What Account Types Can Be Converted Into A Roth Ira

A Roth IRA conversion involves transferring retirement assets into a new or existing Roth IRA account. The types of accounts eligible for conversion generally fall into one of two categories.

Youll Owe Taxes But It Can Still Make Sense To Rollover

Anthony Battle is a CERTIFIED FINANCIAL PLANNER professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling and both the Retirement Income Certified Professional®, and Certified Retirement Counselor designations for advance retirement planning.

Thomas Barwick / Getty Images

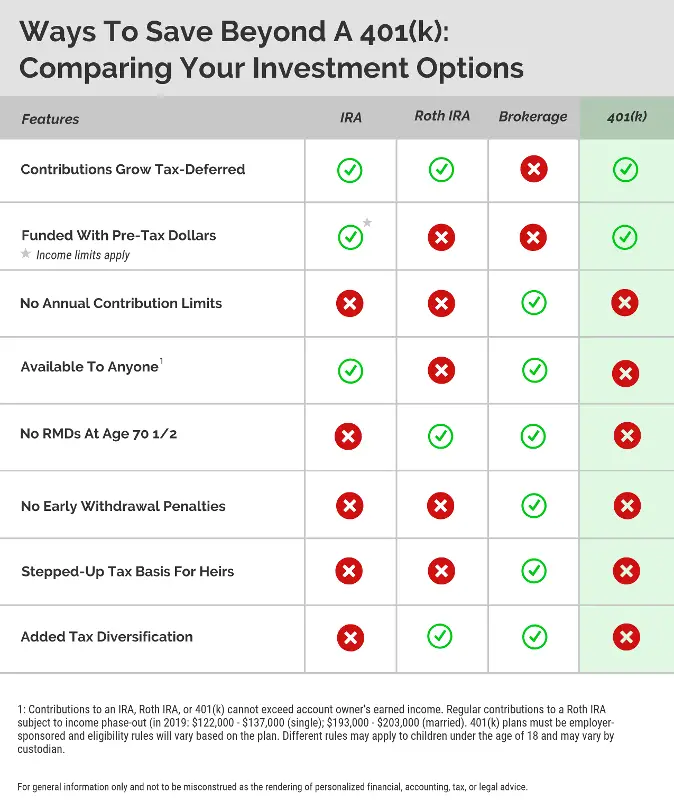

Saving for retirement is an important consideration, and 401 retirement savings plans, offered by many employers, can make it easy. But what happens if you change jobs? You can always keep your existing account, but you also have the option to transferor rolloveryour account into an individual retirement account .

There are two main types of IRAs from which to choose. Traditional IRAs let you set aside some of your income, before its taxed, just like your typical 401. Youll pay taxes later, during retirement, when you make withdrawals. By contrast, Roth IRA contributions are made from funds that have already been taxed. When you withdraw those funds during retirement, you wont be taxed again.

Depending on the type of 401 you have, rolling over to a Roth IRA may have some tax consequences. Lets take a look.

This Tax Information Is Not Intended

This tax information is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Where specific advice is necessary or appropriate, Schwab recommends that you consult with a qualified tax advisor, CPA, financial planner, or investment manager. Depending on the type of account you have, there are different rules for withdrawals, penalties, and distributions. Please understand these before opening your account.

You May Like: Should I Pay Someone To Manage My 401k

How Is The 5

When you roll over a distribution from a designated Roth account to a Roth IRA, the period that the rolled-over funds were in the designated Roth account does not count toward the 5-taxable-year period for determining qualified distributions from the Roth IRA. However, if you had contributed to any Roth IRA in a prior year, the 5-taxable-year period for determining qualified distributions from a Roth IRA is measured from the earlier contribution. So, if the earlier contribution was made more than 5 years ago and you are over 59 ½ a distribution of amounts attributable to a rollover contribution from a designated Roth account would be a qualified distribution from the Roth IRA.

You Can Raid Your Emergency Savings To Cover A Roth Ira Tax Bill

You may not have the ability to cover the taxes on a Roth IRA conversion without raiding your savings account. But Suze Orman insists it’s okay to do so.

You may be thinking, “What on earth?” After all, we’re always told to leave our emergency savings alone unless it’s an actual financial emergency — which a Roth IRA conversion is not. So doesn’t that break the rule?

The answer is yes, this does break that rule. But it’s also okay for one big reason: If needed, your Roth IRA can also serve as your emergency fund.

