Why Employers May Not Offer A 401

Facilitating a 401 plan can be expensive for a company. The IRS requires testing and reporting to ensure retirement plans keep up with regulations. As a result, many small businesses simply can’t afford to administer a 401 plan.

If a company is brand new and trying to get off of the ground, they may not have the time to organize a retirement plan for their employees. Since bringing in an outside firm costs even more money, usually, small businesses don’t have a 401 plan in place.

And because nearly a half of Americans work for small businesses, the amount of people left to their own means to save for retirement is significant.

How To Open A 401 Without An Employer

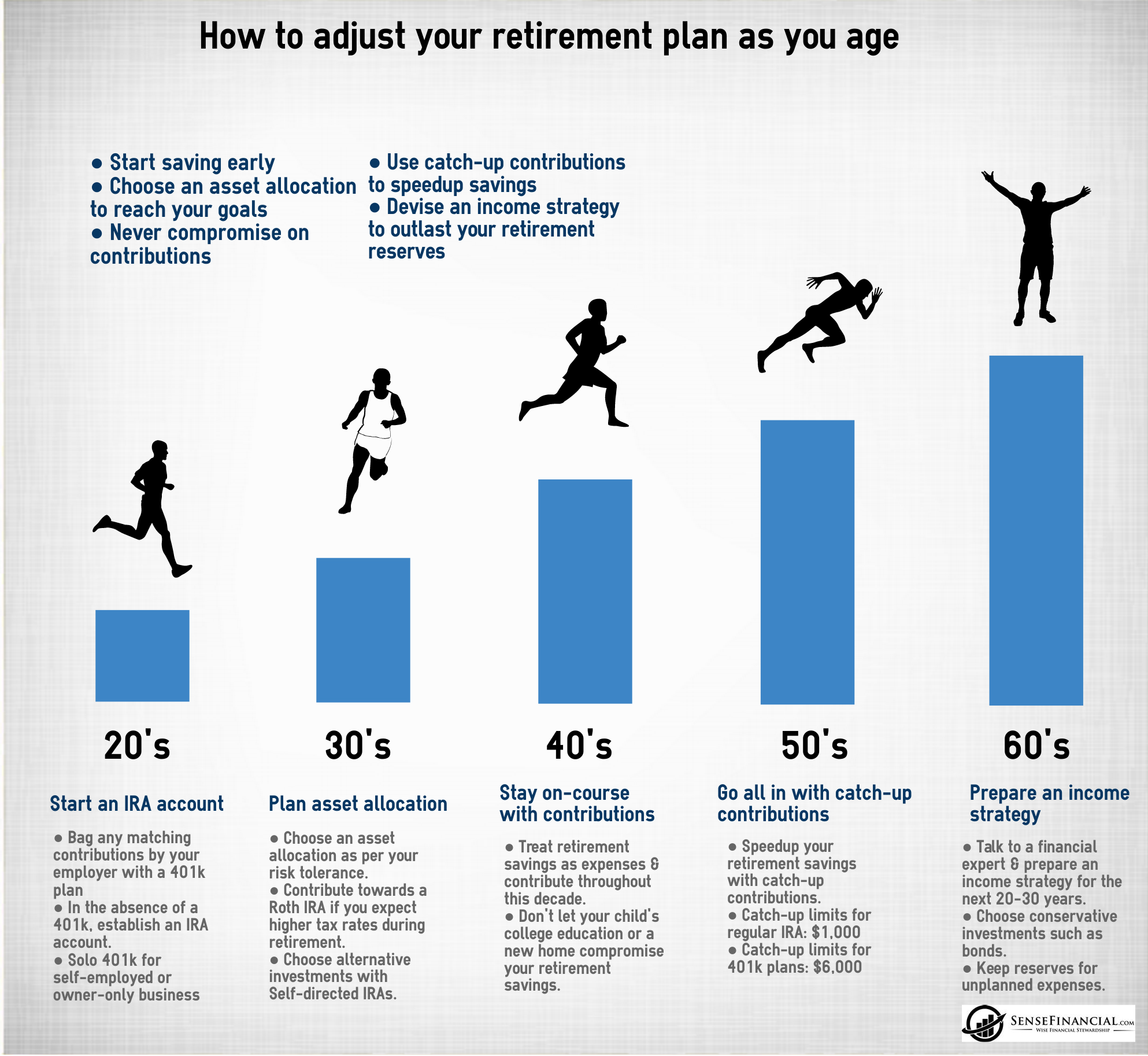

Young professionals hear all the time that they need to start investing in their retirement plan now, so they can have a comfortable nest egg by the time they are ready to retire. One of the most popular retirement plans that many professionals invest in is a 401. However, this option is only available through an employer, so you might be wondering how you can open one if you are self-employed or if your current employer does not offer a 401 plan.

