Benefit From Access To Our Exclusive Alternative Investment Opportunities

*Required Fields

Connect with a team in your area

At J.P. Morgan Private Bank, we specialize in alternative investments, and we believe they can be essential building blocks in your portfolio. But navigating this universe of complex investments can be challenging and require in-depth understanding to accurately gauge the risks and identify high-return potential opportunities.

Finding the right alternative strategy depends on your goals. Our platform provides a wide variety of strategies to support your needs.

Potential to achieve above-market returns

In an environment of modest traditional market returns, private equity, opportunistic/value-add real asset strategies and hedge funds may serve as alternate sources to generate above-market returns for your portfolio.

Exclusive opportunities

We build innovative access points to premier funds across the industry, and offer you exclusive access at more attractive minimum investments. Our heritage and connections across J.P. Morgan give us access to partners and opportunities simply not available anywhere else.

Diversify your portfolio

You may need to look beyond the traditional 60:40 equity/bond portfolio to help manage volatility and achieve real diversification. Adding alternatives could help. Over the long term, through diverse market conditions, an allocation to alternatives has historically demonstrated the ability to improve risk/return versus traditional equity/bond portfolios.

Are Retirement Savers Actually Changing Course

To answer this question, we looked at the behavior of 401 participants during the first half of 2022 from T. Rowe Prices recordkeeping data. Using collective and anonymized data, we analyzed their exchange activity and changes in their deferral rates during this volatile period.

In general, 401 participants have been staying the course. Based on our research, over 95% of 401 participants have not made any investment exchanges during the first half of 2022. But underlying that, there are some noticeable trends.

Apart from exchanges, 401 participants can also change their deferral rates in response to market conditions, but other factors may also be at work. For most of the first half of 2022, average deferral rates stayed relatively stable. More recently, though, the average has trended downward, suggesting that cutting back on contributions is one way workers may be coping with inflation at fourdecade highs. If high inflation persists and the downward trend in deferral rates is prolonged, then it could become problematic because retirement savings might fall.

Average Deferral Rate Has Remained Stable

Weekly average deferral rate during the first and second quarter of 2022

As of July 1, 2022.401 participants of plans with approximate assets> $25m. during the first half of 2022 from T. Rowe Prices record-keeping data.Source: T. Rowe Price.

Types Of Escrow Accounts

Your account options depend on your financial performance and investment needs . Some of them are taxable, which also means that the income in the account is considered taxable when it is earned. Others are not taxed, so taxes are deferred until you withdraw?? money from the account.

From Precious Metals IRAs to direct purchases of gold and silver, Goldco have helped thousands of Americans diversify and protect their 401k, IRA, and retirement savings accounts every day.

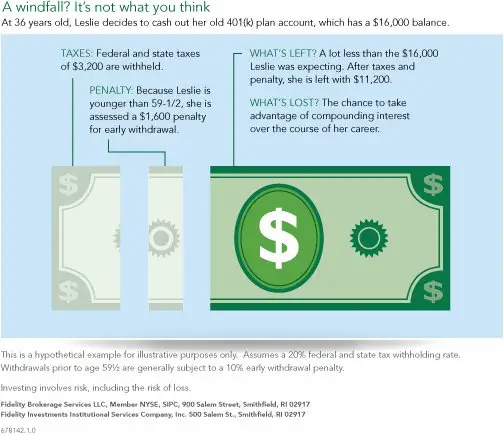

Don’t Miss: When Can You Start Withdrawing From 401k

Have Questions About Investing Funds From Your Ira Or 401k Into Our Multifamily Fund Contact Us For The Pros And Cons

If youre reading this, you likely know that there is enormous value for investors in property investing. Real estate, particularly in multifamily and commercial properties, offers some of the highest ROI. But doing so takes a large investment of funds. What many prospective investors dont know is they may have those resources in their IRA and/or 401K. There are ways to use either of these to invest in multifamily and commercial properties.

With the stock market at record highs, many investors are looking to buy an investment property as a way of diversifying their portfolios. But with real estate also at record highs, it has created a dilemma for some investors: should they be saving for and investing in real estate, or should they stay the course and continue maxing out their retirement accounts?

