Types Of Retirement Accounts: Iras And 401s

We can help. By learning about your options, you can choose the type of savings account thats right for your life, now and in the future.

Lets start with the two most common ways to saveIndividual Retirement Accounts and 401 accounts. Well break down the similarities and differences between traditional 401s and traditional IRAs, then share details around Roth IRAs and Roth 401s, giving you a basic understanding of each.

Also Check: Can I Use My 401k To Purchase A House

How Do Distributions Work

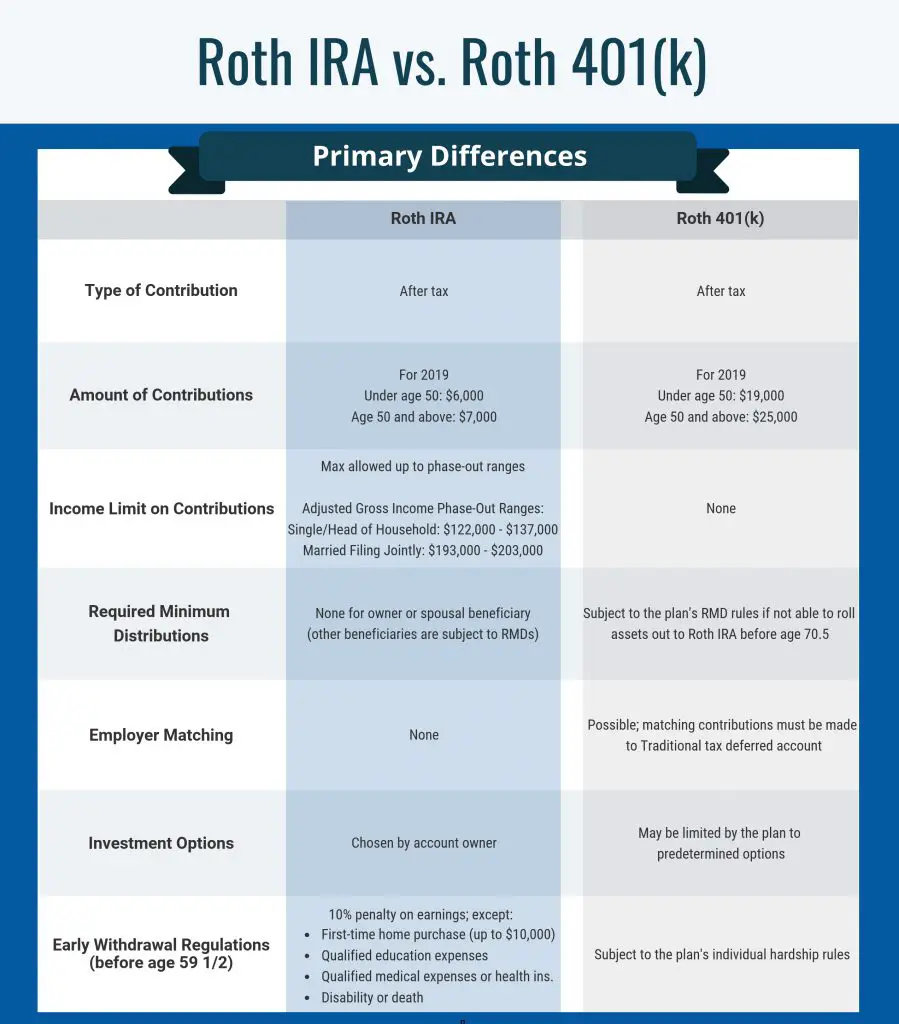

Some retirement plans have required minimum distributions . This is a withdrawal from the account that you must make, and usually theres a specific amount. This applies to traditional IRAs and both 401 plans. For IRAs, you must take the RMD when you turn 70 1/2. For 401s, you take the RMD when you turn 70 1/2 or when you retire, whichever comes later.

Note that you can take distributions before reaching the age of 70 1/2. Once you turn 59 1/2, you can start to take withdrawals without a penalty fee, if you choose to. If you withdraw funds before reaching 59 1/2 years of age, theres a 10% penalty fee.

Both IRA and 401 plans are great retirement planning tools. Planning your finances for retirement doesnt have to be hard. And there are simple steps you can take to make your life easier down the road.

