How To Evaluate Your 401s Performance In 2022

Benz: Well, I think, life stage matters a lot in this context. So, for people who are still fairly early in their investing careers, and I would say, this would be anyone under age 50, say, remember that these down markets are really your friend because they provide an opportunity to add more shares to your account at the same outlay than would have been the case when the market were higher. So, try to tune out the noise. If you can, switch to paperless statements so that you’re not receiving physical statements. Really try to ignore the red ink because, truly, down markets are an opportunity for you. For older investors, down markets are more worrisome because there may be real implications for how you want to position your portfolio and also how much you can take out when you’re retired, assuming that retirement is quite close at hand.

Dziubinski: What if a 401 investor wants to get a context for how their portfolio is doing and for those losses? How can they get a sense of what a good benchmark is or whether their portfolio maybe is doing better than it might actually look?

Dziubinski: And then, how about for investors who might want to dig deeper down to the individual investment selection level and figure out what helped and what hindered during the period? Any tips for them?

Will I Have To Pay Taxes If I Rebalance

No, you can buy and sell investments within your 401 without incurring a tax liability. That is not true of investments held outside of retirement accounts, which are subject to capital gains tax on any profits. 401 accounts are tax-deferred, so you don’t have to pay any taxes on them until you take money out.

Determine How Much You Can Contribute

Workers under 50 can contribute up to $19,500 to a 401 in 2020, but how much you actually earmark for the account depends on your income, debt level and other financial goals. Still, financial experts advise contributing as much as you are able to, ideally between 10% to 15% of your income, especially when you are young: The sooner you start investing, the less you’ll have to save each month to reach your goals, thanks to compound interest.

“That’s your company literally saying: ‘Hey, here’s some free money, do you want to take it?'” financial expert Ramit Sethi told CNBC Make It. “If you don’t take that, you’re making a huge mistake.”

Read Also: How To Check Your 401k Balance Online

Tip #: Know Your Risk Factor

One of the best remedies to make sure you dont panic and pull your money out of the market after a big drop is to assess your risk tolerance, preferably before you start investing in your 401 plan. There are a number of risk-assessment tools, such as Riskalyze, that can help you do this.

For example, if the risk assessment shows you cannot tolerate more than a 10% drop in your portfolio, you can invest more heavily in bonds and cash equivalents and less in stock. If it still turns out your portfolio has fallen more than you can stomach, the best thing to do before you bail out, is to pause and think about it. Perhaps even talk to a friend with more experience investing in stock.

If you do pull out near the bottom, you may miss the market recovery if history repeats itself and the market rebounds, which so far it always has.

