Pros And Cons Of Rolling Over 401k To Ira

Learn the pluses and the minuses of getting all of your IRA and 401k ducks in a row.

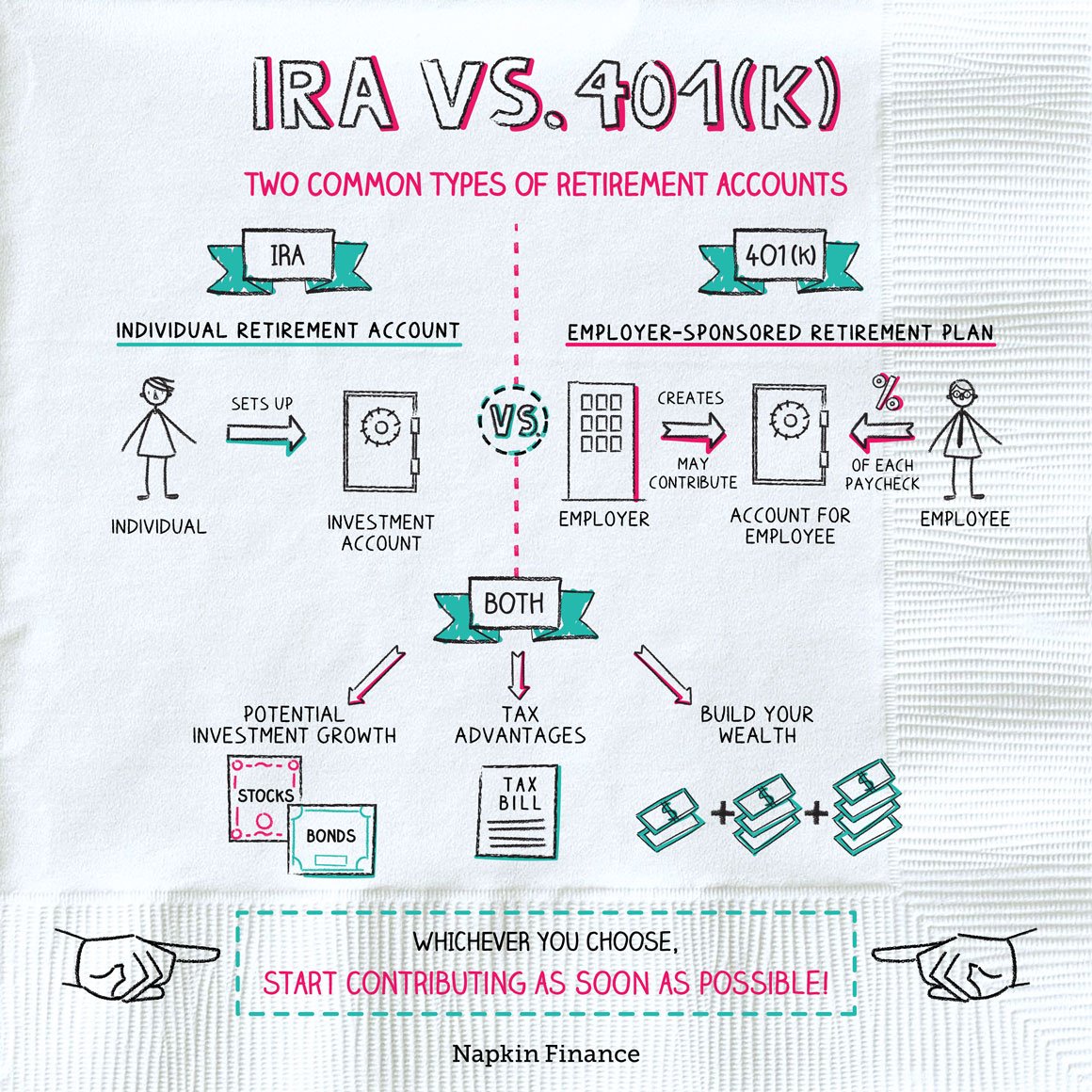

According to the Bureau of Labor Statistics, on average, individuals between the ages of 18 and 52 may change jobs as frequently as 12 times. Some of those jobs probably came with some type of employer sponsored retirement plan such as 401k or an IRA account . When switching jobs, many people choose to rollover any accounts to their new employer’s plan rather than taking them as a withdrawal. When you roll over a retirement plan distribution, penalties and tax are generally deferred. So let’s look at a few of the pros and cons of consolidating them into one IRA with one institution.