To learn more about retirement planning and investing, sign up for our free e-letter below. Its packed with useful insight.

About Amber Deter

Amber Deter has researched and written about initial public offerings over the last few years. After starting her college career studying accounting and business, Amber decided to focus on her love of writing. Now shes able to bring that experience to Investment U readers by providing in-depth research on IPO and investing opportunities.

Traditional Ira Vs Roth Ira Cds

Since were focusing specifically on IRA CDs, we wont dive too deep into the differences between a traditional IRA and Roth IRA, but the terms of your certificate of deposit will depend on which IRA you have. Because of this, well briefly go over the differences between the two.

The biggest difference between these two IRAs has to do with taxes. The money you contribute to a traditional IRA is pre-tax and grows tax-deferred. Withdrawals are taxed after you reach age 59.5.

With a Roth IRA, you contribute after-tax dollars and your money grows tax-free. You can withdraw money from a Roth IRA tax and penalty-free once you reach age 59.5. These withdrawal fees will affect how money is withdrawn from your IRA CD, which well discuss in the next section.

Don’t Miss: When Leaving A Company What To Do With 401k

Ira Vs 401k Withdrawals Rules

With both 401k plans and IRA plans, you can withdraw money before retirement. But the penalties for doing so are outrageous.

With an IRA, any money withdrawn before the age of 59 1/2 is subject to a 10% penalty, plus federal, state and local taxes on that amount. However, there are exceptions.

The 10% penalty wont apply if you use the money to pay for medical expenses, to buy a house for the first time, and to pay for higher education for yourself, spouse, child, or grandchild.

The same withdrawal rules apply for 401k accounts. Like an IRA,youll get hit with a 10% penalty if you make withdrawals from your 401k before age 59 1/2. Like an IRA, there are some exceptions to withdraw money from a 401k without a penalty.

The exceptions are that if you experience financial hardship, such as:

- Paying for medical expenses

- Paying for a funeral or a primary residence.

- You become totally disabled.

- You are recently divorced and you have a court order to give money to your ex-spouse or child.

However, showing financial hardship can be hard to prove. You really have to show that you cant get the money from a bank or from any other sources.

The rules regarding withdrawals from your 401k and IRA can be complex. So, always consult with a tax or financial advisor for more information.

What Is A 401 & How Does It Work

A 401 is an investment account offered by an employer to provide an incentive for employees to save money for retirement. The idea is thatâthanks to the power of compound interestâthe investments will grow over time. Then, when the employee retires, theyâll have access to the money in the account.

With a 401, an employee chooses a percentage or specific amount of money they would like taken out of their paycheck. The employer then automatically deducts this amount and invests the contribution in financial productsâlike mutual funds, stocks and bondsâthat the employee has chosen.

One of the perks of 401s is that many employers choose to contribute to their employeesâ accounts as well. Referred to as âmatching contributionsâ or an âemployer match,â these contributions vary and employers choose how much of a match they offer. For example, a company might contribute a 50% match up to 6% of an employeeâs salary.

Keep in mind that thereâs typically a vesting periodâoften two to six yearsâfor matching contributions. That means that the matching contributions donât fully belong to the employeeâthey arenât âfully vestedââuntil the end of the vesting period. And if the employee leaves the company before theyâre fully vested, they may have to forfeit some of those matching contributions.

Traditional 401 vs. Roth 401

Don’t Miss: How Much Employer Contribute To 401k

Which Of These Tax

A 401 and an individual retirement account are both tax-advantaged retirement accounts. While 401s are typically only offered by employers , IRAs can be opened by individuals through any retail brokerage firm.

401s generally allow higher contributions but offer fewer investment options, whereas IRAs have lower contribution limits — and income caps for high earners — but offer the opportunity to invest in almost any stock, bond, or mutual fund.

Tips For Choosing The Type Of Ira That’s Right For You

There are two types of IRAs: a traditional tax-deductible IRA and a Roth IRA. For 2022, the annual contribution limit for both is $6,000 with a $1,000 catch-up if you’re age 50-plus.

However each IRA does have an income ceiling that will determine whether one or the other is right for you.

