Loans Are Generally Repayable Over Five Years

Yes, loans are generally repayable over five years, unless you use the money for a down payment on a house. Upon receipt of funds from your 401kI know retaintaxes. Although the plan administrator often retains a 10% In terms of taxes, a higher percentage may be withheld, depending on the classification of your leveltax.

If you retain a twenty%I know will prevent you from receiving unexpected tax bills at the end of the year. Check that the appropriate tax forms reach you.

The manager of your 401k plan You must report your withdrawal of funds to I.R.S.and will send you the income forms so you can complete your tax return.

Try to avoid using the funds from your 401k plan. Try to keep your money in a retirement plan or IRA because you can receive the benefits of compound interest and have money saved for the future. Try not to withdraw money early unless absolutely necessary.

Cashing Out A : What A 401 Early Withdrawal Really Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

It’s fairly easy to put money into a 401, but getting your money out can be a different story. That is, unless youre at least 59½ years old thats when the door swings wide open for a 401 withdrawal.

But 2022’s high inflation, rising interest rates and rocky stock market might have some investors itching to cash out early. However, if you do decide to make an early 401 withdrawal before that magical age, you could pay a steep price if you dont proceed with caution.

» Dive deeper:What to do when the stock market is crashing

You Will Eventually Be Required To Take Money Out Of Your 401

If you decide not to tap into your 401 early, there will come a time when you will be forced to start taking distributions. Once you turn 72, you must take required minimum distributions . Just like you owe penalties for taking money out of your 401 early, you will owe penalties if you fail to take RMDs and leave money in your 401 too long.

Ultimately, a solid plan for retirement will show you how to use your savings and other financial tools to generate enough money to live comfortably for the rest of your life. A financial advisor can work with you to build a plan that can allow you to generate reliable income for as long as you live.

This publication is not intended as legal or tax advice. Financial Representatives do not render tax advice. Consult with a tax professional for tax advice that is specific to your situation. All investments carry some level of risk including the potential loss of all money invested.

Are you on track for retirement?

See how much monthly retirement income you may have based on what youâre saving now.

Take the next step

Our advisors will help to answer your questions â and share knowledge you never knew you needed â to get you to your next goal, and the next.

Read Also: What Is My Fidelity 401k Account Number

Other Ways To Avoid The 401 Withdrawal Penalty

The rule of 55 isnt the only way to avoid the 401 early withdrawal penalty. Other circumstances that allow you to avoid that additional 10% penalty include:

Total and permanent disability.

Medical expenses that exceed 7.5% of your adjusted gross income.

Withdrawals made because of an IRS levy plan.

Qualified disaster distributions.

Status as active duty and qualified reservist.

Additionally, Whitney points out, its possible to set up a situation where you take substantially equal periodic payments. This is sometimes called the 72t rule.

With 72t, you use IRS tables to decide how much to take each year if youre under age 59 ½, he says. You wont be stuck with the penalty, but you wont have flexibility. You have to commit to taking those withdrawals for at least five years or until youre 59 ½, whichever is greater.

With the rule of 55, you have more flexibility, Whitney says. As long as you meet the requirements, you can take as much or as little as you want from the 401 without committing to a set schedule.

Hardship Distributions From 401k Plan

If you are younger than 59 ½, youre going to have to demonstrate that you have an approved financial hardship to get money from your 401k account. And thats only if your employers retirement plan allows it. They are not required to offer hardship distributions, so the first step is to ask the Human Resources department if this is even possible.

If it is, the employer can choose which of the following IRS approved categories it will allow to qualify for hardship distribution:

- Certain medical expenses

- Certain expenses for repairs to a principal residence

The only other way to get access to your funds is to leave your employer.

Don’t Miss: How Do I Change My 401k Contribution Fidelity

Understanding The Rules For 401 Withdrawal After 59 1/2

LAST REVIEWED Apr 15 20219 MIN READ

A 401 is a type of investment account thats sponsored by employers. It lets employees contribute a portion of their salary before the IRS withholds funds for taxes, which allows interest to accumulate faster to increase the employees retirement funds. Now, if you have a 401, you could pay a penalty if you cash out your investment account before you turn 59 ½.

Heres some more information about the rules you need to follow to maximize your 401 benefits after you turn 59 ½.

