What Are Average Fidelity 401 Fees

We have evaluated the fees of a few Fidelity plans over the years as part of our 401 fee comparison service. Below are the averages we found for these plans.

|

Average Fidelity 401 Fees |

|

|

All-In Fees |

0.71% |

While their per-capita admin fee was below the $422.30 average in our 2018 401 fee study, that number can easily grow much higher due to the way these fees are charged.

In our experience, about 70% of admin fees charged by Fidelity are paid by revenue sharing hidden 401 fees that lower the investment returns of plan participants. Not only are plan sponsors or participants often unaware that theyre paying them, but theyre always charged as a percentage of plan assets. That means plan participants will automatically pay Fidelity higher and higher administration fees for the same level of service as their account grows. Thats not fair!

When you factor in compound interest, these growing fees can make a huge dent in your retirement savings. As such, you want to do everything in your power to avoid paying them.

If youre currently using Fidelity for your 401, your first step to avoiding these fees is to find out whether or not youre paying them. Well show you how to do that next.

Dont Miss: How Much Can You Contribute 401k

Purchase Exemption And Minimum Investment Requirements

The Fidelity Absolute Return Fund is available to investors who can meet certain eligibility requirements under the accredited investor prospectus exemption under applicable Canadian securities legislation. This Exemption is available only to accredited investors as defined in National Instrument 45-106, Prospectus Exemptions. The minimum purchase amount is CDN$25,000 .

If you are a financial advisor who, under applicable Canadian securities legislation, is registered as a dealing representative of a sponsoring IIROC member investment dealer or MFDA member mutual fund dealer, and you are acting on behalf of a client who qualifies under the Exemption and who can meet the Minimum Purchase Amount, please accept the disclaimer below to learn more about the Fund.

If you are a financial advisor who, under applicable Canadian securities legislation, is registered as a dealing representative, and approved as a portfolio manager, of a sponsoring IIROC member investment dealer, and are acting on behalf of a fully managed account client who qualifies under the Exemption and who can meet the Minimum Purchase Amount, please accept the disclaimer below to learn more about the Fund.

You and your sponsoring IIROC member investment dealer or MFDA member mutual fund dealer, as the case may be, are responsible for ensuring that your client who is purchasing units in the Fund meets the definition of accredited investor and is eligible for the Exemption.

Other Ways To Find Lost Money

If you are hoping to find lost money, you might want to start by creating a comprehensive and detailed retirement plan. This enables you to:

- Document what you have right now.

- Take stock and think about what might be missing.

- Learning about what you need for a secure retirement is a great way organize your financial life.

- Discover opportunities to make more out of what you have. People who use the NewRetirement retirement planner typically improve their plans by thousands of dollars in their first session with the tool.

Also Check: How To Keep Your 401k In A Divorce

How Do I Find My Fidelity Statement Online

Monthly and quarterly account statements, and prospectuses/reports are also available to view as web pages.

If You Are Under 59 1/2

Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resort. Not only will you pay tax penalties in many cases, but youre also robbing yourself of the tremendous benefits of compound interest. This is why its so important to maintain an emergency fund to cover any short-term money needs without costing yourself extra by making a 401k early withdrawal.

However, life has a way of throwing you curveballs that might leave you with few to no other options. If you really are in a financial emergency, you can make a withdrawal in essentially the same way as a normal withdrawal. The form is filled out differently, but you can find it on Fidelitys website and request a single check or multiple scheduled payments.

If you jump the gun, though, and start making withdrawals prior to the age of 59 1/2, youve essentially broken your pact with the government to invest that money toward retirement. As such, youll pay tax penalties that can greatly reduce your nest egg before it gets to you. A 401k early withdrawal means a tax penalty of 10 percent on your withdrawal, which is on top of the normal income tax assessed on the money. If youre already earning a normal salary, your early withdrawal could easily push you into a higher tax bracket and still come with that additional penalty, making it a very pricey withdrawal.

You May Like: How Should I Allocate My 401k

How To Find & Calculate Fidelity 401 Fees

To understand how much youre paying for your Fidelity plan, I recommend you sum their administration and investment expenses into a single all-in fee. Expressing this as both a percentage of plan assets, as well as hard dollars per-participant, will ultimately make it easier for you to compare the cost of your Fidelity plan to competing 401 providers and/or industry averages.

To make this easy on you, weve created a spreadsheet you can use with all the columns and formulas youll need. All you need to do is find the information for your plan, then copy it into the spreadsheet.

