You’ll Get Help Finding Your Old 401s

If you’ve changed jobs a lot, you probably know that transferring a 401 into your new employer’s plan can be a less-than-simple processand that’s probably why so many workers opt to just take the payout from a small 401 instead of going through the hassle.

But the SECURE 2.0 Act creates a new “lost and found” database you can use to find any retirement accounts you may have leftand requires that providers make it easier to move and consolidate them.

For more Real Simple news, make sure to

Read the original article on Real Simple.

Calculate Your Retirement Earnings And More

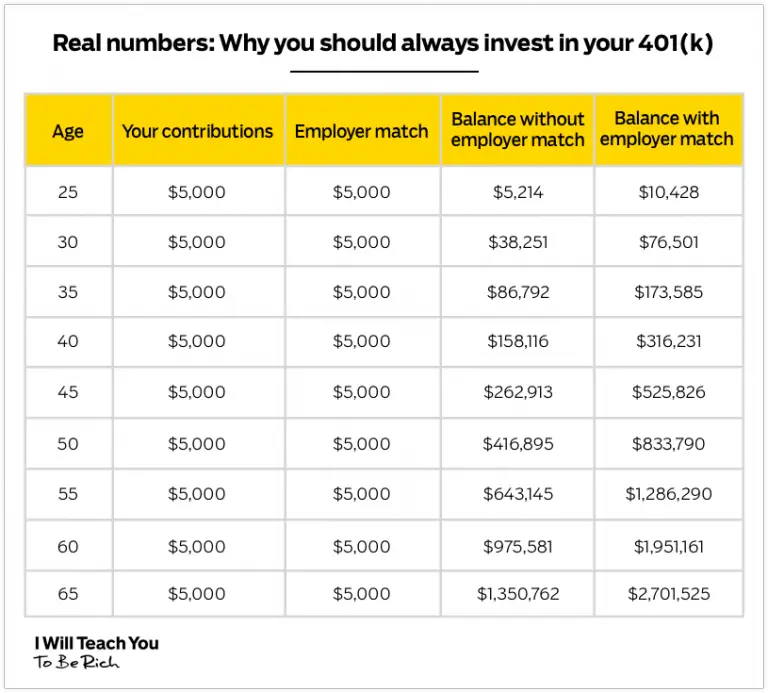

A 401 can be one of your best tools for creating a secure retirement. It provides you with two important advantages. First, all contributions and earnings to your 401 are tax deferred. You only pay taxes on contributions and earnings when the money is withdrawn. Second, many employers provide matching contributions to your 401 account which can range from 0% to 100% of your contributions. The combined result is a retirement savings plan you can not afford to pass up.

What Is The 401k Savings Potential By Age

The following chart depicts 401k savings potential by age, based on several assumptions. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

- The numbers are more forward-looking vs. backward, since the average 401k contribution limits were lower in the past.

- You start full-time employment at age 22 at a company that provides a 401k, without a company match.

- You contribute $8,000 to your 401k after the first year, then from the second year onward, you contribute the maximum annual amount of $20,500.

- The No Growth column shows what you could potentially have in your 401k after so many years of a constant $20,500-per-year contribution and no growth.

- The 8% Growth* column shows what you could potentially have in your 401k after so many years of a constant $20,500-per year contribution compounded over the next 43 years.

- The difference between the two columns emphasizes the power of growth, compounding over time. By starting early and enjoying a historically average return on 401k, at age 65, an individual could turn $869,000 of contributions into over $6.4M dollars.

You May Like: Can I Use My 401k To Buy Gold

How To Check 401k Balance

Knowing how to check how much is your 401 can help calculate your net worth. Additionally, checking your 401 balance ensures your investments are performing, helping you reach your retirement goals.

Monitoring your finances should be cemented in your overall personal finance strategy. Whether it be your budget, credit profile, or retirement accounts, knowing where you stand is essential in determining your financial health. Some, like your bank accounts and credit, are relatively easy to monitor. However, figuring out how to check 401 balances can be more difficult.

Like your car, your 401 needs regular maintenance. Without it, it may not perform as well or will no longer fit your overall investment strategy anymore.

You can find your 401 balance by logging into your 401 plans online portal and check how your 401 is performing. If you donât have access to your account online, contact your HR department and make sure your quarterly statements are being sent to the correct address.

Checking your 401 too frequently can cause overwhelm and panic when the market isn’t performing well. Dips and peaks are typical for any long-term retirement investment. Checking your 401 balances at least once a year will help you gauge how it fits in your retirement strategy.

Letâs look into how to check how much is in your 401, what to look for, and how often you should be checking.

