Create The Withdrawal Calculator

Note that the amount of money youll actually withdraw from the account over 30 years is $720,000, much more than the account balance youll need. The difference between the balance and your withdrawals is the interest earned by continuing to invest the funds while making withdrawals. This is the real power of long-term savings.

A 401 Is A Defined Contribution Plan

Unlike a defined benefit plan , also known as a pension plan, which is based on formulas for determining retirement withdrawals, defined contribution plans allow their participants to choose from a variety of investment options. DCPs, 401s in particular, have been gaining in popularity as compared to DBPs. Today, the 401 defined contribution pension plan is the most popular private-market retirement plan. The shift in the choice between DBPs and DCP can be attributed to a number of reasons, one of which is the projected length of time a person is likely to stay with a company. In the past, it was more common for a person to stay with a company for several decades, which made DBPs ideal since deriving the most value out of a DBP required a person to stay with their company for 25 years or more. However, this is no longer the case today, as the workforce turnover rate is much higher. DCPs are highly mobile in comparison to DBPs, and their values do not drop when a person switches companies. When an employee with a 401 plan changes employers, they generally have the option to:

Other Benefits Of A 401

Even for employers who do not offer any matching program, every employer with a 401 plan is responsible for administering the plan. That may seem like its no big deal, but it actually saves quite a bit of trouble for the employees. As an employee in a 401 plan, you dont have to worry about the complicated rules and regulations that need to be followed, or about making arrangements with the funds in which you invest your moneyyour employer takes care of all of that for you. Thats quite a bit of saved paperwork.

At the same time, employees who participate in a 401 maintain control over their money. While employers provide a list of possible investment choices, most commonly different sorts of mutual funds, employees have quite a bit of freedom to decide their own strategy. Whether you are willing to take on a little more risk with your investments, or if you would rather play it safe, theres probably an option for you.

Read Also: Can I Move My 401k From One Company To Another

Retirement Fund Growth Over Time

This table shows the growth of the retirement fund over time. Each column in the table shows the growth for each of the years listed, if they apply. If the number of years before expected retirement age is less than 40, then the rows for those years will be blank. This calculator is limited to showing the first 40 years of compounded growth for a fund.

Retirement Fund Growth Calculator

Disclaimer: These online calculators are made available and meant to be used as a screening tool for the investor. The accuracy of these calculations is not guaranteed nor is its applicability to your individual circumstances. You should always obtain personal advice from qualified professionals.

Learn More

Keep updated with our round the clock and in-depth cryptocurrency news.

Please be aware that some of the links on this site will direct you to the websites of third parties, some of whom are marketing affiliates and/or business partners of this site and/or its owners, operators and affiliates. We may receive financial compensation from these third parties. Notwithstanding any such relationship, no responsibility is accepted for the conduct of any third party nor the content or functionality of their websites or applications. A hyperlink to or positive reference to or review of a broker or exchange should not be understood to be an endorsement of that broker or exchanges products or services.

When trading in stocks your capital is at risk.

Whats So Great About A 401 For Retirement Planning

Quite a few things. Having your contributions taken out regularly is more convenient than having to write a check to banks or investment firms every so often. That makes it more likely that you will continue to save, which makes it more likely youll have enough money to retire when the time comes.

