Example : A Recent Retiree

Sarah is retiring at age 65 after a long career. She has $250,000 in her employers 401 plan and now must decide whether to keep the money there or roll it over into an IRA. She likes the hybrid mutual fund in which her savings are currently invested, so if she does roll the money over, she wants to put it in the same mutual fund. However, the funds fees in the 401 plan are much lower than in the IRAeven though it is the same fund. For Sarah, the question is whether the difference in fees matters for her retirement security. Here are details that she should consider:

- Total savings: $250,000

- Mutual fund assumed real rate of return: 5% per year

- Time invested: 25 years

- Withdrawals: Sarah would like to withdraw $1,000 each month to supplement her Social Security benefits

- The mutual fund charges an annual fee of 0.46% if the money is held in the 401 plan, but the fee is 0.65% if the money is in an IRA. There are no front or deferred sales charges .

With these inputs, the difference in fees and projected account balance between the 401 plan and the IRA can be calculated. Here are the results:

| Mutual fund in 401 plan | Mutual fund in IRA |

|---|---|

| Total fees over 25 years: $27,233 | Total fees over 25 years: $37,091 |

| Account balance at age 90: $217,553 | Account balance at age 90: $197,040 |

In summary, rolling over her savings to the mutual fund with the higher fee would result in $20,513 less in savings after 25 yearsa significant loss for a person living on a fixed income.

The History Of 401 Plans

The tax code changed in 1978, unintentionally prompting the creation of the 401 savings plan that has largely supplanted company-funded pensions. Intended to clarify the legal status of some extremely wealthy investors existing saving plans, this minor rule adjustment sparked a decade-long financial industry and market boom in the 1990s.

Since the 1980s, when the 401 plan was established in a single financial institution, these plans have evolved into a government-sponsored private investment intended to help employees save for retirement in order to augment their Social Security income. In the first six years of the program, several hundred thousand businesses provided plans as an incentive to their staff. These savings accounts were offered as an option benefit to individuals of all sorts of professions throughout the 1990s.

In 1988, following a series of legislative actions designed to boost participation rates in 401 plans among US workers, the Congress passed a legislation that made employee contributions the default option for all firms offering such programs. Employees wanting to opt out of making 401 contributions have been required to fill out a form stating their wish to do so.

Reasons for Supplemental Retirement Savings

Social Security benefits, in combination with Medicare and Medicaid, are generally not considered adequate alone for sustaining one above the poverty level in retirement.

Inadequacy of Social Security Coverage

Medicare and Medicaid

IRA Plans

Plan Assets And Average Account Balance

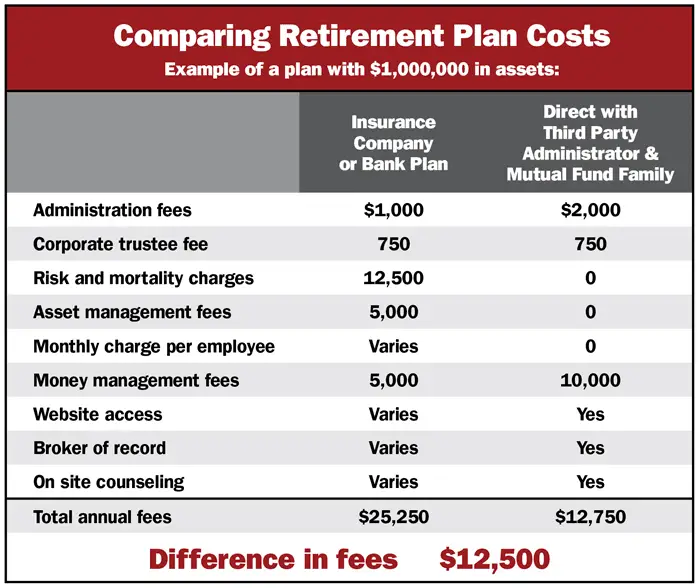

These two items are generally the most significant demographic factors that impact 401 plan pricing because they affect both the costs of providing services and provider revenue.

For example, lets say a plan has $5 million in assets and 200 participants, with an average per participant balance of $25,000. From this cost perspective, the provider will have to keep records of participant files, process phone calls, and provide communication materials for 200 participants.

In the 1980s and 1990s, many 401 provider pricing structures were inversely proportional to the number of plan participants. In an effort to build market share, many providers offered lower pricing to plan sponsors with more employees, regardless of plan size or average account balance.