See How Your Savings Stack Up

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

Don’t Miss: Can You Take From Your 401k To Buy A House

Tracking Down A Lost 401

It’s easy to understand why some workers might lose track of an old 401: Those born between 1957 and 1964 held an average of 12.4 jobs before the age of 54, according to the Bureau of Labor Statistics. The more accounts you acquire, the more challenging it is to keep track of them all.

Perhaps that’s why there are some 24 million forgotten 401s holding assets in excess of $1.3 trillion.1 If left unattended for too long, old accounts can be converted to cashand even transferred to the state as unclaimed propertyforgoing their future growth potential.

If you’re among those with misplaced savings, here’s how to locate and retrieve them:

How To Catch Up On Retirement Savings

If you feel like your retirement savings aren’t at the level they should be, there are tactics you can use to get caught up.

One of the most effective is to find ways to reduce your discretionary expenses or increase your income. Take the money you save or the additional money you earn and use it to beef up your retirement accounts.

Fully funding your retirement accounts by making the maximum allowable contributions in any given year will also help get you on track to a level of savings that will provide a steady stream of income when you’re finished working. The amount you can contribute will vary depending on your age and the type of account you have.

You might also consider adjusting your retirement timeline. Pushing back your retirement date not only allows you to put more on your employment income aside for retirement but also may increase the amount you receive in Social Security benefits.

Read Also: How Do I Get My Money From My 401k

Rolling Over To A New 401

The first step in transferring an old 401 to a new employer’s qualified retirement plan is to speak with the new plan sponsor, custodian, or human resources manager who assists employees with enrolling in the 401 plan. Because not every employer-sponsored plan accepts transfers from an outside 401, it is imperative for a new employee to ask if the option is available from the new employer. If the plan does not accept 401 transfers, the employee needs to select one of the three other options for the 401 account balance.

If the new employer plan accepts 401 transfers from other companies, there is often a substantial amount of paperwork that must be completed by the employee. The paperwork is provided by the new plan sponsor or human resources contact and requires the name, date of birth, address, Social Security number, and other employee identifying information.

In addition, the 401 transfer form must provide details of the old employer plan, including total amount to be transferred, investment selections held in the account, date contributions started and stopped, and contribution type, such as pre-tax or Roth. A new plan sponsor may also require an employee to establish new investment instructions for the account being transferred on the form. Once the transfer form is complete, it can be returned to the plan sponsor for processing.

A transfer from one 401 to another is a tax-free transaction, and no early withdrawal penalties are assessed.

How To Check My 401k Balance Online

Wondering How to check my 401k balance online? This article explains the steps you need to take to find out the details of your 401K, plus how to track down an old 401K that you lost or forgot about when you switched jobs.

Its a good idea to check your 401K balance at least once per year to take a closer look at how your money is being invested, how your well your retirement savings are performing, and whether you need to rebalance your portfolio.

Recommended Reading: Where Do You Get A 401k

Review Your Contribution Rate

The more you contribute to your 401, the more growth you can see. If you havent checked your contribution rate recently, it may be a good idea to calculate how much youre saving and whether you could increase it. At the very least, its a good idea to contribute enough to qualify for the full employer matching contribution if your company offers one.

As noted above, if your plan offers automatic yearly increases, take advantage of that feature. Behavioral finance studies have repeatedly shown that the more you automate your savings, the more you save.

Check On Your 401 Periodically

As mentioned, it’s essential to check how much is in your 401 throughout the year. Ideally, more than once, however, annual checks are enough.

The reason to monitor your retirement savings is to keep up with your retirement goals. For instance, as you near retirement, you may want to move your money to safer investments like bonds. Or, if one area has over-performed others, you might decide to reallocate your money to limit your exposure to one category.

Typically these drastic swings in your portfolio won’t happen that quickly. But by scheduling an annual check of your 401 balance, you’ll get a good picture of your 401 portfolio.

Tags

Also Check: How To Check If You Have Money In 401k

How To Prepare For Your Retirement

Not everyone gets the opportunity to invest in a 401 early in life. As soon as it becomes available, its best to consider taking advantage of this benefit. Knowing the average retirement account balance by age can help you make a financial plan for retirement so you have an idea of how much money you need to have saved up. Its also important to figure out your retirement budget. You can use financial calculators, such as a retirement calculator, to see what your retirement savings progress is and what your budget should look like.

As of 2022, individuals under 49 can legally contribute $20,500 per year. Those 50 or older can save an additional $6,500 as a catch-up contribution. Starting early will allow you to have more saved by the time of retirement.