Doing this for Fidelity can be a bit of a pain, but not to worry well show you everything you need to do in 4 simple steps.

Step 1 Gather All the Necessary Documents

To calculate your Fidelity 401 fees, the only document youll need is their 408 fee disclosure – what Fidelity has named a Statement of Services and Compensation.

Fidelity is obligated by Department of Labor regulations to provide employers with a 408. This document contains plan-level information about their administration fees. This information is intended to help employers evaluate the reasonableness of these fees. This document can be found on the Fidelity employer website.

If you hired an outside financial advisor for your plan, youll need to factor their pricing into your Fidelity fee calculation. This information can usually be found in a services agreement or invoice.

Step 2 Locate Fidelitys Direct 401 Fees

Kept Saving Despite Volatility

One sign of savings persistence was the fact that the average percentage of pay contributed to 401 accounts by workers in plans overseen by Fidelity rose to a record 9.1%. Workers were not scared away by volatility, said Eliza Badeau, vice president of the Fidelity Investments unit that studies behavior by plan members.

Another sign of persistence was that, despite 2020s volatility, 33% of Fidelity 401 savers increased their retirement account contribution rate.

Also Check: Can I Roll A Simple Ira Into A 401k

Closing A Fidelity Account By Phone

One way to close your Fidelity account is by phone. Make sure that before you start the process, you gather all the necessary paperwork so everything can proceed smoothly.

1) Find the Fidelity Customer Service Number

You should first look for the phone number provided by Fidelity for your account.

Check out your account statements. The number should be printed on these documents.

In the event that you do not have any account statements to look through, you can check out the Fidelity website. There will be some Fidelity contact phone numbers that you can use.

2) Call Fidelity Customer Service

Now, its time to give customer service a call. Use the right phone number to do this.

3) Request to Have Your Fidelity Account Closed

You are in contact with customer service now, so tell them that you wish to close your account. Also, you should let them know what type of account you want to close.

The team will ask for certain information so they can confirm your identity. This information will include your phone number, account number, address, and the last 4 digits of the Social Security number.

4) Record the Details of Your Call for Reference

Make sure to write down the exact date and time of the phone call you are having with the Fidelity customer service. Also, it is important to write down the name of the Fidelity representative you are talking to.

In the end, the representative will tell you when you will receive a payment for the amount left after the charges.

How To Check Fidelity Bank Account Number Using Ussd Code

You can use the USSD code to check your account number, all you have to do is simply dial *770*0#. Although this is the code for knowing what your Fidelity balance is. However, when you dial this code, you will receive a message displaying both your balance and your account number.

Ensure that you dial this code from the line you have linked to your Fidelity Bank account.

Likewise, you must activate/registered for the Fidelity transfer code popularly called Instant Banking. To do that, you can check this article on How to register for the Fidelity instant banking.

Recommended Reading: Ishares Broad Usd Investment Grade Corporate Bond Etf

Don’t Miss: What To Do With Your 401k After Leaving A Job

What Is A Routing Number

Youll find your bank routing number on the lower left-hand corner of your checks, right next to your account number. The first two digits in the routing numbers represent one of 12 Federal Reserve Bank districts the bank is located in. The next two digits are the Federal Reserve Bank district branch that covers your bank.

Bank Regionally, Get Perks: Fidelity Savings Account Review

Sysco 401 Plan Enhancement

When you need to take a loan or withdrawal from your 401 plan, it can take days or even weeks to access your funds due to waiting periods. In an effort to support our associates impacted by coronavirus, weâve partnered with Fidelity to make Electronic Funds Transfer and eCertified Hardships available, so you can access your funds quickly.

Electronic Funds Transfer â Starting today, we have eliminated the 10-day waiting period for EFTs. Now, when a participant enters their banking information in NetBenefits, they no longer have a 10-day waiting period to receive funds. EFTs are immediately available for any loans or withdrawals that are $50,000 or less. In addition to eliminating wait times, this will also reduce cost to the participant.

eCertified Hardships â If you need to make a hardship withdrawal, you may be able to initiate a withdrawal in as little at 48 hours through eCertification. You can speak with a representative or initiate a qualifying hardship withdrawal anytime on NetBenefits.

To learn more about accessing your retirement funds for coronavirus-related relief, call Fidelity at 1-800-635-4015 or visit the Fidelity website. Review the rest of the content on this page to learn more about the Sysco 401 Plan.

