Roth Ira Statement From Fidelity Representative: Question:

Can you confirm whether this statement is true or not . The IRS does not allow for Roth IRA money to be rolled into any 401k plan. That is only allowed on pre-tax IRA and retirement accounts. I was hoping to roll over a Roth IRA into my solo 401k roth account. Is this allowed?

The Fidelity representative is correct that a Roth IRA cannot be transferred to a Roth solo 401k. This is a Roth IRA rule. Visit here for more on this rule. I suspect this rule was put in place because the distribution rules are different for a Roth IRA vs a Roth solo 401k.

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if youre cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

Are There Exceptions To The 10% Early Withdrawal Penalty

If youre under 59½ when you cash out of your plan, you may also be subject to a 10% early withdrawal penalty. Certain exceptions include:

- If youre 55 or older when you leave your job.

- Distributions due to death, disability and certain medical expenses.

- You take the distribution as part of substantially equal payments over your lifetime.

Ask your financial professional for more information about these and other exceptions.

Dont Miss: Can You Move 401k To Ira

Also Check: What Can I Use My 401k For

If You Are Under 59 1/2

Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resort. Not only will you pay tax penalties in many cases, but youre also robbing yourself of the tremendous benefits of compound interest. This is why its so important to maintain an emergency fund to cover any short-term money needs without costing yourself extra by making a 401k early withdrawal.

However, life has a way of throwing you curveballs that might leave you with few to no other options. If you really are in a financial emergency, you can make a withdrawal in essentially the same way as a normal withdrawal. The form is filled out differently, but you can find it on Fidelitys website and request a single check or multiple scheduled payments.

If you jump the gun, though, and start making withdrawals prior to the age of 59 1/2, youve essentially broken your pact with the government to invest that money toward retirement. As such, youll pay tax penalties that can greatly reduce your nest egg before it gets to you. A 401k early withdrawal means a tax penalty of 10 percent on your withdrawal, which is on top of the normal income tax assessed on the money. If youre already earning a normal salary, your early withdrawal could easily push you into a higher tax bracket and still come with that additional penalty, making it a very pricey withdrawal.

Know: The Best Roth IRA Accounts

Figure Out What You’re Investing For

You might be thinking, “But wait, shouldn’t my first step be to find some hot, secret stock picks that I can ride to the moon?” But in truth, successful investing generally starts with what you’re investing for, not what you’re investing in.

Lots of people start off by investing for retirement. In fact, we believe that for many people, investing something toward retirement should be pretty high up on your financial to-do list .

Although answering this question may not be as exciting as hunting down stock tips, it can help all the other pieces of your investing puzzle fall into place.

Recommended Reading: Can You Invest In 401k And Roth Ira

Best For Mutual Funds: Vanguard

Vanguard

Vanguard is well known for its own mutual funds and ETFs. If you prefer investing in Vanguard funds, a Vanguard Individual 401 plan gives you easy access with no trade costs, making the company our review’s best choice for mutual funds.

-

No fee to establish an account

-

Trade the Vanguard family of funds with no commissions or load fees

-

Roth contributions allowed

-

$20 annual fee for each Vanguard fund held in this type of account

-

401 loans are not supported

If youre looking to stick with a well-respected list of mutual funds from Vanguard, choose the Vanguard Individual 401. The account doesnt have an annual fee on its own for accounts with at least $10,000 in Vanguard funds. It charges a $20 annual fee below that balance plus a $20 annual fee for each Vanguard fund held in the account. Depending on how you invest, this fee can add up fast and could be a reason to consider buying those Vanguard funds elsewhere. You can also trade stocks and ETFs with no commission, in addition to options and fixed-income investments.

Vanguards founder, the late John Bogle, is credited as a pioneer in index investing, bringing the first index fund to market in 1976. Vanguard remains a leader in investment funds as the second-largest asset manager in the world with about $7.2 trillion under management.

Read our full Vanguard review.

How We Can Help

If you have a 401 and are exploring what options make the most sense for you, we invite you to meet with one of our financial advisors to discuss your situation. He or she will take the time to explain the options available to you, answer any questions you may have and together you can determine whats best for you.

