Need To Open A Roth Ira

My favorite online broker is Ally Invest but you can check out our recap on the best places to open a Roth IRA and the best online stock broker sign-up bonuses. There are many good options out there, but I have had the best overall experience with Ally Invest. No matter which option you choose the most important thing with any investment is to get started.

Roth Ira Income Limits

Anyone can contribute to a traditional IRA, but the IRS imposes an income cap on eligibility for a Roth IRA. Fundamentally, the IRS does not want high earners benefiting from these tax-advantaged accounts. In 2021 and 2022, the annual contribution limit for IRAs is $6,000 or $7,000 if you are age 50 or older.

The income caps are adjusted annually to keep up with inflation. In 2021, the phaseout range for a full annual contribution for single filers is a modified adjusted gross income ranging from $125,000 to $140,000 for a Roth IRA. For , the phaseout begins at $198,000, with an overall limit of $208,000.

In 2022, the income phase-out range for taxpayers making contributions to a Roth IRA increases to $129,000 to $144,000 for singles and heads of households. For married couples filing jointly, the income phase-out range is increased to $204,000 to $214,000.

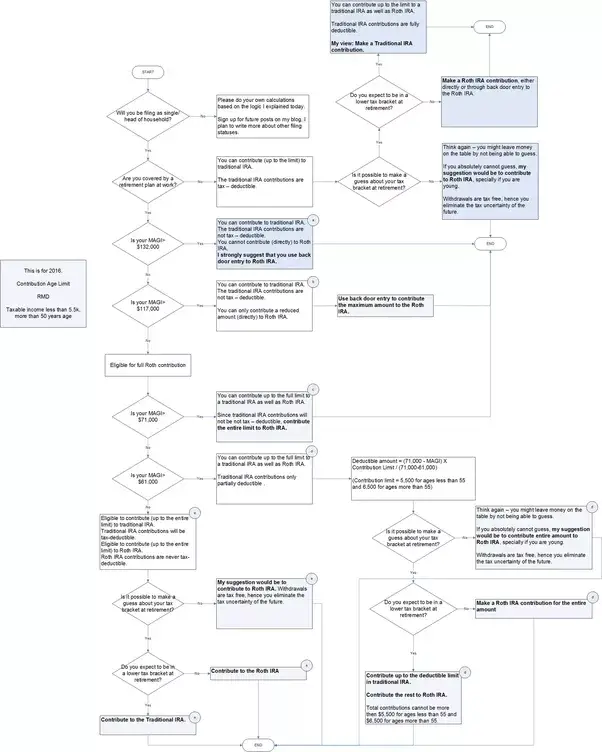

And this is why, if you have a high income, you have another reason to roll over your 401 to a Roth IRA. Roth income limitations do not apply to this type of conversion. Anyone, regardless of income, is allowed to fund a Roth IRA via a rolloverin fact, it is one of the only ways. The other way is converting a traditional IRA to a Roth IRA, also known as a backdoor conversion.

Each year, investors may choose to divide their funds across traditional and Roth IRAs, as long as their income is below the Roth limits. But the maximum allowable contribution limits remain the same.

Rolling The Assets Into An Ira Or Roth Ira

Moving your funds to an IRA is the route financial experts advise in most instances. Now youre in charge and you have more investment flexibility, said Smith. Try not to go it alone, he advises. Once you roll the money over, its you making the decisions, but getting a financial professional should be the first step.

Your first decision: whether to open a traditional IRA or a Roth.

Traditional IRA. The main benefit of a traditional IRA is that your investment is tax-deductible now you put pre-tax money into an IRA, and those contributions are not part of your taxable income. If you have a traditional 401, those contributions were also made pre-tax and the transfer is simple. The main disadvantage is that you have to pay taxes on the money and its earnings later, when you withdraw them. You are also required to take an annual minimum distribution starting at age 70½, whether if youre still working or not.