Read Also: How Do I Know If I Had A 401k

Fidelity Institutional Asset Management Verify Your Identity

https://fps.fidelity.com/ftgw/Fps/Fidelity/FIISCust/ResetPIN/Init

Fidelity Institutional Asset Management. FIDELITY INSTITUTIONAL ASSET MANAGEMENT ® This is a secure transaction. Verify Your Identity. Lets confirm some basic information about your account. Username. Submit. Cancel. Verify Your Identity. Lets confirm some basic information about your account. ZIP Code. Submit. Cancel.

Status: Online

Read Also: What Is The Best Type Of Investment Account

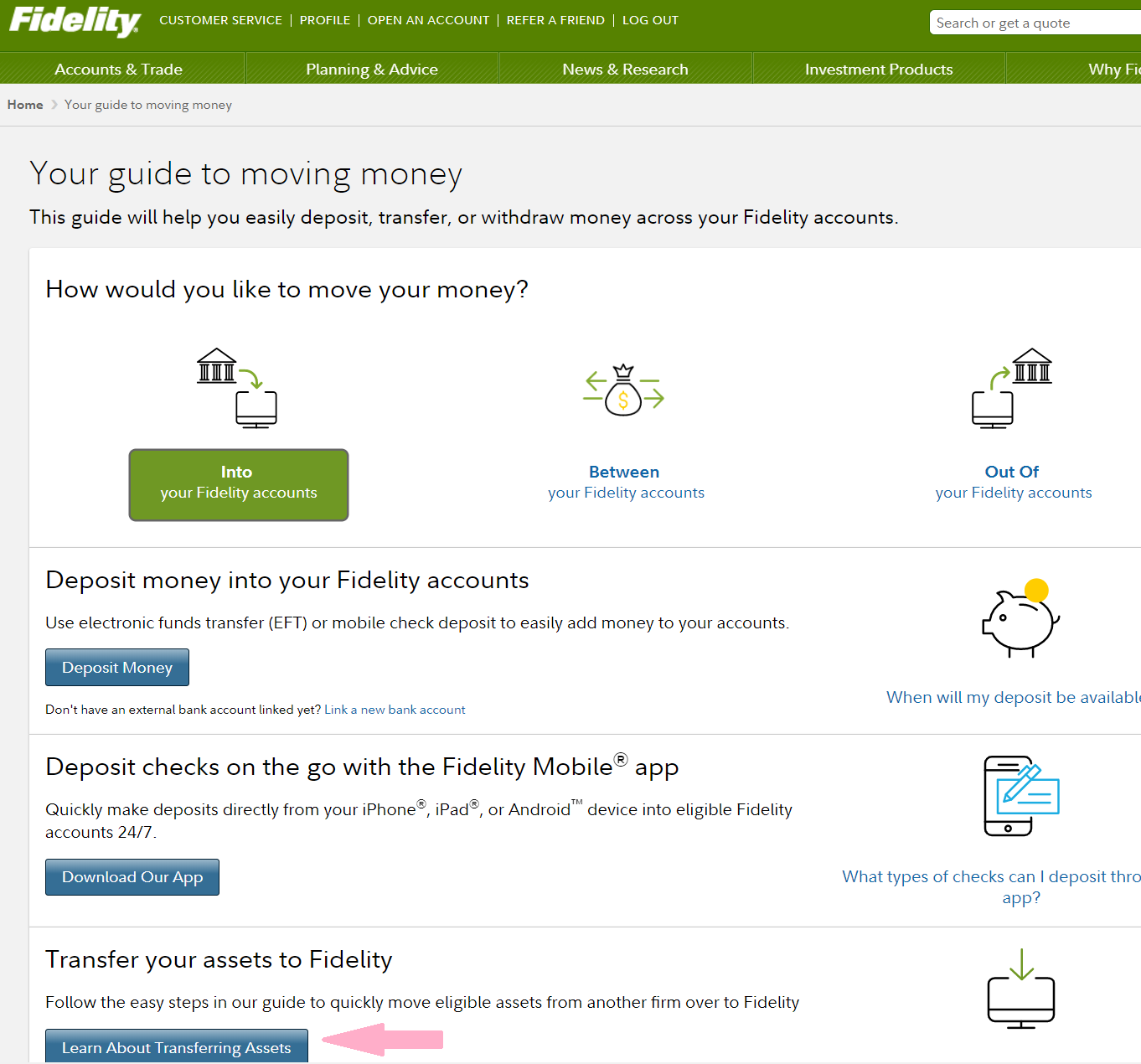

Transfer An Account To Fidelity

Whether you have a retirement account from a former employer or a brokerage account at another financial institution, we can help you easily transfer your accounts to Fidelity.

