How Do I Open A Solo 401

Opening a solo 401 is a pretty simple process, and you can do it with most brokers. You will need an Employer Identification Number , a plan adoption agreement, and an application to get started. Once approved, you can begin setting up your contributions and choosing your investments.

Quick tip: If you don’t have an EIN, applying for one is easy you can submit your application on the IRS’s website.

What Are The Pros And Cons Of A Solo 401

One of the biggest benefits of opening a solo 401 is that it comes with some of the highest contribution limits. Since you can make contributions as an employer and an employee, you can maximize your contributions.

And while you do have to be self-employed to open a Solo 401, it doesn’t have to be your only source of income. If you have a full-time job and consult on the side, you’re eligible to open a solo 401.

You can also choose from a much broader range of assets than you can with a traditional employer-sponsored 401. For instance, you can invest in index funds, mutual funds, exchange-traded funds , stocks, and bonds.

However, there are some downsides you should consider. Like most retirement plans, you’ll get hit with taxes and fees if you withdraw the funds before the age of 59½.

“One disadvantage is that you must have a triggering event, usually retirement or ending employment, to take a distribution,” says deMauriac.

And you’re responsible for managing the plan and handling the paperwork on your own.

|

Pros |

|

|

|

No Employees In Other Businesses

If you have a business that fits the qualification guidelines for Solo 401, you may not be eligible, however, if you or certain family members have ownership in other businesses that do have employees. The IRS defines a Controlled or Affiliated Service Group. If the same 5 or fewer owners have either 80% ownership or more than 50% effective control of one or more businesses, then those businesses are looked at as being one for purposes of plan qualification. If any business within such a group has employees, then all businesses within the group are treated as if they have employees.

Don’t Miss: How To Receive 401k Cash Out

Who Qualifies For A Solo 401 Plan

A Solo 401 plan is an employer sponsored retirement savings plan that is designed specifically for owner-only businesses. The lack of non-owner employees greatly simplifies the administration of the plan, and is a key part of what makes the Safeguard Solo 401 a great self-directed investing platform.

Many kinds of businesses can act as a plan sponsor, including those established as a sole proprietorship, LLC, partnership, or corporation. The enterprise needs to be engaging in a trade or business, with the intent to generate a profit, and have the potential to make future contributions to the plan.

Examples include:

- Professional service providers such as Attorneys, CPAs, Architects and Medical Practitioners

- Financial Advisors & CFPs

- Internet based sales or services businesses

- Physical Fitness Trainers, Coaches or Therapists

- Child or Adult Care Providers

- And many, many more.

Only active business endeavors such a providing a product or service are eligible. Passive earnings such as rental income or K-1 distributions are not viewed as wages, compensation, or self-employment income, and therefore cannot be used to make 401 contributions.

Withdrawing Funds From A Self

As with traditional 401 plans, the self-employed 401 is intended to help you save money for retirement, and there are regulations in place to encourage you to do so. For example:

- Withdrawals prior to age 59½ may be subject to a 10% early withdrawal penalty, along with any applicable income taxes1

- You must take required minimum distributions from self-employed 401s beginning at age 722

- Plans can be structured to allow loans or hardship distributions3

- Plans can be structured to accept rollovers from other retirement accounts, including SEP IRAs and traditional 401s, into your self-employed 401

- You can roll your self-employed 401 assets into another 401 or an IRA

Because of its high contribution levels, flexible investment options, and relatively easy administration, the self-employed 401 is an attractive option for small-business owners or sole proprietors who want to be able to save aggressively for the future.

If there is the potential that your business might add employees at a later date, however, know that you will either have to convert your self-employed 401 plan to a traditional 401, or else terminate it. But if you’re confident that you will remain a one-person operation, and you want the high savings options that these plans offer, this type of account may be a good fit.

Read Also: How Can I Take Money From My 401k

What To Know About Erisa Qualified Retirement Plans

- Blog, Compliance, Entrepreneurship, Participant Loan, SDIRA, Solo 401k, Solo 401k Investing, Solo 401k Qualification, Solo 401k Setup, Uncategorized

The Employee Retirement Income Security Act of 1974 is a federal law. ERISA was created to protect employees who invest in their company retirement plan. Since a Solo 401k doesnt have non-owner employees, many titles of ERISA dont apply. However, its still important to know about the protections in an ERISA Qualified Retirement Plan.

Interestingly, it sets minimum standards for most voluntarily established pension and health plans in private business. The purpose is to provide protection for people vested in the plans. However, to qualify, a plan must be employer sponsored. That means the IRS requires plan contributions to be tax deductible.