Dont worry. You have options.

Self employed business owner? Start a solo 401

Do you own a business and not have any employees who work for you? You are probably eligible for a solo 401. Setting up a solo 401 is advantageous for people who are self-employed business owners because you can contribute up to the annual maximum as well as up to 20% of your net earnings or 25% of compensation as a business owner.

As of 2020, solo 401 account holders can contribute up to $19,500 . This means you have an opportunity to contribute a lot into your retirement funds if you have enough financial security to make the maximum contributions for yourself as the account beneficiary and the matching contributions as your own employer.

Remember, a solo 401 is only applicable if you have no employees in your small business other than yourself. If you have employees, you can explore other 401 options that can benefit you and your employees.

Cant start a solo 401? Invest in alternative retirement options

What To Do If Your Job Doesnt Offer A 401

A lot of people use 401s to invest for retirement, which is why you hear so much about them. But actually, more than one-third of working adults dont have access to a 401 at their job including many part-time workers, self-employed people, and people whose employers just dont offer them.

If youre in that situation, your employer might offer a different kind of retirement plan, like a payroll deduction IRA or a SIMPLE IRA. But if not, no sweat you arent out of luck. Here are some other types of accounts you can use to build up that nest egg for Future You instead.

Don’t Miss: What Is A Pension Vs 401k

Employer Match Does Not Count Toward The 401 Limit

There are two sides to your contribution: what you provide as the employee and the match from your employer . You can only contribute a certain amount to your 401 each year. For 2019, that limits stands at $19,000. In 2020, the limit is expected to rise to $19,500. This contribution limit includes deferrals that you elect to be withheld from your paycheck and invested in your 401 on a pre-tax basis.

The good news is that this limit does not include employer match contributions. If you contribute, say, $18,000 toward your 401 and your employer adds an additional $5,000, youre still within the IRS limits.

However, there is another limit which applies to overall contributions your employer match contributions are taken into account for this overall contribution limit. For 2019, that limit stands at $56,000. This means that together, you and your employer can contribute up to $56,000 for your 401. If you contribute the max of $19,000, your employer can contribute up to $37,000 for 2019. For 2020, you and your employer can contribute up to $57,000. Note, though, that most employers are not this generous with their contributions, so youre likely in little danger of exceeding this limit.

Also Check: How To Take Out 401k Money For House

Complete Plan Documents & Disclosures

After selecting a provider, youll receive a collection of documents called an employer kit or employer application. These documents will help you set up your plan.

Documents that need to be completed for your provider include:

- Client agreement

- QRP basic plan document

- Adoption agreement

This is the stage in the process when youll make initial investment choices. Those initial choices can be changed at any point in the future. Youll receive disclosures and instructions on how to remain compliant. These disclosures will include information on the plan and the benefits of tax-free savings.

In addition, youll receive information regarding items that would go on IRS Form 5500 if you have over $250,000 in your account or have additional plan participants. If you eventually convert your solo 401 to a traditional 401 with more participants, those participants will also receive the same disclosures from the plan administrator.

The primary disclosures for a solo 401 plan include:

You May Like: How To Get A Hardship Withdrawal From 401k

Bankruptcy & Creditor Protection For Solo 401k Plan

QUESTION 4: I am trying to better understand the protections of the solo 401k. I believe it qualifies for unlimited bankruptcy protection, but does it also have unlimited lawsuit protection under ERISA ?

ANSWER:

- Bankruptcy: Solo 401K plans have creditor protection under the federal bankruptcy rules.

- As far as protection from non bankruptcy creditors, the protection falls at the state level. While solo 401K plans are not covered by the federal creditor protection rules of ERISA, they are generally protected under most state laws subject to certain carve outs .

Crank Up The Investments Available

- Contribute more Put a higher percentage of your income into your existing retirement plan. Since it lowers your taxable income, it may be cheaper than you think.

- Try other tax-deferred options Consider opening an individual retirement account if youve reached the maximum contribution level in your employer-sponsored plan.