Roth IRA. Contributions to a Roth IRA are made with post-tax income money you have already paid taxes on. For that reason, when you withdraw it later neither what you contributed nor what it earned is taxable you will pay no taxes on your withdrawals. Investing in a Roth means you think the tax rates will go up later, said Rain. If you think taxes will increase before you retire, you can pay now and let the money sit. When you need it, it is tax-free, said Rain.

Also Check: How To Find Old Employer 401k

Roth Ira Rollover Rules From 401k

As a reminder, you must generally be separated from your employer to roll your 401k into a Roth IRA. However, some employers do permit an in-service rollover, where you can do the rollover while still employed. Its permitted by the IRS, but not all employers participate.

Before January 1, 2008, you werent able to roll your 401 into a Roth IRA directly at all. If you wanted to do so you had to complete a two-step process.

However, the law changed shortly after and this option became available. Still, just because the law has made this option available doesnt mean you can definitely roll your old 401 into a Roth IRA no matter what. Unfortunately, it all depends on your plan administrator.

For example, recently I had two clients who intended to roll their old retirement plans into a Roth IRA.

One client had an old military retirement plan- Thrift Savings Plan and the other had an old state retirement plan. After helping each of them complete the required paperwork, I came across an interesting discovery.

The TSP rollover paperwork had a box you could mark if you wanted to roll over the plan into a Roth IRA . However, the state retirement plan did not give that option.

The only option was to open a traditional IRA to accept the rollover and then immediately convert it to a Roth IRA. That certainly seemed like a hassle at the time, and it definitely was.

Advantages Of Rolling Over Your 401

1. You can consolidate your 401 accounts

Especially if you change jobs often, you might find yourself with many 401 accounts scattered around. The more accounts you have, the harder it may be to actively make decisions. By having your retirement funds all in one place, you may be able to manage them more carefully.

2. Youll have more investment choices in an IRA

With your 401, you are restricted to the investment and account options that are offered in that plan. An IRA can give you a more diverse option of items to invest in. In an IRA you may be able to invest in individual stocks, bonds or other vehicles that may not be available in your 401.

You cant add to the 401 at your previous employer. But if you roll this money over into a traditional IRA, you can add to that traditional IRA over time, up to the annual maximum. Youll have to follow the IRA contribution guidelines.

3. Youll have the choice to bring the account anywhere youd like

With an IRA, you can take your money with you to any advisor, if you already have a financial advisor or financial planner that you work with, for example. Or maybe you already have a brokerage where some of your money is being managed, and you want all your funds there.

Don’t Miss: What Is The Most You Can Contribute To A 401k

Rolling Into A Traditional Ira

Choosing to roll your traditional 401 to a traditional IRA preserves your tax-free money. In this case, your total account would be transferred over to an IRA and no taxes would be due until its time to withdraw. This can be a better solution if you anticipate having a lower tax rate in the future.

Roll Over Your 401 To An Ira

This option makes sense if you want to roll over your 401 and you want to avoid a taxable event. If you have an existing IRA, you may be able to consolidate all of your IRAs in one place. And an IRA gives you many investment options, including low-cost mutual funds and ETFs.

There are plenty of mutual fund companies and brokerages that offer no-load mutual funds and commission-free ETFs, says Greg McBride, CFA, Bankrate chief financial analyst.

You also want to just make sure that youre satisfying any account minimums so that you dont get dinged for an account maintenance fee for having a low balance, McBride says. Index funds will have the lowest expense ratios. So theres a way that you can really cut out a lot of the unnecessary fees.

Check with your IRA institution first to ensure that it will accept the kind of rollover that you would like to make.

The letter of the law says it is OK . But in practice, your 401 plan may not allow it, says Michael Landsberg, CPA/PFS, principal at wealth management firm Homrich Berg.

You May Like: What Does Vested Mean In 401k

Is A Distribution From My Designated Roth Account For Reasons Beyond My Control A Qualified Distribution Even Though It Doesn’t Meet The Criteria For A Qualified Distribution

No, if you have not held the account for more than 5 years or if the distribution is not made after death, disability, or age 59 ½, then the distribution is not a qualified distribution. However, you could roll the distribution over into a designated Roth account in another plan or into your Roth IRA. A transfer to another designated Roth account must be made through a direct rollover.

