Make Sure Your Investments Are Well Diversified

The first thing you should do if your 401 or IRA is losing money is to check that you are well diversified. You want your money spread among many stocks, bonds, and other investment products. If you have all your savings tied up in a single stock and it plummets, that’s a more serious issue than when you’re invested in 100 things and one of them dips in value.

Few 401s allow you to purchase individual stocks anyway. You’ll be choosing mutual funds and exchange-traded funds . These are groups of investment products you purchase as a package, which is a convenient and affordable way to diversify your portfolio.

You want a mix of stocks and bonds, although your preferred ratio will depend on your goals and risk tolerance. You also need to think about the assets and sectors you invest in. You don’t want to invest too heavily in one industry, like technology. If it has a financial crisis, your portfolio could still lose value even if you’re invested in many different assets within that industry.

While some 401s may offer sector-specific funds, you’re more likely to have a choice between U.S. and international stocks or large-cap and mid- or small-cap funds.

If you suspect a lack of diversification is partly to blame for your 401 or IRA taking a hit, ask a financial advisor for tailored recommendations.

Why You Should Roll Over Your Old 401 Accounts

Once you find forgotten retirement funds, you can make it easier to keep track of your money by simply rolling over your old 401 accounts into an IRA at a brokerage you already have an account with. This way you can manage your nest egg easier since all of your money is in one place.

“It’s beneficial to consolidate your accounts to reduce oversight obligations,” Cavazos says. “Having all of your funds consolidated in one account allows you to keep track of your balance and account performance.”

If you already have an existing IRA, you can roll your 401 balance into that account. Otherwise, it’s easy to open a new IRA at the big-name brokers like Charles Schwab, Fidelity, Vanguard, Betterment or E*TRADE. Rolling over your old 401 plan into an IRA gives you more control over how you invest your retirement funds since you won’t be limited to just the funds that were offered by your former employer. These large brokerages give you thousands of investment options, including mutual funds, index funds and individual stocks.

Is It A Good Idea To Borrow From Your 401

Using a 401 loan for elective expenses like entertainment or gifts isnt a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of whats been discussed so far, borrowing from your 401 might be beneficial long-termand could even help your overall finances. For example, using a 401 loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. Whats more, 401 loans dont require a credit check, and they dont show up as debt on your credit report.

Another potentially positive way to use a 401 loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401 loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while youre paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Long-term impact of taking $15,000 from a $38,000 account balance

Don’t Miss: How Much Is The Max You Can Contribute To 401k

What To Do With A Lost Retirement Account When You Find It

Once youve found a lost retirement account, what you do with it depends on what type of plan it is and where its located.

Old 401k balances can be rolled into your current employers plan or rolled into an IRA in a trustee-to-trustee transfer. You can also request a payout of the plan balance, but if you are under the age of 59.5, the payout will be subject to income taxes and a 10% penalty for early withdrawal.

If you find an old pension through the PBGC, youll have to go through a process to verify your identity. Once the PBGC has established that you are owed the benefits, you can apply for them at any time once youve reached retirement age.

Its not uncommon for former employees to leave funds in a former employers retirement plan, believing theyll get around to dealing with it later. Years pass by, and maybe youve forgotten about a few old accounts. Even if they didnt amount to much at the time, a few hundred dollars here and there combined with some market growth over the years just might add up to a nice addition to your retirement savings. Its worth a look!

Learn More About These Investment Vehicles

Once you retire, your relationship with your money changes. After all, youre no longer drawing a paycheck and instead likely need to use some of your money to cover your day to day costs of living. To deal with that change, you need a smart investment plan for your retirement money that enables you to meet several different goals:

· Have the money you need to spend available to you when you need it,

· Deal with the fact that the market does go down from time to time, and

· Deliver enough growth to help cover your long-term costs and fight inflation over time

These six ways to invest your retirement money can each help you meet one or more of those goals. No one investment is likely to meet all your needs, but a combination could help deliver your end to end plan.

Previous

Also Check: Can You Do A Partial 401k Rollover

What To Consider When Choosing A Broker

If youre planning to roll over your 401 into an IRA, youll likely be most concerned with a broker that can do the following things best. Most brokers do offer an IRA, but some popular ones do not, but the brokers below all offer IRAs. We also considered the following factors when selecting the top places for your 401 rollover.

- Price: Trading commissions for stocks and ETFs have fallen to $0 at most online brokers, and thats great for investors. But there are other costs, too, perhaps most notably account fees, such as fees for transferring out of your account.

