Ira Deduction Limits For 2022

If you save with both a 401 and a traditional IRA, you may also face some limits on your ability to deduct your contributions depending on your income. Contributions to a Roth are never deductible.

For instance, if you are covered by a retirement plan at work:

- You can deduct up to the contribution limit, if youre single and your Modified Adjusted Gross Income is $68,000 or less for 2022. You can take a partial deduction if your income is between $68,000 and $78,000 in 2022. Theres no deduction for people who earn more than $78,000 in 2022.

- If youre married and filing jointly, you can deduct the full amount if your MAGI is $109,000 or less in 2022. You can take a partial deduction if your income is between $109,000 and $129,000 in 2022. Theres no deduction if you earn more than $129,000 in 2022.

Making pre-tax IRA contributions is a great way to save on taxes and invest for retirement. If your MAGI is above the threshold, your contribution would be considered nondeductible. There may be alternative and potentially better strategies to explore instead of making nondeductible contributions. Some other avenues to consider would be a Roth IRA and a taxable brokerage account.

Is It Better To Have A 401 Or An Ira

With so many similarities, which one should investors choose? Well, if you can max out your contributions to both, then you wont have to choose while enjoying the full advantages each has to offer. But even though its permitted, many people cant afford to do so.

Forced to choose, many experts believe the 401 is the clearly superior option.

There is actually no comparing IRAs and 401s, says Joseph Auday, a wealth advisor with Steel Peak Wealth Management in Beverly Hills, California, citing the 401s higher contribution limit and the potential for an employer match. If youre not taking advantage of your 401, youre missing out.

However, advisors also stress that both plans remain valuable to retirement planning.

IRAs and 401s can both provide unique value to an individuals retirement strategy, with key uses and specific pros and cons worthy of consideration, says Michael Burke, CFP at Lido Advisors in Southbury, Connecticut.

Yes But The Tax Breaks You Receive May Be Limited By Your Income

The quick answer is yes, you can have both a 401 and an individual retirement account at the same time. Actually, it is quite common to have both types of accounts. These plans share similarities in that they offer the opportunity for tax-deferred savings or Roth IRA, tax-free earnings). However, depending on your individual situation, you may or may not be eligible for tax-advantaged contributions to both of them in any given tax year.

If you have a retirement plan at work, your tax deduction for a traditional IRA may be limitedor you may not be eligible for a deduction, depending on your modified adjusted gross income .

You can, however, still make nondeductible contributions. And if your income exceeds certain thresholds, you may not be eligible to contribute to a Roth IRA at all.

Also Check: Can I Transfer My Ira To My 401k

Making Your 401 And Ira Work Together

The goal of all this is to give you the greatest opportunity to save, with the greatest flexibility. So my thought would be to first contribute enough to your 401 to capture the maximum company match. Then, if you’re eligible contribute to a tax-advantaged Health Savings Account . If your 401 has limited investment options consider opening either a traditional or a Roth IRA and contribute the annual maximum. Next, if you can, put more money in your company plan until you max it out. And if you get to the point where you can save even more , put that money in a taxable brokerage account.

The bottom line is you can’t really save too much, only too little. So use all the savings and investing vehicles available to you, including both an IRA and your 401, to save as much as you can, as early as you canand, at the same time, get the maximum tax break. You won’t regret it.

Have a personal finance question? Email us at [email protected]. Carrie cannot respond to questions directly, but your topic may be considered for a future article. For Schwab account questions and general inquiries, contact Schwab.

How To Avoid Paying Tax On Excess Contributions

You can avoid paying the 6% tax by withdrawing excess contributions, along with any earnings they’ve generated, before the due date for individual tax returns. For contributions made in 2021, that deadline is April 18, 2022. Be aware: To receive these funds by the April 18 deadline, you should ideally request them a month or more in advance.

Contact your 401 plan administrator to request a corrective distribution that includes the excess money you contributed and the interest or appreciation you earned on it. They should issue an amended W-2 with your distributed funds added to your wages for the year. If you overcontributed to an IRA, follow the same steps with your financial institution. You should receive Form 1099-R, which shows what you made on your excess contribution so you can add it to your taxable income.

