How Much Can I Roll Over If Taxes Were Withheld From My Distribution

If you have not elected a direct rollover, in the case of a distribution from a retirement plan, or you have not elected out of withholding in the case of a distribution from an IRA, your plan administrator or IRA trustee will withhold taxes from your distribution. If you later roll the distribution over within 60 days, you must use other funds to make up for the amount withheld.

Example: Jordan, age 42, received a $10,000 eligible rollover distribution from her 401 plan. Her employer withheld $2,000 from her distribution.

If you roll over the full amount of any eligible rollover distribution you receive :

- Your entire distribution would be tax-free, and

- You would avoid the 10% additional tax on early distributions.

Which Types Of Distributions Can I Roll Over

IRAs: You can roll over all or part of any distribution from your IRA except:

Retirement plans: You can roll over all or part of any distribution of your retirement plan account except:

Distributions that can be rolled over are called “eligible rollover distributions.” Of course, to get a distribution from a retirement plan, you have to meet the plans conditions for a distribution, such as termination of employment.

A Rollover Or Transfer Ira May Be Right For You If You Want

Streamlined account management

Access your accountswhenever you need to, however you want. Whatever your preferences, you can securely manage and monitor your accountsalmost anytime, anywhere.

A centralized view of your investments

Whether youre saving for future education, saving for a major life event, or simply want to build your wealth over time, you can invest all your goals in one place.

Ongoing tax-deferred growth potential

Choose an option that allows you to continue to benefit from your savings tax-advantaged status and increase the growth potential of your wealth.

Additional select client benefits

As your assets with us increase, so will your benefits. All our clients enjoy a competitive list of benefits aligned to your investment tier.

You May Like: How To Check Your 401k Account

Reasons To Not Do An Ira To 401 Rollover

How Long Do I Have To Roll Over My 401 From My Old Job

If you have money sitting in a 401 with your last employer and you decide to leave the money in there, theres no time limit. You can roll those funds into an IRA or your new employers retirement plan whenever you want to.

However, if you have your old 401 money sent directly to you from your retirement plan , the IRS says you have just 60 days from the date you receive a retirement plan distribution to roll it over into another plan or an IRA. Otherwise, you will get hit with taxes and an early withdrawal penalty.

You May Like: Where Do You Check Your 401k

Read Also: How Can I See My 401k

Make Sure You Report The Rollover On Your Tax Return

You must report direct and indirect rollovers on your annual tax return. You will receive a 1099-R from your IRA brokerage. This will have the amount that you withdraw on it. Report that number on your 1040 tax return on the line labeled IRA distributions. If the amount on your IRA withdrawal and the amount you deposited into your 401 dont match then you may be subject to a 10% tax penalty on that difference.

If you have multiple retirement accounts, you can often move money between them without consequences. The most common move is to roll your 401 to an IRA, but it is possible to roll a pretax IRA to a 401. The biggest piece of advice is to check with your 401 provider to see if they will let you do an IRA to 401 rollover before starting the process. The different rules that apply to 401 and IRA accounts can be confusing. When considering a rollover of any kind, its best to work with a CERTIFIED FINANCIAL PLANNER® to make sure you are on the right track.

What Are The Benefits Of A Roth Individual Retirement Account

A major benefit of a Roth individual retirement account is that, unlike traditional IRAs, withdrawals are tax-free when you reach age 59½. You can also withdraw any contributions, but not earnings, at any time regardless of your age.

In addition, IRAs typically offer a much wider variety of investment options than most 401 plans. Also, with a Roth IRA, you dont have to take required minimum distributions when you reach age 72.

Also Check: What Is A 403b Vs 401k

You Might Want A Roth Account

If your 401 plan doesnt provide a Roth 401 option, you might choose to roll your retirement savings into a Roth IRA. Advantages of a 401-to-Roth IRA rollover include:

Avoiding Roth IRA income restrictions. Even if your annual income is above the thresholds for Roth IRA contributions, youre still allowed to roll your 401 savings into a Roth IRA. This move is commonly referred to as a backdoor Roth IRA conversion, and it can grant you the benefits of tax-free withdrawals in retirement.

