What Are The Benefits Of Offering A 401 To Employees

When it comes to 401 plans, there are often common misconceptions around the time, resources, and costs it takes to establish and set up a plan. Business owners may believe that a 401 plan isn’t right for them, are unclear of the benefits, or believe the administrative responsibilities are too cumbersome. In truth, there are some significant advantages in offering a 401 plan to employees:

- A 401 can help make your business more competitive in attracting and retaining top talent.

- Employers can take advantage of an annual tax credit of up to $5,000 for the first three years of the plan.

- Plan expenses are tax-deductible, along with employer contributions such as an employee match or profit-sharing.

- Advances in payroll integration and recordkeeping make the implementation and maintenance of offering a retirement plan more affordable than ever.

Employee Productivity Retention And Acquisition

The benefits package you offer may make or break your company when it comes to hiring and retaining employees, so another reason to seriously consider establishing a 401 plan for your small business this year is employee attraction and retention. Offering a retirement savings plan can help small- to mid-size businesses stand apart from other optionswhich may make applicants more likely to accept a job offer and current employees less likely to look elsewhere.

In fact, MetLife found in its 2021 study on employee benefits that financial health is the top concern among employees today and is also a top contributor to poor mental healthwhich frequently causes decreased employee productivity . Even further, the study revealed that the top two financial concerns among workers are directly related to their future retirement:

-

48% are concerned about their ability to retire as planned or on schedule

-

48% are concerned about long-term savings such as 401 accounts, IRAs, or other retirement savings vehicles

Offering a retirement savings vehicle for current and future employees to save in could go a long way in easing their financial anxietieswhich, in turn, may make them more productive and boost your bottom line.

Get Clear On Why Youre Offering A Small Business 401

The 401 can be a very powerful benefit for you and your employees. In order to ensure that youre getting the most value you can out of your 401, youll need to be clear on your reasons for starting one. Here are 3 of the most compelling reasons why so many business owners nowadays are setting up a 401k for their small businesses:

Don’t Miss: Can I Invest In Stocks With My 401k

Arrange A Trust For The Plans Assets

One requirement for starting a 401 plan on your own is that you set up a trust to hold assets . This guarantees that only the participants and their beneficiaries can use the funds.

When arranging the trust, you need to select a trustee. Deciding on a trustee is an important part of establishing a plan, as they must handle contributions, plan investments, and distributions.

What Are 401 Deadlines For Employers And Employees

To maximize the benefits of your workplace 401 program, you have to keep in mind 401 contribution deadlines for key events, including taking required minimum distributions, last day to contribute to 401, the 401 enrollment period, 401 set up deadline, and 401 open enrollment and more!

Heres a comprehensive list of 401 deadlines for employers and employees, including action items and links where you can find additional information.

Read Also: How Can I Invest My 401k Money

Small Business Owners Need Retirement Savings Too

As a small business owner, you need to be able to set aside some retirement savings tooand one of the best ways to do that is in a tax-advantaged account like a401 plan. Not only do 401 plans have a higher contribution limit than other retirement plan options, like IRA and SIMPLE IRA, but they’re also flexible enough to fit with your company’s needs and goals. Have a high number of Highly Compensated Employees at your business, for example? Many 401 plans also offer Safe Harboroptions to help small businesses pass non-discrimination testing you’ll just want to make sure the plan is in place prior to Safe Harbor deadlines for the year.

There are plenty of reasons to consider starting a 401 plan for your small business this year learn more about Why a 401 plan may make the most sense for your company or check out our resource library for employers.

For more information about the benefits of a CoPilot Prime small business 401 plan, contact us today: .

Make Sure Your Payroll System Integrates With Your Recordkeeper

Running a 401 is a lot of work. Trust us, we run a lot of these. As a small business with limited resources, running a retirement plan and keeping it compliant can be a tall order. Thats why we recommend a good 401 payroll integration, which will automatically deposit employee contributions, track employee eligibility, and run validation checks to resolve any discrepancies that might put your plan out of compliance. These integrations make plan administration way easier, so be sure that your provider offers one.

