Borrowing Money From My 401k

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

What To Do With Your 401k When Moving Abroad Here Are Some Options

Categories: Finance,Latest News

Moving abroad brings with it a long and complicated list of challenges. But financial ones are the most important to get right. What, for example, can an American expat do with their 401 retirement plan? Thankfully, there are some options.

The 401 is a staple of the average Americans retirement plan. Money set aside under a 401 is often tax-deferred, meaning the employee doesnt have to pay tax on it until years later when their tax rate might be lower. Earnings from investments in a 401 account in the form of capital gains are not subject to capital gains taxes either, another enticing advantage of the accounts.

So if youre planning on leaving the United States for a new life abroad, however short, knowing what to do with your 401 is a vital task to cross off your list.

Recommended Reading: Can I Borrow Against 401k

You May Like: How To Transfer 401k When Changing Jobs

Tips On 401 Withdrawals

- Talk with a financial advisor about your needs and how you can best meet them. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If youre considering withdrawing money from your 401 early, think about a personal loan instead. SmartAsset has a personal loan calculator to help you figure out payment methods.

High Unreimbursed Medical Expenses

This particular exception is similar to the hardship distributions mentioned earlier, and these medical bills might qualify you under either category. You should know that a hardship withdrawal for medical bills will not entitle you to a waiver of the 10% penalty in all cases. To qualify for a penalty-free withdrawal, the amount of the bills must be greater than 7.5% of your adjusted gross income . You must also take the distribution in the same year in which the bills were incurred. You cannot take money for estimated future bills either. The bills must be currently due for services already provided.

Also note the requirement that the bills be unreimbursed. If your insurance covers part of the bills or will reimburse you for the payments, then you cannot use money from your 401 to pay them. Likewise, the bills must be for you, your spouse, or a qualified dependent. You cannot use the money to pay bills for a parent, sibling, or any other family member. The limit to the amount of money you can withdraw for medical bills was recently removed, so you are allowed to withdraw as much as is needed to cover all the expenses.

Don’t Miss: What To Do With 401k When You Leave A Company

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Making The Numbers Add Up

Put simply, to cash out all or part of a 401 retirement fund without being subject to penalties, you must reach the age of 59½, pass away, become disabled, or undergo some sort of financial hardship . Whatever the circumstance though, if you choose to withdraw funds early, you should prepare yourself for the possibility of funds becoming subject to income tax, and early distributions being subjected to additional fees or penalties. Be aware as well: Any funds in a 401 plan are protected in the event of bankruptcy, and creditors cannot seize them. Once removed, your money will no longer receive these protections, which may expose you to hidden expenses at a later date.

Don’t Miss: What Is The Max Percentage For 401k

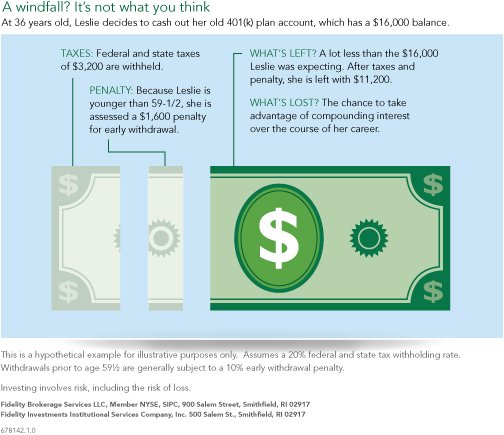

The Irs Charges A 10% Penalty On Early 401 Withdrawals

Generally speaking, the only penalty assessed on early withdrawals from a 401 retirement plan is the 10% additional tax levied by the IRS. This tax is in place to encourage long-term participation in employer-sponsored retirement savings schemes. Learn more about how to calculate your specific penalty for early withdrawal below.

Understanding Early Withdrawal From A 401

Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It really should be a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available to you.

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay regular income taxes on the withdrawn funds.

For a $10,000 withdrawal, when all taxes and penalties are paid, you will only receive approximately $6,300.