Transfer investment or retirement accounts

When you transfer an individual retirement account , a brokerage account, or a health savings account to Fidelity, it’s called a transfer of assets. You can choose to transfer just some of your account, or all of it.

Before you begin

Make sure you have a recent statement from your current firm so you can easily find the information we’ll need to process your transfer.

Also Check: Should I Roll Over My 401k When I Retire

How Do I Download My 401k Statement

To view or print your statement, just log into www.principal.com/retirement/statements to view account information. If you have not yet set up an online account at www.principal.com, you will need to complete the following steps first: Under Account Login, select Personal as the login type and click Go.

Q: What Do I Need To Apply For A Business Loan

This is a list of the general information that may be needed to apply for a business loan at Fidelity Bank: Name of the business, Tax identification number, Legal structure , Validation of business existence , State of formation, Nature of business , Financial documentation , Mailing and physical address , Contact phone number, Purpose of account , Expected level of cash activity . Certain accounts may require additional information.

Recommended Reading: How Soon Can I Get My 401k After I Quit

Read Also: How To Find Out Who Your 401k Is With

Modify Your Investment Elections

Note: Any contributions to your account made after the effective date of this change will be directed into the investments you select.

Banks Can Have Multiple Routing Numbers

Banks and brokers have different routing numbers depending on a variety of factors. One factor is the size. For example, a major bank such as Wells Fargo has different routing numbers in each state. Smaller banks and online-only financial institutions usually only use one routing number nationwide.

An institution might also have different routing numbers to fulfill different functions. For example, Fidelity has different routing numbers used for its brokerage and mutual fund accounts.

| Fidelity Routing Numbers |

Dont Miss: Can An Llc Have A Solo 401k

Also Check: Can I Keep My 401k If I Move To Canada

How Do I Find My Fidelity Investments Account And Routing Numbers

Routing numbers are a form of identification for check processing endpoints. They have been in use for over a century and they are essential in transactions involving financial institutions. In simple terms, routing numbers direct funds to the right bank during a transaction. It can be identified as a nine digit number on the bottom left corner of any check.

Brokers and banking institutions use the routing number to identify the source of funds and determine where they are going to.

How To Make Contribution And Investment Changes

Fidelity is the Master Administrator for the Plan this means that you have the streamlined ability to enroll in the Plan and make contribution changes, whether you contribute to Fidelity, TIAA, or both. In order to contribute to TIAA, you need to have an RIT TIAA account. By offering one consolidated plan, RIT is able to avoid unnecessary fees and keep costs to employees as low as possible.

- View and/or change your contribution percentage

- View and/or change the split between your pre-tax and Roth contribution percentage

- Join the annual increase program to automatically increase your contribution each September 1

- Change your record keeper election between Fidelity and TIAA

Log in at . You can set up a login if you do not have one by clicking on “Register Now” at the top of the page and follow the prompts.

Step 1:Once logged in, click on the drop down arrow to the right of Quick Links and choose “Contribution Amount“. If you are already logged in, click on the “Contributions” tab.

Step 2:There are three choices

- Contribution Amount – to view and change your contribution percentage and/or the split between pre-tax and after-tax Roth contributions

- Annual Increase Program – to enroll or change participation in the program to automatically increase your contribution effective each September 1

- Retirement Providers – to view and change the allocation for your future contributions between the two record keepers, Fidelity and TIAA