Read Also: How To Borrow Money From My 401k

Improved Employee Retainment And Morale

Did you know that retirement plans are the most-wanted benefit after health insurance? Plus, adding a 401 to your benefits package is a cost-effective way to compete for great talent and reduce turnover of current employees. Because a majority of employers provide a match , providing a match can help you remain competitive.

Finalizing Your 401 Selection

Next, with the help of a financial advisor, choose the plan that makes the most sense for your company and your employees. If you have a relatively small company with only a few employees, your plan selection will likely be quite different if you have 90 employees.

The final step will be to inform your employees and to update your benefits package to reflect the change, so you can clearly tell potential employees about the 401 plan, as well. You will likely want to mention the benefit on all of your job listings in the future, too.

CO aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Want to read more?

To stay on top of all the news impacting your small business, go here for all of our latest small business news and updates.

COis committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here.

Recommended Reading: How To Change 401k Investments

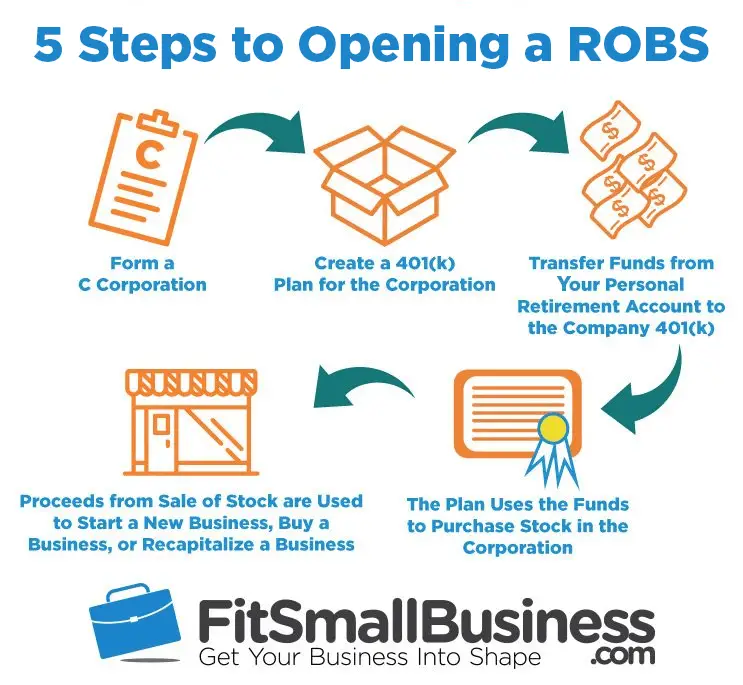

How Does 401 Business Financing Work

401 business financing allows you to tap into your retirement account and use that money to start or buy a business or franchise. To access your money without triggering an early withdrawal fee or tax penalty, a ROBS structure must first be put in place. The structure has multiple moving parts, each of which must meet specific requirements to stay compliant with the IRS.

Who Is Responsible For Monitoring 401 Costs

The plans fiduciaries must monitor fees to ensure theyre reasonable. The Employee Retirement Income Security Act of 1974 includes a set of standards or “duties”often referred to as ERISA fiduciary dutieswhich include running the plan in the interest of participants and beneficiaries, and for the exclusive purpose of providing benefits and paying plan expenses.

All 401 plans must have a Named Fiduciary who has ultimate . Plan documents will identify the Named Fiduciary. If a plan sponsor wishes to share its fiduciary responsibility, it can choose to hire a service provider to perform several administrative functions, including those that fall under Internal Revenue Code sections 3, 3, and 3.

for more information about these shared responsibility options.