Don’t Miss: How To Take A Loan From 401k

Can You Lose Money In A Roth 401 K

There are no tax consequences when you take money out of a Roth 401 when youre 59½ and you have met the five-year rule. If you need $20,000, take out the $20,000, and no taxes are due. If you take a similar distribution from a traditional 401 plan, the money you withdraw is subject to ordinary income tax.

A Roth 401another Option Worth Considering

Whether or not you choose to open an IRA, if your employer offers a Roth 401, you might also consider adding this to your retirement savings strategy. There are no income limits to participate in a Roth 401, and you can have both types of 401 at the same time. Having both doesn’t mean you can contribute more than the total annual 401 contribution limit, but you can split your contributions between the two, giving you a combination of both taxable and tax-free withdrawals come retirement time.

Read Also: Where Can I Find My 401k

Benefits And Drawbacks Of A 401

The prospect of employer matches and large contribution limits can give the 401 an edge, but it does have its limitations. For instance, companies typically place stricter restrictions around your funds. No law states they must allow hardship withdrawals, for example.

And some plans can involve hefty administration fees and fund expenses that can add up, taking a chunk out of your retirement savings. Thats why you should learn everything you need to know about 401 fees. Generally speaking, though, the larger the company, the lower the fees.

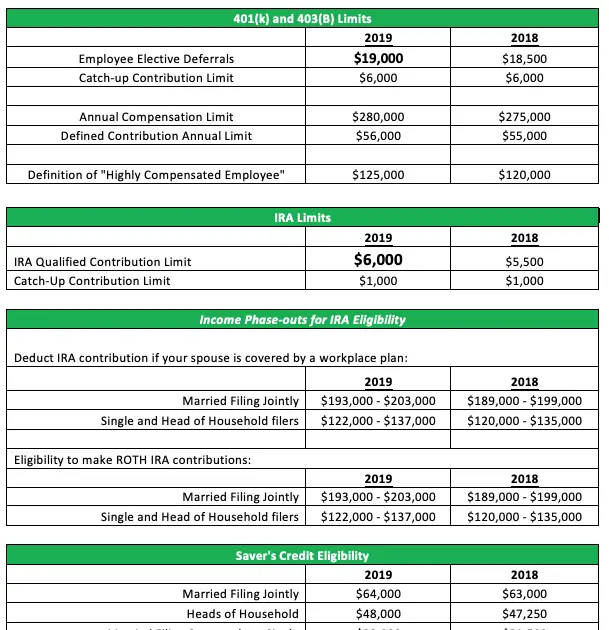

How Much Can I Contribute To My 401k And Ira In 2019

Highlights of Changes for 2019 The contribution limit for employees who participate in 401, 403, most 457 plans, and the federal government’s Thrift Savings Plan is increased from $18,500 to $19,000. The limit on annual contributions to an IRA, which last increased in 2013, is increased from $5,500 to $6,000.

Don’t Miss: How To Make A Loan From 401k

Contributing To Both Plans

It is relatively uncommon to contribute to both a 401 and a Simple IRA in the same year. An employer can only offer either a 401 or a Simple IRA. Consequently, the only way to contribute to both a 401 and a Simple IRA is if you change employers during the year. It is also possible that your employer could switch from one type of plan to another during the year, although this is unusual.

Perhaps the most common way to contribute to both a 401 and Simple IRA is if you work two jobs for two different employers at the same time. One employer may offer a 401 plan, and one employer may offer a Simple IRA plan. If you qualify for retirement benefits with both employers, you could contribute to both a Simple IRA and a 401 in the same year.

Other Retirement Account Combos

You can save to both a traditional IRA and a Roth IRA if you dont have a 401 through work, as long as your combined savings dont exceed the $6,000 or $7,000 annual limit.

It might not make sense to save to a traditional IRA and 401 in the same year, because these two kinds of accounts are designed to do the same thing. The only difference is that IRAs have much lower contribution limits than 401s.

You can save to a small business retirement plan, such as a , if you earn income from freelance or contracting work.

