What Is A 401 Account

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

Where Is My 401

When you leave your employer you have three options for the money youâve accumulated in your old 401 account. You can either:

- Leave it alone and keep it in the same account

- Roll over the funds to your new employerâs 401 plan or

- Roll over the funds to an IRA.

Most people leave their 401âs alone, either from neglect or they donât bother with facilitating the transfer.

You can rollover your old 401 funds to an IRA as soon as youâd like. If your IRA is already set up then it can accept the funds immediately.

However, if your new employer implements a waiting period before you can participate in their 401 program, then you have no choice but to leave it alone until youâre eligible.

This is where things fall through the cracks. Unattended 401âs can end up in a few different places: the old account you have with your former employers, an automatic safe harbor rollover account set up by your plan, the unclaimed property department in the state, or your old 401s could have been cashed out already if the balance was less than $5,000 when you left the job.

What Is A 401k

A 401k is an employer-sponsored retirement account. It allows an employee to dedicate a percentage of their pre-tax salary to a retirement account. These funds are invested in a range of vehicles like stocks, bonds, mutual funds, and cash. Oh, and if you’re curious where the name 401k comes from? It comes directly from the section of the tax code that established this type of plan specifically subsection 401k.

You May Like: How To Turn 401k Into Ira

How Do I Find My Ira Account

leavejob401k

. Thereof, how can I locate my IRA?

Contact mutual funds, banks or brokerage funds you find mentioned as you review financial records. They can tell you if there are accounts you aren& rsquo t aware of. Search online for unclaimed funds in your name or that of the person who may have owned an IRA. You need not pay for an online unclaimed-property search.

Additionally, can you lose all your money in an IRA? The most likely way to lose all of the money in your IRA is by having the entire balance of your account invested in one individual stock or bond investment, and that investment becoming worthless by that company going out of business. You can prevent a total-loss IRA scenario such as this by diversifying your account.

Also Know, what is an IRA account and how does it work?

An individual retirement account allows you to save money for retirement in a tax-advantaged way. An IRA is an account set up at a financial institution that allows an individual to save for retirement with tax-free growth or on a tax-deferred basis.

Can I open an IRA at my bank?

Generally, you can open an IRA at a bank, set one up through an online broker or open an account with a mutual fund provider. If you decide to open an IRA through an online brokerage firm, you may end up with a better return rate. But you may have to deposit a minimum amount of $500 or $1,000.

How Much Of My Salary Can I Contribute To A 401 Plan

The amount that employees can contribute to their 401 Plan is adjusted each year to keep pace with inflation. In 2021, the limit is $19,500 per year for workers under age 50 and $26,000 for those aged 50 and above. In 2022, the limit is $20,500 per year for workers under age 50 and $26,500 for those aged 50 and above.If the employee also benefits from matching contributions from their employer, the combined contribution from both the employee and the employer is capped at the lesser of $58,000 in 2021 or 100% of the employees compensation for the year .

Recommended Reading: How Do I Add Money To My 401k

Traditional 401 Vs Roth 401

When 401 plans became available in 1978, companies and their employees had just one choice: the traditional 401. Then, in 2006, Roth 401s arrived. Roths are named for former U.S. Senator William Roth of Delaware, the primary sponsor of the 1997 legislation that made the Roth IRA possible.

While Roth 401s were a little slow to catch on, many employers now offer them. So the first decision employees often have to make is between Roth and traditional.

As a general rule, employees who expect to be in a lower after they retire might want to opt for a traditional 401 and take advantage of the immediate tax break.

On the other hand, employees who expect to be in a higher bracket after retiring might opt for the Roth so that they can avoid taxes on their savings later. Also importantespecially if the Roth has years to growis that there is no tax on withdrawals, which means that all the money the contributions earn over decades of being in the account is tax-free.

As a practical matter, the Roth reduces your immediate spending power more than a traditional 401 plan. That matters if your budget is tight.

Since no one can predict what tax rates will be decades from now, neither type of 401 is a sure thing. For that reason, many financial advisors suggest that people hedge their bets, putting some of their money into each.