Because there’s no tax break on the money that goes into a Roth IRA, there’s no penalty for taking an early withdrawal as long as you’re only touching your principal contributions, not the gains portion of your account. But let’s say you need $10,000 to cover a Roth IRA conversion tax bill. Suze Orman says that if you take it out of your emergency fund and then need $10,000 in a pinch, guess what? You can tap your Roth IRA to the tune of $10,000. So all told, you’re not really in a worse financial position.

Also Check: When Can I Borrow From My 401k

Do I Have To Convert The Entire Amount In My Traditional Ira Or Qrp

No. You may convert just a portion of your assets, and there is no limit to the number of conversions. To help manage the taxes due on each conversion, you may convert smaller amounts over several years. Keep in mind, if you want to take a distribution, each conversion has its own five-year waiting period to avoid the 10% additional tax if you are under age 59 1/2.

Can I Do A Mega Backdoor Roth Does My 401 Plan Meet The Criteria

To take advantage of Mega Backdoor Roth, your employers 401 should meet these criteria.

1. Must Allow After-Tax Contributions. Your plan must allow extra voluntary after-tax contributions over the $19,000 contribution limit. The ideal scenario is if you can contribute up to the full $56,000 limit or contribute $56,000 directly to an after-tax 401, bypassing the $19,000 in traditional or Roth 401 contributions.

2. Should Allow In-Service Distributions/Conversions. Your 401 should allow so-called in-plan Roth conversions or in-service non-hardship distributions, which are a form of rollover. An in-plan conversion allows you to roll over to a Roth IRA within your employers retirement plan. Meanwhile, in service distribution or non-hardship withdrawal refers to converting contributions from your 401 to an IRA while you are still with your employer. If your employer does not allow in-service withdrawals, you can still execute on this strategy but will have to do the rollover when you leave your employer, which can result in a higher tax bill because you may have more growth.

If you have a self-employed 401 ), its also possible to implement a Mega Backdoor Roth. But you have to make sure that the plan allows after-tax contributions and provides access to in-service withdrawals.