Also Check: How Do I Invest My 401k In Stocks

Also Check: What Percentage Should I Be Putting In My 401k

Distinguishing Account Sources Question:

Thank you for assisting me in opening the three brokerage accounts with Fidelity under your self-directed solo 401k. To recap, I now have the following 3 brokerage accounts at Fidelity:

They all have a zero balance since I just opened them, but they are not labeled accordingly. How do I distinguish them?

You Can Still Withdraw Early Even If You Get Another Job

You arent locked in to early retirement if you choose to take early withdrawals at age 55. If you decide to return to part-time or even full-time work, you can still keep taking withdrawals without paying the 401 penaltyjust as long as they only come from the retirement account you began withdrawing from.

Read Also: How To Check Old 401k Accounts

Best For Active Traders: Td Ameritrade

TD Ameritrade

Most retirement-focused investors would do well to stick with a passive investment style. However, if youre into active investing, TD Ameritrade offers industry-leading platform options and tools.

-

Choose between multiple web, mobile, and desktop platforms

-

Access the advanced thinkorswim trading platform with no added costs

-

Accounts will move to Charles Schwab in the future

-

Advanced platforms may be overwhelming for newer traders

TD Ameritrade is another renowned discount brokerage and our choice as best for active traders. It offers an individual 401 account with no recurring fees and commission-free stock and ETF trades. Its standout feature for active traders, though, is the thinkorswim active trading platform, which is available on desktop, mobile, and the web.

Before diving into other details, its important to note that this brokerage has been acquired by Charles Schwab. TD Ameritrade accounts will become Schwab accounts at some point in the future. However, as you can see from its review on this list, were fans of Schwab as well and look forward to seeing the combined capabilities once the integration is complete.

Read our full TD Ameritrade review.

Get Schooled With Fidelitys Tools

The 401 features many investment options, plus access to planning tools and calculators, education, and guidanceall from industry leader Fidelity.

Fidelitys eLearning tools help you set financial goals to make the right plan for you. Register on Fidelitys website, and after you log in, select Tools from the menu.

And thats not all: Fidelity Investor Centers are located nationwide and available free of charge to all Fidelity account holders. You can meet with a financial advisor who will work with you to review and analyze your 401 account and answer your questions.

Read Also: When You Quit Your Job Do You Get Your 401k

How To Withdraw Money From Fidelity Fidelity Withdrawal Fees

While depositing money to a brokerage account is free in most cases, this is not necessarily always true for withdrawals. International bank transfers and wire transfers in particular can sometimes incur high fees, so always check carefully if this is something that would apply to your transactions.

We have good news for you: basic withdrawal at Fidelity is free of charge. See the table below for details and possible exceptions, as well as how Fidelity compares with some of its immediate competitors.

Recommended Reading: Does Having A 401k Help You Get A Mortgage

Bitcoin Has A Short History And Uncertain Value

The first Bitcoin transaction in history was completed just 13 years ago, so it doesnt have the long-term track record of success that stocks and bonds do. Bitcoin is also prone to extreme periods of volatility that retirement investors may wish to avoid, such as its roughly 80% crash in late 2017 and 2018.

Owen Murray, director of investments for Horizon Wealth Advisors, says its still extremely difficult to determine the true values of Bitcoin and other cryptocurrencies from a fundamental perspective. Bitcoin does not represent ownership of physical assets or intellectual property. It does not generate cash flow and does not pay interest rates or dividends, meaning its price is tied exclusively to investor sentiment and demand.

I think it is reckless for firms like Fidelity to make crypto available to retirement plans, Murray says. It appears to be opportunism at its worst, and the consequences could be severe for those who jump in without really understanding the risks.

Jamie Cox, managing partner at Harris Financial Group, says Bitcoin is a fiduciary lawsuit waiting to happen for retirement plan sponsors, and Fidelitys decision could put the firm under heavy regulatory scrutiny for the time being.

Adding speculative asset classes to 401s isnt in keeping with the intent of qualified plans, Cox says.

Read Also: When Is An Audit Required For A 401k Plan

Is Now A Good Time To Rebalance My 401k

At a minimum, you should rebalance your portfolio at least once a year, preferably on about the same date, Carey advises. You could also choose to do so on a more periodic basis, such as quarterly. An investor who rebalances quarterly would sell bonds and buy stocks to get back to a 60/40 portfolio mix.