Picking The Best Option

Figuring out what to do can be difficult, as there may be complex tax and investment return implications for each decision.

In many cases, unless youre ready to retire, moving the funds into a new retirement account is often a good option. If your funds are in an IRA that was opened in your name, the IRA provider may be charging high fees. And, unless the old employer offers a much better plan than your current options, consolidating your money within a few accounts can make it easier to track your investments and help you qualify for discounts or benefits from plan administrators.

The easiest way to do this is with a direct transfer, where the money never touches your hands. Otherwise, 20 percent of the money has to be withheld for taxes, and you only have 60 days to deposit the funds into the new retirement account or the withdrawal will be treated as a cash out.

Fair warning, there can still be a lot of paperwork involved with a direct transfer. However, the company that youre sending the money to will often be able to help you with the process.

No matter what option you choose, if youve got old retirement accounts floating out there its in your best interests to track that money down sooner than later. The more you know about your retirement funds, the more options you may have the next time youre faced with a major financial setback. At the very least, youll understand where you stand as you prepare for retirement.

Don’t Miss: How Much To Put In 401k

What Happens To My 401k If I Change Jobs

You have a couple of options, but the one most would recommend is a 401k rollover. A 401k rollover is when you transfer your funds from your employer to an individual retirement account or to a 401k plan with your new employer. A much less popular option is to cash out your 401k, but this comes with massive penalties income tax, and an additional 10% withholding fee.

How Long Will My Transfer Take

This depends on the type of transfer you are requesting:

Total brokerage account transfer: Most total account transfers are sent via Automated Customer Account Transfer Service and take approximately five to eight business days upon initiation. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Transfers coming from some smaller firms, which are not members of the National Securities Clearing Corporation , which is responsible for regulating and governing the ACATS system, are processed as non-ACATS transfers. Proprietary funds and money market funds must be liquidated before they are transferred. Please complete the online External Account Transfer Form The transfer will take approximately 5-8 business days upon initiation.

Partial brokerage account transfer: List the specific number of shares for each asset to be transferred when you complete the Transfer Form. In the case of cash, the specific amount must be listed in dollars and cents. This type of transfer is processed as a non-ACATS transfer. Please complete the online External Account Transfer Form.- The transfer will take approximately 3 to 4 weeks from the date your completed paperwork has been received.

Internal TD Ameritrade transfer: Transferring assets between two TD Ameritrade accounts requires an Internal Account Transfer Form. .

Dont Miss: How To Rollover 401k From Empower To Fidelity

Read Also: How To Sign Up For 401k On Adp

How Much Should I Be Putting Into My 401k

Aim to save between 10% and 15% of your income toward retirement. Another piece of general advice is to put all of those funds into your 401k up until your employer’s matching contribution amount. Once that has been reached, maxed out your Roth IRA contribution. If there are funds leftover then consider putting those funds into your 401k.

Another way to determine how much you will need to save is to look at what income amount you will need in retirement. Fortunately, there are a lot of calculators out there that will help you figure out your magic number. Here are two of our favorites.

-

Nerdwallet provides a great basic calculator that lets you play with different contributions and matching amounts.

-

CalcXL makes a recommendation on how much you should be saving based on projected inflation. Tip: You should aim for a retirement income of roughly 80% of your current salary.

What Are The Benefits Of A 401k

401 tax benefits are hard to dispute, as they can offer workers a lot of financial security, including:

-

Employer match

In fact, let’s dig into 401k benefits a little deeper.

401k employer match

Do you like free money? Good, now that we’ve got that out of the way, a company-matched 401k is basically that. Many employers offer to match employee contributions, either dollar for dollar or 50 cents to the dollar, up to a set limit. So, for example, say you make $100,000 a year and your employer offers a 401k matching of 50% up to the first 6% you elect to contribute. If you contribute 6% of your annual earnings , your employer would contribute an additional 50% of that amount. So, 3,000 free dollars.

It’s up to your employer to decide what percentage they will match, but many companies do offer a dollar-for-dollar match.

401k tax breaks

The tax benefits of 401ks are like the triple-crown of finances. First, contributions are pre-tax. You dont pay taxes on the money until you withdraw it when you retire.