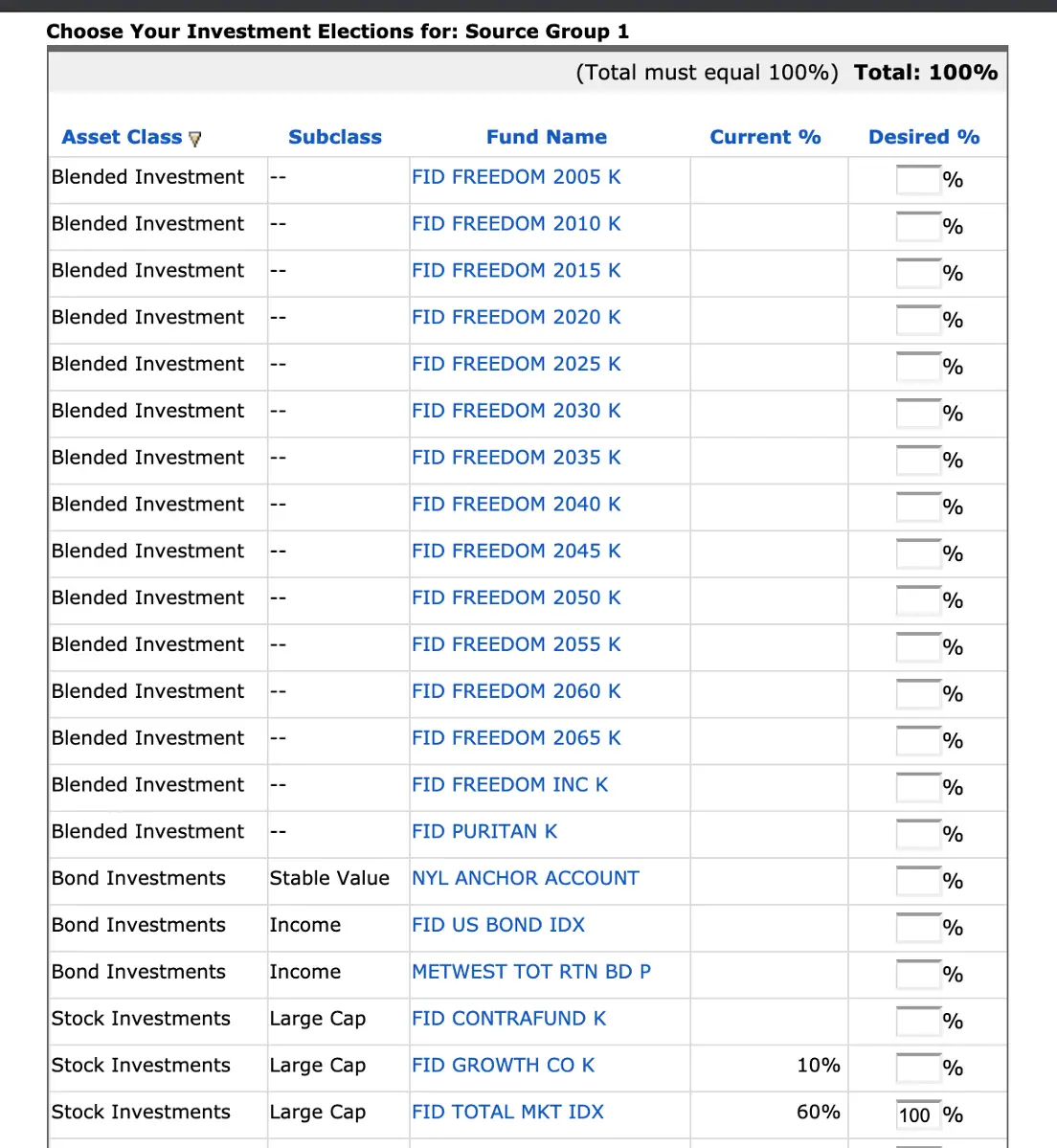

Allocate Money In Target Date Funds

It is always advisable to allocate the amount in your 401 money in Target Date Funds, the target date means your targeted retirement date. You will get to know about these funds, when you see the name of these funds in the calendar year, such a T.

So, when you allocate the money in these target-date funds, they make your long-term investment very easy. You can decide the approximate date for your retirement, and then you can easily pick up the funds which are close to your retirement date.

Lets say for example if you have planned to get retirement at about 25 years from today then you will need to select the funds which will get mature at about 25 years from now, or close to your retirement date and you can pick the target fund with the appropriate name.

So, if you have opted to invest in these target date fund then it will spread your money from 401 plan to various asset classes like large company stocks, small company stocks, bonds, emerging market stocks, real estate stocks, etc. The target date fund automatically chooses how much of the which asset class should be own.

When you are nearing retirement date, these target date fund progressively becomes more conservative, and start owning less stock and fewer bonds. The main motive behind this is that to reduce the risk you are taking as you are nearing your retirement date and where you would be more likely to use your money for the retirement.

Recommended Reading: How To Transfer 401k To Charles Schwab

Looking At The Big Picture

Of course, your 401 plan may be just one of the places you’re investing your money. You might, for example, own some other mutual funds or have a brokerage account apart from your retirement savings. You might also have more than just a couple of funds in your 401 and even several different 401 plans if you’ve changed jobs and left a plan with a former employer. So it’s important to consider the big picture. One way to look at it is as if all of your investments were just one big account and to rebalance them as necessary until your entire portfolio matches your desired asset allocation.

To save on taxes, bear in mind that it could make sense to rebalance through your retirement plans to the extent possible. If you’re like many people, your 401 could be your largest single investment account anyway.

Avoid Making Premature Withdrawals

Most 401 plans offer a hardship withdrawal option, as well as a loan option if you find that you have to take money out of your plan before you retire. But there are limitations and downsides.