Dont Miss: How Do I Find Previous 401k Accounts

Are You Investing Enough For Retirement

Periodically, you may decide to invest more for retirement. This can be easily done using the following steps:

You May Like: What Is Max 401k Contribution For 2021

Open Fidelity Investment Account: Rolling Over From A Fidelity Ira

Open a non-prototype retirement account . Include your full Adoption Agreement and your full trust document. These documents can be found in your 401k documents, located on your 401k dashboard.

Complete the Fidelity IRA one-time withdrawal form

Complete the form to transfer between existing Fidelity accounts

Personalize, complete and sign the rollover acceptance sample template : If you use this template, be sure to update the information in red to reflect your information. This simple document lets Fidelity know you are accepting the rollover as the 401k plan administrator.

Mail your application along with your full Adoption Agreement and full Trust Agreement to Fidelity at:Fidelity Investments, P.O. Box 770001, Cincinnati, OH 45277-0036.

Note: It is not required you fund the account when establishing the non-prototype retirement account. Additionally, you can submit your transfer documents rolling over funds while you establish the new non-prototype retirement account.

What the above steps will accomplish is opening a new non-prototype retirement account, withdrawing the funds from the Fidelity IRA, transferring them to the new non-prototype retirement account with Fidelity and then accepting the rollover as your own plan administrator

Roth 401 For Tcp1 And Tcp2 Participants

Triad offers a Roth 401 retirement savings option to participants in either the Triad TCP1 401 Savings Plan or the Triad TCP2 401 Retirement Plan.

The Roth 401 option differs from a traditional 401 in two specific ways:

Qualifying distributions

Roth 401 retirement distributions are tax-free as long as the distribution is qualified.

A qualified distribution is one that occurs:

- at least 5 tax years after the year the first Roth 401 contribution was made, and

- after the participant has reached age 59 ½, or becomes disabled or deceased.

Recommended Reading: Can I Borrow Against 401k

How To Make Contribution And Investment Changes

Fidelity is the Master Administrator for the Plan this means that you have the streamlined ability to enroll in the Plan and make contribution changes, whether you contribute to Fidelity, TIAA, or both. In order to contribute to TIAA, you need to have an RIT TIAA account. By offering one consolidated plan, RIT is able to avoid unnecessary fees and keep costs to employees as low as possible.

- View and/or change your contribution percentage

- View and/or change the split between your pre-tax and Roth contribution percentage

- Join the annual increase program to automatically increase your contribution each September 1

- Change your record keeper election between Fidelity and TIAA

Log in at . You can set up a login if you do not have one by clicking on Register Now at the top of the page and follow the prompts.

Step 1:Once logged in, click on the drop down arrow to the right of Quick Links and choose Contribution Amount. If you are already logged in, click on the Contributions tab.

Step 2:There are three choices:

- Contribution Amount to view and change your contribution percentage and/or the split between pre-tax and after-tax Roth contributions

- Annual Increase Program to enroll or change participation in the program to automatically increase your contribution effective each September 1

- Retirement Providers to view and change the allocation for your future contributions between the two record keepers, Fidelity and TIAA

You May Like: Should I Rollover 401k To New Employer

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Also Check: How To Rollover Vanguard 401k

How To Set Up A Fidelity 3 Fund Portfolio

April 7, 2022 By Time Value Millionaire

One of the easiest and most efficient ways to invest is setting up a 3 fund portfolio.

Whether you have a standard brokerage account or an employee sponsored 401, Fidelity offers a wide range of investment options in order to build a Fidelity 3 fund portfolio.

As a result, today we will be examining:

- What is a Lazy 3 Fund Portfolio?

- How to Set Up a Fidelity 3 Fund Portfolio

- Examples of Fidelity 3 Fund Portfolios

Lets dive in.