Also Check: How Do I Find 401k From Previous Jobs

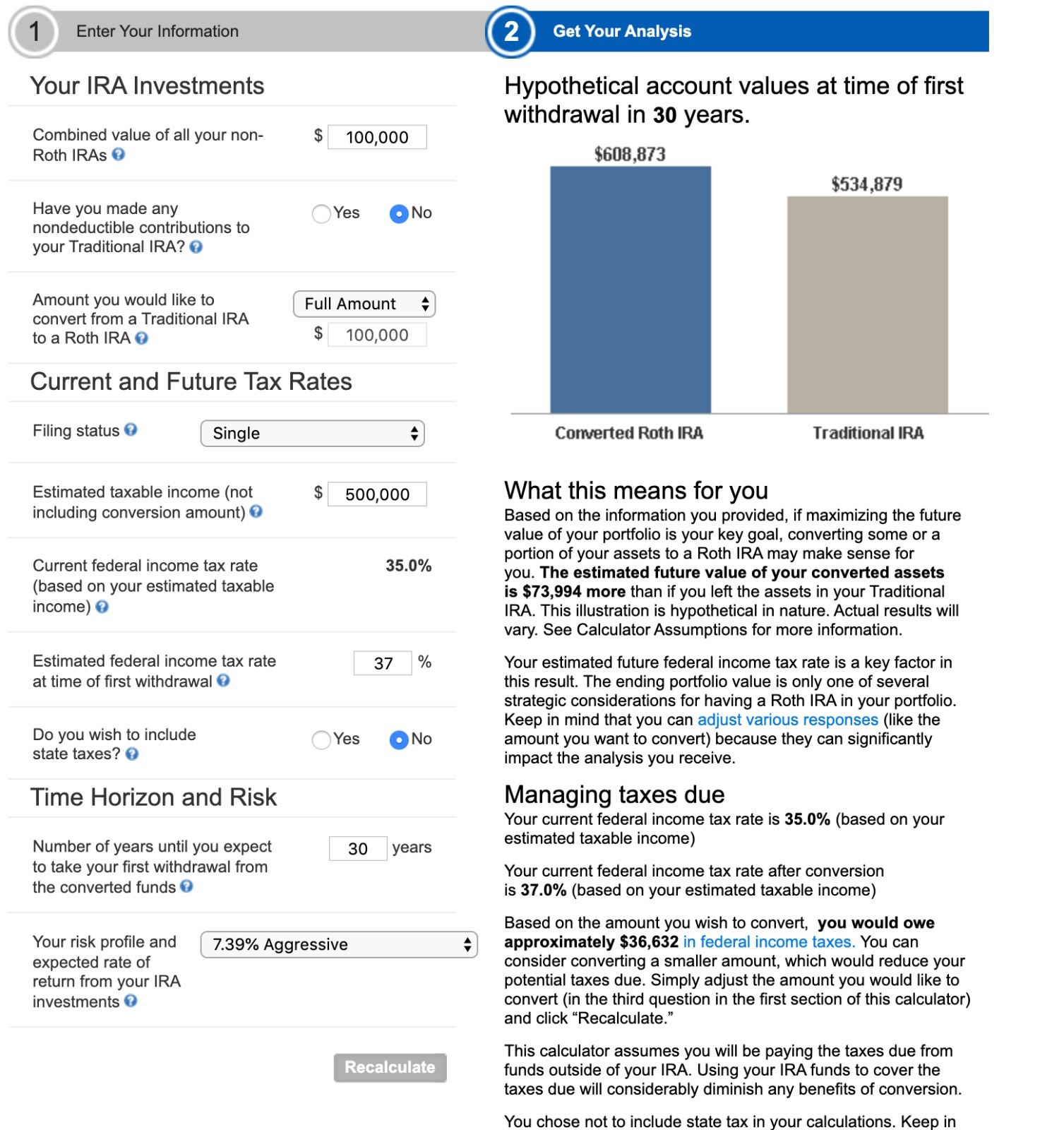

Should I Roll Over Traditional Ira Funds To A Roth

It depends on your tax situation. If you are in a lower tax bracket this year than you plan to be during retirement, a rollover may make sense. For example, if you had been furloughed or laid off due to the coronavirus pandemic, that year might be a good year to consider transferring some of your retirement funds into a Roth IRA. On the other hand, if you expect to be in a lower tax bracket during retirement, it is wise to keep your funds where they are currently.

Why Cant I Access These Converted Funds In My Roth 401 *

In most cases, pre-retirement pro-rata distribution rules apply to unqualified early distributions from a 401. If you have a Roth 401 and take an early distribution, it will most likely be a mix of taxable and nontaxable funds.

After-tax conversions work in Roth IRAs because distribution rules are ordered as follows:

Read Also: Why Is Ira Better Than 401k

Converting After Tax 401 Money To A Roth Ira

If youre in a situation where you have contributions in a 401 that are post-tax contributions, you may be able to roll those contribution amounts to a Roth IRA without paying taxes if you adhere to your plans terms and conditions per the IRS. When rolling post-tax contributions from a 401 to a Roth IRA, you want to avoid creating any taxable income, especially if youve already paid tax on those contributions previously.

In this situation, as with many financial situations that have potential tax implications, its best to consult with both a financial advisor and a taxplanner to ensure that youre making the right move for both your finances and your tax strategy. Youll also need to abide by the rules of your retirement plan as set forth by the plan and your employer.

You may be able to roll your balance from your workplace 401 and put the pre-tax contributions into a traditional IRA while directing any post-tax contributions into a Roth IRA. This option is the most straightforward and tax-savvy if your plan allows for it. The IRS allows for you to take partial withdrawals, so you can take bits and pieces from your 401 and direct them into different places, however, it is ultimately up to your retirement plan administrator if they will allow partial distributions in this manner.

Impact Of Voluntary After

Great question.

- The voluntary after-tax contribution limit is 100% of your self-employment compensation not to exceed the overall limit ) which is $58,000 for 2021 REDUCED BY any salary deferrals or profit sharing contributions made to the Solo 401k.

- The 415c limit is applied on a per employer basis .

- This means that the fact that you made employee contributions to a 401k plan sponsored by an unrelated employer you can still make for 2021 voluntary after-tax contributions up $58,000 to the Solo 401k .

Read Also: Can You Rollover Roth 401k To Roth Ira

Roth Ira Rollover Rules From 401k

As a reminder, you must generally be separated from your employer to roll your 401k into a Roth IRA. However, some employers do permit an in-service rollover, where you can do the rollover while still employed. Its permitted by the IRS, but not all employers participate.

Before January 1, 2008, you werent able to roll your 401 into a Roth IRA directly at all. If you wanted to do so you had to complete a two-step process.

However, the law changed shortly after and this option became available. Still, just because the law has made this option available doesnt mean you can definitely roll your old 401 into a Roth IRA no matter what. Unfortunately, it all depends on your plan administrator.

For example, recently I had two clients who intended to roll their old retirement plans into a Roth IRA.

One client had an old military retirement plan- Thrift Savings Plan and the other had an old state retirement plan. After helping each of them complete the required paperwork, I came across an interesting discovery.

The TSP rollover paperwork had a box you could mark if you wanted to roll over the plan into a Roth IRA . However, the state retirement plan did not give that option.