- Traditional tax-deductible IRAFor someone who doesn’t have a 401 or similar plan, a traditional IRA is fully tax-deductible. Upfront tax deductibility plus tax-deferred growth of earnings are two of the pluses of this type of IRA. However, if you participate in an employer sponsored retirement plan such as a 401, tax deductibility is phased out at certain income levels based on your Modified Adjusted Gross Income . For tax-year 2022, the levels are $68,000-$78,000 for single filers, $109,000-$129,000 for married filing jointly.

- Roth IRAWith a Roth IRA, you don’t get any upfront tax deduction, but you do get tax-free growth plus tax-free withdrawals at age 59½ as long as you’ve held the account for five years. And there’s no restriction if you participate in an employer plan. However, there are income phase-out limits based on your MAGI that determine whether you’re eligible to open and how much you can contribute to a Roth. In 2022, the limits are $129,000-$144,000 for single filers, $204,000-$214,000 for married filing jointly.

Don’t Miss: How To Get A 401k If Self Employed

A 401k And An Ira Can Work Together

Contents

The most important difference between a 401k and an IRA is that a 401k has to be set up by an employer, and an IRA is a personal retirement account that anyone can create for themselves. The amount that can be saved on a tax-deferred basis is also much higher with a 401k.

If you want to have a 401k, you will need to work for a company that creates them for its employees. Assuming you have a 401k from your work, you can also set up an IRA, and save even more money that can grow without being taxed.

Donât Miss: Is A 401k Considered An Annuity

Employer Matching Contributions To A 401

Many employers provide a matching contribution for some or all of an employees 401 contribution, incentivizing employees to participate in the plan. Matching contributions are considered to be traditional 401 deposits, even if the employee contributes to a Roth 401.

For example, some employers may match 50 percent of an employees contributions up to 8 percent of their salary each year. If the employee contributed 8 percent, the employer would add another 4 percent, and the employee would effectively enjoy a total of 12 percent saved. But if the employee contributed 10 percent, the employer would still add a maximum of 4 percent.

Employers offer different matching amounts, and some employers may offer no match at all.

Many employers require matching contributions to vest over time. For example, if the employer requires three years of vesting, employees must remain with the company for at least three years before any matching funds become fully theirs. However, once the employee has surpassed the vesting period, any subsequent matching funds immediately become theirs.

Matching funds may partially vest, depending on the employees length of service. For example, with a three-year vesting schedule, an employee who stays two full years may be able to keep two-thirds of any matching funds. But the rules depend on the details in the employers plan.

You May Like: How To Find 401k From Old Jobs

Disadvantages Of A 401

Your 401 is a great way to save for retirement, but you also need to understand a few of its shortcomings too:

- Fewer options for mutual funds. Your employer usually hires a third-party administrator to run the companys retirement plan. That administrator picks and chooses which mutual funds you can invest in, limiting your options. Womp-womp.

- Your withdrawals in retirement will be taxed. Remember those tax breaks you get on your 401 contributions? Well, theres a catch.Since you fund a 401 with pretax dollars, you wont pay taxes now, but you will pay taxes on that money in retirement. This could lead to a pretty hefty tax bill depending on what tax bracket youre in when you retire.

- Required minimum distributions . You cant leave your money in your 401 forever. Beginning at age 72, you must start withdrawing a certain amount of your savings each year, or youll pay a penalty.2 Alsothere are penalties for withdrawing money before age 59 1/2. Either way, Uncle Sam wants his share!

- Waiting period. If youre new to a company, you may have to wait a certain length of time to participate in a 401 plan or receive an employer match. Thats not great, but some things are worth the wait!

Now that weve broken down the 401, lets turn our attention to the one and only Roth IRA. Then well compare the two and see if theres a clear winner!