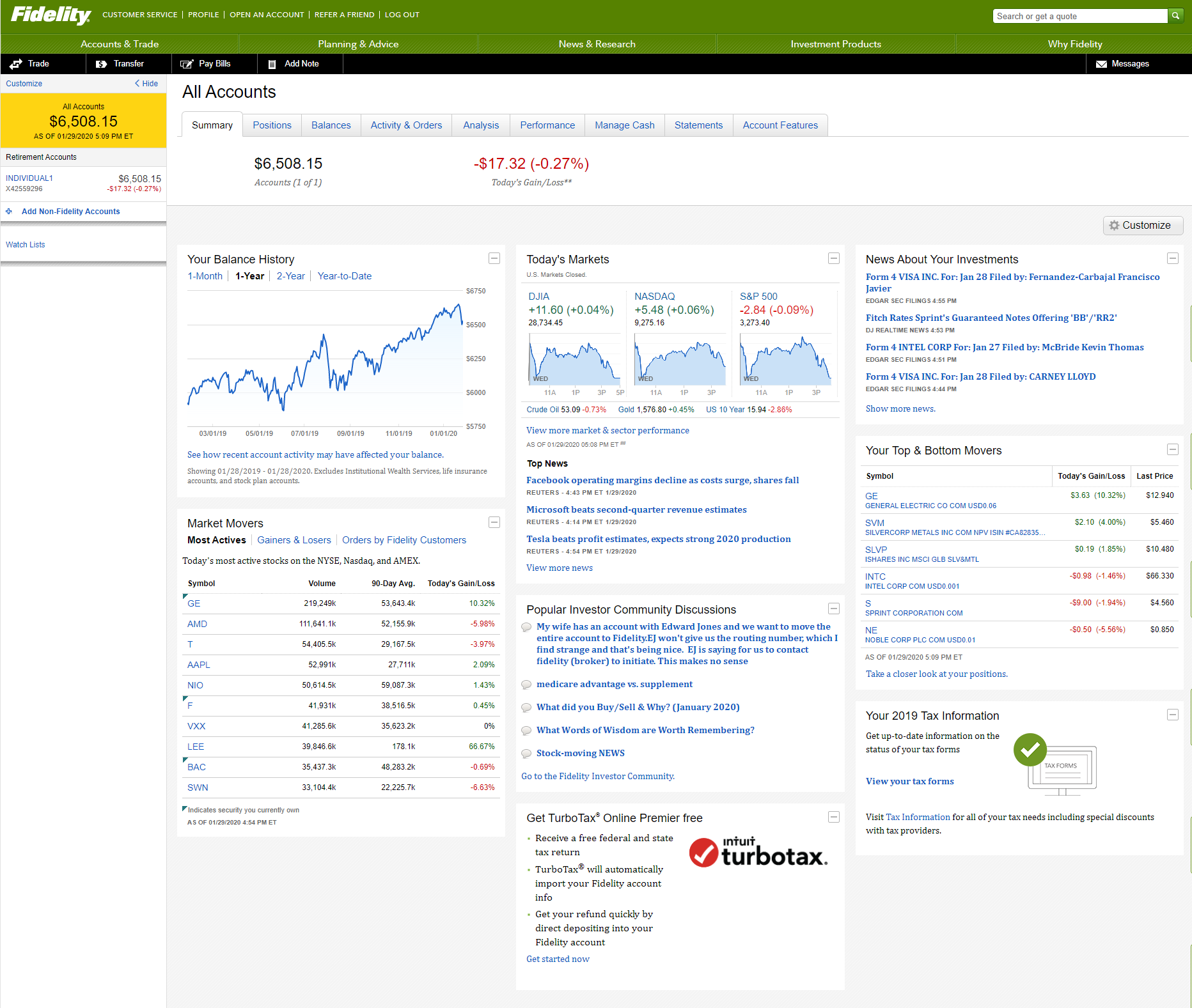

How To Open A Fidelity Account For The Solo 401k

Each brokerage house is different in how they classify their investment-only accounts and applications can update at any time. We have made our best efforts to provide you the most up to date applications here, but please check with Fidelity to ensure you have the right application to open an investment-only brokerage account under your Solo 401k plan and trust.

It’s important to remember you’re not opening a Fidelity 401k. Rather, your 401k plan and trust are opening an investment-only account with Fidelity.

Fidelity calls these types of accounts “non-prototype retirement accounts” and they are designed to work with your Solo 401k.

Also Check: Can You Borrow From Your 401k Twice