Second, your 401k contributions are not counted as income, which could put you in a lower tax bracket. The result: your tax bill will be smaller for your having squirreled away money for your later years.

401k shelter from creditors

If your finances take a turn for the worst, you won’t have to worry about creditors coming for your 401k. Your qualified retirement plan is protected by the Employee Retirement Income Security Act of 1974 from claims by judgment creditors.

Recommended Reading: How Do I Get My Money From My 401k

Leverage The National Registry

The National Registry, run by Pen Check, a retirement plan distribution firm, is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

The site offers an easy, free-of-charge way to locate lost or forgotten employee retirement accounts. You can conduct as many searches as you want, using just your Social Security number. The site is safe, encrypting any information you input on a secure server.

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck – no effort required. The money that doesn’t go to the employee’s take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.

Don’t Miss: Can I Start My Own 401k Plan

Look Through Unclaimed Property Databases

You can also search the National Registry of Unclaimed Retirement Benefits Opens in new window to find plans under your name.

Once you find one account, you can potentially spot a few more, as theres a possibility you have multiple plans hosted by the same company. The other accounts should come up as you log into the management companys website.

How To Find Old 401 Accounts

To corral all your accounts, you first must locate all your retirement plans. This is often the most time-consuming step in the process of organizing and streamlining your retirement portfolio, as youll sometimes have to do a bit of legwork to identify and find your old plans. The more jobs youve held, the more work youll need to do if you havent already rolled over those plans into other retirement accounts.

These suggestions can help you figure out how to find your 401k.

Recommended Reading: Can You Leave Your 401k At Your Old Job

Discover Where Your Funds Are Transferred

If your former employer does not have your old 401, you can search on the Department of Labors abandoned plan database. You will be able to search for your plan using the information you already have, including your name, your employers name and more. If you had a traditional pension plan and it no longer exists, you can search the U.S. Pension Guaranty Corp. database to find your unclaimed pension.

Finally, you may want to search the National Registry of Unclaimed Retirement Benefits. This service is available nationwide and has records of account balances unclaimed by former retirement plan participants.