The only option was to open a traditional IRA to accept the rollover and then immediately convert it to a Roth IRA. That certainly seemed like a hassle at the time, and it definitely was.

Make Sure You Understand These Rules Before Converting Your Retirement Savings

A 401 is a smart place to keep your retirement savings, especially if your company offers a matching contribution. But as some people look toward retirement, they find the Roth IRA’s tax-free distributions more appealing. Contributing funds to a Roth IRA is always an option, but you could also do a 401 to Roth IRA conversion with your existing savings.

This lets you reclassify your 401 funds as Roth savings by paying taxes on the amount you’d like to convert. Here’s a closer look at how 401 to Roth IRA conversions work and how to decide if they’re right for you.

Read Also: What Happens To My 401k When I Switch Jobs

What Is A Mega Backdoor Roth

Mega Backdoor Roth is a strategy allowing taxpayers to get as much as $37,000 extra into their Roth IRA by rolling over after-tax contributions from a 401 plan. That number increases to $56,000 if you opt to contribute everything directly to an after-tax 401. But you can only take advantage of the Mega Backdoor Roth if your 401 plan meets certain criteria. Your plan must meet all of the criteria to take full advantage of this unique retirement savings opportunity.

The 10% Early Distribution Pentaly Question:

The 10% early distribution applies to solo 401k distributions where the participant is under age 59 1/2 at time of the distribution. The conversion of voluntary after-tax contributions to a Roth IRA or a Roth Solo 401k is not subject to the 10% early distribution penalty because the movement of the funds from the solo 401k to the Roth IRA or the Roth Solo 401k is considered a conversion not a distribution.

Recommended Reading: How To Take Your 401k Out

Watch Your Money Grow Tax

Traditional IRAs force you to take required minimum distributions every year after you reach age 72 , regardless of whether you actually need the money. So you lose the tax-free growth on the money you had to withdraw.

On the other hand, Roth IRAs dont have RMDs during your lifetime, so your money can stay in the account and keep growing tax-free.

Traditional 401s Vs Roth 401s

Employer-sponsored 401 plans are an easy, automatic tool for building toward a secure retirement. Many employers now offer two types of 401s: the traditional, tax-deferred version and the newer Roth 401.

Of all the retirement accounts available to most investors, such as 401 and 403 plans, traditional IRAs, and Roth IRAs, the traditional 401 allows you to contribute the most money and get the biggest tax break right away. For 2022, the contribution limit is $20,500 if you’re under age 50. If you’re 50 or older, you can add an extra $6,500 catch-up contribution for a total of $26,000. In 2023, the contribution limit increases to $22,500 and the catch-up contribution raises to $7,500, for a total of $30,000.

Plus, many employers will match some or all of the money you contribute. A Roth 401 offers the same convenience as a traditional 401, along with many of the benefits of a Roth IRA. And unlike a Roth IRA, there are no income limits for participating in a Roth 401. So if your income is too high for a Roth IRA, you may still be able to have the 401 version. The contribution limits on a Roth 401 are the same as those for a traditional 401: $20,500 in 2022, with the $6,500 catch-up amount, and $22,500 in 2023, with the $7,500 catch-up contribution depending on your age.

Recommended Reading: How Do You Roll A 401k Into Another

Converting A Traditional 401 To A Roth Ira

Youll owe some taxes in the year when you make the rollover because of the crucial differences between a traditional 401 and a Roth IRA:

- A traditional 401 is funded with the salary from your pretax income. It comes right off the top of your gross income. You pay no taxes on the money that you contribute or the profit that it earns until you withdraw the money, presumably after you retire. You will then owe taxes on withdrawals.

- A Roth IRA is funded with post-tax dollars. You pay the income taxes upfront before it is deposited in your account. You wont owe taxes on that money or on the profit that it earns when you withdraw it.

So, when you roll over a traditional 401 to a Roth IRA, youll owe income taxes on that money in the year when you make the switch.

The total amount transferred will be taxed at your ordinary income rate, just like your salary.Tax brackets for 2023 range from 10% to 37%, which are the same as those from 2022.