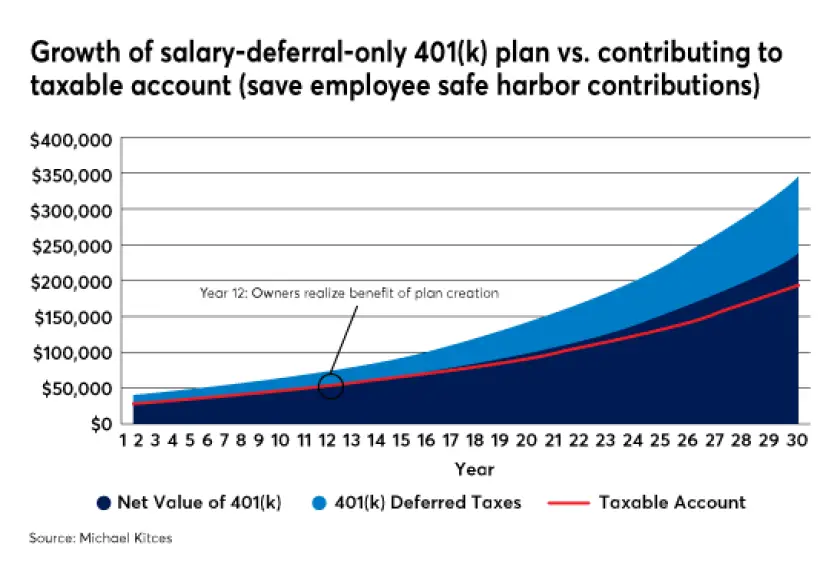

But theres more. Your contributions arent counted as income for taxes, which reduces your annual tax bill. For example, if you earn $50,000 a year and contribute $5,000 of your salary to a 401, youll shelter $5,000 from state and federal income taxes that year. If youre in the 20 percent combined state and federal tax bracket, that will reduce your tax bill by $1,000.

Your earnings also wont be taxed until you withdraw them. In a regular brokerage account, youll owe taxes on income and capital gains the year in which you receive them. A 401 allows your earnings to grow tax-free for as long as you keep the money in your account.

The tax deduction also means that your paycheck wont be hit as much as it would without a 401. If you earn $50,000 a year, for example, you would need to save $417 a month before taxes to have $5,000 saved at the end of a year. If you saved that money in a 401, however, you would still contribute $417 a month, but your paycheck would be reduced by just $333 a month, because youve reduced your tax bill by more than $83 each month.

You May Like: What Is The Best Fund To Invest In 401k

The Benefits Of Compounded Savings

One of the greatest advantages of a long-term savings plan is compounded growth of earnings. This benefit of compounding is that returns generated by savings can be reinvested back into the account and begin generating returns of their own. Over a period of many years, the compounded earnings on a savings account can actually be larger than the contributions you have made to the account.

This potentially exponential growth of earnings is what allows your retirement savings to grow faster as more time passes.

Maximize Employer 401 Match Calculator

Contribution percentages that are too low or too high may not take full advantage of employer matches. If the percentage is too high, contributions may reach the IRS limit before the end of the year. As a result, employers will not match for the rest of the year. This calculation can show the contribution percentage window in order to take full advantage of the employer’s matching contributions.

Read Also: Can Roth 401k Be Converted To Roth Ira

What Is A 401

A 401 is a retirement plan offered by some employers. These plans allow you to contribute directly from your paycheck, so theyre an easy and effective way to save and invest for retirement. There are two main types of 401s:

-

A traditional 401: This is the most common type of 401. Your contributions are made pre-tax, and they and your investment earnings grow tax-deferred. Youll be taxed on distributions in retirement.

-

A Roth 401: About half of employers who offer a 401 offer this variation. Your contributions are made after taxes, but distributions in retirement are not taxed as income. That means your investment earnings grow federally tax-free.

Bonus: Net Worth Tracker

Whether your goal is to retire at 35 or 75, tracking your net worth can keep you organized and speed your progress. Indeed, tracking your net worth is a powerful way to stay aware of your financial standing, making it easier to prepare for retirement.

It can also help you make smarter money decisions for your long-term financial health.

Read more about tracking your net worth with Tiller

Don’t Miss: How Do I Take Money Out Of My Fidelity 401k

How To Calculate 401 Earnings

It is never too early to start saving for a comfortable and secure retirement. In fact, the sooner you start saving and investing in a 401k program the more you should be able to accumulate over a lifetime of work. It is important to keep an eye on how you are doing by calculating your earnings from time to time. You will see how your nest egg is growing. It will also allow you to make any investment changes needed based on your age, your tolerance for risk and the number of years until you retire.

