Come To Terms With Risk

Some people think investing is too risky, but the risk is actually in holding cash. Thats right: Youll lose money if you dont invest your retirement savings.

Lets say you have $10,000. Uninvested, it could be worth less than half that in 30 years, factoring in inflation. But invest 401 money at a 7% return, and youll have over $75,000 by the time you retire and thats with no further contributions. calculator to do the math.)

Clearly youre better off putting your cash to work. But how?

The answer is a careful asset allocation, the process of deciding where your money will be invested. Asset allocation spreads out risk. Stocks often called equities are the riskiest way to invest bonds and other fixed-income investments are the least risky. Just as you wouldnt park your life savings in cash, you wouldnt bet it all on a spectacular return from a startup IPO.

Instead, you want a road map that allows for the appropriate amount of risk and keeps you pointed in the right long-term direction.

Investment #: Bond Funds

A bond is a fixed-income investment representing a loan made by an investor plan) to an entity like the U.S. Treasury, which offers a specific amount of money as a return on investment. When a corporation or a government body needs capital for a project, they will issue bonds publicly. In a 401, some of the fund options you will want to include are bond funds. They represent an important tool for balancing any retirement portfolio. Because they offer a defined amount of return, a bond fund investment can give employees an investment option that will grow their savings at a predictable rate.

Investment #: Stock Funds

Stocks represent ownership of shares in a company, which grants the owner a representative share in the companys assets and earnings. As the company increases in value, so does the stockwhich means an increase in savings for any employee who invests in stocks through their 401 plan. Most commonly, stock investments in a 401 are offered as funds made up of stocks.

There are many ways to categorize stock funds. One way is by the size of the company, which is represented by market capitalization. Stock funds made up of investments in very large corporations would be considered large cap, while the funds made up of smaller companies is represented as small cap. Stock funds are also classified based on the industry they representtech stocks are a popular category of investments in growing tech companies, for example. You may see some stock funds that are labeled as domestic, meaning they represent American companies. International funds, likewise, represent foreign companies.

Unlike bonds, the value of stocks fluctuates with the market. While stocks may have more short-term potential for ups and downs than bonds, the return on investment with stocks tends to smooth out over long periods of time. In fact, stocks outperform bonds 100% of the time over rolling 30-year periods!

Recommended Reading: How To Search For Unclaimed 401k

What Kind Of Investments Are In A 401

A 401 plan will typically offer a range of investments, but any single plan may not offer all possible types of investments. The most common investment options include:

- Stock mutual funds: These funds invest in stocks and may have specific themes, such as value stocks or dividend stocks. One popular option here is an S& P 500 index fund, which includes the largest American companies and forms the backbone of many 401 portfolios.

- Bond mutual funds: These funds invest exclusively in bonds and may feature specific kinds of bonds, such as short- or intermediate-term, as well as bonds from certain issuers such as the U.S. government or corporations.

- Target-date mutual funds: These funds will invest in stocks and bonds, and theyll shift their allocations to each based on a specific target date or when you want to retire.

- Stable value funds: These funds invest in low-yield but very safe assets, such as medium-term government bonds, and the returns and principal are insured against loss. These funds are more appropriate for investors near retirement than for younger investors.

Some 401 plans may also allow you to buy individual stocks, bonds, ETFs or other mutual funds. These plans give you the option of managing the portfolio yourself, an option that may be valuable to advanced investors who have a good understanding of the market.

Basics Of 401 Allocation

When you allocate your 401, you can decide where the money you contribute to the account will go by directing it into investments of your choice.

At a minimum, consider investments for your 401 that contain the mix of assets you want to hold in your portfolio in the percentages that meet your retirement goals and suit your tolerance for risk.

You May Like: How To Move A 401k To A Roth Ira

Can You Lose Money In A 401

Yes. Because your 401 will be invested in various assets , your portfolio will be exposed to market risk. If the stock market crashes, the stocks component of your portfolio will also go down in value. This is why it is responsible to begin shifting into less-risky assets like bonds as retirement approaches. Note, however, that even bonds can lose money, such as in a rising interest rate environment.

