open a solo 401 plan, according to the Internal Revenue Service .

First, you have to adopt a plan in writing, making a written declaration of the type of plan you intend to fund. The choices are the same as are given to an employee opening a 401 plan: you can choose a traditional 401 or a Roth 401. Each has distinct tax benefits.

A solo 401 must be set up by Dec. 31 in the tax year for which you are making contributions.

You can open a solo 401 at most online brokers and traditional brokers or directly through a financial services company. You’ll want to do some research ahead of time to identify the best solo 401 company for you.

You’ll need an employer identification number to get started with the enrollment process. If you don’t have one already, you can apply online directly to the IRS.The rest of the documentation will be provided by the broker or financial services company you choose for the account.

When Should You Choose A Traditional Ira

If your income is too high to contribute to a Roth IRA, you can go with a traditional IRA. Like a Roth IRA, you can contribute up to $6,000 a year$7,000 if youre 50 or olderand you and your spouse can both have an account.4

Thats where the similarities end. Unlike a Roth IRA, there are no annual income limits. But youre required to begin withdrawing from a traditional IRA once you turn 72, and even though contributions to a traditional IRA are tax-deductible, youll have to pay taxes on the money you take from it in retirement.5

Still with us? Now, lets look at some other options you can explore if youre self-employed.

Don’t Miss: How To Generate Income From 401k

Talk To Hr About Enrolling In Your 401

If you’re interested in opening a 401, talk with your employer to learn about how your company’s plan works. Some employers automatically enroll employees and withhold a default amount of their paychecks, which you can change yourself at any time. You can also opt to stop contributing to the plan if you’re not interested in doing so right now.

Other companies require participants to declare their desire to participate in the 401. You’ll have to fill out paperwork saying that you’d like to contribute to the plan and how much money you’d like to set aside initially. You can always change this later.

You’ll also need to choose your beneficiary — the person you’d like to inherit your 401 if you die — when you sign up. Usually you choose a primary beneficiary and a secondary, or contingent, beneficiary who will inherit the 401 if the primary beneficiary is deceased or doesn’t want the money.

Roth Solo 401k Benefits

The Roth Solo 401k is the best retirement plan for self-employed and small business owners. With the potential increase of federal and state income tax rates, the ability to generate tax-free returns from your IRA investments is the last surviving legal tax shelter.

With this plan, you can make almost any type of investment tax-free. This includes real estate, tax liens, precious metals and more. You can also continue to make traditional investments, like stocks, bonds and mutual funds. When you reach age 59 1/2, youll have the ability to live off your Roth 401 assets without having to pay tax.

Look at the Roth Solo 401k this way: if you start contributions in your 40s and generate a modest rate of return, you may have over $1 million tax-free when you retire. With a Solo Roth 401, you have options. A Solo Roth 401 has the following benefits:

- Solo 401 benefits

Learn about the Roth Solo 401 retirement plan

Recommended Reading: When Can I Take 401k

You May Like: How To Find Out If I Have Old 401k

How To Open A Solo 401

You can open a solo 401 at most online brokers, though youll need an Employer Identification Number. The broker will provide a plan adoption agreement for you to complete, as well as an account application. Once youve done that, you can set up contributions. Youll have access to many of the investments offered by your broker, including mutual funds, index funds, exchange-traded funds, individual stocks and bonds.

If you want to make a contribution for this year, you must establish the plan by Dec. 31 and make your employee contribution by the end of the calendar year. You can typically make employer profit-sharing contributions until your tax-filing deadline for the tax year.

Note that once the plan gets rocking, it may require some additional paperwork the IRS requires an annual report on Form 5500-SF if your 401 plan has $250,000 or more in assets at the end of a given year.

If you need help managing the funds in your solo 401, robo-advisor Blooom will manage your 401 at your existing provider. If you want even more comprehensive financial help, you might opt for an online planning service. Companies such as Facet Wealth and Personal Capital offer low-cost access to human advisors and provide holistic guidance on your finances, including how to invest your 401.

How Many Years Does 401k Payout

The catch is that once you start, you have to continue taking the periodic payments for five years, or until you reach age 59 ½, whichever is longer. Also, you will not be allowed to take more or less than the calculated distribution, even if you no longer need the money. So be careful with this one!

Also Check: How Do I Transfer 401k To New Employer

Don’t Miss: Can You Roll A Roth Ira Into A 401k

Whats The Big Deal About A 401 Anyway

Among ways to save for retirement, the 401 plan is the undisputed king. Thats because:

- Employees can contribute with pre-tax dollars, and earnings are tax-deferred

- In 2018, employees can save up to $18,500 in a 401 compared to just $5,500 in an individual retirement account

- There are no income limits for making 401 contributions

- Many employers provide matching contributions

You May Like: How To Find My 401k Money

Workers Of All Ages Can Benefit From Stashing Away After

If your employer offers a Roth option in your 401, itâs a great idea to invest in it, or at least consider investing a portion of your 401 contribution in the Roth. Contributions to a Roth 401 wonât reduce your tax bill now. While pretax salary goes into a regular 401, after-tax money funds the Roth. But as with Roth IRAs, withdrawals from Roth 401s are tax- and penalty-free as long as youâve had the account for five years and are at least 59½ when you take the money out.

Because there are no income limits on Roth 401 contributions, these accounts provide a way for high earners to invest in a Roth without converting a traditional IRA. In 2021, you can contribute up to $19,500 to a Roth 401, a traditional 401 or a combination of the two. Workers 50 or older can contribute up to $26,000 annually.

If you get matching funds from your employer, they go into a traditional pretax 401 account. However, a proposal in the Securing a Strong Retirement Act, which has been nicknamed the SECURE Act 2.0, would allow workers to have employer matching contributions invested in a Roth 401. The House Ways and Means Committee has approved the bill, though it still needs to be voted on by both chambers of Congress.

Also Check: Should I Roll Over 401k To Ira

I Participate In A 401k Through My Primary Employer And I Have A Part Time Business Can I Have A Solo 401k For My Part Time Business

Yes. You are eligible to establish a Solo 401k for a side business even if you participate in a 401k, 403b, 457 or Thrift Savings Plan through your primary employer. It is important to note that contributions made to the employers 401k, 403b or Thrift Savings Plan will impact the contributions for the Solo 401k. Contributions to the employers 401k, 403b or TSP count towards the Solo 401k salary deferral limit. The 2021 salary deferral limit is $19,500 and $26,000 if age 50 or older. Contributions made into a 457 plan do not count towards the salary deferral limit. In addition to a salary deferral contribution, a business owner can also make contributions to the profit sharing portion of a Solo 401k.

Example: Jennifer is age 40 and works as a W-2 employee for ABC accounting firm and contributes $10,000 to the 401k. In addition to working at the accounting firm, Jennifer is the owner of an S corporation. She is the only employee and pays herself a $100,000 W-2 salary in 2021.

Based on this information Jennifer would be eligible to make a contribution of $9,500 in salary deferrals plus make a profit sharing contribution of $25,000 for a total of $34,500 in Solo 401k contributions in 2021.