You Expect To Pay Higher Taxes In The Future

Since Roth IRAs use after-tax dollars, youll have to pay taxes upfront on any funds you roll over. However, you wont have to pay taxes on your distributions, which could be extremely beneficial if youre taxed at a higher rate when you reach retirement. Youll pay taxes either way now or later. But with a Roth IRA, you can rest assured your withdrawals will be tax-free.

Roll Over 401 Into An Ira

For those who would prefer not to rely on their new companys 401 plan’s investment offerings, rolling over a 401 to an IRA is another option. Again, rollovers can be direct, direct trustee-to-trustee transfers, or indirect, with the distribution paid to the account owner. But either way, once you start the process, it has to happen within 60 days.

The best option might be rolling the money over into the new companys 401 plan. The 401 plan is simpler because the plan is already set up for you. It’s also less expensive, because costs are spread over many plan participants.

Can Anyone Roll Over Into A Roth Ira

You May Like: When Do I Have To Start Withdrawing From My 401k

Rolling Over A : What Are Your Options

Lets say youre starting a new job and youre wondering what to do with the money in a 401 you had at an old job. You have four options:

- Option 1: Cash out your 401.

- Option 2: Do nothing and leave the money in your old 401.

- Option 3: Roll over the money into your new employers plan.

- Option 4: Roll over the funds into an IRA.

Well walk you through the pros and cons of each one:

Youll Have More Investment Options To Choose From In An Ira

The more investment options you have, the more likely you are to make better decisions. Thats why Dave likes to say if you have two bad options in front of you, go look for better ones!

Like we mentioned before, rolling your old 401 funds into an IRA means you have thousands of mutual funds to choose from instead of the handful of options you had in your old workplace plan.

You May Like: How To Close 401k Fidelity

Option : Roll It Into An Ira

If your new employer doesnt offer a 401 or you dont like their option, you can roll your 401 into an IRA.

Rolling over accounts is easier than it sounds. You may need to open an IRA at a brokerage company and sign a few papers that allow the brokerage to transfer the money into your new account. This option will help keep your balance growing tax deferred and you can continue to make tax-deferred contributions.

Recommended Reading: What Is An Ira Vs 401k

Pros Of Roth 401 To Roth Ira Rollovers

Something that applies to Roth 401 accounts but not Roth IRAs is that, beginning at age 72, you must take required minimum distributions from your account. This is similar to a traditional 401 or IRA. So if you would rather let your retirement funds grow tax-free until you need them, rolling them into a Roth IRA might be the best move for you since RMDs do not apply to this kind of IRA.

In fact, you can leave rollover funds in a Roth IRA indefinitely if need be. That may be something of interest to you, particularly if youre looking to maximize the assets you leave for your beneficiaries.

You May Like: How Much Can Employer Match 401k

Converting A Nondeductible Ira Contribution To A Roth Ira

You may know that if you or your spouse have a retirement plan available at work, it limits the deductible contributions you can make to a traditional IRA.3 If you’re in that boat and want to make the most of your tax-advantaged saving options, you can still make nondeductible IRA contributions. Earnings on these contributions will be tax-deferred but you do have the option of converting to a Roth IRA. In that case, your nondeductible contributions wont be taxed again, although any earnings would be treated as pre-tax balances, which means they would be taxable when converted. This type of conversion is sometimes called a backdoor Roth IRA.

If you do decide to convert either pre-tax or non-deductible contributions, the timing can be a little bit tricky. Some time should pass between the date of the contribution and the date of the conversion, but it’s not completely clear how much is enough. If you do decide to convert, consult your tax advisor first to ensure that you understand the full scope of potential tax consequences.

Would You Like To Make Your Tax Payments

Its not always easy to figure out what the best course of action is for ones finances. When contemplating a conversion to a Roth IRA, a good number of owners of regular IRAs experience this sentiment.

Do you think its possible for someone to have $300,000 saved in an IRA and then immediately decide to give away $75,000 of it? Converting your traditional IRA into a Roth IRA might seem like an attractive option on paper, but in practice, it could be more difficult.

You might be able to make up for the taxes you have to pay when you switch to a Roth IRA by giving money to charity.

Deductions from taxable income are one tactic that could be useful in mitigating the financial impact of converting a traditional IRA into a Roth IRA. To use this method, you will first need the money and the desire to give to a charity.