Most people dont realize that it isnt an either-or situation.

In fact, it is possible to use both your 401k and individual retirement accounts to invest in real estate. And contrary to popular belief, it is possible to do so without suffering from steep withdrawal penalties.

There are some key differences between how to invest with either an IRA or 401k, which well cover in this article. This guide is intended to be an investors go-to resource for learning about how to leverage their retirement plans to buy an investment property, including the pros and cons of using this approach and alternative investment strategies to consider.

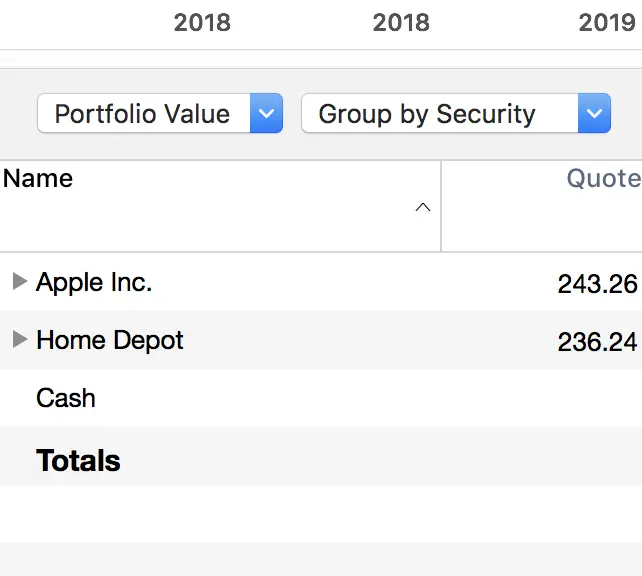

Things To Know Before Opening A 401 Brokerage Account

If you’re considering a 401 brokerage account, the first thing you must decide is what percentage of your retirement savings you’d like to put there. You can put all of it there if you’d like, but it may be better to leave part of it in a mutual fund chosen by your employer, just to be safe.

You should also note that some 401s only allow you to transfer funds to a brokerage account during a certain window each year. If this is the case for your plan, make a note of this time frame so you don’t miss it.

Next, look into the account maintenance fees and any other fees associated with the investment products you’re considering. Ideally, you can keep these at or below 1% of your assets. That means you’ll pay $1,000 or less per year for every $100,000 you have in the account. If you plan to employ a financial adviser to help manage or offer suggestions for your 401 brokerage account, don’t forget to factor in those fees as well.

If a 401 brokerage account isn’t a good fit for you, go with one of your employer’s investment selections instead. This is the safer bet if you don’t have the time or interest to learn more about investing. These are your retirement savings at stake, so you don’t want to take unnecessary risks.

The Motley Fool has a disclosure policy.

Read Also: Can You Transfer 403b To 401k

The 10 Best Stocks For Your 401k

Choosing the best retirement stocks requires a delicate balance between stability and speculation

If youre one of millions of Americans climbing the corporate ladder, the greatest decision you can make is to contribute to your 401k plan. Most major firms offer matching contributions up to a certain level this is the equivalent of free money and youd be foolish not to participate. At the same time, choosing the best stocks for your retirement portfolio is a substantial undertaking.

On the other side of the table, its a daunting challenge for market analysts as well. Not all 401k stocks are appropriate for every investor, as not every investor has the same risk tolerance. Furthermore, depending on how close someone is to retirement, he or she must modulate his or her portfolio accordingly. Even demographics arent always the end-all, be-all, since many American workers failed to plan for their future.

Unlike other stories about deciphering the best stocks for your 401k, I understand the balance between capital returns and stability. Too many times, we see the most boring, staid investments hawked as ideal retirement stocks. While you might not lose with them, youre likely not going to win adequately.

Nevertheless, I know how it is most of us wish we could save more for our future. To that end, Ive compiled a list of powerful retirement stocks. A single name wont do it, but having a diverse basket will see you through the constant ebb-and-flow.