Pull out a copy of your latest 401k statements. Most 401k statements are sent on a quarterly basis.

Circle the beginning balance, the amount of contributions you made and the amount of contributions your employer made. Add these three numbers together.

Find your ending balance and subtract the total you calculated in Step 2 from that balance. This is the amount of your gain for the period.

Divide the amount of your gain from Step 3 by the total you calculated in Step 2 and multiply the result by 100 to get the percentage gain for your 401k portfolio during the time period. For instance, if the total of your beginning balance plus all contributions was $15,000 and the amount of your gain was $500, the percentage gain for the time period would be approximately 3.33 percent. If you are looking at a quarterly statement you would multiply that figure by four to come up with an annualized percentage gain of 13.32 percent.

Writer Bio

What Happens To My 401k If I Change Jobs

You have a couple of options, but the one most would recommend is a 401k rollover. A 401k rollover is when you transfer your funds from your employer to an individual retirement account or to a 401k plan with your new employer. A much less popular option is to cash out your 401k, but this comes with massive penalties income tax, and an additional 10% withholding fee.

Also Check: Can You Roll A 401k Into An Existing Roth Ira

Assumed Rate Of Return

Ive seen people use everything between 5% and 12% for average annual returns over a lifetime of investing. But which rate of return is more accurate: 5% or 12%?

Maybe both. There are two big factors to consider:

- Whether or not the assumed rate of return accounts for inflation.

- The investment time period.

Retirement Spreadsheet Recommended By Reddit

The inputs for this spreadsheet include:

- Working ROI Estimated annual return on investment during working years.

- Retired ROI Estimated annual return on investment during retirement.

- Retired SWR Safe Withdraw Rate, or amount of total investment you plan on withdrawing annually during retirement.

- Savings Rate Percentage of income you will save during working years.

- Beginning Bal

Recommended Reading: How Can You Take Out Your 401k

What Your 401 Could Look Like In The Next 20 Years

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

For building retirement savings, 401 plans have become one of the better deals. Traditional 401s allow you to save pre-tax dollarsbefore you get your paycheckto build a retirement nest egg. Since 2006, a Roth version of the 401 has been added to many workplace plans using after-tax dollars, it allows you to build savings that you can withdraw tax-free in retirement as long as you meet certain prerequisites. Many employers provide matching contributions to employee plans, making them an even better deal.

There are many 401 savings calculators available, and all of them demonstrate how your retirement account balance can grow over time. Even a modest level of savings that is allowed to grow over a period of many years can grow into a significant sum of money.

What Is An Ira

While there are a number of benefits to 401ks, they’re not the only retirement plan in the game. An IRA is an individual retirement account. Where a 401k can only be offered through an employer, an IRA account can be opened up by an individual whether they’re associated with an employer or not. That means they’re the best option for independent contractors without an employer or anyone who wants to do some extra retirement planning on top of their 401k.

Don’t Miss: How Often Can I Rollover 401k To Ira

What Is A Roth Ira

A Roth IRA is a type of individual retirement account similar to traditional IRAs in many ways, but with some significant differences. One of the main differences is how the tax breaks are different: with a traditional IRA, the money you put in isn’t taxed with a Roth IRA the money you take out isn’t taxed. Roth IRA’s also have no requirements on when the money must be taken t, so they can be a good tool to pass along wealth to your beneficiaries if you find you don’t need the money in retirement.

General Pros And Cons Of A 401

Pros

Cons

- Few investment optionsGenerally speaking, 401s have few investment options because they normally originate from employers, they are limited to what is offered through employers’ 401 plans, as compared to a typical, taxable brokerage account.

- High feesCompared to other forms of retirement savings, 401 plans charge higher fees, sometimes as a percentage of funds. This is mainly due to administration costs. Plan participants have little or no control over this, except to choose low-cost index funds or exchange-traded funds to compensate.