Don’t Miss: How To Cash Out My 401k

Disadvantages Of An Ira Rollover

A rollover is not for everyone. A few cons to rolling over your accounts include:

- . You may have credit and bankruptcy protections by leaving funds in a 401k as protection from creditors vary by state under IRA rules.

- Loan options are not available. The funds may be less accessible. You may be able to get a loan from an employer-sponsored 401k account, but never from an IRA.

- Minimum distribution requirements. You can generally withdraw funds without a 10% early withdrawal penalty from a 401k if you leave your employer at age 55 or older. With an IRA you generally have to wait until you are age 59 1/2 to withdraw funds in order to avoid a 10% early withdrawal penalty. The Internal Revenue Service offers more information on tax scenarios as well as a rollover chart.

- More fees. You may be responsible for higher account fees as compared to a 401k which has access to lower-cost institutional investment funds because of group buying power.

- Tax rules on withdrawals. You may be eligible for favorable tax treatment on withdrawals if your 401K is invested in company stock.

Neither State Farm nor its agents provide tax or legal advice.

Why Would You Want To Convert A 401 Into A Roth Ira

When youre employed by a company that offers a 401 plan, its an indispensable investing tool. Many companies match some of your contributions, which is essentially free money.

However, when you leave that job, this is a great time to look at the 401 youve been given and evaluate what is working for you, says Nicole Stanley, a financial coach and founder of Arise Financial Coaching.

Here are some of the most common reasons you might want to convert your 401 into a Roth IRA:

Also Check: How To Properly Invest In 401k

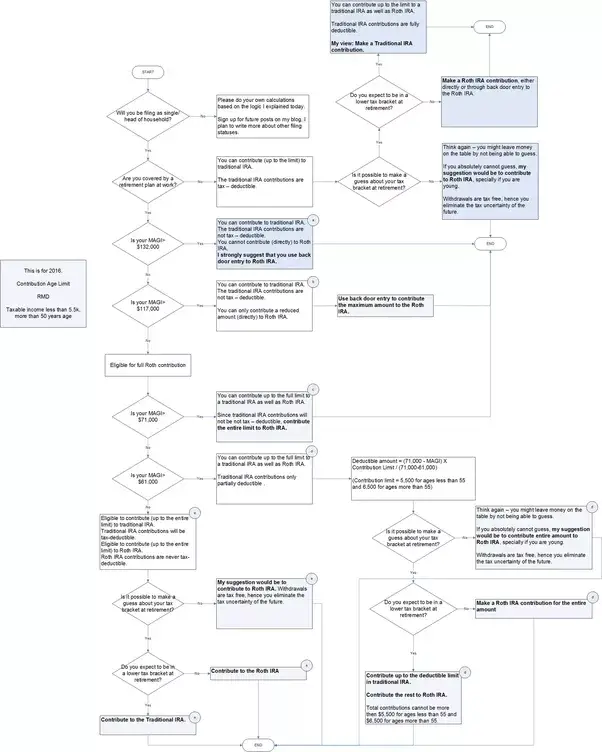

Decide Between A Traditional Or Roth Ira

The type of IRA you roll your old 401 money into will depend on what kind of 401 youre transferring the money from.

In most cases, if you have a traditional 401, youll probably want to roll the money into a traditional IRA. That way, you wont have to pay any taxes on the transfer .

If you had a Roth 401, thats a different story. You could roll the money you contributed into a Roth IRA completely tax-free and continue to enjoy tax-free growth and tax-free withdrawals in retirement. But your employers contributions are treated like traditional 401 contributions . . . so that money needs to either be rolled over into a traditional IRA or you can pay the taxes to roll them into a Roth account.

Easy, right? Traditional to traditional, tax-free today. Roth to Roth, mostly tax-free today and tax-free in retirement.

Converting A Traditional 401k Into A Roth Ira

You also have the option to convert a traditional 401k into a Roth IRA transfer. The process is a bit more complicated than a straight rollover, because you will be required to pay income tax on the amount in your 401k. The savings overall will be worth it, but you need to be prepared to pay the taxes before you begin the process.