Average 401k Balance At Age 45

When you hit your 50s, you become eligible to make larger contributions towards retirement accounts. These are called catch-up contributions. Make sure that you take advantage of them! Catch-up contributions are $6,500 in 2022. So if you contribute the annual limit of $20,500 plus your catch-up contribution of $6,500, thats a total of $27,000 tax-advantaged dollars you could be saving towards your retirement.

Read Also: When Can I Withdraw Money From 401k

Average 401k Balance At Age 65+ $458563 Median $132101

The most common age to retire in the U.S. is 62, so its not surprising to see the average and median 401k balance figures start to decline after age 65. Once you reach age 65, there are still several considerations for your retirement, even if you are no longer working and accumulating wealth. Some of these include making decisions about Medicare, creating a plan around withdrawing money from your retirement accounts, and evaluating any additional insurance needs.

Why Investors Need To Open And Read Their 401 Statements

Many investors approach their 401s with a set-it-and-forget-it strategy. This is not advisable as 401s are often peoples largest asset come retirement.

If you dont pay attention to how your 401 is performing, understand what youre paying in fees, or rebalance at least quarterly, you are not in control of your financial future.

Heres a breakdown of the 3 reasons you want to make it a point to open and read your 401 statements:

This last reason is critical because the three-legged stool of retirement is all but gone.

The stool once consisted of Pensions, Social Security, and Personal Savings.

Pensions, for the most part, are no longer a part of many workplaces. If you still have one, you are one of the lucky few.

The future of Social Security is uncertain. We hear daily the problems with Social Security running out of money or delaying the dates you may receive your income.

That leaves us with Personal Savings, which includes 401s. Personal Savings is the only leg remaining that people can count on to support them in retirement.

Recommended Reading: How Do I Pull Money Out Of My 401k

How Do I Find Out If I Have Retirement Funds

To find out if you have any retirement funds, the best place to start is by contacting the employer with whom you have worked in the past. Ask them if they have any record of your retirement savings.

Additionally, you can speak with the financial institution with whom you had your accounts with in the past. They should be able to inform you if they have any current or past accounts in your name. Finally, you can also reach out to the Social Security Administration in order to see if you have any past or current retirement funds.

They will be able to inform you about any retirement funds that have been processed through their office.

Contact Your 401s Administrators

Your human resources department or administrator will be able to help you check your 401 balance.

You have most likely been mailed statements of your 401 accounts yearly or quarterly unless there is a different address on file.

Speak with your representative to verify that your contact information and address are up to date to prevent future lapses in correspondences.

If your 401 plan’s administrator uses an online portal, similar to your online banking platform, they can help you get set up.

Online access to your 401 is excellent in checking your 401 balance and how your funds are performing. Some 401 platforms allow you to research the various funds, as well as reallocate your investments right on the platform.

Read Also: What To Do With Old 401k Account

A 401 Is A Defined Contribution Plan

Unlike a defined benefit plan , also known as a pension plan, which is based on formulas for determining retirement withdrawals, defined contribution plans allow their participants to choose from a variety of investment options. DCPs, 401s in particular, have been gaining in popularity as compared to DBPs. Today, the 401 defined contribution pension plan is the most popular private-market retirement plan. The shift in the choice between DBPs and DCP can be attributed to a number of reasons, one of which is the projected length of time a person is likely to stay with a company. In the past, it was more common for a person to stay with a company for several decades, which made DBPs ideal since deriving the most value out of a DBP required a person to stay with their company for 25 years or more. However, this is no longer the case today, as the workforce turnover rate is much higher. DCPs are highly mobile in comparison to DBPs, and their values do not drop when a person switches companies. When an employee with a 401 plan changes employers, they generally have the option to:

Tax On Early Distributions

If a distribution is made to you under the plan before you reach age 59½, you may have to pay a 10% additional tax on the distribution. This tax applies to the amount received that you must include in income.

Exceptions. The 10% tax will not apply if distributions before age 59 ½ are made in any of the following circumstances:

- Made to a beneficiary on or after the death of the participant,

- Made because the participant has a qualifying disability,

- Made as part of a series of substantially equal periodic payments beginning after separation from service and made at least annually for the life or life expectancy of the participant or the joint lives or life expectancies of the participant and his or her designated beneficiary. ,

- Made to a participant after separation from service if the separation occurred during or after the calendar year in which the participant reached age 55,

- Made to an alternate payee under a qualified domestic relations order ,

- Made to a participant for medical care up to the amount allowable as a medical expense deduction ,

- Timely made to reduce excess contributions,

- Timely made to reduce excess employee or matching employer contributions,

- Timely made to reduce excess elective deferrals, or

- Made because of an IRS levy on the plan.

- Made on account of certain disasters for which IRS relief has been granted.

Read Also: Is An Annuity A 401k