Track Down Old 401 Plan Statements

The first thing you can do to find money held in forgotten 401 accounts is to go through old plan statements you may have. The statements could have come in the mail or you may have received them electronically through email.

Finding these statements makes it easier to know which employers you were at during the period when you had the 401 plan and can help you determine who to contact to access your account. You can also check with former co-workers who are still with the company to see who you should get in touch with.

Us Department Of Labor Abandoned Plan Search

If your former employer has filed for bankruptcy, gone out of business, or was purchased by another company, your 401 might be in limbo.

In these cases, employers are required to notify you so you can receive your funds. However, if your contact information has changed or you’ve moved, your plan may have been abandoned.

You can use the Department of Labor’s Abandoned Plan Search tool to locate your old 401s. You will need to enter basic information about your former employer then, you can narrow your search using your social security number.

Like the National Registry of Unclaimed Retirement Benefits, the DOLâs Plan Search tool only located abandoned plan. Thereâs a good chance your old 401s wonât show up in these results.

Check Unclaimed Benefits Websites

There are several online resources that can help you find a lost 401. The National Registry of Unclaimed Retirement Benefits is a database of lost retirement accounts maintained by PenChecks Trust, a retirement benefit distribution company. The service, which allows you to enter your social security number to securely search for lost accounts, is free. In some cases, a 401 has been terminated by the employer, and plan participants paid out. The U.S. Department of Labor maintains a database of terminated 401 plans that you can search by employer name.

Recommended Reading: How To Use My 401k To Start A Business

Also Check: How To Pull My 401k

Contact Your Previous Employer For Information About Your Old 401

Permitting that your previous employer is still in operation, you can reach out to them directly. Typically, the human resources department will have information on your account or point you in the right direction.

Most companies try to reach out by sending mail regarding your account when you leave the company. If you moved when you changed jobs, you might have missed those notifications. If the company did not hear from you for an extended period, it might have transferred your funds to a separate, unmanaged account.

How To Claim Lost Retirement Funds

There’s $1.3 trillion in lost retirement funds in the U.S. Here’s how to find out if any of that is yours.

Once upon a time, it was common for employees to spend their entire careers with one company. Those days seem to be in the rearview mirror.

People born in the later years of the baby-boom generation worked an average of 12.4 jobs from ages 18 to 54, according to the U.S. Bureau of Labor Statistics. Expect those numbers to rise dramatically in the coming years: A recent survey of American workers found that 64% had a favorable view of jumping from job to job, according to management consulting agency Korn Ferry. Even more notable, 75% of those 34 or younger believed job-hopping would be beneficial to their careers.

Retirement is probably not on the minds of those starting a new job. But what often gets lost in all this moving around are retirement funds. More than 24 million 401 accounts and $1.35 trillion in assets have been left behind by former employees, according to Capitalize.

If you contributed to your employers 401, you have money sitting out there. Heres how to track it down.

Also Check: What Happens When You Roll Over 401k To Roth Ira

What Happens To Old 401s

401 administrators have different procedures for what to do with left behind accounts. Depending on the amount, they could be distributed directly to you, transferred to an IRA on your behalf, or sent to a separate holding account until you claim them.

Unwilling to bear the burden of maintaining vast amounts of accounts from former employees, 401 plans prefer to unload them any way possible. This can make it challenging to find your old 401s.

Contact Your Old Employer About Your Old 401

Employers will try to track down a departed employee who left money behind in an old 401, but their efforts are only as good as the information they have on file. Beyond providing 30 to 60 days notice of their intentions, there are no laws that say how hard they have to look or for how long.

If its been a while since youve heard from your former company, or if youve moved or misplaced the notices they sent, start by contacting your former companys human resources department or find an old 401 account statement and contact the plan administrator, the financial firm that held the account and sent you updates.

You may be allowed to leave your money in your old plan, but you might not want to.

If there was more than $5,000 in your retirement account when you left, theres a good chance that your money is still in your workplace account. You may be allowed to leave it there for as long as you like until youre age 72, when the IRS requires you to start taking distributions, but you might not want to. Heres how to decide whether to keep your money in an old 401.

The good news if a new IRA was opened for the rollover: Your money retains its tax-protected status. The bad: You have to find the new trustee.

You May Like: Can You Open A Roth 401k On My Own

My Wife And I Are In Our Mid 40s Save 15% A Year And Have A 401 Balance Of More Than Half A Million Dollars Are We On The Right Track Toward Retirement

The fact that youâre saving at good clip and that you already have a sizeable amount tucked away in retirement savings about half way through your career suggests that youâre likely on pace toward a secure retirement, or at least not too far off.

But itâs always smart to check now and then to get a better handle on where you really stand. After all, the last thing you want is to blithely assume everythingâs going swimmingly only to find out when youâre ready to retire that youâre not nearly as prepared as you thought.