Know Your Investment Risk Tolerance

Whats the difference between investment types and asset classes? A lot centers around risk vs. return.

In general, the higher the potential for return the higher the potential for risk of lossand vice versa.

Risk tolerance is how much you can keep the emotion out of investing. Healthy markets typically go up and down, but those short-term market changes can stir both excitement and regret.

Some people are more comfortable knowing they could lose money in the short run if there are possible gains in the long run. Others are more conservative, preferring less risk.

To learn about coping with market volatility, watch our video.

Don’t Miss: How To Withdraw From 401k For Home Purchase

If You Really Cant Stand It Boost Your Comfort Cash

So hes heard from people across the spectrum who express concerns that they cant afford to lose what they have. Even many educated investors wanted out during the downturn early in the pandemic, he said.

Struthers will counsel them not to panicand to remember that downturns are the price investors pay for the big returns they get during bull markets. But he knows fear can get the better of people. You cant just say dont sell because youll lose some people and theyll be worse off.

And its been especially discouraging to investors to see that bonds, which are supposed to reduce their portfolios overall risk, are down too. People lose faith,Struthers said.

So instead of trying to contradict their fears, he will try to get them to do something to assuage their short-term concerns, but do the least long-term damage to their nest egg.

Your 401 Plan: The Basics

A 401 plan is an excellent employer-sponsored retirement plan that is generally recommended for full-time employees. As an employee, a person contributes to your 401 plan regardless of salary, and if youre lucky, your employer may equalize your contributions up to a certain amount. You can contribute up to $19,000 in 2019per year for your 401 plan and up to $500 if you reach the $18,500 contribution limit by 2018. -up to $6,000 in 2019, the same as in 2018. p>

Also Check: How To Open Your Own 401k

Can I Buy Stock With My 401k

Unless your 401 plan offers a self-directed brokerage window, you cannot use a 401 to directly buy private stock. Your 401 : The Basics A 401 plan is an employer-sponsored retirement plan that is generally offered to full-time employees.

You typically cant invest in specific stocks or bonds in your 401 account. Instead, you often can choose from a list of mutual funds and exchange-traded funds . Some of these will be actively managed, while others may be index funds.

As a general rule, you cannot invest in certain stocks or stocks in your 401 account. Instead, you can usually choose from a list of good mutual funds and exchange-traded funds . Some of them are actively managed and friends may be index funds.

How A 401 Self

Employers who offer brokerage accounts in their 401s must pick a specific firm to use, such as E*TRADE or Charles Schwab, and list this account along with the other investment choices in the plan. In some cases, participants may have a specified window of time each year to move money from their general omnibus account in the plan into the brokerage account.

Plan participants can then buy and sell stocks, bonds, ETFs, and mutual funds in the normal manner, albeit with no tax consequences. However, some types of higher-risk trades are prohibited, such as trading on margin and buying put or call options or futures contracts. Covered call writing is permissible unless the plans charter forbids it.

As of 2015, 40% of U.S. employers offered brokerage windows in their 401 account, according to a study by HR consulting firm Aon Hewitt. Some 19% of the plans Vanguard administers offer a brokerage window, according to the mutual fund companys How America Saves 2020 Report.

The Plan Sponsor Council of Americas 60th Annual Survey of Profit Sharing and 401 Plans, released in 2018,indicated that about a quarter of the plans offered by 590 plan sponsors featured a brokerage window. Some 403 plans now also offer this feature.

Vanguard reports that 19% of its 401 accounts offer a brokerage window, but only 1% of participants take advantage of it.

Recommended Reading: What Happens To My 401k If I Lose My Job

A Full Spectrum Of Alternative Investment Strategies

Finding the right alternative strategy depends on your goals. Our platform provides a wide variety of strategies to support your needs.

A global team with access, scale and specialty

We harness the knowledge and experience of our global team1 to bring you a carefully curated set of high-conviction, long-term growth opportunities, with broad implementation possibilities to help ensure you realize your goals. Our unique approach focuses on maximizing the benefits of our access, the experience of our team and our strategic insights to deliver the best opportunities to you.