- No-transaction-fee mutual funds: The brokers in the list below offer thousands of mutual funds without a transaction fee. If youre rolling over your 401 and you like the mutual funds you have already, these brokers may allow you to buy and sell the same one without a fee.

- Investing strategy: While a 401 may limit your investing options to a pre-selected group of mutual funds, an IRA gives you the ability to invest in almost anything trading in the market. So we considered how each broker might fit an investors needs.

You May Like: When Leaving A Job What To Do With 401k

Mortgage Backed Securities: A False Sense Of Security

The high positive ratings of Mortgage Backed Securities by the rating agencies gave false senses of security to numerous mutual funds, investment banks, insurance companies, and all types of investors worldwide into believing that mortgage backed securities were a safe haven as secure as US Treasuries savings bonds and even cash. This false sense of security was reinforced by the credit default swaps and insurance policies in place to offset borrower default.

The credit default swaps and borrower default insurance policies, do not insure the profit streams from the interest payments, instead protecting the original principal amounts leant to the borrower. This in theory maintains the value of principal amounts of the loans supporting the mortgage backed securities. As discussed in the securitization section, mortgages were sold at multiples in excess of the original principal amounts leant to borrowers, generating a portion of the losses sustained to investor portfolios.

Read Also: Can I Get My Own 401k Plan

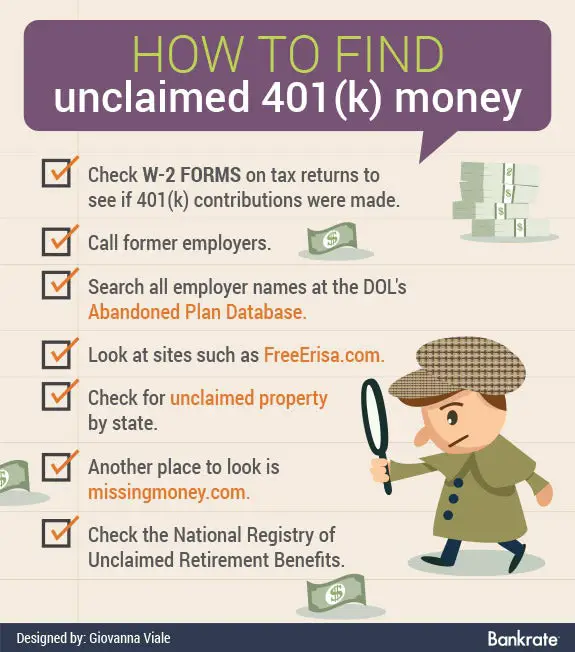

Search Unclaimed Assets Databases

If your search is still coming up empty, your former employer has folded or was bought by another company, youâre not out of luck yet.

It may take a little more effort and research but there are many national databases that can help you track down your old 401 accounts:

- The Department of Laborâs Abandoned Plan database can help you identify what happened to your old plan and the contact information of the current administrator

- The National Registry of Unclaimed Retirement Benefits allows you to do a free search for any unclaimed retirement money using just your Social Security number

- FreeERISA is another free resource to search for any old account information that has been filed with the federal government

- The Securities and Exchange Commissionâs website or your stateâs Secretary of State can provide more information on your previous employer

A Rollover Or Transfer Ira May Be Right For You If You Want

Streamlined account management

Access your accountswhenever you need to, however you want. Whatever your preferences, you can securely manage and monitor your accountsalmost anytime, anywhere.

A centralized view of your investments

Whether youre saving for future education, saving for a major life event, or simply want to build your wealth over time, you can invest all your goals in one place.

Ongoing tax-deferred growth potential

Choose an option that allows you to continue to benefit from your savings tax-advantaged status and increase the growth potential of your wealth.

Additional select client benefits

As your assets with us increase, so will your benefits. All our clients enjoy a competitive list of benefits aligned to your investment tier.

Also Check: How To Start Withdrawing From 401k

What Is A 401k Cares Act Withdrawal

Normally, participants who withdraw money from a tax-deferred retirement account before reaching age 59½, must pay a 10% early withdrawal penalty in addition to including the distribution in their taxable income for the year.

There are a few exceptions to the rule, including one for hardships, such as avoiding foreclosures, repairing your home after a disaster, or covering out-of-pocket medical expenses. However, these hardship withdrawals are normally limited to the amount needed to meet a limited list of hardships.

The CARES Act provided more flexibility for making emergency withdrawals from a tax-deferred retirement account by eliminating the 10% early withdrawal penalty. Participants are allowed to withdraw up to $100,000 per person without being subject to a tax penalty. Any early withdrawals above that amount dont qualify for special tax treatment.