No required minimum distributions . With a 401or even a traditional IRAyoure subject to RMDs, or the mandated annual withdrawals from your retirement savings once you reach age 72. Roth IRAs are free of RMDs, providing you with more control over your retirement savings.

Tax-free withdrawals in retirement. When you roll over a traditional 401 into a Roth IRA, youll probably end up paying some taxes on the amount youre converting. But these taxes may be less than what youd pay if you took regular withdrawals from a traditional 401 in retirement.

Access to additional death benefits. Because there are no lifetime distribution requirements, you can pass down your Roth IRA to your heirsalthough beneficiaries need to draw down the account within 10 years.

Henderson cautions that you must be aware of the immediate tax consequences when you roll your money from a 401 to a Roth account, however.

Get Help With Your 401 Rollover

Having an investment professional in your corner, someone who can help you find the right investments to add to your portfolio and walk you through all the ins and outs of a 401 rollover, makes this process a lot easier.

Dont have an investment professional? No worries! Our SmartVestor program can get you in touch with someone in your area to help you get started.

Also Check: How To Enroll In 401k

Understanding Reverse Ira Rollovers

Rolling the assets in an IRA account over into a 401 is sometimes referred to as a reverse rollover. Thats because its far more common, at least nowadays, to move assets in the opposite directionfrom a 401 to an IRA. This often happens when an employee leaves a job or decides they would like more investment options than a strict corporate 401 offers.

Its certainly possible to move assets between other types of retirement accounts, though. However, its important to check if your employers 401 accepts this kind of incoming transfer. Some plans do, but others do not. The IRS also provides guides as to what kinds of transfers are allowed and how to report them.

As this guidance states, you are only allowed one rollover in any 12-month period, and you must report any transaction when you submit your annual tax return for both direct and indirect rollovers. If you move assets out of your IRA to put them in your 401 or use them for another purpose, your IRA brokerage will send you a Form 1099-R that will show how much money you took out. On your 1040 tax return, report the amount on the line labeled IRA Distributions. The taxable Amount you record should be $0. Select rollover.

Though this maneuver is unusual, it can have advantages in some circumstances.

Already Have An Ira With Principal

Log in to view account information online or add to your account.

Learn more about rollover IRAs:

This document is intended to be educational in nature and is not intended to be taken as a recommendation.

Investment and insurance products are:

- Not insured by the Federal Deposit Insurance Corporation or any federal government agency.

- Not a deposit, obligation of, or guaranteed by any Bank or Banking affiliate.

- May lose value, including possible loss of the principal amount invested.

The subject matter in this communication is educational only and provided with the understanding that Principal® is not rendering legal, accounting, or tax advice. You should consult with appropriate counsel or other advisors on all matters pertaining to legal, tax, or accounting obligations and requirements.

Financial professionals are sales representatives for the member of Principal Financial Group®. They do not represent, offer, or compare products and services of other financial services organizations.

Insurance and plan administrative services provided through Principal Life Insurance Co. Securities offered through Principal Securities, Inc., 800-547-7754,member SIPC. Principal Life and Principal Securities are members of Principal Financial Group® , Des Moines, IA 50392.

Principal, Principal and symbol design, and Principal Financial Group are trademarks and service marks of Principal Financial Services, Inc., a member of the Principal Financial Group®, Des Moines, IA 50392.

Don’t Miss: Does Employer 401k Contributions Count Towards Limit

Rolling Over Your 401 To An Ira

You have the most control and the most choice if you own an IRA. IRAs typically offer a much wider array of investment options than 401s, unless you work for a company with a very high-quality planusually the big, Fortune 500 firms.