- Consider getting taxed up front Money placed in a Roth IRA is taxed now, but qualified Roth earnings are never taxed. This can save you more money in the long run.

Recommended Reading: How To Access My Fidelity 401k Account

Don’t Miss: Is Spouse Entitled To 401k In Divorce In Ny

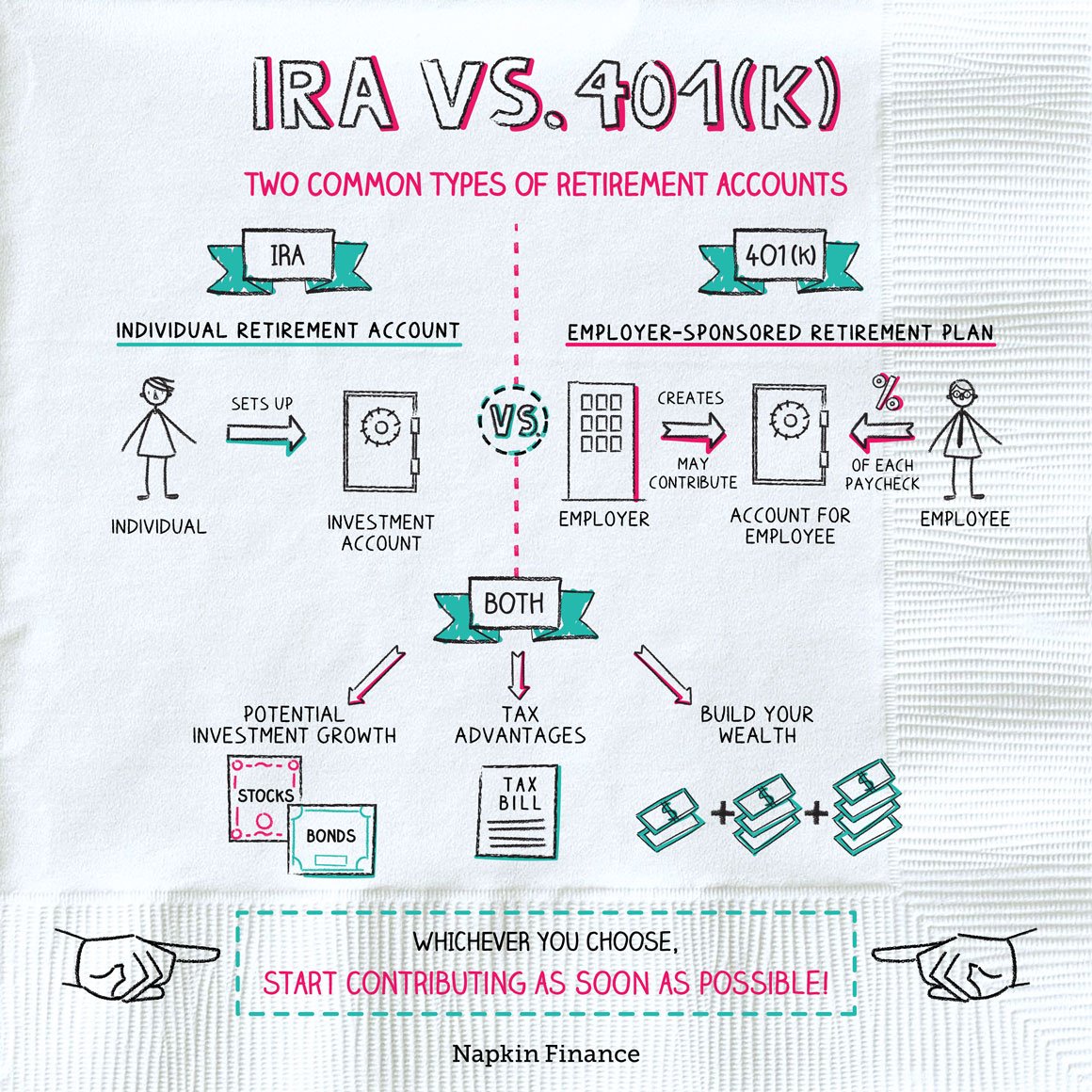

Traditional Or Roth Ira

If youre just starting out, you may want to stick to basics: a traditional or Roth IRA. You can put in as much as $6,000 for the 2021 and 2022 tax years . With a traditional IRA, your contributions may be deductible, and the growth is tax-deferred.