Read Also: How Much Tax To Convert 401k To Roth Ira

How To Roll Over A 401 While Still Working

Some 401 plans allow you to roll them over while still employed with your company.

Anyone can roll over a 401 to an IRA or to a new employers 401 plan when leaving a job. Depending on your plans policies, you might be able to make the rollover while youre still with the company. Unlike a post-job rollover, your plan doesnt have to allow in-service rollovers, but many companies do. However, there are usually significant restrictions.

Dont Miss: Is It Better To Rollover 401k To Ira

Calculating The Total Penalty

In the example above, assume your employer-sponsored 401 includes a vesting schedule that assigns 10% vesting for each year of service after the first full year. If you worked for just four full years, you are only entitled to 30% of your employer’s contributions.

If your 401 balance is composed of equal parts employee and employer funds, you are only entitled to 30% of the $12,500 your employer contributed, or $3,750. This means if you choose to withdraw the full vested balance of your 401 after four years of service, you are only eligible to withdraw $16,250. The IRS then takes its cut, equal to 10% of $16,250 , reducing the effective net value of your withdrawal to $14,625.

If you remove funds from your 401 before you turn age 59 12 , you will get hit with a penalty tax of 10% on top of the taxes you will owe to the IRS.

Don’t Miss: What Is 401k In Usa

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Alternatives To Cashing Out

If you want to make a more conservative decision, you can leave your money in your 401 k when you change to a different company or employer. Cashing out your 401 k isnt a requirement, after all. If youre happy with your old employers 401 k, we recommend that you leave the money where it is. You can withdraw it once you retire. This is also a great way to avoid paying excessive income tax.

You can also stretch out the time that you withdraw money from your 401 k. The funds dont have to come out in a lump payment. A plan participant leaving an employer typically has four options , each choice offering advantages and disadvantages. You can leave the money in the former employers plan, if permitted Roll over the assets to your new employer plan if one is available and rollovers are permitted Roll over the funds to an IRA or cash out the account value. The more time between your payments, the easier it is to avoid paying extra tax on the money. This is because funds from your 401 k are considered part of your taxable estate.

Also Check: How To Start A Solo 401k

Early Withdrawals During A Recession

A recession spells out bad times for all. Gross domestic product falls and industrial production slows down. Most noticeably of all, unemployment rates rise. You may find yourself on the wrong side of that trend with dwindling savings. You do have a nice amount of money that you set aside for a future version of yourself.

It’s a tempting idea that many people follow through on. A study from the IRS conducted in 2013 found that in 2004, prior to the Great Recession, 13.3% of people with some retirement plan experienced a taxable retirement account distribution essentially they did an early withdrawal. That percentage rose to 15.4% in 2010.

An early withdrawal should be a last resort. If you can afford not to withdraw early, do so. However, like many other issues within personal finance, recessions impact income levels differently. The same survey states that lower-income households have a higher propensity for an early withdrawal because they’re more deeply impacted by the economic shock.

Note: Retirement savings in a 401 might decline as a result of a recession-induced bear market, which might also drive people to withdraw. The Great Recession set 401s back by over $2 trillion. Yet, despite the volatile markets over the last few years, the average 401 balance has stayed relatively steady, according to Fidelity.

Do You Get Your 401 If You Quit

Be aware of the following rules regarding your old 401 account:

-

If your 401 has a total investment of more than $5,000, your employer may allow you to leave the account with them even after you quit the job.

-

If your account has a balance of less than $1,000, your employer may force you out and pay the amount left in your account with a check.

-

If the total investment amount in your old 401 is between $1,000 and $5,000 and your employer wants to force you out, they must transfer the amount to your IRA.

You May Like: Can You Roll A 401k Into A Self Directed Ira

Recommended Reading: Can I Have A Sep Ira And A Solo 401k

If Youve Already Taken A Withdrawal Or Loan You Can Recover

Stay calm and make steady progress toward recovery. It can be done. Build up a cushion of at least three to nine months of your income. No matter what incremental amount you save to get there, Poorman says, the key detail is consistency and regularity. For instance, have the sum automatically deposited to a savings account so you cant skip it.