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

Should You Roll Over An Ira To A Roth Ira Before Moving To Canada

One question that often comes up when I speak to cross-border clients is whether one should roll over an IRA to a Roth IRA before moving to Canada.

Sometimes clients ask if they should at least roll over a portion of their 401 to a traditional IRA and a portion to a Roth IRA as a Roth Conversion. You might do this to minimize the tax you pay on the money you take out of an IRA once you are a Canadian tax resident.

As this is an important decision, you should consult with a cross-border accountant before deciding if this is a good option for you.

You May Like: Do I Have Money In A 401k

How To Roll Over Your Old 401

8 Min Read | Sep 8, 2022

Forty-seven million. Thats how many people left their jobs in 2021 at the height of the Great Resignation. And millions more are planning to quit this year.1

While theres nothing wrong with blazing new career paths, many of those folks are leaving a trail of forgotten 401s, sometimes with thousands of dollars in retirement savings left behind. Maybe youre one of them!

If youve got money gathering dust in a long-forgotten retirement account, its time to find it a new home. Thats where a 401 rollover comes in.

When It Might Make Sense

Here are some of the most common reasons people roll IRAs into 401 accounts.

Continue reading below, or watch this video with the same information:

Avoid required minimum distributions :

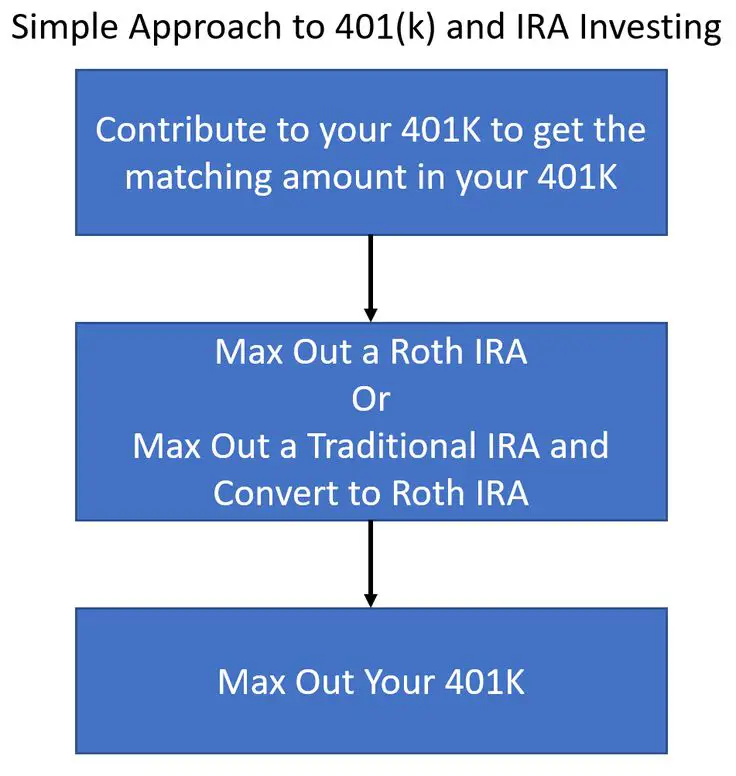

Backdoor Roth and conversions: If you plan to convert traditional IRA money to Roth IRA money or make back door Roth contributions you might want to minimize pre-tax money in IRAs. Doing so may neutralize the pro-rata rule, which causes complications and taxes when you have pre-tax money in an IRA. By shifting that pre-tax IRA money to your 401, only post-tax money remains in the IRA, which simplifies things substantially.

401 loans: Some 401 plans allow loans, but IRAs do not. Is there any way to borrow against the money in your IRA? If your 401 plan allows loans, you could potentially roll your IRA into the 401, increasing the amount of money available to you via 401 loan. Check with your plan administrator to learn about plan rules and logistics before you get your heart set on anything. Also, just because its possible doesnt mean its a good idea. Its risky to raid your retirement funds.

You May Like: How To Fill Out A 401k Enrollment Form

Are There Tax Implications Of Ira Rollovers

Depending on how you move your money, there might be tax implications. If you move your money into an account with the same tax treatment as your old account, there shouldnt be issues as long as you deposit any checks you receive from your 401 into a tax-advantaged retirement account within 60 days. However, if you move a traditional 401 into a Roth IRA, you could end up with a tax bill. Check with a tax professional to find out how you may be affected.