Recommended Reading: Can I Roll My 401k Into A Brokerage Account

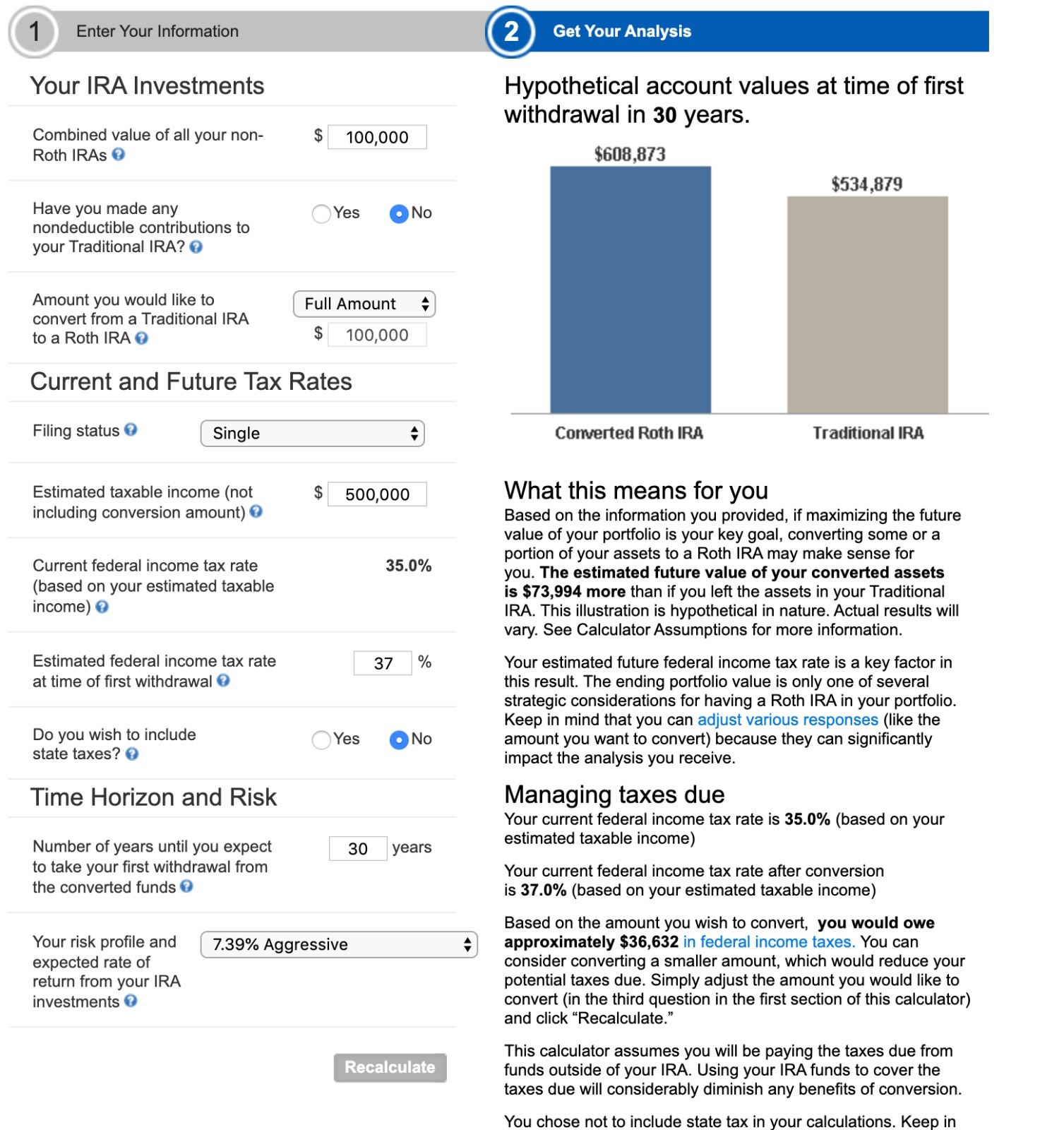

Paying Taxes On Your 401 To Roth Ira Conversion

Roth retirement accounts are funded with after-tax dollars, while traditional 401s are funded with pre-tax dollars, so you must pay taxes on your 401 to Roth IRA conversions. In most cases, the funds you’re converting count toward your taxable income, but you must complete your conversion by Dec. 31 if you want it to go on this year’s tax bill.

The effect on your tax bill depends on how much you’re converting and how much other taxable income you’ve earned during the year. If you’re not careful, your 401 to Roth IRA conversion could push you into a higher tax bracket, meaning you’ll lose a higher percentage of your income to the government. You can avoid this by staying mindful of your tax bracket throughout the year and striving to keep your total taxable income, including conversions, under your bracket’s upper limit.