100+ dedicated professionals

An incredible array of talent from fund due diligence and manager selection to portfolio management and construction, working in concert to bring you high-conviction, exclusive opportunities at a lower cost.1

Strategic point of view

We offer a long-term, strategic point of view, as well as nimble, opportunistic ideas to meet your needs.

Proprietary insights and solutions

We conduct thousands of manager and client meetings every year to keep our fingers on the pulse of the market. With these key insights, our access and scale, we create proprietary funds around market themes where we have conviction, and deliver them exclusively to you.

We can help

Even the most experienced investors can easily be overpowered by the array of alternative classes, strategies and vehicles now on offer. But you never have to go it alone.

Can I Buy And Sell Stocks In My 401k

Asked by: Dr. Brendan Vandervort

Because you can buy and sell stocks whenever you want in a 401, you can use a day-trading strategy. Day trading in a 401 has a potential tax benefit over day trading in a regular brokerage account. … When you make a gain in your 401, you don’t owe taxes on the gain as long as the money stays in your account.

Recommended Reading: How Much Should I Put In 401k

Do Retirement Savers Need To Change Course

To track the progress of retirement savers, T. Rowe Price publishes age and incomespecific savings benchmarks.1 These are approximations of how much someone should have saved by a given age and level of income to have sustainable replacement income in retirement. For the calculation of these savings benchmarks, we assume an average annual return of 7%. This assumption is based on historical returns of different asset classes and agebased portfolio allocations.

But in lower expected return environments, should those saving for retirement assume lower returns and save more? To answer this question, we explored a hypothetical alternative retirement savings benchmark.

The hypothetical alternative savings benchmark assumes 4% returns for fiveyears, which we consider the midterm, and then reverts to 7% after that.

Under the lower midterm return assumptions, our agespecific savings benchmarks are unchanged for workers under age 50. In our view, these workers have enough time left to recover from any short-term to midterm market turmoil and need not focus on shortterm market returns if they are on track to reach these benchmarks.

Our Retirement Savings Benchmarks Remain Mostly Unchanged

Savings benchmarks by ageas a multiple of income

A good rule of thumb is that workers save at least 15% of their annual salary for retirement. This is a rule of thumb in practice, the suggested savings rate will vary from person to person, usually increasing for people with higher incomes.

Which Companies Have The Best 401 Matching

Now your next step is to find a gold IRA company to invest in. Goldco is our number 1 for many reasons. It is currently the leading precious metals IRA in the industry with over 10 years of experience. It also offers you a top-notch customer support system that guarantees short and informative promotions to its consumers.

Recommended Reading: Can The Irs Take My 401k If I Owe Taxes

Forget Timing The Market

Bearish markets can be a bear on your psyche. There may be times when you are tempted to sell your equity investments and move the proceeds into cash or a money market fund.

Youll tell yourself you will move the money back into stocks when things improve. But doing so will just lock in your losses.

If youre a long-term investor which includes those in their 60s and early 70s who may be in retirement for 20 or more years dont expect to outwit the current downward trends.

When it comes to success in investing, Its not about timing the market. Its about time in the market, said Taylor Wilson, a certified financial planner and president of Greenstone Wealth Management in Forest City, Iowa. During bull markets people tend to think the good times will never end and during bear markets they think that things will never be good again. Concentrating on things you can control and implementing proven strategies will pay off over time.

Say youd invested $10,000 at the start of 1981 in the S& P 500. That money would have grown to nearly $1.1 million by March 31, 2021, according to Fidelity Management & Research. But had you missed just the five best trading days during those 40 years, it would only have grown to roughly $676,000. And if youd sat out the best 30 days, your $10,000 would only have grown to $177,000.

Can I Choose Individual Stocks In My 401

Only in certain circumstances may employees select individual transfers or investments for their 401 form. In some cases, employers choose 401 courses for their employees that allow them to select individual stocks. However, this may only apply to a certain percentage due to the funds included in the plan.

Read Also: How To Pull My 401k