How Does A 401 Work When You Retire

Over the course of your working years, you diligently contribute to your 401 in preparation for retirement. But what happens once you actually get there? In short, itâs time to switch from saving your money to generating income with your savings.

So how does a 401 work when you retire? For starters, it can be an essential source of income when you exit the workforce. But before you start withdrawing money from your 401, itâs a good idea to build a plan to create your retirement income. Hereâs what you can expect from your 401 when you retire.

Are You Still Working

You can access funds from an old 401 plan after you reach age 59 1/2, even if you haven’t retired. The best idea for old 401 accounts is to roll them over when you leave a job. If you are 59 1/2 or older, you will not be hit with penalties if you withdraw from your old accounts. However, you need to check with your human resource department about the rules around withdrawing from your current 401 if you are still in the workplace.

Check with your 401 plan administrator to find out whether your plan allows what’s referred to as an in-service distribution at age 59 1/2. Some 401 plans allow this, but others don’t.

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Also Check: How To Open Up Your Own 401k

How Long Does It Take To Cash Out A 401

While the amount of time it takes to receive money differs by plan, administrator and employer, you can often expect to wait several weeks minimum to receive your funds. Some plans may also be bound by rules that prohibit them from distributing these funds more than once a quarter or year, extending this time horizon to 30 90 days or more.

As 401 plans are highly regulated, and subject to strict governance, it can often take a considerable amount of time to ensure that proper guidelines are followed. Complete paperwork must also be in hand in order for requests to process. Noting that any funds withdrawn are unlikely to become immediately available, be sure to consult your summary plan description document to learn more about the rules of your plan, and how long it can take to receive disbursements.

Can A 401 Help You Make A Down Payment

The short answer is yes. The longer answer is yes, but

First things first your 401 is your money to use at your discretion. While it doesnt function the same way as a standard deposit account, you still have the right to access it if you choose to do so. If youre like many, your 401 is your largest financial account, and it can certainly be tempting to use these funds as the source of your down payment. However, there are some distinct drawbacks to this strategy, including penalties, taxes, and potential repayment requirements.

Typically, those who decide to use their 401 as a down payment source are first-time homebuyers who likely dont have the savings or assets to make a down payment otherwise.

If youve weighed the pros and cons and believe using the funds in your 401 is the best choice for you, you have two options for accessing your money.

- 401 Loan: In this scenario, you are simply borrowing from yourself. All funds you withdraw will have to be repaid with interest .

- 401 Withdrawal: By withdrawing money, you avoid any repayment requirements. However, you will incur a 10% penalty and be required to pay income tax on the amount withdrawn.

Lets take a deeper look into each of these options.

Also Check: How Much Can I Withdraw From My 401k

Generally The Best Move You Can Make When Your 401 Balance Drops Is To Leave Your Account Alone

While contributing a portion of every paycheck toward your employer-sponsored 401 plan is undoubtedly a smart way to save for retirement, it can be quite concerning when you see your balance drop.

First, know that this situation is completely normal. The money in your 401 is invested in the market, meaning it’s exposed to everyday fluctuations and can both gain and lose value in accordance with stock market performance.

“As investors in mainstream publicly traded equities, you are likely gaining broad exposure through your 401 and there will be periods of time where you go through declines, as we have since markets started correcting in late 2021,”Austin Winsett, certified public accountant and financial advisor at Exencial Wealth Advisors, tells Select.

Although 401 balances can experience drops, the good news is most plans are designed to protect your funds against any large losses. They’re also naturally diversified, meaning your 401 money is invested in things like mutual funds, index funds, target-date funds and exchange-traded funds versus individual stocks, so your risk is more spread out.

Our best selections in your inbox. Shopping recommendations that help upgrade your life, delivered weekly. Sign-up here.

Ways Of Finding My Old 401ks Including Using Ssn

If youâve ever left a job and wondered âWhere is my 401?â, youâre not alone. Locating 401âs is complicated. Thus, billions of dollars are left behind each year. Beagle can help track down your money.

