Why Choose A Self

Self-Directed IRAs are for those who want to be in the drivers seat of managing their retirement. Experienced investors and/or those who have a great interest in investing are often drawn to these accounts, because they allow for alternative investments, such as real estate, private equities, lending money, and much more.

While the IRS does require that you work with a certified IRA custodian, such as our firm IRA Innovations, its this freedom to choose, combined with the tax advantages offered through a Self-Directed IRA that are some of the biggest benefits listed by our clients.

Direct & Indirect Rollover Tax Implications:

As mentioned above you need to choose between a direct or indirect rollover of funds from your 401k. The direct rollover is the more straight forward option. The funds just move from the 401k straight into the new IRA without you laying a hand on them.

The indirect option involves you receiving a check and then having to deposit it in the IRA within 60 days. If you fail to deposit it within the 60-day window you will be hit with a tax penalty from the IRS. Once the 60 days have elapsed the IRS will class them as a taxable withdrawal.

In addition to this, a 10% early withdrawal penalty will be applied if you are aged 59.5 years or younger. You can see how this is a situation you clearly want to avoid. So, if you opt for an indirect rollover on your 401k it is critical you get the check deposited within those 60 days.

Better still, maybe just go for a direct rollover. Unexpected things happen and you dont want to be caught holding that check when you realise sixty days have just passed!

For more info on switching a 401k to a gold IRA, see Regal Assets 401k to Gold IRA in 24hrs.

Related articles and guides:

Is It Better To Open An Ira With A Bank Or Brokerage Firm

Most retirement savers should open an IRA with a broker

Because youre investing your retirement cash for the long-term and hoping to eventually have enough to comfortably stop working you need higher returns than youll get at a bank. This is why you probably want to open an IRA at a brokerage.

You May Like: What Is A Simple 401k

Read Also: How To Withdraw From 401k Fidelity

Follow These 3 Easy Steps

Step 1Select an eligible Vanguard IRA for your rollover*

- If youre rolling over pre-tax assets, youll need a rollover IRA or a traditional IRA.

- If youre rolling over Roth assets, youll need a Roth IRA.

- If youre rolling over both types of assets, youll need two separate IRAs.

Note: You can roll over your assets to a new or an existing Vanguard account.

Step 2Contact the financial institution holding your employer plan

Tell them you want to make a direct rollover from your employer plan to your Vanguard IRA®, and ask what information they need

Need a letter of acceptance?

Youll be able to create and print a letter of acceptance during our online rollover process.

Note: You may not be eligible to roll over a plan account that youre still contributing to.

What types of assets do I have in my employer plan account?

Knowing whether you have pre-tax or Roth assets will help you figure out what type of IRA you need to open at Vanguard. If you own company stock in your plan, that may add a layer of complexity to your rollover.

What name did I use on my employer plan account?

A common situation that can delay a rollover is when a check from the current financial institution is made payable to a name that doesnt match your Vanguard account registration. Examples include use of birth name versus married name, a missing suffix , differing middle initials , etc.

What are your rollover requirements?

Are e-signatures or faxed copies allowed?

Do you need a letter of acceptance ?