You may not owe taxes on the full amount of your 401 to Roth IRA conversion if you’ve made nondeductible 401 contributions in the past. But that’s where things get a little hairy. Nondeductible 401 contributions are funds you contribute to a traditional 401 but don’t get an immediate tax break for. You pay taxes on your contributions, but earnings grow tax deferred until you withdraw them.

Will I Pay Taxes When Rolling Over A Former Employer

Generally, there are no tax implications if you move your savings directly from your employer-sponsored plan into an IRA of the same tax type to a Roth IRA).

If you choose to convert some or all of your pretax retirement plan savings directly to a Roth IRA, the conversion would be subject to ordinary income tax.

Don’t Miss: What’s The Most I Can Contribute To My 401k

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. You’ll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

Transfer To Your New Employers 401 Plan

If your new employer allows it, you can move the funds from your old plan into your new one. It can be easier to manage your investments when they are all in one place, which makes this a good option for some. Keep in mind, you still may be limiting yourself regarding investment choices and expenses could be higher too.

There is no one-size-fits-all approach to retirement planning or investing, which is important to keep in mind as Roth conversion strategies gain popularity. Roth conversions may play a large part in maximizing future wealth for some investors. Consider your next steps carefully and find a strategy that is consistent with your retirement planning goals and wealth management objectives.

For a more complete discussion on the various options for an old 401, please see this article.

Don’t Miss: How Can I Invest My 401k

How To Transfer Retirement Funds To A Roth Ira: Convert Your 401 To A Roth Ira

This article was co-authored by Dmitriy Fomichenko and by wikiHow staff writer, Eric McClure. Dmitriy Fomichenko is the president of Sense Financial Services LLC, a boutique financial firm specializing in self-directed retirement accounts with checkbook control based in Orange County, California. With over 19 years of financial planning and advising experience, Dmitry assists and educates thousands of individuals on how to use self-directed IRA and Solo 401k to invest in alternative assets. He is the author of the book “IRA Makeover” and is a licensed California real estate broker.There are 22 references cited in this article, which can be found at the bottom of the page. This article has been viewed 1,523 times.

If youre looking to grow your retirement savings tax-free, a Roth IRA is like a dream come true. However, if youve got multiple retirement accounts or youre trying to figure out what youre allowed to do here without causing yourself problems, it may be hard to find the info you need. While the transferring part is easy enough, understanding the impact after that happens can be tricky. Luckily, weve got you covered with everything you need to know about consolidating, transferring, and rolling over your funds into a Roth IRA while minimizing your upfront costs.

You Want To Relax Early

Proponents of the FIRE movement invest aggressively so they can become work-optional in their 50s or even earlier.

If thats your plan, youll want at least a portion of your investments to be in an account thats more accessible than a 401, which you cannot tap without penalty before the age of 59 ½. A strategy known as a Roth conversion ladder involves converting 401 funds into a Roth IRA over a period of years.

Its a bit complex, says Hernandez. Theres a small number of people that it could make sense for. Its important to understand the tax impact.

Read Also: Is An Annuity Better Than A 401k

You Want To Avoid Required Minimum Distributions

Heres another rule that applies to a 401 but not a Roth IRA: required minimum distributions, or RMDs.

The IRS requires all 401 owners to withdraw a minimum amount from their accounts each year beginning in the year they turn 72. The exact amount depends on your balance, your age, and a life-expectancy variable determined by the IRS.

With a Roth IRA, that money has already been taxed, so RMDs are not required.

S For Rolling Over A 401 Into A Roth Ira

Once youve done the research, consulted a professional, and decided that a 401 conversion to a Roth IRA is right for you, theres a few things youll have to do.

First, youll need to open a Roth IRA account. NextAdvisor recommends these 5 online brokerages, which generally have low fees and good customer service.

Next, call that brokerage and tell them youd like to roll over a 401. This will likely be more effective than calling the institution that holds your 401 money after all, that company is not incentivized to help you move it out. As a general rule, its usually a lot easier to get money into a financial institution than it is to get money out of one, says Hernandez.

Depending on the institutions involved, the next steps may involve a paper check being mailed to your home, so youll need to make sure that both institutions have your most updated personal information on file. Make sure youre keeping track of the transactions for tax purposes. The 401 institution should provide you with a 1099-R form, which you can provide to your tax preparer.

Try not to get overwhelmed by the paperwork, says Stanley. Break the task into steps and give yourself time to get it done. You dont even need to do it all at once, she says. Whether you get it done in days or weeks, youll have taken a great step toward your financial goals.

Don’t Miss: How To Find Out If Someone Has A 401k