Contributing to an employer-sponsored 401 plan is a great way to build wealth for retirement especially if youâre receiving a match from your company. The problem is they are tied to an individual employer. We forget about them, leave that company, and one day we realize âOh yeah! Where is my 401?â

A 401 can be in a few different places. Most commonly it could be with your previous employers, an IRA they transferred your funds to after you left, or mailed to the address they had on file.

Believe it or not, Americans unknowingly abandoned $100 billion worth of unclaimed 401 accounts. According to a US Labor Department study, the average worker will have had about 12 different jobs before they turn 40. So itâs easy to see how we can lose track of so much 401 money.

To find your old 401s, you can contact your former employers, locate an old 401 statement, search unclaimed asset database in different states, query 401 providers using your social security number or better yet, get some help to find your 401 accounts from companies like Beagle.

Also Check: How To Get Money Out Of 401k Without Paying Taxes

You Can Also Borrow From Your 401 But There Are Downsides

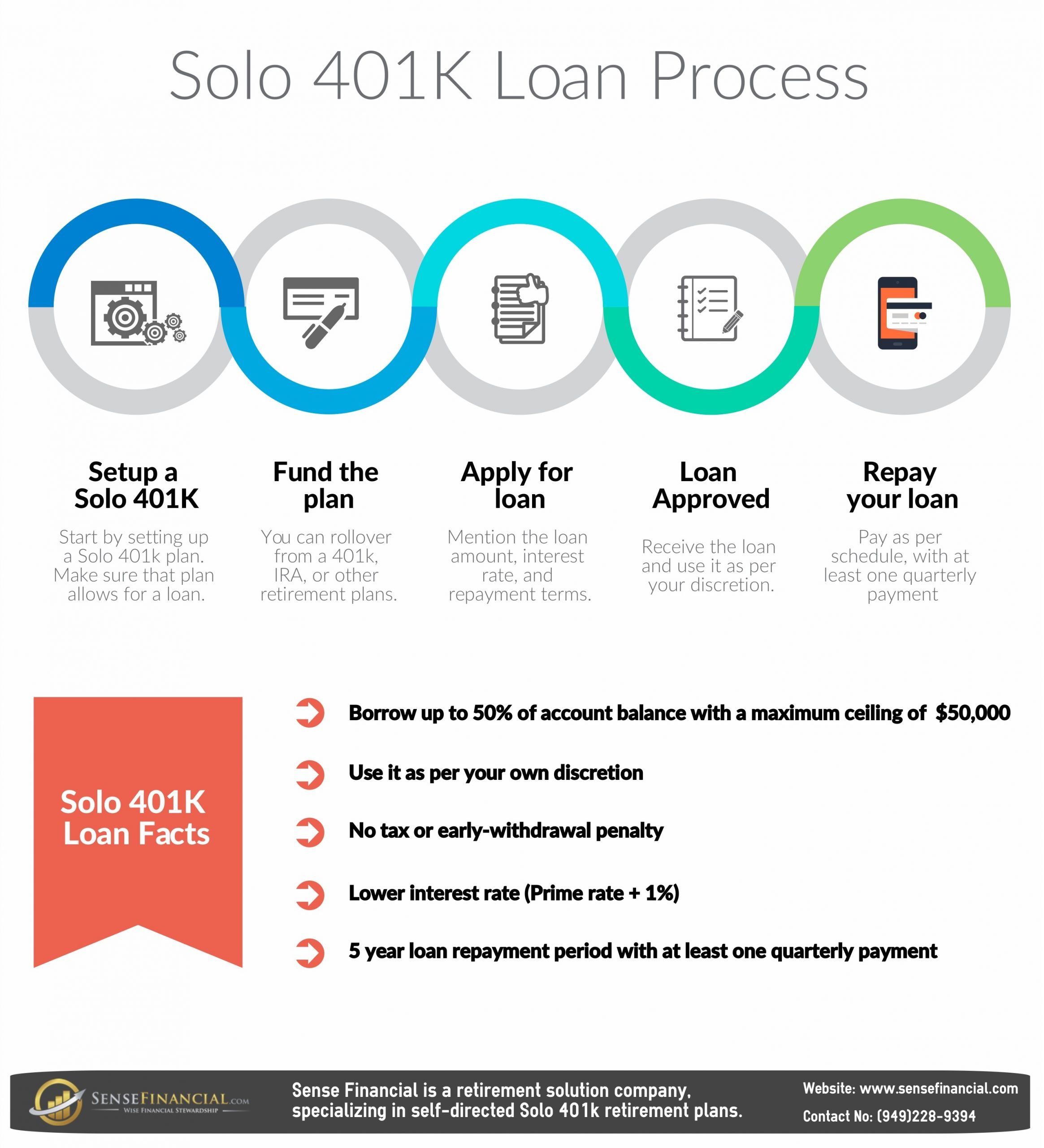

According to Quicken Loans, you can often borrow from your 401generally up to 50 percent of your vested account balance or $50,000, whichever amount is lessalthough the company advises checking with your employer or HR department to determine whether your 401 plan even allows loans.

The company also notes that youll have an allotted time for repaying the loan, which is usually within five years. Youll pay interest on the loan, which is often 2 points over the prime rate. The loan might impact your debt-to-income ratio and make it harder to get a mortgage.

However, there are upsides. Quicken Loans said, Besides allowing you to make a purchase you might otherwise not be able to make, borrowing from your 401 is basically borrowing from yourself, rather than another lender. That means that you might not be losing as much money on interest payments as you would if you got the funds via another means.

You May Like: How To Invest In A 401k Plan

The 4% Withdrawal Rule

The 4% rule says that you can withdraw 4% of your savings in the first year, and calculate subsequent yearâs withdrawals on the rate of inflation. This rule is based on the idea that you should withdraw 4% annually, and maintain the financial security in retirement for 30 years. This strategy is preferred because it is simple to compute, and gives retirees a predictable amount of income every year.

For example, if you have $1 million in retirement savings, 4% equals $40,000 in the first year. If the inflation rises by 2.5% in the second year, you should take out an additional 2.5% of the first yearâs withdrawal i.e. $1000. Therefore, the withdrawal for the second year will be $41,000.