Read Also: Can I Transfer From 401k To Roth Ira

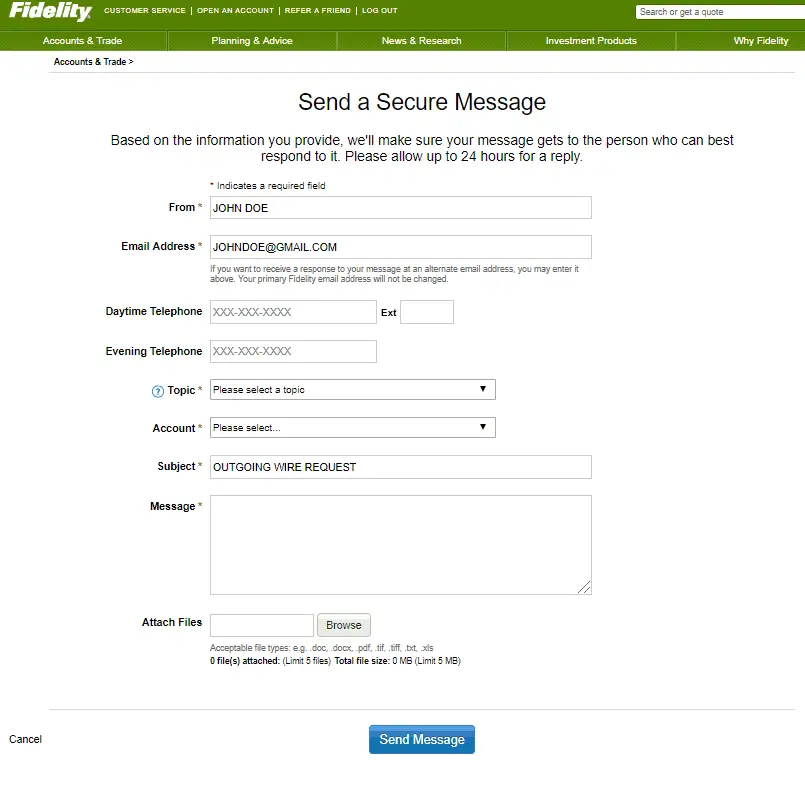

Placing Real Estate Investment Question:

That is good news, and it sounds like the Fidelity brokerage account set up up process went smoothly and now you can start placing investments in alternative investments such as real estate. You can either place the investments by writing a check or by filling out the Fidelity outgoing wire directive, which we can fill out for you. for more information regarding investing in real estate.

Read Also: Can I Start My Own 401k Plan

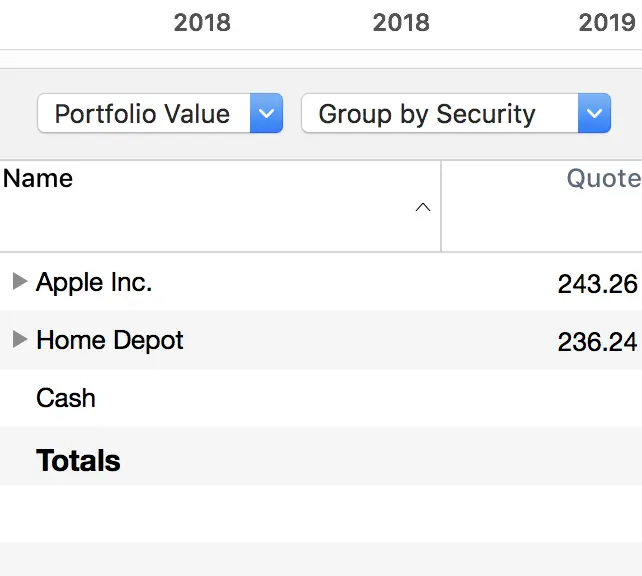

Balances Hit A New All

- Retirement account balances are at new highs, according to Fidelity Investments.

- Thanks to the markets recent run-up and increased savings, the number of 401 and IRA millionaires also hit all-time records in the second quarter of 2021.

Although many Americans continue to face financial uncertainty due to the pandemic, the outlook for retirement savers is only improving.

Retirement account balances, which took a sharp nosedive in 2020 when the coronavirus outbreak caused economic shock waves, are now at new highs, according to the latest data from Fidelity Investments, the nationâs largest provider of 401 savings plans.

The overall average 401 balance hit $129,300 as of June 30, up 24% from the same time last year, according to Fidelity.

Individual retirement account balances were also higher reaching $134,900, on average, in the second quarter, up 21% from a year ago.

Despite Covid case numbers rising in the U.S. and around the world, the yearâs market highs have been a boon for savers. In the second quarter, the S& P 500 ended up 8.2%, before retreating more recently.

Nearly 12% of workers increased their contributions during this time, while a record 37% of employers also automatically enrolled new workers in their 401 plans.

As a result, the number of 401 and IRA millionaires hit fresh highs, as well.

Together, the total number of retirement millionaires has nearly doubled from one year ago.

You May Like: When You Leave A Job Do You Get Your 401k

Read Also: Can I Roll My Ira Into My 401k