How Do I Find My Ira

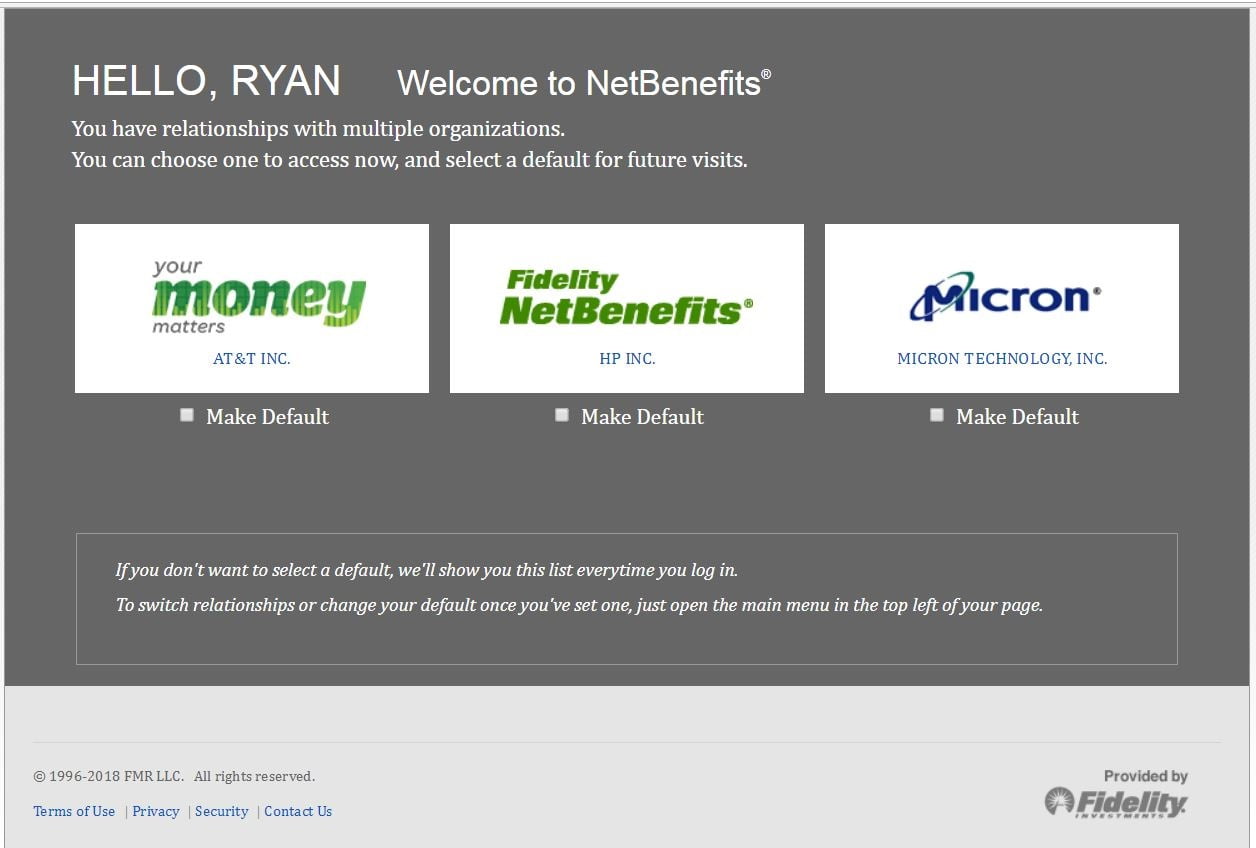

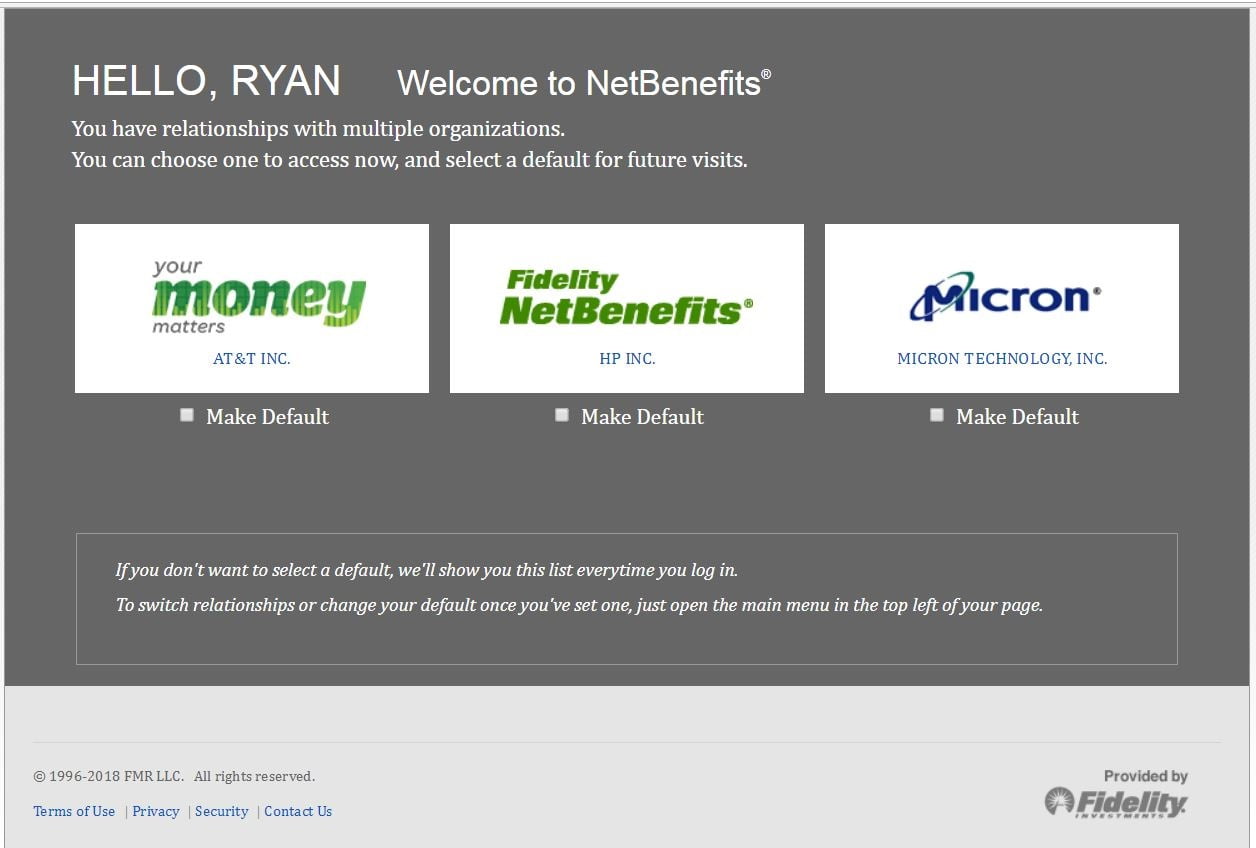

There are two ways to find your IRA. You can either find your IRA number online or look up your IRA account number on the IRS website. As long as your employer offers a 401, 403, or other employer-offered retirement accounts, you should be able to find your IRA information online.

When you go online to your employers retirement plan website, youll see a menu at the top with links to all your employer-offered retirement accounts. Youll see a link to Find Your Account on this menu. Click on this link, and youll be prompted to enter your last name, first name, and a valid Social Security number. If you dont know your Social Security number, you can find it online by visiting the Social Security Administration website.

Once your Social Security number is verified, youll be taken to a page showing all the retirement accounts your employer offers. Click on the Find Your Account link next to your retirement account, and youll be taken to a page with your IRA account number.

Also Check: When Can You Access 401k

Why You Should Recover Your Old 401k

Theres a simple reason why you should attempt to recover a lost 401k account: Its your money. Whether your old 401k plan holds a lot of money or a little, every penny counts when staying on track with your retirement savings.

Another important point to consider: If youve changed jobs multiple times, its possible that you could have more than one lost 401k and taken together, that money could make a surprising difference to your nest egg.

Last, if you were lucky to have an employer that offered a matching 401 contribution, your missing account may have more money in them than you think. For example, a common employer match is 50%, up to the first 6% of your salary. If you dont make an effort to find old 401k accounts, youre missing out on that free money as well.

National Registry Of Unclaimed Retirement Benefits