That said, keep in mind that no assessment can give you complete assurance that youâll be able to retire on schedule and live the post-career lifestyle you envision. There are too many variables, uncertainties and potential disruptions along the road to retirement for such certainty. But the idea is to come away with a decent sense of whether youâre on the right path and, if not, change what youâre doing so you can tilt the odds more in your favor.

So, for example, if you earn $50,000 a year, plan to maintain your current lifestyle in retirement and expect to stop working at 65, Fidelity estimates you should have about six times your salary, or about $300,000, saved in retirement accounts by age 45.

How To Reclaim Your Retirement Plan With A Previous Employer

Millions of Americans accidentally or unknowingly leave money in retirement plans with previous employers. According to a study by the National Association of Unclaimed Property Administrators, Americans lost track of more than $7.7 billion in retirement savings in 2015.

If you’ve left a retirement plan with a previous employer, not to worry. Here are 6 tips you can follow to reclaim your money.

Don’t Miss: How Long Does It Take To Get Your 401k Check

Too Complicated Get Some Help

If this process seems like a lot of work, youâre not alone. Locating your old 401 accounts and finding the proper place to transfer them to can get confusing.

Fortunately, Beagle can do all of the difficult work for you. The tasks of finding your accounts and facilitating their transfers are all done for you. Getting started is free and only takes a few minutes.

Where To Find Unclaimed Money

The kind of unclaimed money may affect the type of database you need to search in or the state agency you need to contact.

Unfortunately, this is a state-by-state issue, says Warren Ward, CFP, founder of WWA Planning and Investments in Columbus, Indiana. I know of no national database.

So for many types of unclaimed money or property, youll need to search your states records.

In Indiana you can visit indianaunclaimed.gov, a site maintained by the attorney generals office, says Ward. Its actually something we do every year for our clients, but its very easy to do for an individual if they care.

Ward cautions about treasure hunters contacting you out of the blue and offering to find lost money for you.

The claiming process is now automated, but we still hear of people cruising the database for large amounts of money and trying to get people to pay them to locate the funds, he says.

So if someone contacts you about finding unclaimed money, it may be a tip-off that you have funds out there somewhere. That means you should initiate a search yourself. You can conduct a search for free at any of the state websites and neednt pay anyone to find money for you.

Recommended Reading: Why Convert 401k To Ira

Use Resources To Discover Unclaimed Assets

Once you use these resources to locate your funds, you can use the following resources to get access to your unclaimed assets.

Also Check: How To Pull From 401k

How To Find A Lost 401 Account

Think you may be one of the millions with forgotten 401 money floating around somewhere? Start by scouring your personal email or laptop for any old 401 plan statements that you may have saved in the past.

“Your statement will provide your account number and plan administrator’s contact information,” Corina Cavazos, managing director, advice and planning at Wells Fargo Wealth & Investment Management, tells Select. Your former coworkers may have old statements that you can reference, too.

If you don’t have any luck, Cavazos says that your best bet is to contact your former employer’s HR or accounting department. By providing your full name, Social Security number and dates of employment with that company, you can have them check their 401 plan records to see if you were once a participant.

If you’ve tried contacting your 401 plan administrator or former employer to no success, you may be able to find old retirement account funds on the National Registry of Unclaimed Retirement Benefits. Upon entering your Social Security number, the secure website allows you to conduct a free database search to see if there’s any unpaid retirement money in your name.

Another search database is the FreeERISA website, which indicates if your former employer rolled your 401 funds into a default participant IRA account on your behalf. FreeERISA requires you to register before performing a search, but it is free to do so.

Also Check: Can I Roll An Old 401k Into A New One

Discover Where Your Funds May Have Been Transferred

If your former employer does not have your old 401, you can search on the Department of Labors abandoned plan database. You will be able to search for your plan using the information you already have, including your name, your employers name and more. If you had a traditional pension plan and it no longer exists, you can search the U.S. Pension Guaranty Corp. database to find your unclaimed pension.

Finally, you may want to search the National Registry of Unclaimed Retirement Benefits. This service is available nationwide and has records of account balances unclaimed by former retirement plan participants.

Ways Of Finding My Old 401ks Including Using Ssn

If youâve ever left a job and wondered âWhere is my 401?â, youâre not alone. Locating 401âs is complicated. Thus, billions of dollars are left behind each year. Beagle can help track down your money.