Don’t Miss: What Is Asset Allocation In 401k

Use Balanced Funds For A Middle

A balanced fund allocates your 401 contributions across both stocks and bonds, usually in a proportion of about 60% stocks and 40% bonds. The fund is said to be “balanced” because the more conservative bonds minimize the risk of the stocks. This means that when the stock market is quickly rising, a balanced fund usually will not rise as quickly as a fund with a higher portion of stock. When the stock market is falling, expect that a balanced fund will not fall as far as funds with a higher portion of bonds.

If you dont know when you might retire, and you want a solid approach that is not too conservative and not too aggressive, choosing a fund with balanced in its name is a good choice . This type of fund, like a target-date fund, does the work for you. You can put your entire 401 plan in a balanced fund, as it automatically maintains diversification and rebalances your money over time to maintain the original stock-bond mix.

Make A 401 Withdrawal

Your second option would be to make a direct 401 withdrawal for your home purchase. As mentioned above, this is the less desirable of the two options.

An early withdrawal would be classified as a hardship withdrawal. The IRS considers any emergency removal of funds from a 401 to cover an immediate and heavy financial need as a hardship withdrawal. Whether or not the purchase of a home using your 401 counts as a hardship withdrawal is a determination that falls to your employer, and you will need to present evidence of hardship before the withdrawal can be approved.

Regardless, you will still likely incur the 10% early withdrawal penalty. There are exemptions in place for specific circumstances, including home buying expenses for a principal residence. Qualifying for such exemptions is difficult by design, however. If you possess other assets that could be used for your home purchase, then you likely wont qualify for an exemption. Even if you do, your withdrawal will still be taxed as income.

Read Also: When Can You Take 401k Out

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

|

career counseling plus loan discounts with qualifying deposit |

PromotionGet $100 when you open a new, eligible Fidelity account with $50 or more. Use code FIDELITY100. Limited time offer. Terms apply. |

Take Out A Personal Loan

Theres also the option of taking out a personal loan to help deal with a temporary setback. Personal loans arent backed by any assets, which means lenders wont easily be able to take your house or car in the event you dont pay back the loan. But because personal loans are unsecured, they can be more difficult to get and the amount you can borrow will depend on variables such as your credit score and your income level.