Roth Ira Eligibility Contribution Rules

Roth IRAs were not designed for wealthy savers. In fact, there is an income cap on Roth IRA eligibility. The IRS income rules for Roth IRAs use your adjusted gross income as a guide. Your AGI is simply the total of all your taxable income, minus certain qualified deductions such as those for medical expenses and unreimbursed business expenses.

The IRS sets an income eligibility range that tells you whether you can make:

For 2022, the AGI phase-out range for a married couple filing jointly is $204,000-$214,000. For those filing single, the range is $129,000 to $144,000.

If your income falls below the bottom of the range, you can contribute the full $6,000 to a Roth IRA. If its within the range, you are subject to contribution phase-out rules, meaning that you wont be able to contribute the full $6,000. If your income is above the top of the phase-out range, IRS rules prohibit you from contributing to a Roth IRA.

You May Like: When Can You Draw Money From 401k

If My Only Participation In A Retirement Plan Is Through Non

You can contribute to a traditional IRA regardless of whether or not you are an active participant in a plan. However, when determining whether you can deduct a contribution to a traditional IRA, the active participant rules under IRC Section 219 apply. You are an active participant if you make designated Roth contributions to a designated Roth account. As such, your ability to deduct contributions made to a traditional IRA depends on your modified adjusted gross income.

Roth 401 Vs Traditional 401

Itâs only logical when looking into Roth 401s to compare them against the traditional 401. Weâve just covered what a Roth 401 is letâs briefly go over traditional 401s.

Weâre pretty familiar with the traditional 401. Contributions are made with pre-tax dollars, which helps lower the tax burden during our working years. A more considerable amount is saved each paycheck. However, that money thatâs contributedâand its growthâwill be taxed when it is distributed during retirement. Additionally, employers can match contributions, and that amount will also be taxed when withdrawn.

Looking at Roth 401s vs. traditional 401s, the glaring difference is the tax situation. Traditional 401s arenât taxed immediately but pay taxes during retirement. Roth 401s pay taxes initially, but distributions arenât taxed during retirement.

Those choosing which one needs to decide whether they want to be taxed first or wait and be taxed during retirement.

Read Also: How Do I Access My 401k From A Previous Employer

Calculating The Tax Impact

That said, income reported on a Roth conversion increases income before credits or deductions so a Roth conversion could potentially increase taxable income and trigger various phaseouts.

An increase in taxable income is fairly easy to figure out. Take a look at the for the year in which youre converting. An increase in taxable income will cost you roughly your marginal tax rate times the conversion value.

Analyzing various phaseouts is a bit more complicated. Having more income could result in more Social Security benefits being subject to taxation, or it could trigger a phaseout or elimination of various deductions or tax credits.

The best way to figure out the impact of a Roth conversion in these various circumstances is to run a projection in your tax software to analyze the tax increase resulting from a Roth conversion.

Can My Employer Match My Designated Roth Contributions Must My Employer Allocate The Matching Contributions To A Designated Roth Account

Yes, your employer can make matching contributions on your designated Roth contributions. However, your employer can only allocate your designated Roth contributions to your designated Roth account. Your employer must allocate any contributions to match designated Roth contributions into a pre-tax account, just like matching contributions on traditional, pre-tax elective contributions.

Also Check: How To Get Money Out Of 401k Early

Is Income Tax Withholding Required On In

There is no income tax withholding required on an in-plan Roth direct rollover. However, if you receive a distribution from your plan, the plan must withhold 20% federal income tax on the untaxed amount even if you later roll over the distribution to a designated Roth account within 60 days. The IRS may waive the 60-day rollover requirement in certain situations if you missed the deadline because of circumstances beyond your control. See FAQs: Waivers of the 60-Day Rollover Requirement.

Beware 401 Balance Minimums

If your account balance is less than $5,000 and youve left the company, your former employer may require you to move it. In this case, consider rolling it over to your new employers plan or to an IRA.