A withdrawal could cost you a 10% early withdrawal penalty on money you take out before age 59½, depending on what you spend the money on. Youll have to pay it back with interest by a certain time if you take a loan from your 401.

NOTE: The Balance doesnt provide tax or investment services or advice. This information is presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any one investor. It might not be right for all investors. Investing involves risk, including the loss of principal.

You May Like: How To Transfer 401k From Prudential To Fidelity

Start With Your Plan Document

The best place to start making your 401 selections is your companys Plan Document. This document gives you all the important details specific to your companys retirement plan, like the employer match and vesting schedule.

Whats a vesting schedule? Its an outline for when the money your company contributes to your 401 is completely yours. The money you put into the 401 and its growth are always yours. But many companies require you to remain employed a certain number of years before the money they contribute to your 401 is 100% yours. With each year of employment, an increased percentage of the employer match is yours to take with you if you leave your job.

Many companies require you to remain employed a certain number of years before the money they contribute to your 401 is 100% yours.

The Plan Document also includes information about the fees related to your 401, the services available to you, and how to make changes to your 401 portfolio.

Your Action Step: The more you understand about the specifics of your 401 plan, the more confident youll be. If you dont have a copy of your Plan Document, contact your HR department. They should be able to give you a copy or tell you where to find one.

But Avoid Being Too Aggressive

If you have a long time horizon, it can be smart to get aggressive with your portfolio, but those closer to retirement should be careful, too. For retirees and near-retirees, it may be time to shift into preserving your assets rather than trying to play catch-up.

Yet many are focused on growing their assets including aggressive investment strategies rather than preserving their assets against sudden market downturns, says David Potter, former spokesperson for MassMutual Financial, citing the companys research. Many people may be taking more risk than they realize.

Potter suggests that investors reevaluate their portfolio regularly to consider how they would fare if the market declined significantly.

Typically, financial professionals recommend that retirement savers dial back their exposure to stocks as they get within five years of retirement and within the first five years after retiring, he says. A steep market downturn of 20 percent or more during those periods could irreversibly reduce your income in retirement.

Heres how to tell if your portfolio is too aggressive.

Read Also: How To Transfer 403b To 401k

Know When It Pays To Be Bolder

If you have a guaranteed source of income such as a pension or annuities, treat those holdings as if they were bonds, says David Littell, professor of taxation at The American College of Financial Services.

When you combine those with your 401, your overall allocation might be more risk-averse than you expected. This means you might want to consider a more aggressive asset mix in your 401 than would be suitable for someone who only has a 401. You might say you should keep it all in stocks because your total allocation is still pretty conservative, Littell says.

Mistake #: Failing To Take Full Advantage Of Retirement Saving Plans

If your companys 401 or other qualified employer sponsored retirement plan , including 403 and governmental 457, offers a company match , you have an extra incentive. If you neglect to invest enough to receive the full company match, youre leaving money on the table. If you get a raise, consider increasing your QRP contribution.

Read Also: Can You Self Manage Your 401k

How To Make Your 401 Selections

8 Min Read | Sep 27, 2021

If you value your companys 401 benefit, the day you receive your enrollment package is an exciting one. Soon youll be building your retirement nest egg with the help of your employers 401 match and the right investment selectionsyou cant wait to get started!

So you rip open your envelope and glance over the contents: forms, a nice-looking brochure, and maybe a letter from your employer welcoming you to the companys 401. Once youve read the letter, however, the rest of the materials simply dont make a lot of sense. Theres information about vesting, beneficiaries, equities, risk assessments, and 401 selectionsbut nothings clicking.

The only thing that seems clear is that investing in a 401 is important business. Your ability to retire depends on you getting it right. But how can you make such major, long-term decisions when you dont even understand what the choices are?

Understanding your workplace 401 is the first step toward the retirement of your dreams, so let’s get started.

What Are The Benefits Of A 401

There are two main benefits to a 401. First, companies usually match at least a portion of the money you put into your 401. Every company’s match is different, but your $100 contribution each week to your 401 may result in your company putting an additional $100 into your 401 as well.