Some 401 plans only have a half dozen funds to choose from, and some companies strongly encourage participants to invest heavily in the company’s stock. Many 401 plans are also funded with variable annuity contracts that provide a layer of insurance protection for the assets in the plan at a cost to the participants that often run as much as 3% per year. IRA fees tend to run cheaper depending on which custodian and which investments you choose.

With a small handful of exceptions, IRAs allow virtually any asset, including:

If you’re willing to set up a self-directed IRA, even some alternative investments like oil and gas leases, physical property, and commodities can be purchased within these accounts.

Other Things To Keep In Mind With Your 401

Depending on the amount in your 401, you may choose to leave it in your former employers plan if they allow you to do so. But be aware that if your balance is below $5,000, your previous employer can remove you from the plan and automatically roll your funds into an IRA of their choosing. This can happen if you take too long to decide what to do with your funds, so make sure to take action sooner rather than later.

If you have a 401 with your new employer, you may also be able to just roll your old 401 into your new employers plan. Just as you would with an IRA, you can typically have your old 401 provider perform a direct transfer, which allows you to avoid paying taxes on any distributions. 401 plans also have higher annual contribution limits $20,500 for 2022, compared to $6,000 for an IRA which allows you to lower your taxable income by a greater amount.

Don’t Miss: How To Pull Money From 401k

How To Roll Over An Ira To A 401

Rolling over your 401 to an individual retirement account is common practice when starting a new job. But what about doing the opposite: moving IRA assets into a 401 plan? While not nearly as common, these reverse rollovers do exist and may be an option if youre an investor looking to merge multiple retirement accounts. When considering a rollover of any variety, it may help to work with a financial advisor who can guide you on your path to retirement.

Keeping The Current 401 Plan

If your former employer allows you to keep your funds in its 401 after you leave, this may be a good option, but only in certain situations. The primary one is if your new employer doesn’t offer a 401 or offers one that’s less substantially less advantageous. For example, if the old plan has investment options you cant get through a new plan.

Additional advantages to keeping your 401 with your former employer include:

- Maintaining performance:If your 401 plan account has done well for you, substantially outperforming the markets over time, then stick with a winner. The funds are obviously doing something right.

- Special tax advantages: If you leave your job in or after the year you reach age 55 and think you’ll start withdrawing funds before turning 59½ the withdrawals will be penalty-free.

- Legal protection: In case of bankruptcy or lawsuits, 401s are subject to protection from creditors by federal law. IRAs are less well-shielded it depends on state laws.

You might want to stick to the old plan, too, if you’re self-employed. It’s certainly the path of least resistance. But bear in mind, your investment options with the 401 are more limited than in an IRA, cumbersome as it might be to set one up.

Some things to consider when leaving a 401 at a previous employer:

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 does protect up to $1.25 million in traditional or Roth IRA assets against bankruptcy. But protection against other types of judgments varies.