If youre not covered by an employer plan, your traditional IRA contributions are deductible, with no income limits. But if you have a spouse covered by a plan, income limits may apply. For more details, check the IRS website.

With a Roth IRA, your contributions are made on an after-tax basis, but your money will grow tax-free, and youll pay no taxes on your distributions as long as you follow the withdrawal rules. Plus, you can take out your own contributions anytime without paying tax.

Roth IRAs do have income limits. Those who are married and filing jointly must have modified adjusted gross incomes below $198,000 for 2021 to make a full contribution.

Which IRA is right for you? A lot depends on your age and current income. Young people, for instance, are likely to have smaller incomes and thus pay less in taxes than they will when they get older.

If you think that your taxes will be higher later than they are today, it makes sense to favor a Roth IRA, says Ed Slott, a CPA and founder of IRAhelp.com.

Conversely, those with higher incomes might want to get the immediate tax deduction with a traditional IRA.

Could You Invest Just 2 Percent More

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Even 2 percent more from your pay could make a big difference. Enter information about your current situation, your current and proposed new contribution rate, anticipated pay increases and how long the money might be invested, as well as your own assumptions about the growth rate of your investments, and see the difference for yourself*. For additional information, see How to use the Contribution Calculator.

*This calculator is intended to serve as an educational tool, not investment advice. It enables you to enter hypothetical data. The variables you choose are not meant to reflect the performance of any security or current economic conditions. The examples are intended for illustrative purposes only and are not a prediction of investment results.

Calculations are based on the values entered into the calculator and do not take into account any limits imposed by IRS or plan rules. Also, the calculations assume a steady rate of contribution for the number of years invested that is entered.

Recommended Reading: How Do You Find An Old 401k

Rules Change Regarding Offering Solo 401k Plan To Part

QUESTION 5: Have the rules changed for 2020 regarding whether I can still fund my solo 401k if I have two part-time employees that work less than 1000 hrs/year, but more than 500 hrs/year? Would I have to open up retirement accounts for them?

ANSWER: In short yes resulting from the SECURE Act, but it would be for those part-time employees who satisfy the new rule by 2024. Effective for tax year 2021 , solo 401k plans will need to be offered to part-time employees who have three consecutive 12-month periods of 500 hours of service and who satisfy the plans minimum age requirement. Hours of service during 12-month periods beginning before January 1, 2021, are not taken into account for this rule. See Section 112 of the ACT for more information.

Last Weeks Most Popular Solo 401k FAQs

How To Start A 401k

Setting up a 401k retirement plan can be quite simple or complicated depending on your approach. Most people choose to outsource at least some portion of the process in other to ease up the burden involved. In particular, they use a template legal document to establish the 401k plan because its a lot cheaper than hiring an attorney to reinvent the wheel for you. Unless your retirement plan is especially tricky or youre trying to get fancy , youll probably use preconfigured programs from 401k vendors. These programs are often called volume submitter or prototype plans.

You May Like: Is Rolling Over 401k To Ira Taxable

Why Your Employer Doesn’t Offer A 401

The most common reason an employer doesn’t offer a 401 is that most of their jobs are entry-level or part-time. The average worker in these positions is either very young or living paycheck to paycheck, so saving for retirement is difficult most would pick getting more money upfront instead of a retirement plan anyway.

There are other reasons why your employer might not offer a plan. An employer might not have the experience or time to create an individually designed plan or have a go-to financial or trust institution. In these cases, plenty of employers make the decision not to offer benefits rather than spending time and money chasing a good sponsor.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Recommended Reading: How To Set Up 401k On Adp

Can I Open A Roth Solo 401k On My Own

A Roth Solo 401k provides the self-employed business owner with a new twist on personal taxes, a retirement boost, and business tax breaks. Your Roth account is the same as a Solo 401k when it comes to business tax breaks. The profound difference is what the twist on personal taxes can do to boost your retirement income.

These plans have only been available since 2006, but they are gaining in popularity as a way to establish a retirement income that is free from tax liability. Roth Solo 401k accounts are increasingly popular with younger participants who have many years remaining to grow their retirement accounts. These are also favored by high-income earners looking to shelter retirement income from taxes.

The Roth Solo 401k involves already-taxed money that becomes tax-free withdrawals. Yes, you pay taxes upfront, but withdrawals are tax-free in retirement. That means if you grow your Roth account by 2X, 5X, 25X, or even 100X its original value, the entire amount remains tax-free when withdrawn at retirement.