Withdrawing Funds From 401 At 72

If you are age 72, you must start taking annual distributions from the 401, commonly known as required minimum distributions . You must take the first distribution by April 1 of the year you turn 72, and thereafter, you will be required to take the annual withdrawals by December 31 each year. If you delay in taking the first distribution, you must take two distributions in the same year, which will push you to a higher tax bracket. If you miss taking a mandatory distribution, the IRS imposes a 50% penalty on the amount you were required to take during the specific period.

An exemption to the RMDs is if you are still working. To qualify for this exception, you must not own 50% or more of the employerâs company. You can use this exception to delay taking the mandatory distributions until when you stop working.

Recommended Reading: Which 401k Investment Option Is Best

How To Withdraw Money From Your 401

The 401 has become a staple of retirement planning in the U.S. Millions of Americans contribute to their 401 plans with the goal of having enough money to retire comfortably when the time comes. Whether youve reached retirement age or need to tap your 401 early to pay for an unexpected expense, there are various ways to withdraw money from your employer-sponsored retirement account. A financial advisor can steer you through these decisions and help you manage your retirement savings.

Can I Deposit My 401k Into My Bank Account

Can you transfer your 401k to your bank? Once you have attained 59 ½, you can transfer funds from a 401 to your bank account without paying the 10% penalty. However, you must still pay the withdrawn amounts ordinary income .

If you have already retired, you can elect to receive monthly or periodic transfers to your bank account to help pay your living costs. An annuity can automate this process and guarantee to continue to deposit a monthly income into the bank account after the 401 has depleted its account.

Recommended Reading: How To Draw Money From 401k

How To Make An Early Withdrawal From A 401

When you have determined your eligibility and the type of withdrawal you want to make, you will need to fill out the necessary paperwork and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but when all the paperwork has been submitted, you will receive a check for the requested funds, hopefully without having to pay the 10% penalty.

Do I Pay Taxes On 401k Withdrawal After Age 62

Traditional 401 withdrawals are taxed at an individual’s current income tax rate. In general, Roth 401 withdrawals are not taxable provided the account was opened at least five years ago and the account owner is age 59½ or older. Employer matching contributions to a Roth 401 are subject to income tax.

You May Like: How Much Money Can You Put In 401k Per Year

You Can Only Withdraw From Your Current 401

Penalty-free early withdrawals are limited to funds held in your most recent companys 401 or 403 under the rule of 55.

Even if youre 55 or older, you cant reach back to old 401s and use that money, says Luber. Additionally, this rule doesnt apply to individual retirement accounts , so you need to leave your IRA alone if you want to avoid the penalty.

If youre actively planning how to retire early, Roger Whitney, certified financial planner and host of the Retirement Answer Man Show, suggests rolling retirement funds from old jobs and other retirement accounts into your current 401 before you leave. This way, you can get access to they money with the rule of 55.

The 401 Withdrawal Rules For People Older Than 59

Most 401s offer employer contributions. You can get extra money for your retirement, and you can keep this benefit after you change jobs as long as you meet any vesting requirements. Thats an important advantage that an IRA doesnt have. Stashing pre-tax cash in your 401 also allows it to grow tax-free until you take it out. Theres no limit for the number of withdrawals you can make. After you become 59 ½ years old, you can take your money out without needing to pay an early withdrawal penalty.

You can choose a traditional or a Roth 401 plan. Traditional 401s offer tax-deferred savings, but youll still have to pay taxes when you take the money out. For example, if you withdraw $15,000 from your 401 plan, youll have an additional $15,000 in taxable income that year. With a Roth 401, your contributions come from post-tax dollars. As long as youve had the account for five years, Roth 401 withdrawals are tax-free.

You May Like: How Do I Locate My 401k

Understanding Early Withdrawal From A 401

Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It really should be a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available to you.

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay regular income taxes on the withdrawn funds.

For a $10,000 withdrawal, when all taxes and penalties are paid, you will only receive approximately $6,300.

What Is A Systematic Withdrawal Plan

In a systematic withdrawal plan, you only withdraw the income created by the underlying investments in your portfolio. Because your principal remains intact, this is designed to prevent you from running out of money and may afford you the potential to grow your investments over time, while still providing retirement income. However, the amount of income you receive in any given year will vary, since it depends on market performance. Theres also the risk that the amount youre able to withdraw wont keep pace with inflation.