Federal Advisor Technology Fund

Your 401 could benefit from a sector fund like FADTX. For the past 10 years, it has delivered high returns. In 2020, FADTX posted a 77.38% return. This fund concentrates on U.S. tech companies. Its most prominent holdings are Microsoft , NVIDIA and Apple .

FADTX has a high expense ratio and a low net asset balance. But its 10-year AAR ranks in the upper quintile in its category it has the highest score of 5 on the YTD Lipper Rating. Since sector investments have a tendency to outperform, FADTX would make an excellent complement to your core holdings in your 401. The table shows FADTX stats.

| Expense Ratio |

|---|

Facet Wealth connects you with 1 Certified Financial Planner . You’ll meet with the same CFP consistently. He or she will get to know you as a person to gain a deep understanding of your needs, goals and dreams. You’ll meet with your CFP virtually to create a tailored financial plan.

Facet doesn’t believe in charging commissions or fees based on assets under management.

And you can store all your financial data in 1 secure hub. It’s easy to see a snapshot of your financial life on the Facet dashboard for a clear picture of your finances at your fingertips.

Read Also: Can 401k Be Used For Home Purchase

What Is A Registered Retirement Savings Account

An RRSP is a retirement savings plan that you open at a bank or other financial institution. You can do that either in person or online, depending on the services is offered by your chosen institution. RRSPs are registered by the federal government of Canada, which specifies the maximum amount each Canadian can contribute to it each year. There are two big benefits to saving or investing inside an RRSP: One, your money is allowed to grow tax-free until you need to withdraw it and two, you get an immediate break on the income tax you would otherwise pay on the amount you contribute each year, up to your annual limit.

Read Also: How To Check My 401k Balance

If You Want A Million

When youre saving for retirement, you want to make sure that youre making the most of your investments, so when that day finally comes, you have the most money possible. The account you invest can have huge implications for how much money youll have when you retire and how you can best minimize your tax hit.

Below, three seasoned Motley Fool contributors review the best ways to invest for retirement in order to make the most of the money you contribute.

Also Check: What Should My 401k Contribution Be

Also Check: How Do I Find My 401k Plan

Best Funds For A 401k: Vanguard 500 Index

Type: Indexed Large-CapExpenses: 0.17%, or $17 for every $10,000 invested

Large-cap index funds make outstanding core holdings for building a diversified portfolio, and Vanguard 500 Index is the cream of the crop in this category.

The reason why index funds are great core holdings is because in many categories, its difficult for even the most skilled managers of actively managed funds to have any real advantage and this is especially true for large-cap stocks. Thats in part because of higher expenses relative to most index funds in the space, but also because large-cap stocks are more efficiently priced than stocks of smaller capitalization.

Vanguard 500 Index, as the name implies, is simply an S& P 500 tracker that gives you exposure to the 500 companies like Apple Inc. and Exxon Mobil Corporation in that index.

HONORABLE MENTIONVanguard Total Stock Market Index : Cheap at 0.17% in fees.Fidelity Spartan 500 Index : One of the cheapest index funds on the planet at 0.095%.

Best Funds For A 401k: Vanguard Target Retirement 2035

Type: Target-Date RetirementExpenses: 0.15%

Vanguard Target Retirement 2035 is one of the best funds in the longtime staple target-date retirement category.

Of course, you dont necessarily have to be retiring in 2035 to enjoy what Vanguard has to offer. When choosing the best target retirement fund for you, just simply find the fund with the year that closely matches your expected retirement year, or soon thereafter, and allocate 100% of your 401k assets and future contributions to that one fund.

For example, if you plan to retire in about 20 years, in 2036, the VTTHX fund would be the best choice for you. As you approach retirement, the asset allocation gradually becomes more conservative. And if you planned to retire sooner, say in 10 years, around 2026, youd look for a target retirement 2025 fund for instance, Vanguard Target Retirement 2025 Fund .

Several fund companies offer target retirement funds, but I like Vanguard because it uses index funds for the underlying holdings, and its asset allocations are a bit more conservative than other similar funds.

HONORABLE MENTIONT. Rowe Price Retirement 2035 : Charges 0.74%.Fidelity Freedom 2035 : Charges 0.75%.

Article printed from InvestorPlace Media, https://investorplace.com/2016/03/10-best-funds-for-your-401k/.