This led more than 100 providers to exit the 401 recordkeeping business. Recently, providers have begun to consider the costs associated with each 401 plan participant and price accordingly. This change has driven many providers to offer revenue per participant pricing models that are based on plan assets and average account balances.

If plan sponsors pursue this type of pricing model with their current/potential providers, then the providers typically convert the revenue to an asset-based fee once the revenue per participant is negotiated. This asset-based fee may either be built into the investment expense or charged against the assets, in addition to the investment expense.

Read Also: Which 401k Plan Is Best For Me

Being Proactive: How To Protect Yourself From High 401 Fees

Figuring out exactly how many fees and what types of fees you are paying for your 401 plan can get complicated, especially when statement disclosures can range from a short summary to dozens of pages. You may have to do a little homeworkand it may require some timebut its critical to your long-term goals to know exactly how much youre paying.

-

Tip: Start by seeing if you can identify any conversion-related charges, plan administration costs, investment product fees, or service provider charges. The DOL provides some useful examples of 401 plan fee disclosure forms, along with videos, charts, and other resources that you may find helpful.

Youll be able to make better retirement savings decisions if youre well informed about the 401 fees youre paying. However, if you still think youre overpaying, you can investigate whether your plan has a low-fee fund optionor ask your employer to include more low-cost investment options.

Small Business 401 Plan Fees

Small businesses are overlooked in the 401 industry and charged higher fees because they have fewer employee participants and smaller account balances. At Ubiquity Retirement + Savings, helping small businesses with affordable retirement plans is all we do. Ubiquity was the first in the industry to offer small businesses a flat fee retirement plan. We also offer a diverse group of investments for you to choose from. Our goal is to help small business start and maintain 401 plans in a way that saves time and money, so employers and employees can grow their retirement savings.

You May Like: Can You Rollover A Pension Into A 401k

What Fees Are There In A 401 Plan

Typically, 401 plans have three types of fees: Investment fees, administrative fees, and fiduciary and consulting fees. Some of these 401 fees are charged at a plan level for the management and administration of a plan, while others are related to the investments made by employees within the plan. Sometimes, the fees paid in a 401 are taken directly from plan assets by your service provider and then paid out to the various vendors working on the plan. In other cases, the investments themselves will carry fees, which are taken out of the money invested in that specific investment. All together, fees in a 401 plan can go to many places, including:

Investment Managers, who oversee the investments in a fund Administrators, who handle things like the transfer of assets in and out of a fund Recordkeepers, who keep detailed records of a 401 plans transactions Lawyers, who draft legal documents and oversee regulatory compliance Accountants, who may perform audits of a 401 plans activities The Government, which collects any applicable taxes related to a funds activities.

Fees Paid By The Employee

Employees enrolled in the employerâs 401 plan can be charged any of the three types of 401 fees. However, the main types of fees that employees pay include investment fees and administrative fees. Also, where the employer does not cover fiduciary and consulting fees charged by 401 specialized advisors, these costs will be passed on to the employee.

Employees will also be subject to the 12b-1 fee, which derives its name from the Investment Company Act of 1940. This fee is charged by mutual funds, and it pays for the cost of marketing and distributing mutual funds, and to compensate salespeople for bringing in new clients into the retirement plan. As more investors join the retirement plan, there will be more money to invest into the mutual fund, and this will reduce the operating costs per investor. The 12b-1 fee ranges from 0.25% to 0.75%.

You May Like: Can I Use My 401k To Start A Business

Evaluate Your Admin Fees On A Per

After you have calculated your all-in fee, we recommend you take a quick look at your Fidelity administration fees on a per-capita basis.

The reason?

Excess administration fees basically, fees that outstretch your 401 providers level of service might not be readily apparent if theyre solely evaluated on an all-in basis with investment expenses. This is especially true if your plan has lots of assets.

To demonstrate the value of this evaluation, consider a $1,625,825.48 401 plan with only 7 participants from our 2018 small business 401 fee study. While its $25,611.64 all-in fee was only a bit above the studys 1.40% average, its $2,521.81 per capita administration fee was about six times average!

To calculate your per-capita administration fees, simply divide the administration fee total from your spreadsheet by the number of participants in your plan. For our 13-participant example, this number is $637.83 quite a bit higher than what participants could be paying with a low-cost 401 provider.