If you do know about Roth accounts, it might be the Roth IRA. Many people are unaware that there are income limits associated with Roth IRA accounts. The Roth Solo 401k has no income limits for the employee contribution. This allows high-income earners to qualify for much larger savings in a Roth Solo 401k profit-sharing plan.

Roth And Traditional Iras

Often the first thing advisors recommend to those who dont have an employer-sponsored 401 is opening a Roth individual retirement account, where youd set up your own contributions with after-tax dollars.

I love the Roth IRA for young investors, said Tess Zigo, a certified financial planner at Emerge Wealth Strategies in Lisle, Illinois, adding that this is because young people are usually in a lower tax bracket early in their careers than they will be later.

Saving money in a Roth IRA means the funds will grow tax-free, meaning you dont have to pay anything to withdraw the money in retirement. People using a Roth IRA can also put away a nice chunk of money each year. In 2021, the total you can save in a Roth IRA is $6,000, or $7,000 if youre 50 or older.

More from Invest in You:10 work-from-home jobs that pay six figures

Of course, there are some limits. In 2021, your modified adjusted gross income must be less than $140,000 for single filers and $208,000 for those married filing jointly in order to qualify.

If you have taxable compensation, you could also save for retirement in a traditional IRA, which allows you to defer taxes, similar to a 401. This makes sense if you are in a higher tax bracket now than you will be later. In 2021, the contribution limit for a traditional IRA is $6,000 or $7,000 if youre 50 or older.

Also Check: How Do I Combine My 401k From A Previous Job

Open A Solo 401k If I Also Participate In Day

QUESTION 4: If I already have a full-time job as an employee, can I still open a solo 401k plan for my side business?

ANSWER: If you are self-employed or have income from freelancing, you can open a solo 401k plan. Even if you have a full-time job as an employee, if you earn money freelancing or running a small business on the side with no full-time W-2 employees, you could take advantage of the potential tax benefits of a solo 401k plan. While you wont be able to make pretax or Roth solo 401k contributions if you have already maxed out these contributions to your day job employer 401k plan, you will still be able to make profit sharing contributions to the solo 401k plan.

Roth 401k And Voluntary After

- Voluntary after-tax solo 401k contributions fall under the employee contribution umbrella.

- This type of contribution is not considered employer contributions, so the contribution is not tax deductible because it is considered made with post-tax dollars.

- When voluntary after-tax solo 401k contributions are converted to a Roth IRA or the Roth Solo 401k, the conversion has to be documented in writing by completing a conversion Form , and a Form 1099-R has to be issued to report the conversion whether taxable or not. This reporting is covered by our annual service and fee.

- Voluntary after-tax solo 401k contributions can be distributed and thus converted at any time. This is why the conversion of voluntary after-tax solo 401k contributions has been dubbed the mega-backdoor Roth solo 401k.

- There is a lesser known rule called the overall 415 limits. The overall 415 limit for 401 plans including solo 401k plans. For 2020, the overall limit is $57,000. The overall limit increased to $58,000 for 2021. The overall limit looks at the total annual additions to all of a participants accounts in plans maintained by one employer and includes not just their salary deferrals, but also matching contributions, allocations of forfeitures and other amounts. Voluntary after-tax solo 401k contributions are subject to the overall annual limit $57,000 for 2020, and $58,000 for 2021.

I have provided the following links for more information and examples: https: 401k-contributions/

Don’t Miss: How To Take Money Out Of 401k Fidelity

Take Advantage Of Other Benefits

Startups may offer other options, such as buying stock options instead of a retirement account. This can allow you to benefit from the growth of the company in the first few years. Its a good option when its managed right.

Make sure your portfolio is highly diversified. A startup could fold without warning. Owning this type of stock is riskier.

There are also rules for how soon you can sell your stock after purchasing it so this should not be your whole retirement plan. These rules can vary by company.

Some companies offer deferred compensation programs that allow you to defer pay until some future date, such as when you retire. This option lets you reduce your taxable income now. Youll save money on income taxes, earn interest on the money, then take the money as either a lump sum or over a period of time when you decide you want it.

The rules for participating in such a program, and for how these programs are operated, can be tricky. Consult with a qualified retirement planning specialist before you enroll.

Read Also: How To Find Out If Someone Has A 401k