©2022 InvestorPlace Media, LLC

Read Also: What Are The Advantages Of A 401k

Invest Based On The Time Until You’ll Need The Money

Remember that a 401 is a retirement account, so you should plan not to withdraw money until you are at least 59 1/2. If you’re fairly young now, that means you have a long investing horizon ahead of you. If you’re nearing retirement age, however, your investing horizon is much shorter you will need to start withdrawing that money soon to fund your retirement.

Keep this timeline in mind when determining your risk tolerance. If you’re investing in your 401 throughout your career, your willingness to take risks should change over time. When you’re younger, more of your 401 funds should be invested in the stock market to maximize potential returns. You have time to wait out any downturns. However, as you age, you have less flexibility around market volatility and should shift your funds toward safer investments.

Lower-risk investments such as cash, CDs, money market funds, and bonds present far less risk of loss but also lower rates of return. If you overinvest your 401 funds in safe investments like these, you risk missing out on the wealth-building returns of the stock market.

To make sure you aren’t taking on too much — or too little — risk with your 401, consider this simple formula: Subtract your age from 110 and invest the resulting percentage of your 401 money in the market. A 20-year-old would have 90% of their money in stocks while an 80-year-old would have just 30% of their assets in the market.

Fund Types Offered In 401s

Mutual funds are the most common investment options offered in 401 plans, though some are starting to offer exchange-traded funds . Both mutual funds and ETFs contain a basket of securities such as equities.

Mutual funds range from conservative to aggressive, with plenty of grades in between. Funds may be described as balanced, value, or moderate. All of the major financial firms use similar wording.

Don’t Miss: Is It Better To Contribute To 401k Or Roth 401k

Extra Benefits For Lower

The federal government offers another benefit to lower-income people. Called the Saver’s Tax Credit, it can raise your refund or reduce the taxes owed by offsetting a percentage of the first $2,000 that you contribute to your 401, IRA, or similar tax-advantaged retirement plan.

This offset is in addition to the usual tax benefits of these plans. The size of the percentage depends on the taxpayer’s adjusted gross income for the year and tax-filing status. The income limits to qualify for the minimum percentage offset under the Saver’s Tax Credit are as follows:

- For single taxpayers , the income limit is $34,000 in 2022.

- For married couples filing jointly, it’s $66,000 in 2021 and $68,000 in 2022.

- For heads of household, it maxes out at $49,500 in 2021 and $51,000 in 2022.

Revisit Your Plan And Consider Adjustments At Least Once A Year

One of the best things about using a 401 to invest for retirement is that you can put your investments on autopilot. However, this doesn’t mean you should simply set up your 401 contributions once and forget it forever. You need to make sure you’re on track with your retirement goals, that your portfolio remains balanced, and that your investments are performing as expected.

To stay on top of your retirement investing, make a repeating appointment on your calendar to check in on your 401 at least once a year.

You should also consider making changes as you reach key milestones in your life and career. If you get a big raise, consider upping the percentage of your salary that goes toward your 401. If you pay off your student loans, consider shifting the money you’d been spending there to instead build wealth on your behalf. When you hit key milestone birthdays or your kids become able to care for themselves, those are also great times to revisit your plan and make adjustments.