Heres How Much 401 Plan Fees Have Dropped

For both small and large retirement plans, average total plan costs for 401s continued to decline in 2021, with plan investment fees leading the way, according to the latest edition of the 401k Averages Book.

The 22nd edition of the book shows that all scenarios saw a year-over-year decrease in total investment costs ranging between 0.01%0.06% from the previous year, with the average representing a decrease of 0.03%.

Not surprisingly, smaller plans are still paying slightly more in fees than larger plans. According to the data, the smallest plans with $5 million in assets costs 1.19%, while the average cost for plans with $50 million in assets is 0.88%.

The data is through Sept. 30, 2021. Among the key findings in the new edition:

For years there has been an increased awareness around the impact 401 fees have on long-term savings. The trend in lower fees shows that employers and their advisors have been working to reduce the drag caused by these fees, Joseph Valletta, author of the 401k Averages Book, said in a statement.

Published since 1995, the 22nd edition of the 401k Averages Book is available for $95 and can be purchased by calling 888-401-3089 or online at www.401ksource.com.

You May Like: How Does Retirement Work With 401k

How To Avoid 401 Fees

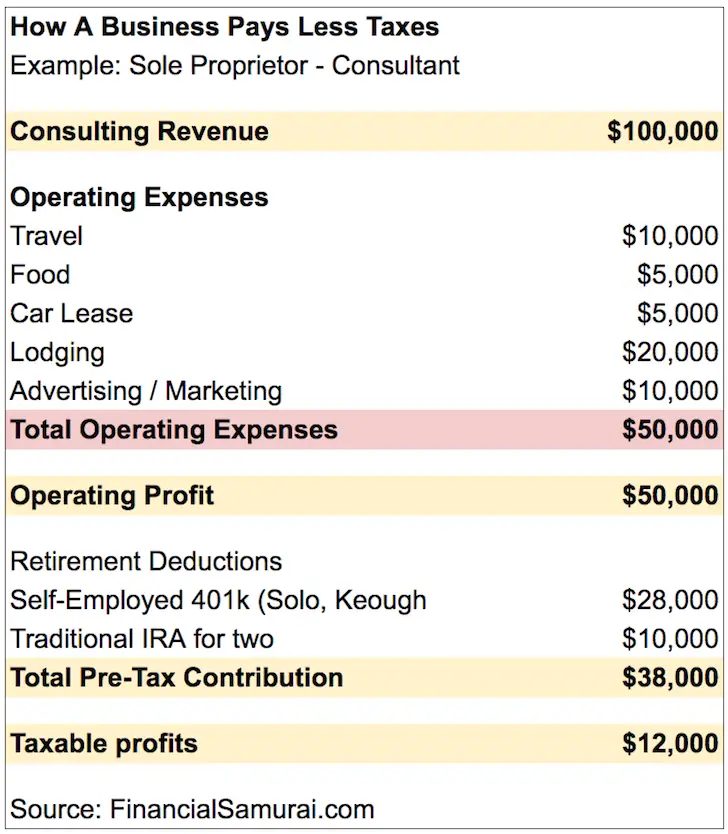

It is very difficult to avoid any 401 fees once youve decided to invest because the fees are charged by the plan and plan provider, neither of which you control or can change. You could potentially save money if you get a choice in what funds to invest in. Some funds require additional fees that you can void altogether by investing in other assets.

The only other option to avoid 401 fees is to not invest in your companys provided 401 program. You could instead invest into other retirement accounts where you have more control over who you work with and can choose what fees youre willing to pay that way. However, the amount you can contribute annually into an individual retirement account is much less than you would be able to through a 401.

Plus, you could be missing out on any contributions that your employer agrees to make when you invest in their 401 program. Receiving contributions from your employer might make paying the fees worth it when you consider all the money flowing in and out of your account.

What Are Different Types Of Fees

There are a variety of fees associated with investing. The types below are among the most common, but you might see other fees not listed here based on the products you have and where you are invested.

Operating fees are paid to the fund company for work done on behalf of shareholders, such as buying and selling shares within the fund.

Account fees typically cover the administrative costs to maintain your account and offer services such as record-keeping, statement preparation and online account access. You pay account fees when you open or enroll in certain types of investment accounts, including 401s or similar workplace retirement plans. Account fees may be a flat fee deducted from your account value or a percentage of your total return. They are separate from operating fees charged by a mutual fund.

Think of it this way: You pay operating fees for each of the mutual funds you hold in your retirement savings account, then you pay an account fee on the total value of all the investments.