Contact Your Current 401 Provider And New Ira Provider

Ideally, you want a direct rollover, in which your old 401 plan administrator transfers your savings directly to your new IRA account. This helps you avoid accidentally incurring taxes or penalties. However, not every custodian will do a direct rollover.

In many cases, youll end up with a check that you need to pass on to your new account provider, Henderson says. Open your new IRA before starting the rollover so you can tell the old provider how to make out the check.

The goal, Henderson says, is to avoid having to ever put the money into your personal bank account.

You only have 60 days to complete the transaction to avoid it being a taxable event, and its best to have everything set up before getting that check, Henderson says.

Recommended Reading: Can I Move Money From 401k To Roth Ira

Con: Limited Creditor Protection

If someone wins a lawsuit against you, the Federal Employment Retirement Income Security Act prevents such parties from accessing the funds in your 401 to settle their claims. However, IRAs do not enjoy the same level of protection as 401 accounts. A creditor may access your IRA funds up to a certain limit to settle their claims. Some IRAs may offer creditor protection up to a specific level, but these limits vary from state to state.

Will Taxes Be Withheld From My Distribution

- IRAs: An IRA distribution paid to you is subject to 10% withholding unless you elect out of withholding or choose to have a different amount withheld. You can avoid withholding taxes if you choose to do a trustee-to-trustee transfer to another IRA.

- Retirement plans: A retirement plan distribution paid to you is subject to mandatory withholding of 20%, even if you intend to roll it over later. Withholding does not apply if you roll over the amount directly to another retirement plan or to an IRA. A distribution sent to you in the form of a check payable to the receiving plan or IRA is not subject to withholding.

Recommended Reading: Can You Get Your Own 401k

Roll Over An Ira To A : The Pros And Cons

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

In the world of retirement account rollovers, theres one type that doesnt get much love: the IRA-to-401 maneuver, which allows you to roll pretax traditional IRA assets into a 401. Its frequently overshadowed by rollovers in the other direction 401 to a rollover IRA because theyre more common. But in some cases, this less common move is also worth considering.

The Option To Convert To A Roth

An IRA rollover opens up the possibility of switching to a Roth account. s, a Roth IRA is the preferred rollover option.) With Roth IRAs, you pay taxes on the money you contribute when you contribute it, but there is no tax due when you withdraw money, which is the opposite of a traditional IRA. Nor do you have to take required minimum distributions at age 72 or ever from a Roth IRA.

If you believe that you will be in a higher tax bracket or that tax rates will be generally higher when you start needing your IRA money, switching to a Rothand taking the tax hit nowmight be in your best interest.

If you’re under the age of 59½, it’s also a lot easier to withdraw funds from a Roth IRA than from a traditional one. In most cases, there are no early withdrawal penalties for your contributions, but there are penalties if you take out any investment earnings.

Your 401 plan rules may only permit rollovers to a traditional IRA. If so, you’ll have to do that first and then convert the traditional IRA into a Roth. There are a number of strategies for when and how to convert your traditional IRA to a Roth that can minimize your tax burden. Should the market experience a significant downturn, converting a traditional IRA that is down, say 20% or more, to a Roth will result in less tax due at the time of the conversion. If you plan to hold the investments until they recover, that could be an attractive strategy.

Also Check: How Can I Use My 401k To Pay Off Debt

Should I Roll Over My 401

Theres a lot to consider when deciding whether to roll over your 401 after a job change. The available options of keeping your account with your former employer or rolling it over into a new tax-deferred plan pose a number of pros and cons, all of which factor into the decision that you will ultimately make. A financial advisor can help guide you through this decision and others like it. Lets break down the reasons for rolling over and not rolling over your 401.

Also Check: Should I Rollover My 401k Into An Ira

Con: Loss Of Access To Credit Facilities

Generally, 401 plans cap the number of times account holders can make withdrawals from their accounts. However, if you need funds urgently, you can take a 401 loan and use the retirement savings as collateral. This privilege is lost when you transfer your funds to an IRA, which does not offer loans. However, you can take an early distribution to pay certain expenses without paying taxes or early-withdrawal penalties.