Read Also: Where Can I Find My 401k Statement

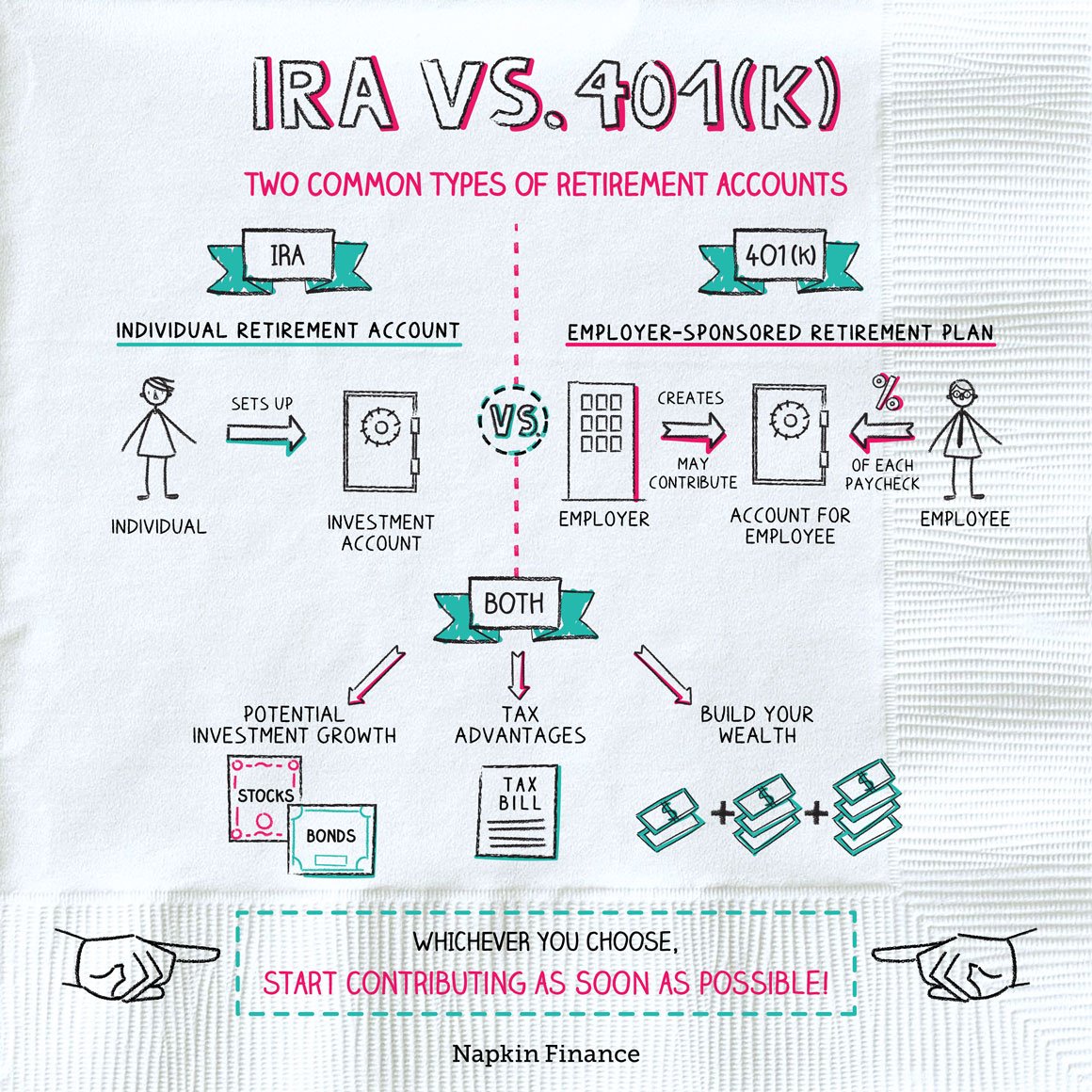

What Is A 401

A 401 is an employer-sponsored retirement plan that is only available to employees of the company offering the plan. Contributions come from your paycheck, and many companies will provide matching contributions. The company will decide the investment options, which can vary wildly depending on the employer.

There are two types of 401s: Roth and traditional.

- Roth 401: With a Roth 401, you cannot deduct contributions on your taxes, but you will be able to withdraw money tax-free in retirement.

- Traditional 401: If you have a traditional 401, you can deduct contributions on your taxes, but you’ll pay taxes on any withdrawals in retirement.

In 2022, the IRs set the maximum 401 contribution amount for employees to $20,500, and those 50 or older can contribute an extra $6,500. The limit for combined employee and employer contributions is $61,000 or $67,500 for those 50 or older.

You cannot move an existing sum of money from an IRA into a 401. You can only contribute money from your paycheck. A 401 is tied to the employer and not the individual, so when you leave the company, you usually have to move the account funds. You can choose to move it to a 401 at your new employer or an existing or new IRA.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Can I Roll Money From 401k To Roth Ira

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.