Third: Complete The On

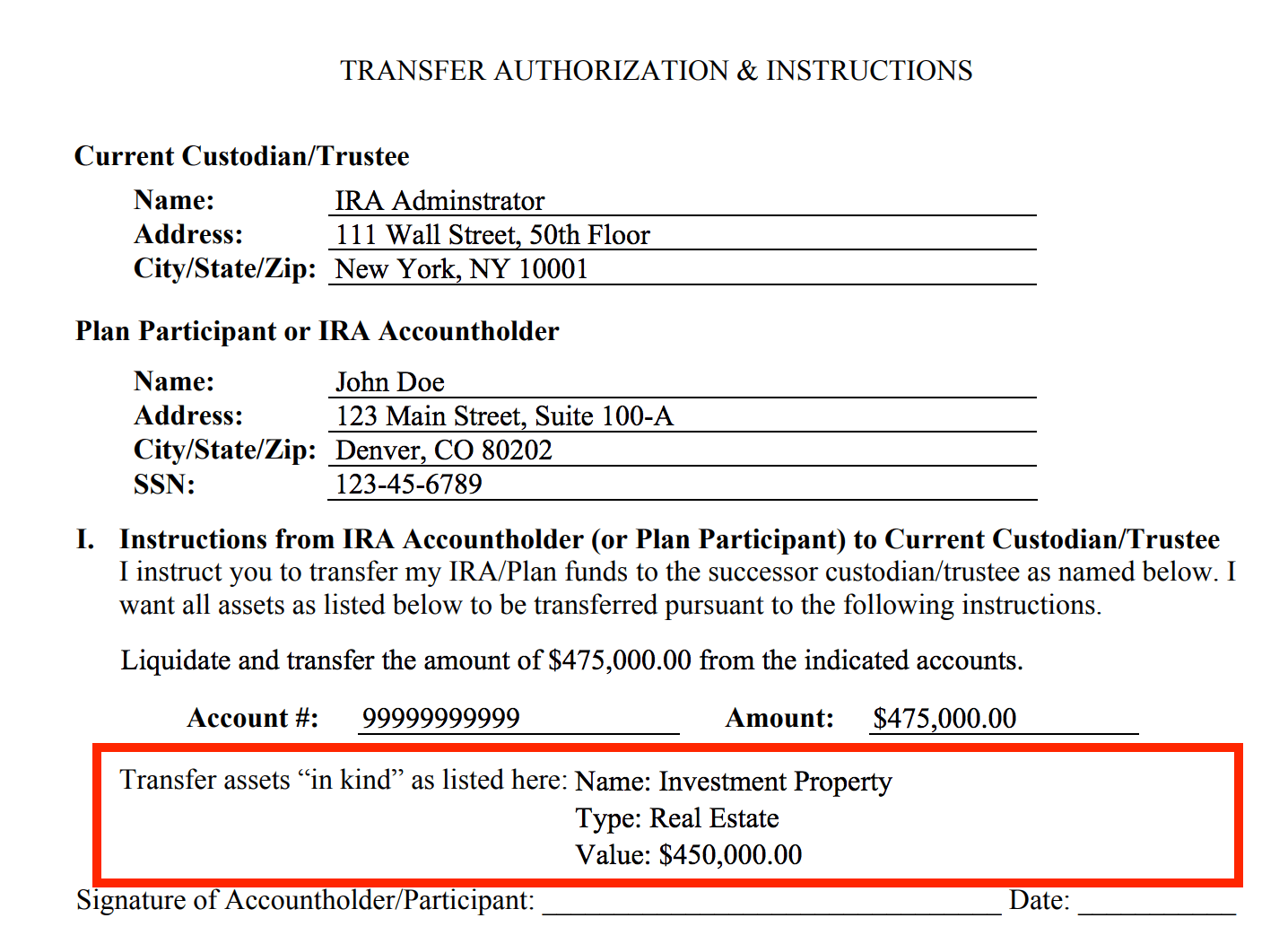

The self-directed solo 401k provider will need to issue a Form 1099-R to report the non-taxable transfer of the solo 401k and its assets to the self-directed IRA. For My Solo 401k Financial clients, the following form is used:

REPORTING THE FULL SOLO 401K DIRECT ROLLOVER TO A TRADITIONAL IRA

Form 1099R

The solo 401k provider will report the direct rollover from the solo 401k to the IRA on Form 1099-R. A 1099-R is a required document that must be completed and sent to the IRS for all distributions, including non-taxable direct rollovers to a TRADITIONAL IRA from a Solo 401k plan. The 1099-R will be issued in February of the year following the transfer, with a copy sent to you for filing with your taxes and a copy sent to the IRS. IMPORTANT: The direct rollover is not taxable only re-portable IF the funds are transferred to a TRADITIONAL IRA.

Recommended Reading: How To Start A 401k Account

Also Check: How To Make 401k Grow Faster

When Leaving Your Job You Can Typically Cash Out Your 401 Or Roll It Over Into A Different Retirement Account Certain Options Can Make You Much Richer

Both a 401 and IRA are tax-advantaged retirement accounts, but they work differently. 401s are sponsored by employers and often offer limited investment options. IRAs aren’t linked to employment. They can be opened with any brokerage firm or other financial institutions and have a wider variety of investment selections, but require more hands-on management.

Because 401s are offered through employers, you’ll need to determine what to do with yours when you leave your job. Your options include:

- Leave it invested

- Rollover to a new 401

- Rollover to an IRA

There are plenty of pros and cons to these options, but let’s take a close look at when rolling your workplace 401 into an IRA may make sense for you.

Rollover Vs Cashing Out

First things first, the temptation to just cash out your existing 401K may be hard to resist but should be avoided at all costs. Not only will cashing out your retirement savings slow the growth of your account, but it will also make your money susceptible to an early withdrawal penalty by the IRS of up to 10% of your total saved funds. You should also be prepared to pay between 7%-25% for state and federal income taxes. These fees will whittle away at your retirement savings, not making it worth the short-term cash-out.