If you think a personal loan is your best option, it may be a good idea to apply for one with a bank or credit union where you have an existing account. Youre more likely to get the loan from an institution that knows you and they might even give you some flexibility in the event you miss a payment.

Don’t Miss: Can You Do Your Own 401k

A 401 Is One Source Of Retirement Income

Remember that a 401 on its own is not a retirement income plan. While itâs certainly a smart way to save for your future and plays an integral part in building your nest egg, a 401 is just one source of income in retirement.

A plan to create income in retirement will certainly take your 401 into consideration. But it should also include income withdrawals from other accounts like IRAs, Roth IRAs, investments, cash value built up within a whole life insurance policy and cash reserves. Your retirement plan will also include income from Social Security, and may include income from annuities and pensions. By having multiple streams of income, you can more efficiently generate retirement income by strategically leaning on different sources at different times. This approach can help you minimize taxes while balancing the need to grow your investments and generate reliable income that will last through your retirement.

How To Use Your 401 Fund Your New Business

If your business requires less than $50,000 to start and you have a solid repayment plan, borrowing your businesss startup funds from your 401 may prove a viable option.

Borrowing money from your 401 to start a business may be a useful and effective option, as long as you understand the risks and implement a repayment plan.

Considering using your 401 to start a business? According to Fidelity Investments, the average retirement account balance is at an all-time high, and the number of 401 millionaires continues to grow. Thats a lot of cash invested in the markets. For some entrepreneurs, financing a business launch is an equally savvy way to grow those retirement dollars.

Depending on the amount of money youve put aside and the amount you need, there are two ways to leverage your retirement savings and bootstrap your business.

Borrowing from your 401 may be the answer if:

Read Also: Should I Convert My 401k To Roth

How Much Tax Do You Pay On 401k Withdrawal

There is a mandatory withholding of 20% of a 401 withdrawal to cover federal income tax, whether you will ultimately owe 20% of your income or not. Rolling over the portion of your 401 that you would like to withdraw into an IRA is a way to access the funds without being subject to that 20% mandatory withdrawal.

Halt Your Credit Card Spending

Consider restricting your credit card spending. If credit card debt is your biggest stressor, cut up or hide your cards to avoid shopping temptations. Check in on your financial goals by downloading our app for quick updates on the fly. We send out weekly updates to see where you are with your financial goals.

Don’t Miss: How Can You Check Your 401k

Traditional Ira Vs Roth Ira

Like traditional 401 distributions, withdrawals from a traditional IRA are subject to your normal income tax rate in the year when you take the distribution.

Withdrawals from Roth IRAs, on the other hand, are completely tax free if they are taken after you reach age 59½ . However, if you decide to roll over the assets in a traditional 401 to a Roth IRA, you will owe income tax on the full amount of the rolloverwith Roth IRAs, you pay taxes up front.

Traditional IRAs are subject to the same RMD regulations as 401s and other employer-sponsored retirement plans. However, there is no RMD requirement for a Roth IRA.

Benefits Of Borrowing From Your 401k To Buy A Home

The great thing about 401k loans is that they dont count towards your . Using a 401k loan to finance your down payment can put you in a more favorable position for financing your mortgage. And, these loans are not reported to the credit bureaus, so they dont impact your credit score. It can also be beneficial to borrow from your 401k as a first time home buyer in order to make a higher down payment, especially in a competitive . That said, you should consider the monthly payments on your 401k loan along with your monthly mortgage payment to ensure that these payments are within your budget.

You May Like: What Investment Is Better Than 401k

Transfer Balances To A Low

If high-interest payments are diminishing your budget, transfer them to a low-interest account. Compare your current debt interest rates to other competitors. Sift through their fine print to spot any red flags. Credit card companies may hide variable interest rates or fees that drive up the cost. Find a transfer card that works for you, contact the company to apply, and transfer over your balances.