You may not be able to control operating and accounts fees, but you can comparison shop based on fees .

Transaction fees are paid directly to a broker/dealer for services when you buy or sell a fund. They can include flat fees for things such as the cost of mailing a check, trade execution, overdrafts, debit card transactions and more. They are more common when you have an individual investment outside of a retirement plan.

You May Like: Can I Rollover My 401k To An Annuity

Common 401 Management Errors To Avoid

Cashing Out Too Soon

The worst thing you can do with an existing IRA is to withdraw funds before retirement. This is the final option for these savings, as they are difficult to replace later in your career. At all costs, you should avoid taking this path.

Investing Too Little to Get Maximum Matching Funds

The IRS has some of the most stringent requirements in terms of what you must do to qualify for their matching funds, but many firms have far more stringent standards. One typical error is not saving enough money, which lowers or eliminates your employers contribution amount.

Before you sign on, double-check the firms withdrawal criteria. This policy should be clearly stated in your strategy if it is not, ask for clarification. If you have made a mistake and do not realize it, act swiftly to correct it.

Taking 401 Loans

In a difficult job climate, it can be nearly as bad to take loans on your 401 as simply cashing it out and reinvesting elsewhere. The restrictions on what you are allowed to withdraw funds for can be exacting. In addition to the amount of principal removed from your account, there is an interest rate that you will be responsible for paying back.

Investing Too Aggressively

The majority of 401 plan losses in 2008 were caused by aggressive investing. When several plans fell at the same time, some investors focused on unsecured debt or junk bonds, which made them fall even more.

Rolling Over Into IRA Savings

Want To Ask Your Employer For A Lower

Here at Human Interest, our HI advisory fee is on average 0.50%2, and employers can choose to cover most of that. We offer access to nearly every mutual fund and index fund on the market, including low-cost funds from Vanguard, Dimensional Fund Advisors, BlackRock, Charles Schwab, and more. In fact, the average fund fee for our model portfolios is 0.07%, for a total average fee of 0.57%. By offering lower charges than the average 401 fees, expenses, and other costs, we can help plan participants such as yourself maximize your retirement savings.

If your companys 401 provider is charging high fees or doesnt offer low-cost funds, tell your HR manager about Human Interests investment policy were committed to making retirement possible for everyone. Get in touch with our helpful representatives to find out more about our 401 services.

Article By

Anisha Sekar

Anisha Sekar has written for U.S. News and Marketwatch, and her work has been cited in Time, Marketplace, CNN and more. A personal finance enthusiast, she led NerdWallet’s credit and debit card business, and currently writes about everything from getting out of debt to choosing the best health insurance plan.

You May Like: How Much Does 401k Cost Employers

Expense Ratios: What Are Average 401 Fund Fees

Okay, lets say this plainly: when it comes to 401 fees, a lot of participants are paying way too much. And one of the biggest reasons for this is because, for many plans the 401 expense ratios are way too high.

But if youre reading this post today, you might be wondering: what the heck is a 401 expense ratio? What are participants paying on average, how does my plan stack up, and what can be done to lower these fees?

If you find yourself asking any of these questions, not to worry – youve come to the right place!

In this post, well quickly break down what 401 expense ratios are and why they matter. Then well walk you through the latest data on average fund fees, and end with insider tips sourced from industry experts on how you can lower fund fees for your plan.

Ready to get started? Lets jump right in!

How Can I Find Out How Much Im Paying In Retirement Plan Fees

Since 2012, the Department of Labor has required investors to be provided with an annual disclosure of the fees they pay for their retirement plans. However, it can still be quite tricky to find out how much youre paying in fees, Ventre says.

To figure that out, first head to your plan website and look for a document called the participant fee disclosure, or Form 404 DOL. That form will show the expense ratios for all the funds your plan offers as well as the performance of those funds.

If you cant find it on the website, call and ask them for a copy and to explain it to you, says Ventre. You should feel empowered to ask the plan manager questions or go to your HR department to ask for help.

Also Check: What Percentage Should I Put In My 401k

Stay With Your Current 401 Service Provider Or Choose A New One

The last step of this process is to review your findings and decide whether or not the fees in your plan are reasonable. Its critical to document not only the direct cost-to-cost comparison between your plan and others, but also what you perceive about your plans service level and how it stacks up. If you get the sense that youre paying too much for the service youre receiving, document that notion and then seek out proposals from other providers to see if you can find either better service or a better price.