You may be able to locate your retirement account funds on the National Registry of Unclaimed Retirement Benefits. This registry is a secure search website designed to help both employers and former employees. Employees can perform a free database search to determine if they may be entitled to any unpaid retirement account money. Employers can register names of former employees who left money with them. Youll need to provide your Social Security number, but no additional information is required.

Recommended Reading: How Much Can I Borrow From 401k

Search For Unclaimed Retirement Benefits

When all else fails, search for yourself in the National Registry of Unclaimed Retirement Benefits. Not all employers participate in this service, but many do because it provides benefits that help them meet their legal requirements. It’s a free service, and it only requires your Social Security number.

Option : Move The Money To An Ira

If you’re not able to transfer the funds to your current 401 or you don’t want to, you can roll over the funds to an IRA instead. The process is the same as doing a rollover to a new 401, and you still have the choice between a direct or indirect rollover.

You’ll need to set up a new IRA with any broker if you don’t already have one. Make sure you choose an IRA that’s taxed the same way as your old 401 funds. Most 401s are tax-deferred, which means your contributions reduce your taxable income in the year you make them, but you pay taxes on your withdrawals in retirement. You want a traditional IRA in this case because the government taxes these funds the same way.

If you had a Roth 401, you want a Roth IRA. Both of these accounts give you tax-free withdrawals in retirement if you pay taxes on your contributions the year you make them.

In most cases, losing track of your old 401 doesn’t mean the money is gone for good. But finding it is only half the challenge. You must also decide where to keep those funds going forward so they’ll be most useful to you. Think the decision through carefully, then follow the steps above.

You May Like: What Happens To 401k During Divorce