It is important to note that the withdrawal is taxable income the special tax treatment waives the tax penalty but not the taxable event. However, the CARES Act allows people who take hardship distributions to elect to pay federal income taxes on the distribution over a three-year period or repay the distribution amount over a three-year period and avoid tax consequences entirely. The three-year repayment period starts on the day of the distribution.

Private Sector Employees Can Invest For Retirement With A 401 Plan

A retirement plan may be one of the most valuable benefits of employment. Used effectively, it can deliver a long-term impact on your financial well-being. See how a retirement plan works and learn about the power you have to control your financial future.

In general, a 401 is a retirement account that your employer sets up for you. When you enroll, you decide to put a percentage of each paycheck into the account. These contributions are placed into investments that youve selected based on your retirement goals and risk tolerance. When you retire, the money you have in the account is available to support your living expenses.

Also Check: How To Withdraw My 401k

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

Where Does 401 Money Go

If you just started investing in your 401, it is important to know where 401 money goes. Here is everything you need to know.

A 401 is one of the main retirement vehicles that American workers use to build up a retirement nest egg. Workers enjoy various tax benefits, and the automated contributions make 401 a valuable financial instrument to accumulate retirement savings.

When you contribute to a 401 plan, the funds are invested in various investments such as mutual funds, exchange-traded funds, company stock, and other investments. These investments have different risk levels, and they range from conservative to aggressive. However, compared to other retirement plans such as IRAs, 401 accounts have a limited selection of investments.

Don’t Miss: How Do I Get My 401k From Walmart

How Many Lost 401ks And Other Retirement Accounts Are Forgotten

Think lost and forgotten retirement accounts amount to chump change? Although no one keeps data on how much retirement money gets lost or forgotten, in an interview with Bloomberg, Terry Dunne of Millennium Trust Co., made an educated guess based on government and industry data that more than 900,000 workers lose track of 401k-style, defined-contribution plans each year.

That figure doesnt include pensions. According to the Pension Benefit Guaranty Corporation, an independent agency of the U.S. government tasked with protecting pension benefits in private-sector defined benefit plans, there are more than 38,000 people in the U.S. who havent claimed pension benefits they are owed. Those unclaimed pensions total over $300 million dollars, with one individual being owed almost $1 million dollars!

Could that money belong to you?

Follow These Steps With Help If You Need It

At the same time, finding your old accounts may be challenging for several reasons. In the first year of the pandemic, for example, hundreds of thousands of U.S. businesses closed permanently. In addition, says Zigo, you may have moved, or changed your email address, so your previous employer cant find you. Your old 401 plan may have changed sponsors. One of my clients has tried 10 times to reach a previous sponsor. It can be a frustrating process. And the bigger the hurdle, the less likely we are to try, she says. But help is available. A qualified financial planner can guide you through the following steps.

1. Take stock of your accounts

First, make a list that includes every employer where you contributed to a 401, suggests Charles Sachs, a CFP at Kaufman Rossin Wealth LLC in Miami, Florida. Next, call each one to see if they still have an account in your name, and update your contact information, if needed. Reaching out to them is the only way to find out where you stand, Sachs says. Its common for our clients to discover one or two old plans where they still have funds.

2. If a company has closed, check these websites

You can search for your money, which may be considered unclaimed property, at databases such as unclaimed.org and missingmoney.com. Both have links to state treasurers, comptrollers or other officials who update their lists of unclaimed assets regularly.

3. Rollover the money directly to avoid expensive withholding

Don’t Miss: How Do You Check How Much Is In Your 401k

What About Retirement Savings When You Die

Each of your accounts should have a beneficiary attached to it. In the event of your death, the money should automatically go to the beneficiary you have named. This is why proper financial planning is important. You must ensure that your plans are in order. Once youre deceased, you cannot change the financial decisions youve already made.

If you have any new income once you have died, it may automatically go to your beneficiaries. This depends on the type of plan and account you have. Your IRA generally transfers the money and assets you have to another account immediately, though.

I Still Have A 401k From My Last Job What Do I Do About That

As you move ahead from job to job, dont make the mistake of leaving a trail of old savings accounts behind you. Put your hard-earned savings to work for you by looking at all the options. If youve left a job and a 401k, here are the options available to you for those funds.

- Leave your balance

- Rollover to new 401 plan.

- Rollover to an IRA.

- Cash out your 401.

Recommended Reading: Do I Need Life Insurance If I Have A 401k