Rolling over your account from one custodian to another will prevent the IRS, state, and federal fingers out of your savings account. Each custodians process and rules can vary, but the IRS gives account holders 60 days after distribution to deposit funds into a new account.

Also Check: How To Move My 401k To An Ira

Got $1000 The 10 Top Investments Wed Make Right Now

Our team of analysts agrees. These 10 real estate plays are the best ways to invest in real estate right now. By signing up to be a member of Real Estate Winners, youâll get access to our 10 best ideas and new investment ideas every month. Find out how you can get started with Real Estate Winners by .

Should You Roll Over Your 401

To start, its worth knowing that you dont have to make a 401-to-IRA rollover, even if you do leave your job. You have the option of leaving the money youve invested in the plan at your old company. You cant keep contributing to it, but it will stay invested and if your investments go up, youll continue to see your account grow. This is called an orphan account.

Do you like the way your money is invested currently? If so, you may want to consider keeping your money in the existing plan. If you currently arent working but anticipate taking a new job soon, you could leave your money at your old plan temporarily and put it into your new companys plan once you have access to it.

For those who dont think theyll end up in another 401 plan but still want to save more for retirement, it might make sense to do a 401-to-IRA rollover. Remember, even though you still have your account at your old companys 401, you wont have the ability to make more contributions.

Read Also: How Much Goes Into 401k

How To Roll Over Your 401k Plan Into A Self Directed Ira

If there is one thing that 2020 has taught us, it is that nothing is as certain as it was before. One of the biggest fears for many Americans right now is their job security. Many people have already lost their jobs and are wondering what comes next for them. A major effect of leaving a job, whether it be through retirement, layoffs or simply moving to a new company, is that your 401 from your previous employer becomes eligible to be rolled over to an IRA.

There are a variety of different options that become available to you with your previous employer 401 and we have listed the 3 most common options:

When To Roll Over Your 401 To An Ira

Rolling over your 401 to an IRA is possible only if youre leaving your current employer or your employer is discontinuing your 401 plan. It is an alternative to:

- Leave your money invested in your existing 401

- Rollover to your new employers 401

- Withdrawal from your 401, which would trigger a 10% penalty if you arent 59 1/2 or older

A rollover or IRA) does not have tax consequences. This would not be the case if you do a rollover to a Roth IRA.

Rolling over a 401 to an IRA provides you with the opportunity to choose which brokerage you want to hold your retirement funds. It may be the right choice if:

- Your new employer doesnt offer a 401 plan

- You cannot keep your money invested in your current workplace plan because your plan is being discontinued or your 401 administration wont allow you to stay invested for some other reason

- Your new employers 401 plan charges high fees, offers limited investments, or has other drawbacks

- Youd prefer a wider choice of investment options

However, there are some downsides to consider:

- While 401 loans allow you to borrow against your retirement funds, no such option exists with an IRA.

- Transferring company stock can be complicated account, read up on an NUA strategy that could save you a lot of money.)

If these downsides arent deal breakers for you, the next step is figuring out how to roll over your 401 to an IRA.

Also Check: When To Start A 401k Plan

Why Transfer Your 401 To An Ira

Why would you move savings from an old 401 plan to an IRA? The main reason is to keep control of your money. In an IRA, you get to decide what happens with the funds: You choose where to invest and how much you pay in fees, and you dont need anybodys permission to take money out of the account.

More Control

Cost and providers: In your 401, your employer controls almost everything. Employers choose vendors for the plan, which determines the investment lineup available. Those might not be investments you like, and they might be more expensive than you want. If you want to practice socially-responsible investing, the 401 may lack options for that.

Timing: 401 plans also require extra steps when you want to withdraw funds: An administrator needs to verify that you are eligible to access your money before youre allowed to take a distribution. Plus, some 401 plans dont allow partial withdrawalsyou might need to take your full balance.

Easy Withdrawals

If you need access to your 401 savings for any reason, its easier when the money is in an IRA. In most cases, you call your IRA provider or request a withdrawal online. Depending on what you own in your account, the funds might go out as soon as the next business day. But 401 plans might need a few extra days for everybody to sign off on the distribution.

Complicated Situations

Control Tax Withholding

You May Be Charged Lower Fees

Even if your company covers fees charged by your plan now, it may not once youve parted ways. And you have no guarantee your future companys 401 will be fee-free. Make sure you have a handle on potential costs your employer-sponsored retirement plan has just for managing your money.

