I Participate In A 401k Through My Primary Employer And I Have A Part Time Business Can I Have A Solo 401k For My Part Time Business

Yes. You are eligible to establish a Solo 401k for a side business even if you participate in a 401k, 403b, 457 or Thrift Savings Plan through your primary employer. It is important to note that contributions made to the employers 401k, 403b or Thrift Savings Plan will impact the contributions for the Solo 401k. Contributions to the employers 401k, 403b or TSP count towards the Solo 401k salary deferral limit. The 2021 salary deferral limit is $19,500 and $26,000 if age 50 or older. Contributions made into a 457 plan do not count towards the salary deferral limit. In addition to a salary deferral contribution, a business owner can also make contributions to the profit sharing portion of a Solo 401k.

Example: Jennifer is age 40 and works as a W-2 employee for ABC accounting firm and contributes $10,000 to the 401k. In addition to working at the accounting firm, Jennifer is the owner of an S corporation. She is the only employee and pays herself a $100,000 W-2 salary in 2021.

Based on this information Jennifer would be eligible to make a contribution of $9,500 in salary deferrals plus make a profit sharing contribution of $25,000 for a total of $34,500 in Solo 401k contributions in 2021.

Can You Contribute To 401k Without Employer

How do I start a 401k?Here’s your 401 to-do list:

Can I start a 401k on my own?

401k accounts are typically offered through your employers, so usually individuals cannot open their own 401k account. The exception is if you own a business yourself, or considered self employed.

Can you contribute to a 401k without an employer?

If you’re self-employed, you don’t have an employer to offer a 401 to you. Thus, you still have alternatives. Even if you’re not self-employed, you can open a traditional or Roth IRA. Nonetheless, self-employed individuals have three key optionssolo 401, SEP IRA, and SIMPLE IRA.

How much money do I need to start a retirement account?

The IRS doesn’t require a minimum amount to open an IRA. However, some providers do require account minimums, so if you’ve only got a small amount to invest, find a provider with a low or $0 minimum. Also, some mutual funds have minimums of $1,000 or more, so you need to account for that as you choose your investments.

Investing Outside Of Retirement Accounts

You dont have to stop saving for retirement just because you reach your maximum allowed savings for the year. You can save with other investments. It doesnt have to be an official retirement account.

In fact, youll want to have a good portion of your benefits in separate accounts if youre planning on retiring early so you can access the money without being hit with an early withdrawal penalty. You arent allowed to take money from either an IRA or a 401 without a 10% penalty until you reach age 59 1/2. But there are a few exceptions.

You may want to retire sooner than that. Other investments will allow you to withdraw money before age 59 1/2 to avoid the penalties.

Also Check: How Much Can You Contribute To 401k

When 401 Plans Without A Match Are Worthwhile

The employer matching contribution that is part of many 401 plans is an attractive benefit. In some cases, it is equivalent to your employer guaranteeing a 100% return on your investment. However, its not the only advantage that 401 plans have to offer.

With a traditional 401, your contributions to the plan are tax deductible and the accounts earnings over the years will be tax deferred. You wont owe taxes on any of that money until you withdraw it, usually in retirement. If you contribute to a Roth 401, you wont receive any up-front tax deduction, but all of your withdrawals will be tax free if you meet certain rules.

These tax benefits are the same for every standard 401 plan, whether your employer makes a matching contribution or not. If you are going to be in a lower income tax bracket in retirement than you are now, as is often the case, then putting your money in a 401 could save you thousands of dollars a year in taxes.

Of course, there are other ways of saving for retirement besides a 401. A traditional individual retirement account works much like a traditional 401 when it comes to taxation, and it might offer you a broader range of options for investing your money. .)

Even if your employer matches your 401 contributions, that money doesnt belong to you until it has vested according to the rules of your plan.

Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.

You May Like: How Do I Get My 401k

Read Also: How Soon Can I Borrow From My 401k

Drawbacks To A Solo 401

A solo 401 may not be right for small businesses that plan to expand and hire employees in the near-term, since doing so would likely result in plan ineligibility. In addition, calculating profit-sharing contributions for sole proprietorships and partnerships tends to be complex because it requires modified net profits. The formula for this calculation is available in IRS Publication 560.

More Options If Youre A Freelancer Or Entrepreneur

If youre the boss of you, then you might have a few more choices available to you when it comes to saving for retirement.

One is a , which is like a regular IRA above, except the employer makes all the contributions. You just have to be 21 years old, earn at least $600 a year, and have worked for your company in three out of the last five years. The great part about SEP IRAs is that they have high contribution limits up to 25% of earnings or $61,000, whichever is lower.