Ira Vs 401k Comparative Table

Let us have a glance at the differences between IRA and 401K retirement schemes:

| Category | ||

|---|---|---|

| Within 50 up to $6,000 At and above 50 up to $7,000 | Within 50 up to $20,500 At and above 50 up to $27,000 | |

| Eligibility | Only if employers provide for the scheme | |

| Taxation | Federal and state taxes apply to traditional IRAs distributions after 59.5 years of age. | A mandatory federal tax upon withdrawal |

| Choices | Investment choices are more, ranging from stocks, funds, bonds, fixed income investments, and other assets. | Limited investment choices with the freedom to invest in only a few dozen mutual funds. |

| Employer contribution | None as such | Employers normally choose to make a matching contribution based on a portion of the employees salary. |

| Suitable for | All those who have earned income | For only those whose employer provides for the option. Also, it is meant for individuals with higher income as the contribution limit is higher. |

Don’t Miss: How To Keep Your 401k In A Divorce

How To Make A 401 And Roth Ira Work Together

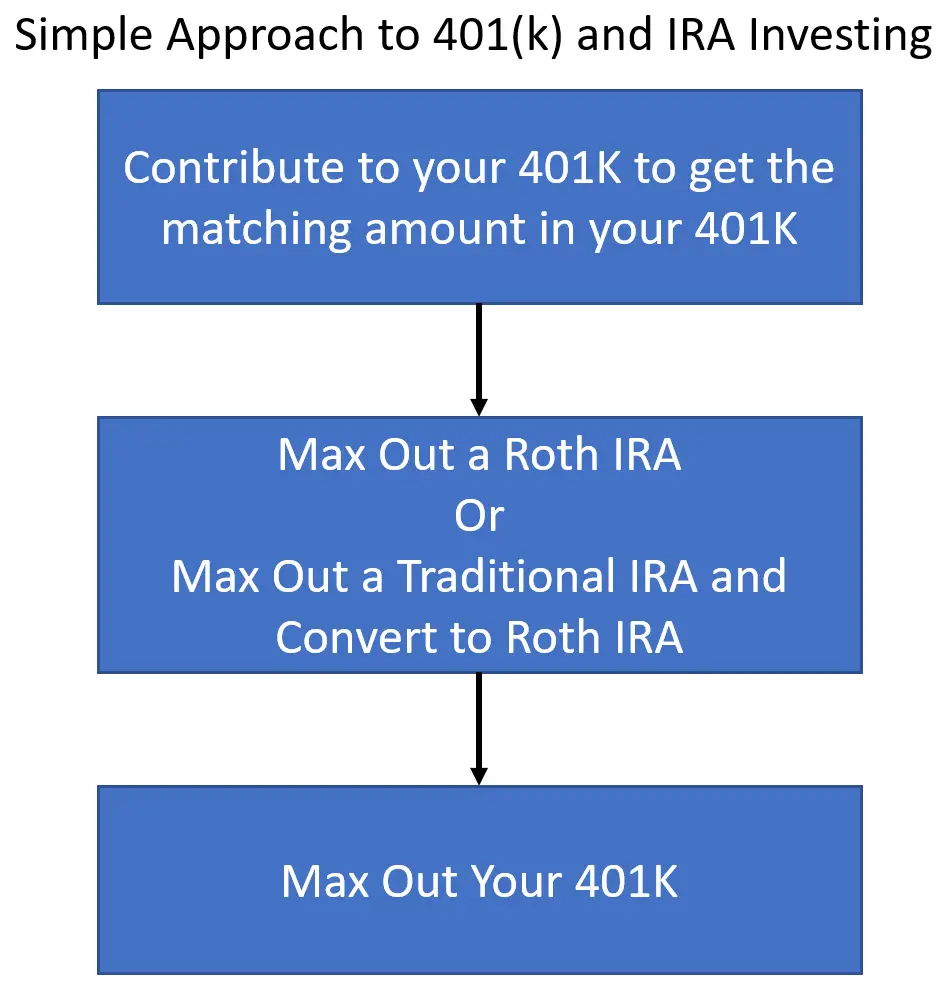

OK, so now weve arrived at the moment of truth: Should you put your money in a 401 or a Roth IRA? The answer is . . . yes!

If youre eligible for a 401 and a Roth IRA, the best-case scenario is that you invest in both accounts . That way, youre taking advantage of your employer match and getting the tax benefits of a Roth IRA.

The best way to remember where to start is with this rule: Match beats Roth beats Traditional. An employer match is free money, and you simply dont leave free money on the tableso thats where you start!

After that, you take the tax advantages of Roth accounts like a Roth IRA over traditional IRAs and their tax-deferred growth every time. It pays off more in the long run!

Heres how that works in three simple steps: Lets say you make $60,000 a year and youre under 50. Once youre debt-free and have a fully funded emergency fund, your goal is to invest 15%$9,000 in this casein retirement.