A corporate 401k is an ERISA qualified retirement plan because it is employer defined and therefore employer sponsored.

Important: You can be the employer who sets up a Solo 401k for yourself. This is something many people dont understand. People see the words employer sponsored and think they have to work for someone else. However, many owners operate their own small business. Any business owner can set up a qualified retirement plan.

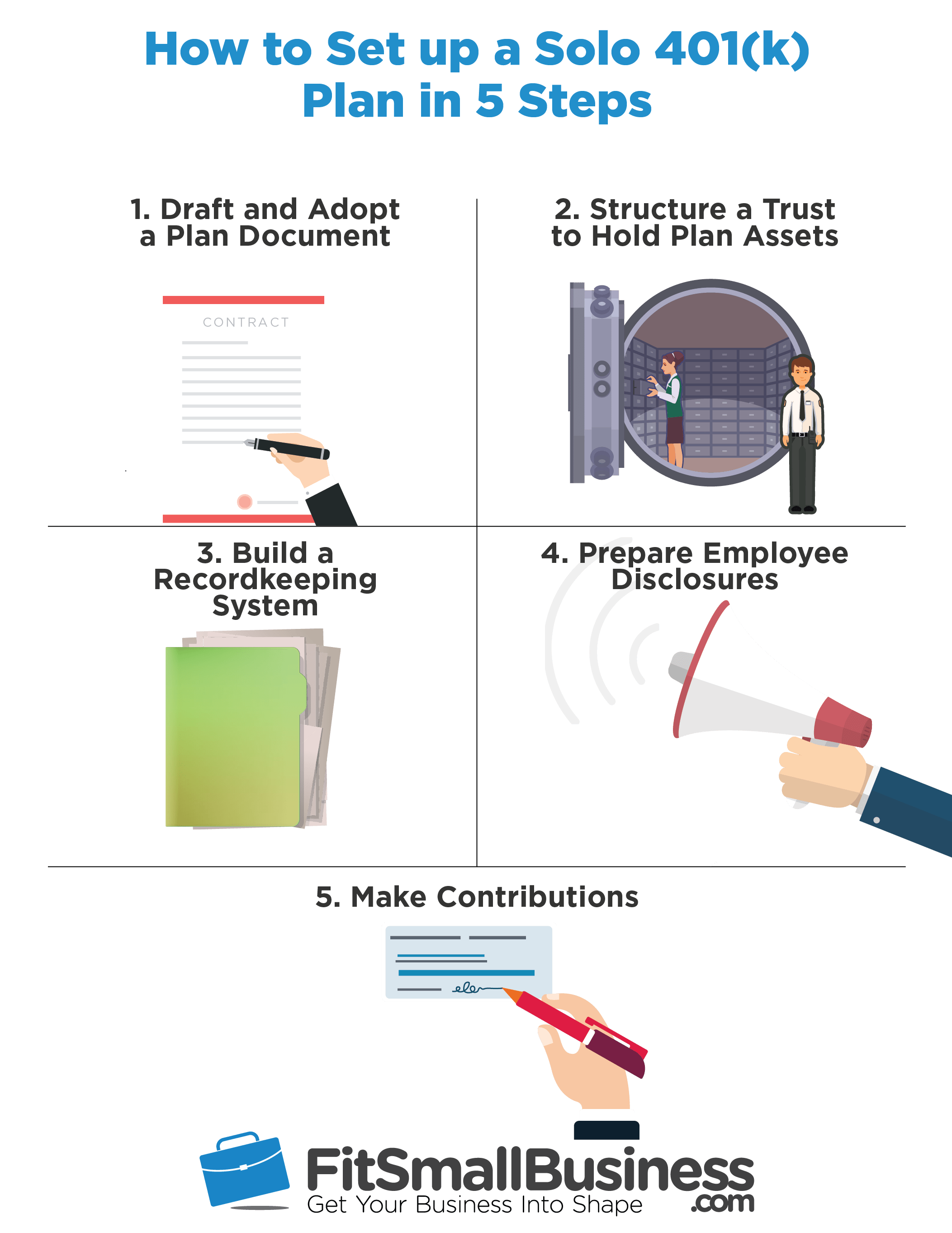

How Do You Set Up A Self

It is easy to set up a self-employed 401 plan with many 401 administrators. You can also open a solo 401 online. To set one up, you will need an Employer Identification Number , which you can get from the IRS. You also need to complete a plan adoption agreement and an account application. Self-employed 401s are easy to administer and attract low maintenance fees because they involve only one or two people.