- Illiquid 401 funds can only be withdrawn without penalty in rare cases before 59 ½. This includes all contributions and any earnings over time.

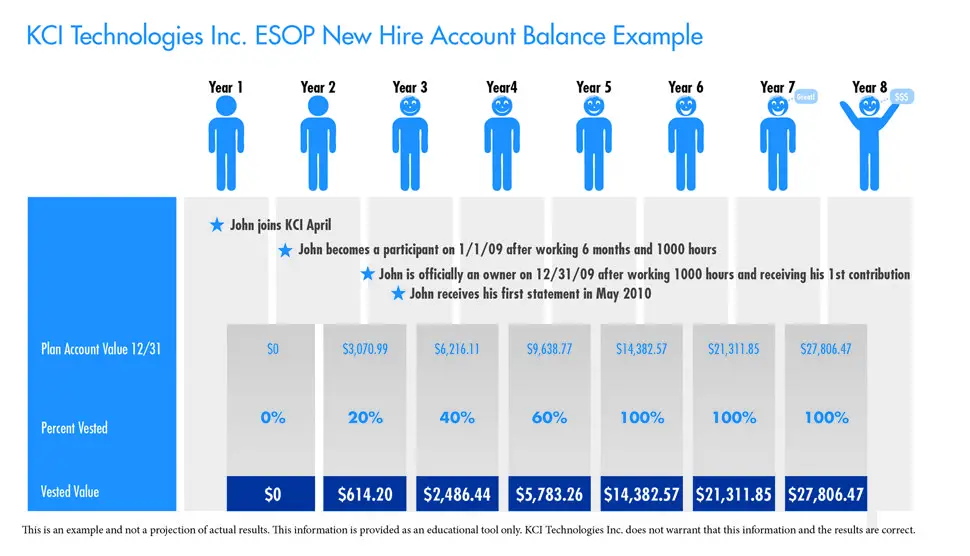

- Vesting periodsEmployers may utilize vesting periods, meaning that employer contributions don’t fully belong to employees until after a set point in time. For instance, if an employee were to part ways with their employer and a 401 plan that they were 50% vested in, they can only take half of the value of the assets contributed by their employer.

- Waiting periodsSome employers don’t allow participation in their 401s until after a waiting period is over, usually to reduce employee turnover. 6 month waiting periods are fairly common, while a one-year waiting period is the longest waiting period permitted by law.

Recommended Reading: How Do I Roll Over My 401k

When Can You Withdraw From Your 401k Without A Penalty

Wondering when can you withdraw from 401k? 59 and 1/2 is the current age when you can take money out of your 401k without incurring a penalty. However, the money you take out is still taxed as income. At the age of 70, you will be forced by the IRS to start taking distributions from your retirement accounts.

Contributions Time And Rate Of Return

Your future retirement balance is a function of your balance today, future contributions from you and your employer, your rate of return, and the timeline. If you know these values, you can plug them into a compound interest calculator for a quick gauge of where your balance will be at some future date. It seems simple enough, right up until you have to predict your rate of return. That’s the tricky part, because it depends on how your money is invested and what’s happening in the financial markets. There’s also inflation to consider, which reduces your returns by shrinking the buying power of your money.

Also Check: Can You Take Out Your 401k To Buy A House

Commit To 401 Saving In 2022

This year, commit to retiring with $1 million in your 401. You can act on that commitment now by setting realistic goals and raising your contributions at every opportunity. Get comfortable using compound interest calculators so you can plan ahead and monitor your progress.

Make those moves while expanding investing expertise in 2022, and youre sure to carry your 401 balance to new heights.

10 stocks we like better than Walmart

When our award-winning analyst team has an investing tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now and Walmart wasnt one of them! Thats right they think these 10 stocks are even better buys.

Stock Advisor returns as of 6/15/21

The Motley Fool has a disclosure policy.