While youll probably never be able to escape fund expense ratios, you can minimize or completely eliminate most administrative fees by moving from a 401 to an IRA. An IRA may also afford you better access to more low-cost funds, like index funds.

Recommended Reading: Can You Switch A 401k To A Roth Ira

What Are Alternative Investments

Self-directed IRAs are in most ways similar to other individual retirement accounts , meaning they have tax advantages designed to encourage Americans to save for retirement. As a result, the Internal Revenue Service gets some say in what an IRA can and cannot be invested in, which includes some alternatives to the usual stock and bond funds.

As of 2021, the IRS permits self-directed IRAs to invest in real estate, development land, promissory notes, tax lien certificates, precious metals, cryptocurrency, water rights, mineral rights, oil and gas, LLC membership interest, and livestock.

The IRS also has a list of investments that are not permitted. That list includes collectibles, art, antiques, stamps, and rugs.

Are There Any Tax Traps What About Ubit/ubti

The tax UBIT applies when your IRA receives unrelated business income. However, if your IRA receives investment income, then that income is exempt from UBIT tax. Investment income exempt from UBIT includes the following.

- Real Estate Rental Income ) Rent from real estate is investment income, and is exempt from UBIT

- Interest Income ) Interest and points made from the money lending is investment income, and is exempt from UBIT.

- Capital Gain Income ) The sale, exchange, or disposition of assets is investment income, and is exempt from UBIT

- Dividend Income ) Dividend income from a C-Corp where the company paid corporate tax is investment income, and exempt from UBIT

- Royalty Income ) Royalty income derived from intangible property rights, such as intellectual property, and from oil/gas and mineral leasing activities is investment income, and is exempt from UBIT.

So, make sure your IRA receives investment income as opposed to business income

Recommended Reading: Is There A Limit For 401k Contributions

Why Rollover To An Sdira

Self-directed IRAs grant you personal control over your funds. Though the IRS states that your assets must be handled by a certified IRA custodian, this retirement plan places you in the drivers seat. All asset allocation, selections, and financial planning are done by the account holder. Of course, as the account holder, you are responsible for any mishaps that may occur when setting up your fund. Perform your due diligence and be sure you are selecting a plan thats right for you.

Disadvantages Of Rolling Over Your 401

1. You like your current 401

If the funds in your old 401 dont charge high fees, you might want to take advantage of this and remain with that plan. Compare the plans fund fees to the costs of having your money in an IRA.

In many cases the best advice is If it isnt broken, dont fix it. If you like the investment options you currently have, it might make sense to stay in your previous employers 401 plan.

2. A 401 may offer benefits that an IRA doesnt have

If you keep your retirement account in a 401, you may be able to access this money at age 55 without incurring a 10 percent additional early withdrawal tax, as you would with an IRA.

With a 401, you can avoid this penalty if distributions are made to you after you leave your employer and the separation occurred in or after the year you turned age 55.

This loophole does not work in an IRA, where you would generally incur a 10 percent penalty if you withdrew money before age 59 1/2.

3. You cant take a loan from an IRA, as you can with a 401

Many 401 plans allow you to take a loan. While loans from your retirement funds are not advised, it may be good to have this option in an extreme emergency or short-term crunch.

However, if you roll over your funds into an IRA, you will not have the option of a 401 loan. You might consider rolling over your old 401 into your new 401, and preserve the ability to borrow money.

Don’t Miss: How To Start A 401k For Employees

View Important Information About Our Online Equity Trades And Satisfaction Guarantee

- View important information about our online equity trades and Satisfaction Guarantee

-

1. Standard online $0 commission does not apply to over-the-counter equities, transaction-fee mutual funds, futures, fixed-income investments, or trades placed directly on a foreign exchange or in the Canadian market. Options trades will be subject to the standard $0.65 per-contract fee. Service charges apply for trades placed through a broker or by automated phone . Exchange process, ADR, and Stock Borrow fees still apply. See the Charles Schwab Pricing Guide for Individual Investors for full fee and commission schedules.

2. If you are not completely satisfied for any reason, at your request Charles Schwab & Co., Inc. , Charles Schwab Bank, SSB , or another Schwab affiliate, as applicable, will refund any eligible fee related to your concern. No other charges or expenses, and no market losses will be refunded. Refund requests must be received within 90 days of the date the fee was charged. Schwab reserves the right to change or terminate the guarantee at any time. Go to schwab.com/satisfaction to learn whats included and how it works.