Theres also a solo 401, aka a one-participant 401. With this kind of account, think about it like youve split yourself into two people: the employer and the employee. The employer side of you can contribute up to 25% of earnings, while the employee side of you can contribute up to $20,500 . The total limit is still $61,000, but depending on your income, this weird split might actually let you contribute more with a solo 401 than a SEP IRA.

So, no need to let a lack of a 401 get you down. You can still take care of Future You and build that dream retirement starting today.

The information provided should not be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice.

The information provided does not take into account the specific objectives, financial situation or particular needs of any specific person.

Recommended Reading: What Age Can You Take Out 401k

Take Advantage Of Other Benefits

Startups may offer other options, such as buying stock options instead of a retirement account. This can allow you to benefit from the growth of the company in the first few years. Its a good option when its managed right.

Make sure your portfolio is highly diversified. A startup could fold without warning. Owning this type of stock is riskier.

There are also rules for how soon you can sell your stock after purchasing it so this should not be your whole retirement plan. These rules can vary by company.

Some companies offer deferred compensation programs that allow you to defer pay until some future date, such as when you retire. This option lets you reduce your taxable income now. Youll save money on income taxes, earn interest on the money, then take the money as either a lump sum or over a period of time when you decide you want it.

The rules for participating in such a program, and for how these programs are operated, can be tricky. Consult with a qualified retirement planning specialist before you enroll.

Read Also: How To Find Out If Someone Has A 401k

How To Fund A Retirement Account

So you know how much you need to save for retirement and which accounts you can open. Now you have to fund those accounts without your employers help. The first step you can take is to set up direct deposit. You can set it so that a portion of your paycheck automatically deposits into your IRA or other account. You may also set up automatic transfers from a bank account to your retirement savings account. That way, you can set it and forget it.

You may also want to set aside any tax refunds, windfalls or bonuses you get. Its easy to deposit those funds into an account right away. That way, you can pretend that you never had access to that money anyways.

Its important to know that putting money into your IRAs or solo 401 isnt all you need to do. Youll also need to choose your investments. Luckily, you wont be limited to the funds your employer has selected to provide. A good place to start is with an S& P 500 index ETF and an intermediate term bond index fund. Youll need to make sure your investments are well-diversified and optimized. You dont need to do this all on your own, though. If you need help, there are a ton of financial advisors or robo-advisors out there who can help you manage your accounts.

You May Like: How To Borrow From 401k For Home Purchase

Don’t Miss: Can You Have Your Own 401k

Rollover To A New 401

If you quit your job for another employer, you should check if your new employer has a 401 plan and when you are eligible to participate. Some employers may require new employees to complete a certain period of service to be eligible to join the plan. Once you are eligible, you should request a direct rollover from your former employer to the new 401. You will be required to fill out some paperwork with the former employer, and provide your new 401 details for the transfer to be effected.

Can You Withdraw Money From A 401 Early

Yes, if your employer allows it.

However, there are financial consequences for doing so.

You also will owe a 10% tax penalty on the amount you withdraw, except in special cases:

- If it qualifies as a hardship withdrawal under IRS rules

- If it qualifies as an exception to the penalty under IRS rules

- If you need it for COVID-19-related costs

In any case, the person making the early withdrawal will owe regular income taxes year on the money withdrawn. If its a traditional IRA, the entire balance is taxable. If its a Roth IRA, any money withdrawn early that has not already been taxed will be taxed.

If the money does not qualify for any of these exceptions, the taxpayer will owe an additional 10% penalty on the money withdrawn.