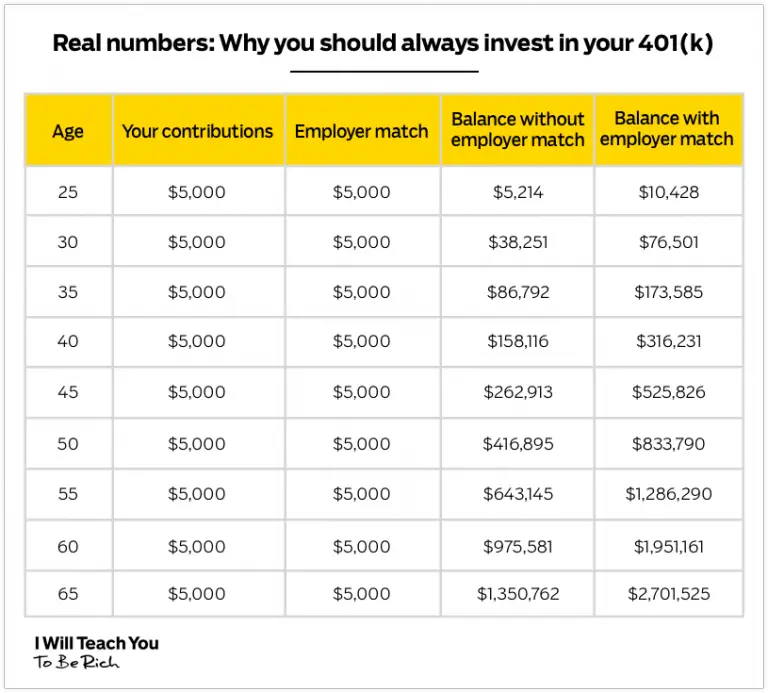

Contributing to an employer-sponsored 401 plan is a great way to build wealth for retirement especially if youâre receiving a match from your company. The problem is they are tied to an individual employer. We forget about them, leave that company, and one day we realize âOh yeah! Where is my 401?â

A 401 can be in a few different places. Most commonly it could be with your previous employers, an IRA they transferred your funds to after you left, or mailed to the address they had on file.

Believe it or not, Americans unknowingly abandoned $100 billion worth of unclaimed 401 accounts. According to a US Labor Department study, the average worker will have had about 12 different jobs before they turn 40. So itâs easy to see how we can lose track of so much 401 money.

To find your old 401s, you can contact your former employers, locate an old 401 statement, search unclaimed asset database in different states, query 401 providers using your social security number or better yet, get some help to find your 401 accounts from companies like Beagle.

You May Like: How To Move A 401k From One Company To Another

What Is A 401 Account

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

Dont Miss: How To Take Money From 401k Without Penalty

Does Adp Show 401k

There are many people who believe that ADP shows 401k plans.

There is no one answer to this question as it is dependent on the company that is doing the testing and the individuals specific needs. However, some people may believe that ADP shows 401k plans because it is a reliable source of information.

Read Also: When Can I Rollover My 401k Into An Ira

Where Is My 401

When you leave your employer you have three options for the money youâve accumulated in your old 401 account. You can either:

- Leave it alone and keep it in the same account

- Roll over the funds to your new employerâs 401 plan or

- Roll over the funds to an IRA.

Most people leave their 401âs alone, either from neglect or they donât bother with facilitating the transfer.

You can rollover your old 401 funds to an IRA as soon as youâd like. If your IRA is already set up then it can accept the funds immediately.

However, if your new employer implements a waiting period before you can participate in their 401 program, then you have no choice but to leave it alone until youâre eligible.

This is where things fall through the cracks. Unattended 401âs can end up in a few different places: the old account you have with your former employers, an automatic safe harbor rollover account set up by your plan, the unclaimed property department in the state, or your old 401s could have been cashed out already if the balance was less than $5,000 when you left the job.

Read Also: Does Maximum 401k Include Employer Match

Track Down Previous Employer Via The Department Of Labor

If you cant find an old statement, you may still be able to track down contact information for the plan administrator via the plans tax return. Many plans are required to file an annual tax return, Form 5500, with the Internal Revenue Service and the Department of Labor . You can search for these 5500s by the name of your former employer at www.efast.dol.gov. If you can find a Form 5500 for an old plan, it should have contact information on it.

Once you locate contact information for the plan administrator, call them to check on your account. Again, youll need to have your personal information available.

Recommended Reading: How To Find A 401k From An Old Employer

What To Do If Youve Lost A Pension

If your search for unclaimed retirement benefits is specific to a pension rather than a 401, the U.S. Department of Labors Employee Benefits Security Administration can help. The site has an Abandoned Plans section that details plans that have been neglected by the employers who sponsored them. This often happens when an employer filed bankruptcy or the plan sponsor is no longer around to administer it.

Another resource for tracking down a lost pension is the U.S. Department of Labors Form 5500 Search. Employers are required to report their retirement details using this form, so a search can help you track down the information you need to get in touch with your plan administrator.

If your pension was governmental, you should go through the government website specific to your city, county, or state. State and local government pensions can be tracked down through the personnel office. Military pensions are administered through the U.S. Department of Veterans Affairs, and information on federal government pensions is available through the Federal Employees Retirement System .

Whatever search you use to ask, Do I have retirement money somewhere? these databases are solely designed to identify those funds. Youll still have to contact the plan administrator or former employer to get your money. It will at least give you the information youll need to get started, though.