Second, there are tax benefits for these accounts. If your contributions to your 401 are pre-tax, you don’t have to pay taxes on the gains you earn over time when it comes time to withdraw money for retirement. If your contributions are post-tax, you get to deduct your contributions on your federal income tax return.

Also Check: How To Get My 401k

How To Invest Your 401

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Nothing is more central to your retirement plan than your 401. It represents the largest chunk of most retirement nest eggs.

Finding the money to save in the account is just step one. Step two is investing it, and thats one place where people get tripped up: According to a 2014 Charles Schwab survey, more than half of 401 plan owners wish it were easier to choose the right investments.

Heres what you need to know about investing your 401.

Plan Your Asset Allocation

After you’ve determined how much money you will need, the next step is to figure out how your investments can help you get there.

Asset allocation is the key. Your money should be diversified between stocks and bonds to help you ride out market storms, though the allocations will vary with factors like your age and risk tolerance. Younger savers have more time to recoup bear market losses, and so may benefit less from the advantages of bonds in lowering the risk and volatility of a retirement portfolio.

Diversifying is especially vital if your employer’s stock makes up a big chunk of your retirement portfolio. If the stock market is in trouble, having too many eggs in a single basket could scramble your returns. Limiting employer stock to no more than 10% of your holdings is a good rule of thumb.

One study found that modest portfolio adjustments during a bear market, such as increasing an allocation to stocks from 50% to 60%, resulted in minimal improvement to returns. According to another study, 98% of the 401 accounts surveyed made no plan changes in March 2020 as the S& P 500 plunged as much as 34% from the prior month’s highs.

Read Also: How To Roll 401k Into New Job

Take Your 401 With You

Most people will change jobs more than half-a-dozen times over the course of a lifetime. Some of them may cash out of their 401 plans every time they move, which can be a costly strategy. If you cash out every time, you will have nothing left when you need itespecially given that you’ll pay taxes on the funds, plus a 10% early withdrawal penalty if you’re under 59½. Even if your balance is too low to keep in the plan, you can roll that money over to an IRA and let it keep growing.

If you’re moving to a new job, you may also be able to roll over the money from your old 401 to your new employer’s plan if the company permits this. Whichever choice you make, be sure to make a direct transfer from your 401 to the IRA or to the new company’s 401 to avoid risking tax penalties.

Income Balanced And Growth Asset Allocation Models

We can divide asset allocation models into three broad groups:

Income Portfolio: 70% to 100% in bonds.

Balanced Portfolio: 40% to 60% in stocks.

Growth Portfolio: 70% to 100% in stocks.

For long-term retirement investors, a growth portfolio is generally recommended. Whatever asset allocation model you choose, you need to decide how to implement it. Next up, well look at three simple asset allocation portfolios that you can use to implement an income, balanced or growth portfolio.

Don’t Miss: Should I Move My 401k To Bonds 2020

Spread 401 Money Equally Across Available Options

Most 401 plans offer some version of the choices described above. If they dont, a fourth way to allocate your 401 money is to spread it out equally across all available choices. This will often result in a well-balanced portfolio. For example, if your 401 offers 10 choices, put 10% of your money in each.

Or, pick one fund from each category, such as one fund from the large-cap category, one from the small-cap category, one from international stock, one from bonds, and one that is a money market or stable value fund. In this scenario, youd put 20% of your 401 money in each fund.

This method works if there are a limited set of options, but requires much more time and research if there are an array of options. In addition, it’s not as fail-safe as the first three because the asset mix may not be suitable for your retirement goals, and you have to rebalance the portfolio to maintain a certain percentage of each asset category over time.

When possible, it is always recommended that you complete an online risk questionnaire or consult a knowledgeable investment professional before haphazardly choosing stock investments that may lose you money.

When Do You Need The Money

If you’re not planning to retire for decades, you have plenty of time to ride out any temporary downturns in your account balance. So you can afford to take on more risk in the hopes of getting higher returns.

If you’re getting close to retirement, however, you won’t have as much time to wait for the market to bounce back if it hits a rough patch. In this case, you might be better off in an asset mix with lower risk.

But be careful not to be too conservativeyour account needs to continue growing enough to last you through several decades of retirement!

You May Like: Can I Rollover My 401k Into An Existing Ira