You May Like: How Much Can An Employer Match In A 401k

Pro: Manage Your Assets In One Location

A report by the Bureau of Labor Statistics shows that young baby boomers change jobs an average of 12 times during their working years. This means that a baby boomer nearing retirement may have a trail of 401 accounts. If you have multiple 401 plans, rolling them over to an IRA can help you consolidate the funds and make it easier to create a well-diversified portfolio.

How Long Do You Have To Roll Over A 401

If a distribution is made directly to you from your retirement plan, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan or an IRA, according to the IRS.

But if you have more than $5,000 in a 401 at your previous employer and youre not rolling it over to your new employers plan or to an IRA there generally isnt a time limit on making this decision.

Read Also: What Is The Difference Between An Annuity And A 401k

I Retired Should I Move My 401 To An Ira

Q. I retired from my job on April 3, 2020. I have a 401 with this employer with a balance of approximately $600,000. Should I rollover the 401 into an IRA or leave it where it is?

Retired

A. Congratulations on your retirement.

There are many reasons why someone may leave their 401 in place after leaving a job.

The perception of lower costs is one of the main reasons.

But theres been a lot of questions surrounding the lack of transparency of 401 plan fees.

Some 401 plan costs are actually quite high, said Matthew DeFelice, a certified financial planner with U.S. Financial Services in Fairfield.

I think its worth looking at the internal fund fees expense ratios on the investments in your 401 and comparing them to what similar investments may cost in an IRA, he said. This will require a bit of research on your part, but its worthwhile to take the time to do it so you know what you are dealing with.

Arguably the best reason for keeping assets in a 401 plan whether thats rolling it into your new employers 401 or keeping your old one applies only if youre planning to retire between ages 55 and 59 ½, DeFelice said.

In general, you must pay a 10% early withdrawal penalty if you take money out of your 401 or IRA before you reach age 59½, DeFelice said.

There is, however, an important exception for 401 plans: Workers who leave their jobs in the calendar year they turn 55 or later can take penalty-free withdrawals from that employers 401 plan, he said.

Request A Direct Transfer Rollover From Your Old 401

Remember, you need to ask for a direct transfer rollover from the plan administrator of your old 401this could be your old employer or a third party. Theyll give you a form to fill out that will usually ask you to provide your contact information and account information for the plan youre transferring money from and the account youre transferring the money to.

You May Like: What Is My Fidelity 401k Account Number

How Long Do I Have To Roll Over My 401 From My Old Job

If you have money sitting in a 401 with your last employer and you decide to leave the money in there, theres no time limit. You can roll those funds into an IRA or your new employers retirement plan whenever you want to.

However, if you have your old 401 money sent directly to you from your retirement plan , the IRS says you have just 60 days from the date you receive a retirement plan distribution to roll it over into another plan or an IRA. Otherwise, you will get hit with taxes and an early withdrawal penalty.

Establish An Ira Rollover Account

First, you must have an IRA account open and an account number. You can open an account with your chosen financial institution without putting any money in just let them know you will be transferring a 401 or another retirement account into that IRA.

Next, contact your old employer or retirement plan administrator , and let them know you would like to roll your 401 money over to your IRA. They probably will send you paperwork you must complete. Some companies will process the rollover via phone if you provide them the new custodian’s information and your IRA account number.

Many retirement plans insist on mailing the check to you, and it will be up to you to quickly get it to your new IRA custodian. The IRA rollover must be completed within a 60-day time frame, or it will be considered a taxable distribution.

Some retirement plans will wire the funds or mail them directly to your new IRA custodian. Ask whether they offer that option, and if they do, it may be best for you to let them send the funds directly.

You May Like: Can You Use Money From 401k To Buy A House

What Are The Tax Implications Of Rolling Over Your 401

When it comes to tax implications, there are a few differences to note between a direct and indirect rollover.

If you dont complete an indirect rollover within a 60-day window from the day you liquidated the 401 then the funds withdrawn will be treated as a distribution rather than a rollover. Consequently, you will pay taxes on the withdrawal. Also, if the distribution is not a qualified distribution, you will incur penalties. This requirement is known as the 60-day rollover rule.

While you should also seek to complete a direct rollover within 60 days, taxes and penalties dont apply as they do with indirect rollovers.

When you make an indirect rollover, the administrator of your 401 must withhold 20% tax on the amount withdrawn. If its a transfer to a traditional IRA, where you are not supposed to pay tax, you can recover the withholding tax. However, to do this, you must deposit the total amount withdrawn into the traditional IRA.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: Does It Make Sense To Rollover 401k