Before choosing a plan administrator, it is important to compare their fees before you sign up. You may also want to choose an administrator that allows you to invest your retirement savings into a broad range of assets including mutual funds, ETFs, CDs, stocks, and bonds. Other features to look for include 24-hour multi-channel support, investment advisory, low fees, and positive customer reviews. Once youve completed the paperwork, and the plan becomes active, the only thing you have to do is to set contribution levels and choose investments.

Self-employed 401 plans have no annual minimum contribution requirements. In good years, you can make the maximum contributions and reduce your savings when the cash flow is low. But once you have up to $250,000 in the account, you must file IRS Form 5500-EZ to report the financial status of your solo retirement plan to the tax authorities.

Dont Miss: How Much Should I Put In My 401k

Also Check: How Do I Pull From My 401k

Contributions To A Traditional 401 Reduce Your Taxable Income

Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Contributions to qualified retirement plans such as traditional 401 plans are made on a pre-tax basis, which removes them from your taxable income and thus reduces the taxes youll pay for the year.

There are limits to how much you can contribute tax-free to such a plan. For 2020 and 2021, the annual limit is $19,500. Those who are 50 or older can almost alwaysits allowed by 98% of plans make an additional catch-up contribution each year of $6,500. You can even contribute the catch-up when you are 49, provided you will turn 50 before the end of the calendar year.

It Pays To Know Your Solo 401 Plan Options

Solo 401 plans are popular with business owners because they offer unrestricted contributions including mega back door Roth IRA contributions up to the 415 limit. The kicker? Theyre typically much less expensive than other 401 plans because theyre small and not subject to many plan qualification requirements.

However, you want to avoid 401 providers that limit your solo 401 plan design options. Their limitations can keep you from maximizing your plan benefits.

Also Check: Can You Open A Roth 401k On My Own

Qualified Plan Considerations For The Employer

In general, employers have the greatest need for awareness when it comes to qualified plans. Employers are responsible for obtaining qualified plan status, setting up appropriate procedures, ensuring that operational procedures are consistently maintained, and auditing plans annually for compliance.

One of the most important requirements for a qualified plan is non-discrimination. This means a qualified plan must be offered to all employees equally, regardless of their status within the company.

Employers have several advantages for the company if they offer a qualified plan. Any contributions to a qualified plan are tax-deductible. Businesses with 100 or fewer employees can get a tax credit. Lastly, qualified plans are an important benefit that helps companies attract talent to their organization.

Withdrawals from a qualified retirement plan before you are 59½ generally incur a 10% early withdrawal penalty and are subject to income tax at the current annual rate.

What Are The Potential Tax Benefits Of A Solo 401

One of the potential benefits of a Solo 401 is the flexibility to choose when you want to deal with your tax obligation. In a Solo 401 plan all contributions you make as the “employer” will be tax-deductible to your business with any earnings growing tax-deferred until withdrawn. But for contributions you make as an “employee” you have more flexibility. Typically, your employee “deferral” contributions reduce your personal taxable income for the year and can grow tax-deferred, with distributions in retirement taxed as ordinary income. Or you can make some or all of your employee deferral contributions as a Roth Solo 401 plan contribution. These Roth Solo 401 employee contributions do not reduce your current taxable income, but your distributions in retirement are usually tax-free. Generally speaking, there are tax penalties for withdrawals from a Solo 401 before 59 1/2 so be sure to know the specifics of your plan.

Read Also: How To Calculate Employee 401k Match

Preparing And Responding To Irs Investigations

- When asked to provide information, make sure to provide it in connection with your solo 401k plan and self-employed business not your personal accounts or assets. You should also consult with your solo 401k plan provider to make sure all disclosures are up to date.

- If the IRS asks for supporting documents, make sure to provide all the documents listed on the IRS examination notice.

- If IRS requires an interview, prepared for as if it were a trial or a deposition.

About Mark Nolan

Each day I speak with energetic entrepreneurs looking to take the plunge into a new venture and small business owners eager to take control of their retirement savings. I am passionate about helping others find their financial independence. Having worked for over 20 years with some of the top retirement account custodian and insurance companies I have a deep and extensive knowledge of the complexities of self-directed 401ks and IRAs as well as retirement plan regulations.Learn more about Mark Nolan and My Solo 401k Financial > >

What Are The Solo 401k Contribution Types

There are two types of Solo 401k contributions.