If your previous 401 has a balance of less than $1,000, your employer has the option to cash out your accounts, according to FINRA.

Always keep track of your hard-earned 401 money and make sure that it is invested or maintained in an account that makes sense for you.

Don’t Miss: How To Pull From 401k

How A 401 To Roth Ira Conversion Works

Converting a 401 to a Roth IRA is essentially the same process as rolling your 401 funds over to a traditional IRA, but theres the extra step of paying taxes on your converted funds, as most 401s are taxed differently from Roth IRAs.

First, make sure youre allowed to do a 401 to Roth IRA conversion. Many companies will allow only former employees to do rollovers or conversions, but a few may permit current employees to roll some of their savings over to an IRA as well. You should also check to see whether youre allowed to roll over your 401 funds directly to a Roth IRA. Some plans permit you to roll your 401 savings only into a traditional IRA. Then you can open a Roth IRA and do your conversion.

Second, you must decide how much youd like to convert. You can convert the full value of your plan, or you may be able to convert just a portion if your plan allows it. If you cant do a partial conversion but dont want to convert everything to Roth savings, you can always roll part of your savings into a Roth IRA and the other part into a traditional IRA.

There arent any limits on how much you can convert to a Roth IRA in a single year, but most people try to keep themselves from jumping up to the next tax bracket, which we will discuss below.

Make Sure You Understand These Rules Before Converting Your Retirement Savings

A 401 is a smart place to keep your retirement savings, especially if your company offers a matching contribution. But as some people look toward retirement, they find the Roth IRA’s tax-free distributions more appealing. Contributing funds to a Roth IRA is always an option, but you could also do a 401 to Roth IRA conversion with your existing savings.

This lets you reclassify your 401 funds as Roth savings by paying taxes on the amount you’d like to convert. Here’s a closer look at how 401 to Roth IRA conversions work and how to decide if they’re right for you.

Also Check: What Is The Contribution Limit For 401k

Tax Tips: Should You Rollover Your Roth 401k Into A Roth Ira

Paul Hansen

If you have retirement funds held in the Roth 401k plan of a prioremployer , you might want to consider rolling thoseafter-tax retirement accounts directly into a Roth IRA. While there are manysimilarities to the tax-free investment growth that these accounts offer, it isimportant to understand the differences that exist before making a rollover.

Advantages

- Roth IRAs typically provide a broader selection of investment options than those offered in a Roth 401k.

- Roth IRAs do not require the original owner to take minimum annual distributions once they reach age 70½, but a Roth 401k is subject to Required Minimum Distributions even though the distributions are tax exempt

- Roth IRA earnings distributions prior to age 59½ could qualify for exemptions from the 10% premature withdrawal penalty in some circumstances that are not available for Roth 401k distributions

Disadvantage

- Roth 401k plan management fees might be lower than fees related to the management of a Roth IRA if you pay an advisor to manage the account for you.

Dont forget to consider the five-year rule!

Here are a few key points related to this five-year rule:

Paul Hansen, CPA, CFP®

Keys Unlocking Roth Ira Vs Roth 401k

Both the Roth and Traditional Solo 401k offer tax advantages when you contribute a part of or all of your self-employment salary into one of these retirement accounts. Both provide you with the ability to invest and compound the earnings as long as the funds remain in your retirement account. Nabers Group offers both types within your single Solo 401k account so that you can contribute to both each year or change your preference from one year to the next.

When you participate in a Traditional Solo 401k plan, the taxable salary that you report to the IRS is reduced by the amount that you defer to your account. This means income taxes on that money are postponed until you withdraw them from your account, usually after you retire.

When you participate in a Roth Solo 401k, the amount you contribute doesnt reduce your taxable income or your current income taxes. However, when you withdraw after you retire, the amounts you take out are tax-free, provided youre at least 59½ and your account has been open for at least five years. This means that all of the earnings you accumulate over the years are completely tax-free.

You May Like: When Can You Convert 401k To Roth Ira