You May Like: How To Borrow From Fidelity 401k

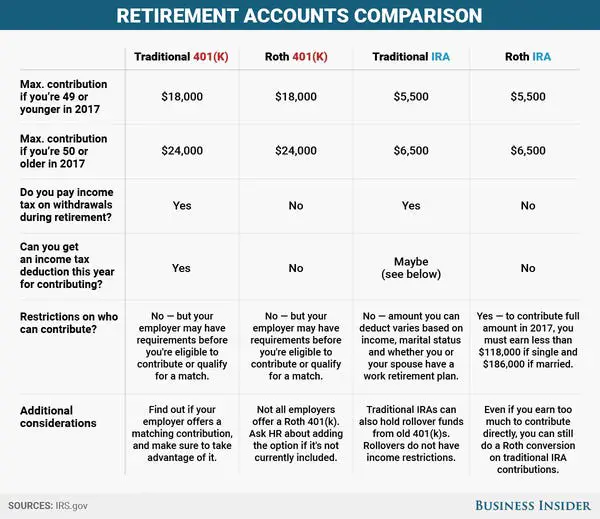

Questions About Traditional Vs Roth Plans

Even if theyre opening a personal IRA, employees might still come to you with questions about how to divide their savings strategy between two accounts. The general distinction between a traditional IRA, Roth IRA, 401 and Roth 401 lies in when their money is taxed. With a traditional 401 or IRA, no contributions or funds from interest will be taxed until the money is used during retirement. Traditional IRAs and 401s offer money the opportunity to grow tax-deferred.

Roth IRAs and Roth 401s differ in that the taxes are paid when the money is deposited in the account, but theres no tax later when the funds are withdrawn, and no tax on the earnings if the distribution is qualified. Employees can decide which type of account to contribute to by considering what they expect their tax bracket to be during retirement. Many factors, like deducting children from taxes, the end of tax credits for paying interest on a mortgage or student loans, even an increase in tax rates could mean people are in a different tax bracket after retirement, even if their income stays the same or goes down. If employees expect to be in a lower tax bracket during retirement, a traditional plan may be best, because they wont pay taxes on their contributions until they withdraw them later, when theyre taxed at a lower rate. However, if the employee expects to be in a higher tax bracket, a Roth plan in which taxes are paid now may be a better choice.

Tips For Choosing The Type Of Ira That’s Right For You

There are two types of IRAs: a traditional tax-deductible IRA and a Roth IRA. For 2022, the annual contribution limit for both is $6,000 with a $1,000 catch-up if you’re age 50-plus.

However each IRA does have an income ceiling that will determine whether one or the other is right for you.

- Traditional tax-deductible IRAFor someone who doesn’t have a 401 or similar plan, a traditional IRA is fully tax-deductible. Upfront tax deductibility plus tax-deferred growth of earnings are two of the pluses of this type of IRA. However, if you participate in an employer sponsored retirement plan such as a 401, tax deductibility is phased out at certain income levels based on your Modified Adjusted Gross Income . For tax-year 2022, the levels are $68,000-$78,000 for single filers, $109,000-$129,000 for married filing jointly.

- Roth IRAWith a Roth IRA, you don’t get any upfront tax deduction, but you do get tax-free growth plus tax-free withdrawals at age 59½ as long as you’ve held the account for five years. And there’s no restriction if you participate in an employer plan. However, there are income phase-out limits based on your MAGI that determine whether you’re eligible to open and how much you can contribute to a Roth. In 2022, the limits are $129,000-$144,000 for single filers, $204,000-$214,000 for married filing jointly.

Recommended Reading: How Much Should Go Into 401k

Ira Eligibility And Contribution Limits

The contribution limits for both traditional and Roth IRAs are $6,000 per year, plus a $1,000 catch-up contribution for those 50 and older, for both tax years 2020 and 2021. You can split your contributions between the two types, but your total contribution is still limited to $6,000 or $7,000. Traditional and Roth IRAs also have some different rules regarding your contributions

Tax Considerations For A 401 And A Roth Ira

While saving in a Roth IRA doesnt offer you any tax advantages today, the future advantages can add up.

Keep in mind how importantor nota present-day tax break from income is to your household, says Whitney. Lets say you earn $80,000 annually. If you put $15,000 into your 401, your taxable income for that calendar year then becomes just $65,000.