Potential advantages: This approach only touches the income not your principal so your portfolio maintains the potential to grow.

Potential disadvantages: You wont withdraw the same amount of money every year, and you might get outpaced by inflation.

For illustrative purposes only.

Read Also: How Do You Borrow Money From Your 401k

How Covid Retirement Plan Withdrawals Affect Your Taxes

Though you dont have to pay the 10% penalty on these withdrawals, youll still owe taxes on the money you withdraw. To make things a bit easier, though, the CARES Act allows you to spread the income over three different tax years.

For example, if you borrowed $30,000, you can apply $10,000 to your 2020 taxable income, $10,000 in 2021 and the last $10,000 in 2022. You must take at least one-third of the money in each year, though. You can also opt to take more in any year, including up to all of the money if you so choose.

If, in a later year, youve made back the money you withdrew, that is allowed. Youll have to file an amended return for any years with withdrawal money to get a refund. Again, the same rules apply for IRAs and 401s.

Take An Early Withdrawal

Perhaps youre met with an unplanned expense or an investment opportunity outside of your retirement plan. Whatever the reason for needing the money, withdrawing from your 401 before age 59.5 is an option, but consider it a last resort. Thats because early withdrawals incur a 10% penalty on top of normal income taxes.

While an early withdrawal will cost you an extra 10%, it will also diminish your 401s future returns. Consider the consequences of a 30-year-old withdrawing just $5,000 from his 401. Had the money been left in the account, it alone would have been worth over $33,000 by the time he turns 60. By withdrawing it early, the investor would forfeit the compound interest the money would accumulate in the years that follow.

Don’t Miss: How To Rollover Fidelity 401k To Vanguard

How To Withdraw Money From A 401k After Retirement

Finance Writer

During your working years, you’ve probably set aside funds in retirement accounts such as IRAs, 401s, or other workplace savings plans. Your challenge during retirement is to convert those accounts into an income stream that can continue to provide adequately throughout your retirement years.

If youre approaching the age that you want to hang your hat from working, you may be wondering how to withdraw money from your 401 after retirement. It isnt always exactly straightforward, which is why weve broken down some of the basics of using your 401. Heres what you need to know.

Wait To Withdraw Until Youre At Least 595 Years Old

If all goes according to plan, you wont need your retirement savings until you leave the workforce. By age 59.5 , you will be eligible to begin withdrawing money from your 401 without having to pay a penalty tax.

Youll simply need to contact your plan administrator or log into your account online and request a withdrawal. However, you will owe income taxes on the money , so a portion of each distribution should be designated to cover your tax liability. 401 withdrawals arent mandatory until April 1 of the year after you turn 72 , at which point you must take a required minimum distribution every year.

Also Check: What’s The Max You Can Put In 401k Per Year

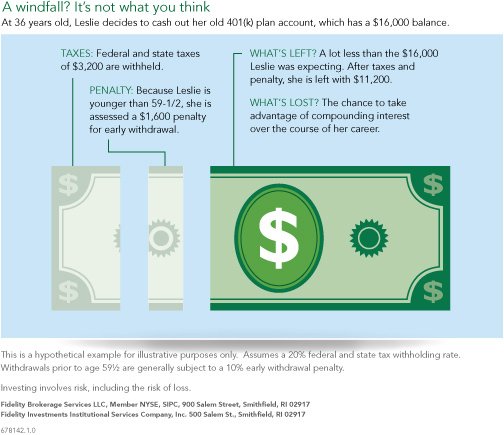

Three Consequences Of A 401 Early Withdrawal Or Cashing Out A 401

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw $10,000 from your 401 at age 40, you may get only about $8,000. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 or 10% of that $10,000 withdrawal in addition to paying ordinary income tax on that money. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

It may mean less money for your future. That may be especially true if the market is down when you make the early withdrawal. If you’re pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Scottsdale, Arizona.

Its All About Decumulation Planning

To learn more about how planning for retirement is different, read our Founder, Dana Anspachs 5-star rated book Control Your Retirement Destiny. It gives you a step-by-step outline of how to plan for a transition out of the workforce. Or check out her course, How to Plan the Perfect Retirement, on Wondrium.

You can also watch & share our short video below,Age Related 401 Plan Rules in 5 Minutes Or Less.

You May Like: How To Convert Traditional 401k To Roth Ira

Disadvantages Of Closing Your 401k

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.