Scale back daily expenses. Keep your compact car with 120,000 miles and drive it less often to your favorite steakhouse or fashion boutique.

Save aggressively to your 401 plan as soon as possible and stay on track. Bump up your 401 contribution 1% annually, until you maximize your retirement savings. Sock away the money earned from any job promotion or raise.

Read Also: How To Pull Money From 401k

If You Are Under 59 1/2

Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resort. Not only will you pay tax penalties in many cases, but youre also robbing yourself of the tremendous benefits of compound interest. This is why its so important to maintain an emergency fund to cover any short-term money needs without costing yourself extra by making a 401k early withdrawal.

However, life has a way of throwing you curveballs that might leave you with few to no other options. If you really are in a financial emergency, you can make a withdrawal in essentially the same way as a normal withdrawal. The form is filled out differently, but you can find it on Fidelitys website and request a single check or multiple scheduled payments.

If you jump the gun, though, and start making withdrawals prior to the age of 59 1/2, youve essentially broken your pact with the government to invest that money toward retirement. As such, youll pay tax penalties that can greatly reduce your nest egg before it gets to you. A 401k early withdrawal means a tax penalty of 10 percent on your withdrawal, which is on top of the normal income tax assessed on the money. If youre already earning a normal salary, your early withdrawal could easily push you into a higher tax bracket and still come with that additional penalty, making it a very pricey withdrawal.

Recommended Reading: What Investment Is Better Than 401k

Recommended Reading: Where To Check 401k Balance

Can I Withdraw From My 401k If I Have An Outstanding Loan

Most 401 plans allow participants to tap into their retirement savings. Find out if you can withdraw from your 401k if you have an unpaid 401 loan.

When contributing to a 401 plan, most people have every intention of accumulating a sufficient retirement nest egg that they can live off in retirement. However, when heavy financial emergencies occur and you do not have an emergency fund, you could be forced to raid your retirement savings to settle the urgent financial needs.

Most 401 plans allow you to take a 401 loan against your retirement savings, or a hardship withdrawal if you are below 59 ½. However, there are circumstances when you can withdraw from your 401 if you have an unpaid loan. For example, if you leave your job or are fired, you could rollover your 401 to an IRA or the new employerâs 401 even if you have an outstanding 401 loan. When this happens, the outstanding 401 balance will not be rolled over, and you will have until the tax due date to pay off the loan balance.

Substantially Equal Period Payments

Substantially Equal Period Payments might be a good option if you need to withdraw money for a long term need. These payments must last a minimum of 5 years or until you reach the normal 401k withdrawal age of 59 1/2, whichever is shorter. For this reason, this is not a good option if you have a short term need like a sudden unexpected expense. You cannot withdraw funds under this method if you still work for the employer through which you have the 401. To calculate the amount of these payments, the IRS recognizes three acceptable methods.

Recommended Reading: How To Find Your Lost 401k

Continue To Invest In Your Ira When You Can

It goes without saying that you should try to leave your 401k and IRA money untouched as long as possible so even if you want to retire early leave your investment accounts alone if you can. Also note that throughout this entire distribution period your investments will continue to grow in your IRA even though you are taking distributions. I personally plan on both taking distributions and adding to the IRA account during this time period so I can actively use money in my 401k as needed in my early-retirement.

How Taking A 401 Distribution Affects Your Retirement

Time in the market and compounding interest are critical factors when it comes to your retirement savings. While investment returns will vary, in general more money in the market means more at retirement, while anything you withdraw now is that much less youll have for your golden years. Plus, taking money out means missing any potential gains your investments would have seen along the way, even if you reinvest the money down the road.

Thats why its important to carefully assess your situation if youre experiencing a true emergency and your retirement is your only financial source, consider limiting the amount you take out to only what you need. If youre certain that you can pay yourself back, theres also less of a risk in going this route. But if you can go without touching your nest egg, over time you may be able to reap the rewards of compound interest and avoid any potential losses.

Read Also: How Do I Offer 401k To My Employees

You May Like: How To Borrow Money From My 401k