However, if you contribute the maximum amount to a Roth IRA, youll still report a household income of $80,000, and the money put into a Roth is never taxed again.

Imagine years of investment compounding in action, and no mandated time to withdraw the funds, nor tax upon withdrawal, she said.

Except for a few scenarioslike a first-time home purchase or college expensesthere are tax implications for Roth IRAs if funds are withdrawn within five years of the initial contribution.

Read Also: How To Roll 401k Into Another 401k

Employee Contributions To A 401

Employee contributions to a 401 plan are limited to $20,500 in 2022. Employees can have the money seamlessly deducted from their paychecks and deposited into their accounts, making it easy for employees to participate in the plan and not feel as if theyre missing the money.

If theyve opted to purchase mutual funds as part of their plan, the money will be automatically invested in those funds, according to the investment plan.

Can You Contribute To Both A 401k And A Roth Ira

You can contribute to both a Roth IRA and an employer-sponsored retirement plan, such as a 401, SEP, or SIMPLE IRA, subject to income limits. Contributing to both a Roth IRA and an employer-sponsored retirement plan can make it possible to save as much in tax-advantaged retirement accounts as the law allows.

You May Like: How To Take Out Money From My 401k

What Is A Recharacterization Of A Contribution To A Traditional Or Roth Ira

A recharacterization allows you to treat a regular contribution made to a Roth IRA or to a traditional IRA as having been made to the other type of IRA. A regular contribution is the annual contribution you’re allowed to make to a traditional or Roth IRA: up to $6,000 for 2020-2021, $7,000 if you’re 50 or older . It does not include a conversion or any other rollover.

Create A Retirement Savings Home Base

Most people from every generation are likely to have multiple jobs with multiple employers. Take people born from 1957 to 1965: They have held an average of 12 jobsand thats just one subgroup of baby boomers.1 That may mean multiple retirement savings accounts over time that need to be managed and tracked.

Heres why that matters: While a 401 is set up and typically funded in part by an employer, a traditional IRA or Roth IRA is set up and funded entirely by you. When you leave a job that has a 401, you must choose what to do with those savings. If you are leaving one job for another one with a 401, you can roll the funds over into that new savings. Or, you can roll those funds into your own IRAan option that works if youre leaving the workforce or going to another employer without its own retirement savings, too.

Thats one reason why some people prefer setting up and contributing to an IRA. It gives you a long-term account that, as you transition through employers over time, you can use to consolidate your money, says Stanley Poorman, a financial professional at Principal.

You May Like: What Happens To 401k In Divorce

How Much Can You Contribute To Retirement Accounts

For 2022, workplace retirement plans, such as a 401 or 403, allow you to contribute up to $20,500 or $27,000 if youre over age 50. If youre like Justin and max one out with cash to spare, saving more in an IRA is a smart move.

For 2022, the IRA contribution limits are much lower than workplace plans at up to $6,000 or $7,000 if youre over 50. All the limitations Ive covered apply whether you use a traditional or Roth IRA or account at work.

READ MORE:IRA Contribution Rules When You Have No Income

Can I Contribute To A 401 And Ira Account

Traditional IRAs offer the benefit of tax-deductible contributions. The money you deposit is pre-tax , and contributions grow tax-deferred so you pay tax when making qualified withdrawals in retirement.

Opting for the tax deduction these tax-deferred plans provide might appeal to you if youre in a higher tax bracket during your working years and want to minimize your tax liability now.

So, can you contribute to 401 and IRA plans at the same time? Its possible to make contributions to a 401 at work and a traditional IRA. The IRS doesnt have any rules that prevent you from making contributions to both. But there are limits on the amount of IRA contributions you can deduct in this scenario.

Specifically, a full deduction of the amount you contribute to an IRA is allowed if:

You file single or head of household and your modified adjusted gross income is $68,000 or less

Youre married and file jointly, or a qualifying widow, with an MAGI of $109,000 or less

A partial deduction is allowed for incomes over these limits, though it does eventually phase out entirely.

You May Like: Where Do I Check My 401k