Elective deferral: As an employee of a self-employed business with no full-time employees, you can make an employee contribution known as the elective deferral. The solo 401k employee contribution in 2020 is $19,500 if youre under age 50 and $26,000 if youre 50 and older.

Profit Sharing: As the employer of a self-employed business with no full-time employees, you can make an employer contribution known as a profit sharing contribution. Unlike the elective deferral, the profit sharing contribution is based on a percentage of income. For 2020, you can make a contribution of $37,500 whether you are under or over 50 years old.

Learn more about the 2020 Solo 401k contribution limits.

You May Like: Can I Start A 401k For My Child

Contribution Limit As An Employer

Wearing the employer hat, you can contribute up to 25% of your compensation.

The total contribution limit for a solo 401 as both employer and employee is $58,000 for 2021, and $61,000 in 2022, or 25% of your adjusted gross income, whichever is lower.

People ages 50 and above can add an extra $6,500 a year as a “catch-up contribution.” In other words, in 2022 you can contribute a total of $61,000 along with a $6,500 catch-up contribution if applicable for a maximum of $67,500 for the year.

You can have a solo 401 even if you’re moonlighting. If you have a 401 plan at both jobs, the total employee contribution limits must be within the maximum for the year, but the employer contribution is not limited. If you’re one of these lucky folks with two retirement savings plans, talk to a tax adviser to make sure you follow the IRS rules.

Sole Proprietorship Or Single Member Llc

Imagine that Stephanie, 35 years old, is a sole proprietor and has $125,000 in self employment income on Schedule C of her tax return. Stephanie may make $19,500 in employee deferrals. She may also make a profit sharing contribution of 25% of her adjusted earned income: $92,935. Adjusted earned income is calculated as: / .

/ = $92,935. 25% of this amount works out to $23,233. Stephanies total contribution between elective deferrals and profit sharing contributions would be $42,733.

Recommended Reading: How To Start My Own 401k

You May Like: Can I Transfer Rollover Ira To 401k

Who Is Eligible For A Solo 401

Solo 401 plans are intended for the self-employed. If you have employees and are looking for a retirement plan, then you have other options such as the or SIMPLE IRA, both of which allow you to provide tax-advantaged benefits to your employees. A lesser-known program called a SIMPLE 401 also allows businesses to set up retirement plans.

While solo 401 plans are intended for one-person businesses, there is an exception. The spouse of the business owner can also participate in the plan. With a spouse in the plan, your small business can really stash away cash for retirement. A qualifying couple could save as much as $114,000 annually in the plan, and even more if they were eligible for catch-up contributions.

Is A Solo 401 Right For Me

If you bring in any self-employment income, a solo 401 could be a good option for you. The plan comes with a broad range of investment options and high contribution limits. And if your spouse is involved, you can maximize your contributions and save money quickly.

According to Lee, a solo 401 works well for married couples and small professional services firms. However, she reiterates that it won’t work if you have even one employee.

Don’t Miss: How Does A 401k Work When You Change Jobs

Solo 401 Tax Advantages

All 401 plans offer tax advantages. How that works with a solo 401 depends on the type you use.

Traditional solo 401: One of the advantages of a traditional solo 401 is that you can reduce your taxable income. For instance, “if your income is $80,000 and you defer $20,000 into your solo 401, you would have an adjusted tax base of $60,000 on your W-2,” Lee says.

The money you invest grows tax-deferred until retirement, and you’ll pay taxes when you distribute the funds.

Roth solo 401: Unlike a regular Roth IRA, there are no income limits with a Roth solo 401. And Lee stresses that one of the advantages is that you fund the account with after-tax earnings. “This is a beautiful thing because you will never have to pay tax on the money that grows.”

What Is A Solo 401 Plan

A Solo 401 plan is a 401 qualified retirement plan that was designed for self-employed individuals and small business owners with no full-time employees, excluding a business partner and spouse. Much like the traditional 401, this unique plan encourages individuals to save for retirement in a tax-advantaged environment. When participants contribute funds into the Solo 401, taxes on the funds will be deferred until the participant takes a qualified distribution.

The Solo 401 is an IRS-approved plan that has the same rules and requirements as a traditional employer-sponsored 401. However, the Solo 401 allows participants to make annual contributions to the plan as both an employee and employer, which ultimately increases the yearly maximum contribution limit.

Also known as a self-employed 401 or individual 401, individuals can benefit even if they generate a portion of their total income through self-employment activities, such as a freelance gig. What are the Benefits of the Solo 401k?

Read Also: Can An Individual Open A 401k