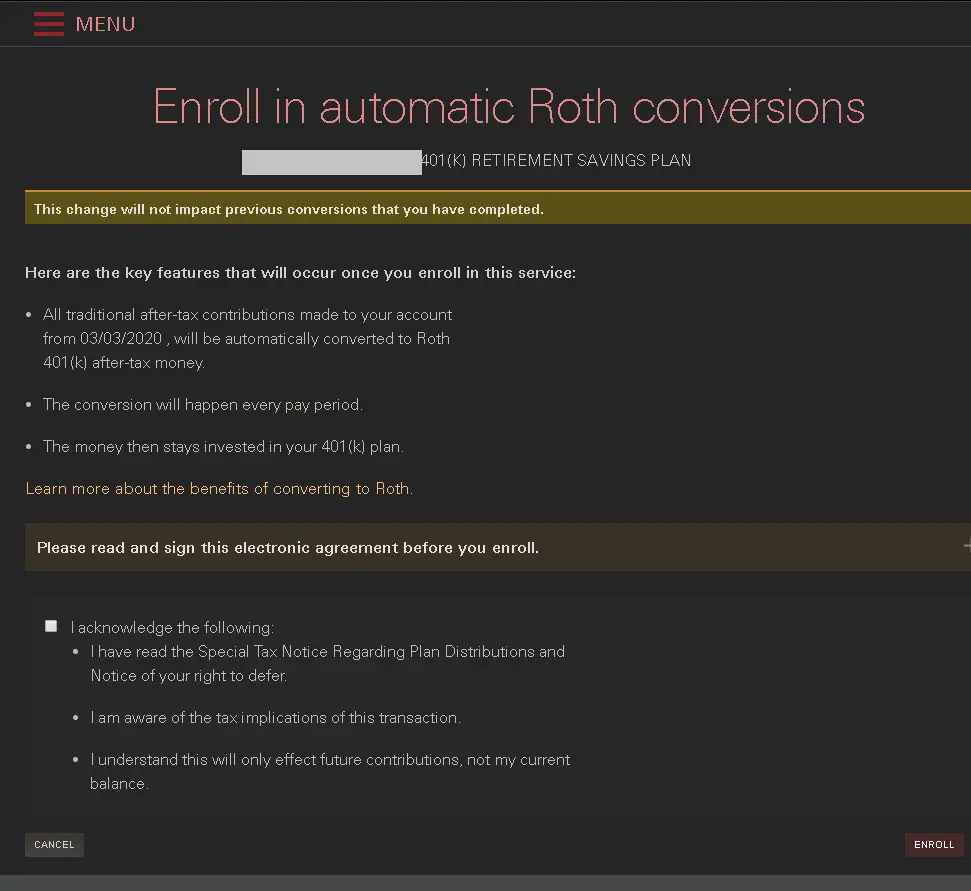

Put Contributions Into A Roth

You may be able to put your after-tax contributions into a designated Roth account to ensure tax-free withdrawals during retirement. That is, as long as you wait until age 59½ to withdraw, and you make your first contribution at least five years before then.

There are two ways you can roll after-tax contribution dollars into a Roth account:

-

In-plan conversion: If your job offers an in-plan conversion, you can convert all or some of your 401 into a Roth. You have to pay taxes on the amount you convert, but like with a Roth IRA, your withdrawals in the future would be tax-free. Some plans have an auto-convert feature that automatically converts your after-tax contributions into your Roth.

-

In-service withdrawal: If your employer offers in-service distributions or withdrawals, you can do a mega backdoor Roth. This is when you roll after-tax contributions into a Roth IRA outside of your retirement plan.

If your employer doesnt offer in-plan conversions or in-service distributions on your 401 plan, you might consider asking what your options are for withdrawing money and putting it into an IRA. Make sure to ask about the rules associated with withdrawing money from your 401 and any potential penalties.

You May Like: How To Use My 401k Money

Irs Rules About Rolling After

The financial planning and tax community wasn’t sure for many years whether after-tax funds in a company plan could legally be rolled into a Roth IRA. An IRS ruling clarified this in September 2014. The answer is a definite “Yes.” You’re permitted to roll the after-tax contributions from a qualified company retirement plan to a Roth IRA.

But there’s a catch. You must also roll over your pre-tax 401 contributions in a proportional amount based on what you’ve put into your fund. Your rollover distributions will always be 10% after-tax and 90% pre-tax if your 401 has $200,000 in it, and 10% of that includes after-tax contributions.

Roth 401 To Roth Ira Conversion

Roth 401s are essentially the same as traditional 401s, except they’re funded with after-tax dollars, like the Roth IRA, instead of pre-tax dollars. The exception to this rule is employer-matched funds. These are considered pre-tax dollars even in a Roth IRA.

Because the government taxes Roth 401 and Roth IRA contributions the same way, you can roll over Roth 401 savings to a Roth IRA without paying any taxes on your Roth 401 contributions. But if the amount you’re rolling over includes employer-matched funds, these will affect your tax bill for the year.

Also Check: What Is The Average Management Fee For A 401k