Also Check: How To Access My 401k From Previous Employer

Is Investing In A 401 Right For You

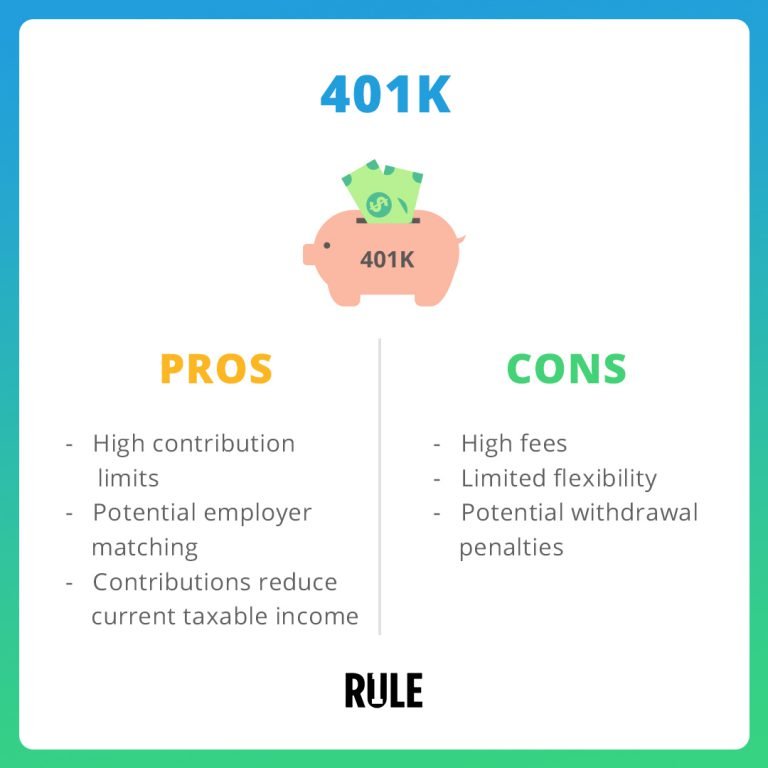

Overall, if youre wondering whether a 401 plan is worth it it depends. There are two major benefits that appeal to employees using a 401 plan: the tax savings and employee matching programs.

Other investment options may come with lower fees or greater flexibility. That can be valuable to certain investors. Plus, you may not want to have restrictions on your own money. Work through your investment goals before enrolling in a 401 program. If you need to, talk to a financial advisor.

Meeting Your Fiduciary Responsibility To Diversify 401 Investments

Before you start picking investments for your 401 plan, we recommend you first understand your fiduciary responsibility to diversify your investment menu. These requirements are outlined in ERISA section 404. Meeting them is not difficult. You just need to pick at least three core investments with materially different risk and return characteristics. A menu of equity , fixed income , and capital preservation funds can do the trick.

In short, your diversification responsibility is nothing to fear. Selecting prudent investments is where you’re much more likely to land yourself into hot water. Thats why impartial guidance is so important. In our view, you have two clear options.

You May Like: How To Start A 401k For Small Business

Convert Old 401s To Roth Iras

Lets pretend that youve changed jobs at least once in your career, and you still have a 401 from a former employer. If you have enough cash on hand, you can convert that 401 into a Roth IRA. Since the money in that 401 wasnt taxed when you first put it into the account, youll pay taxes on that money when you convert it to a Roth IRA. Doing that rollover is not complicated. Youll have to make some phone calls and fill out some paperwork.

Why would you want to convert that old 401 into a Roth IRA? There are a couple of reasons.

Remember this: converting is an option only if you have the cash on hand to pay the taxes. If you dont have enough, try Door #3.

Recommended Reading: Best Long Term Investment Accounts

Is A 401 Worth It

Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny stocks for 20+ years. He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win. Gordon is a Chartered Market Technician . He is also a member of CMT Association.

You don’t have to master investing to allocate money in your 401 account in a way that meets your long-term goals. Here are three low-effort 401 allocation approaches and two additional strategies that might work if the first three options aren’t available or right for you.

Recommended Reading: When Can I Take Out My 401k

Weigh Your Investment Options

401s tend to have a small investment selection thats curated by your plan provider and your employer. Youre not selecting individual stocks and bonds , but mutual funds ideally ETFs or index funds that pool your money along with that of other investors to buy small pieces of many related securities.

Stock funds are divided into categories. Your 401 will probably offer at least one fund in each of the following categories: U.S. large cap which refers to the value of the companies within U.S. small cap, international, emerging markets and, in some plans, alternatives such as natural resources or real estate. Diversify your portfolio by spreading the portion youve allocated to equities among these funds.

You want to allocate more to the biggest asset classes, like U.S. large caps and international. U.S. small cap, natural resources and real estate are not as prevalent asset classes, so youll take smaller bits of those, Walters says.

That might mean putting 50% of your equity allocation into a U.S. large cap fund, 30% into an international fund, 10% into a U.S. small cap fund and spreading the remainder among categories such as emerging markets and natural resources.

The bond selection in 401s tends to be even more narrow, but generally youll be offered a total bond market fund. If you have access to an international bond fund, you might put a bit of your savings in there to diversify globally.