Don’t Miss: Can You Rollover A Roth 401k To A Traditional Ira

Document The 401 Plan

The first step youll need to take once you decide to offer your employees a 401 plan is to document the plan details. This process can be tedious, and small business owners often outsource this task.

Your plan should include details about contribution amounts, benefits payment timelines and eligibility information. Once you create the plan, youll have to submit it to the IRS for approval. Also, remember to review this plan annually to remain in compliance.

Does Automatic Enrollment Increase The Number Of 401 Plan Participants

The Law of Inertia: A body in motion will stay in motion and a body at rest will stay at rest unless an external force acts upon it. While originating in the world of physics, the Law of Inertia is amazingly applicable to the world of retirement planning. As plan sponsors and financial advisors know, getting people who are not already saving to start saving requires a force nearly equal to the gravitational field of a planet. And getting people to save more than they are already saving is an accomplishment of galactic proportions.

You May Like: What Happens To My 401k From My Old Job

There Arent Exactly Types Of 401 Plans

The notion that there are different types of 401 plans that are distinct from one another is not technically accurate.

You see, 401 plans are highly-customizable. What you might think of as different plan types are in fact different contribution features that can be added to a plan in various combinations.

Well now discuss your feature options and how to decide whether each is right for your plan or not.

Reason : Youre Investing In Your Own Business

Youve probably been pumping every last dollar back in your own business in an effort to get yourself on a solid foundation. Many self-employed people do the same. Its a mistake. Youre prioritizing your present over your future. Balance is the key here.

Reality: Is that still necessary? Its great to pump every last nickel into your business when youre a startup, but is it really necessary now? Cant you take some money off the top and sink it into a retirement account each month? Your future self will thank you when youre living the good life in your golden years.

Recommended Reading: How Much Should I Contribute To My 401k

Terminating A 401 Plan

401 plans must be established with the intention of being continued indefinitely. However, business needs may require that employers terminate their 401 plans. For example, you may want to establish another type of retirement plan instead of the 401 plan.

Typically, the process of terminating a 401 plan includes amending the plan document, distributing all assets, and filing a final Form 5500. You must also notify your employees that the plan will be discontinued. Check with your plans financial institution or a retirement plan professional to see what further action is necessary to terminate your 401 plan.

How Much Money Can You Use

One of the major differences between a 401 loan and a ROBS is the amount of money you can use. With a 401 loan, $50,000 is the maximum you can borrow. With a ROBS, on the other hand, $50,000 is the minimum you have to take out of your retirement account. Therefore, your choice between these two 401 business financing options will largely depend on the amount of money that you have in your retirement account and the percentage that youre willing to put toward your business.

Don’t Miss: When Can I Transfer My 401k To An Ira

Reality: Employer Matching Programs Are Completely Optional

You can offer a 401 plan for your employees to invest and save for their own retirement even if youre not able to afford a company match. That said, 51% of plans offer a match and it can be a great way to incentivize employees to save. The average match is 4.7% but the typical range is between 0 and 6%.

If you are thinking about offering a match, consider vesting schedules i.e. the requirement you set for the period of time that employees must have worked at your company before the employee owns any matching contribution. The majority of plans require 12 months of service before employees are eligible for employer matching.

Determine Whether Youll Match Create A Plan Document And Set Up An Asset Trust

Next, youll need to consider: How much do your employees want to invest in their 401s? How much are you willing to contribute? Keep in mind, any contributions you make can be deducted as a business expense.

The maximum contribution is $61,000 for employees under age 50 and $67,500 for employees age 50 or older. Depending on the type of 401 established, certain rules may apply. You may choose to match 50 cents on the dollar, dollar-to-dollar, a percentage of salary, or up to certain limits.

All of this should be clearly spelled out in a legally binding plan document written by the financial institution and professional tasked with handling the plan. This document will also explain employee eligibility or vesting requirements, contribution amounts, and an explanation of how contributions and distributions will be made. A trust will need to be set up to hold the assets.