- You start by investing in your 401 up to the match your company offers. Lets say, in this case, that its 3% of your gross income . You invest $1,800 in your 401 to reach the employer match. This leaves you with $7,200 more to invest.

- Then, you max out your Roth IRA. You can only contribute $6,000 in 2022, so that leaves you with $1,200.

- Return to your 401 and invest the remaining $1,200.

Which Retirement Account Is Right For You

Both a 401 and IRA can be great retirement vehicles and should be used in combination to maximize retirement savings. The account you choose, the type of contributions , and how much to save will depend on your situation today and your plans for your future.

You may also want to consider taxable investment accounts where appropriate to further diversify taxes. For maximum flexibility, investors should have three primary taxable buckets of money: pre-tax, post-tax , and taxable .

Your strategy needs to be dynamic as your life evolves personally, professionally, and financially, to ensure you maximize your retirement savings and reduce your taxes today, as your money grows, and when you need it in the future.

- Saving + Investing

Read Also: What Is The Tax Rate On 401k After 65

Differences Between Ira And 401k

An Individual Retirement Account refers to the savings account individuals own to secure their financial position post-retirement. On the other hand, 401K is a retirement savings scheme that employers sponsor for their employees as a loyalty reward for their tenure of service.

Together, they form the most significant retirement savings schemes that individuals can opt for to have a financially secure post-retirement life. However, both these options differ in terms of the investment options they offer and the contribution limits. Though most people think they have to choose between these two post-retirement savings options, they can opt to invest in both schemes simultaneously for a financially healthy life after retirement.

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:

Is A 401 Considered An Ira For Tax Purposes

Not all retirement accounts have the same tax treatment. There are different tax benefits for IRAs and 401s. Roth IRAs dont offer a tax deduction for contributions, but withdrawals are tax-free in retirement. Traditional IRAs offer a tax deduction, while 401s allow pre-tax income to be deposited, which reduces taxable income in the year of the contribution. Distributions in retirement from 401s and IRAs are considered taxable income.

Read Also: When Can I Take Money Out Of My 401k

What Are Roth 401 Contribution Limits

For 2022, the 401 contribution limit is $20,500. This contribution limit applies to all of your 401 contributions, whether theyre in a Roth or traditional 401. That means if youre contributing to both, the combined total of your contributions cant exceed that amount. And in case you were wondering, your employers contributions do not count toward the limit.

If youre 50 or older, you can also pitch in an extra $6,500 as a catch-up contributionwhich increases your contribution limit to $27,000.

You May Like: How To Calculate Your 401k Contribution

What Is The Difference Between A Regular Cd And An Ira Cd

The biggest differences between a regular CD and an IRA CD are the term lengths, withdrawal penalties, and deposit limits. Regular CDs generally have longer term lengths and larger deposit limits than IRA CDs. The early withdrawal penalties differ between regular CDs and IRA CDs as well, though both have those penalties.

You May Like: Can You Transfer 401k To Ira While Still Employed

Traditional Vs Roth: Whats The Difference

Whether youre contributing to a 401 or an IRA, you may get to choose between Roth or traditional.

If you still arent confident about the difference, dont fret.

When you contribute to a traditional 401 or IRA, youre putting in pre-tax dollars. That means you havent paid any taxes to the IRS on those dollars. And you wont pay any taxes until you withdraw the money in the future.

When you contribute to a Roth 401 or IRA, youre putting in post-tax dollars. That means youve already paid taxes to the IRS on those dollars. And if you follow the rules, you wont ever have to pay taxes on that money again.

Clark expects taxes to rise in the future. So unless youre sure that your tax rate is higher now than it will be in the future, he thinks Roth is better than traditional .

Read Also: Where To Check 401k Balance

Can I Put Off Saving For Retirement

Someday your will to work will disappear. Your bills, unfortunately, wont.

So, in most circumstances, no, you cant put off saving for retirement. And the longer you put it off the less youll reap the benefits of compound interest.

Whatever excuse you have for not saving for retirement probably falls into one or more of the below three categories.

Now, lets debunk some of these common excuses one by one:

Don’t Miss: How To Save For Retirement Without A 401k