Recommended Reading: Can I Roll A Simple Ira Into A 401k

Tips For Comparing 401 For Small Business Costs

A 401 for small business owners is not the same as a 401 for a sprawling multi-national corporation.

If you currently have a 401, review your providers 408 2 fee disclosure.

Since July 2012, the Department of Labor has required plan providers to provide notice of all fees and services provided. Benchmarking to compare competitor fees is the best way to ensure fairness. Review proposals from multiple providers, identifying the compensation paid to each, including indirect compensation paid for with plan investments. Evaluate the experience of each provider to determine if there are any conflicts of interest.

Enter data into the Department of Labors 401 fee disclosure worksheet to compare.

If this is your first plan, look at the fund lineup expense ratios, setup, and administration costs.

For many plans, the 401 expense ratios are way too high. The expense ratio refers to the percentage of retirement fund assets that plan participants pay for their investments. This percentage-based charge includes the cost of administering the plan, operating fees, recordkeeping, management, investment fees, and marketing expenses.

Compare and model out beyond the current year to see the impact of costs over time.

Assess the compounding effect of any fees or high costs on your employees retirement savings.

A Rollover For Business Startups May Be The Solution If:

- You cannot qualify for a business loan, due to credit issues or time constraints.

- Your retirement plan qualifies. It cannot be a Roth 401, for example.

- The administrator of the plan allows it. Many employers do not allow the rollover of funds from your 401 while you are still employed. Funds from previous employer plans will qualify.

- You need $50,000 or more to launch your business. ROBS is a complex process. Whether you put the entire rollover into the hands of a financial services provider or do it yourself, you will incur legal, accounting and administrative fees. Providers consider this the amount at which the accompanying fees make sense.

- You will be an employee of the business.

Don’t Miss: How To Start Your 401k

Regardless Of Their Size Small Businesses Have Many Options For Employee Retirement Plans They Can Offer As Part Of Their Benefits Package

- Offering retirement plans to employees is a good way to attract and retain top talent in your industry.

- The IRS provides tax incentives to small businesses that offer retirement plans.

- There are several different plan types for small businesses, from simple plans that anyone can open to employer-sponsored plans for businesses with two to 100 employees.

- This article is for small business owners looking to learn more about retirement plan options for their employees.

Choosing the right retirement plan for your small business starts with researching all the options available to you and your employees. Analyze who your employees are and what retirement plan options make the most sense for them, then choose one that aligns with your small businesss needs and values.

Several different types of small business retirement plans are available, and plan providers have affordable, accessible options designed for even very small businesses. There are also some tax advantages that can offset the expense of sponsoring a small business retirement plan.

You can choose from simple plans that anyone can open, plans designed for self-employed people with no employees, or employer-sponsored retirement plans for small businesses that employ anywhere from two to 100 workers. Read on to learn more about the small business retirement plan options available to you and some tips to help you decide which ones you want to discuss with your CPA or financial advisor.

Managing 401 Plans For A Small Business

Setting up a 401 can be complicated, but you don’t have to do it alone. Look for a provider with an excellent track record that can help you get started, manage your plan, and even share ideas and guidance to maximize the value to you and your employees. Doing so can go a long way in ensuring an ongoing, positive benefit for years to come.

**Largest 401 recordkeeper by number of plans, PLANSPONSOR magazine, 2022

Don’t Miss: How Do I Look Up My 401k

Understanding The True Cost Of 401 Administration Costs And Expenses

It’s difficult to get accurate ranges on a 401 plans average cost because plan costs can vary widely. For example, plans with less than $1 million in assets may cost $5,000-$10,000 per year: an initial startup fee of $500-$3,000, quarterly per-participant charges of $15-$40, and $800-$1,000 in administrative fees².

Employees generally pay most 401 fees related to investing. Depending on plan design, employers may cover 401 administration costsor, pass them to employees as flat fees or as a percentage of assets in the plan.