Don’t Miss: What Is A Good Percentage To Contribute To 401k

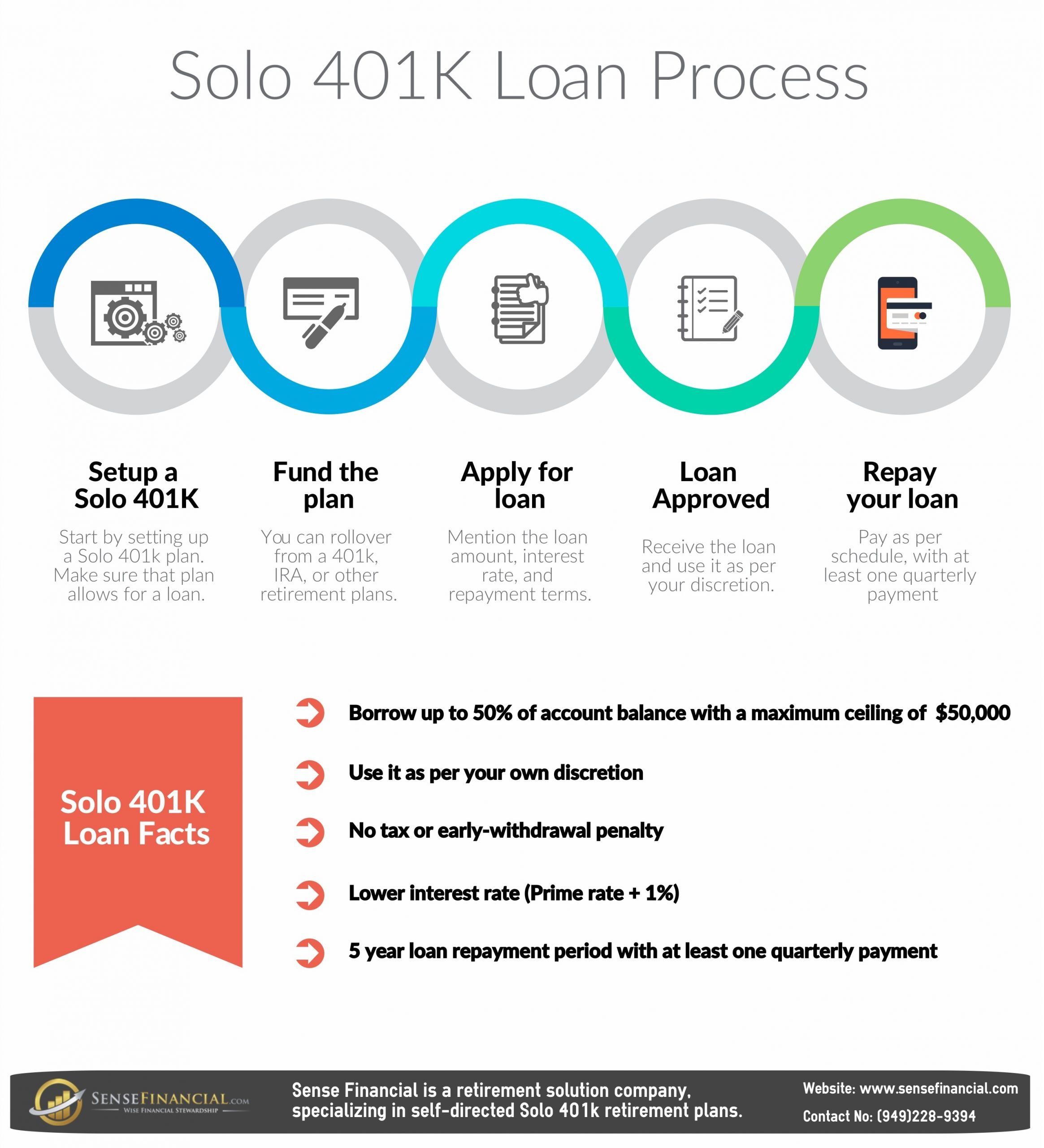

How To Open A Solo 401k

You need an Employer Identification Number and earned income verified by the IRS, but a solo 401k is easy to open. They are offered by most online brokers.

What Is A 401 Plan

A 401 plan is a type of IRS-approved retirement plan that allows employees to contribute pretax amounts to individual retirement accounts. Employers also can contribute to employee accounts, often by matching employee contributions, up to a certain percentage.

You can choose from several types of small-business 401 plans and other varieties of retirement plans. Get help from a retirement plan advisor to select the best one for your business.

Read Also: What Are The Advantages Of A 401k

Read Also: How Much Can You Put Into A Solo 401k

How To Open A 401 Without An Employer

Young professionals hear all the time that they need to start investing in their retirement plan now, so they can have a comfortable nest egg by the time they are ready to retire. One of the most popular retirement plans that many professionals invest in is a 401. However, this option is only available through an employer, so you might be wondering how you can open one if you are self-employed or if your current employer does not offer a 401 plan.

Dont worry. You have options.

Self employed business owner? Start a solo 401

Do you own a business and not have any employees who work for you? You are probably eligible for a solo 401. Setting up a solo 401 is advantageous for people who are self-employed business owners because you can contribute up to the annual maximum as well as up to 20% of your net earnings or 25% of compensation as a business owner.

As of 2020, solo 401 account holders can contribute up to $19,500 . This means you have an opportunity to contribute a lot into your retirement funds if you have enough financial security to make the maximum contributions for yourself as the account beneficiary and the matching contributions as your own employer.

Remember, a solo 401 is only applicable if you have no employees in your small business other than yourself. If you have employees, you can explore other 401 options that can benefit you and your employees.

Cant start a solo 401? Invest in alternative retirement options

Can I Make Roth Contributions

Youve probably heard of a Roth IRA a retirement account that allows you to make taxable contributions today so you can take tax-free distributions later.

But did you know theres also such thing as a Roth 401?

If your company offers a Roth 401, it is possible to make contributions and its a lot more common than you might think, according to Malik S. Lee, certified financial planner and founder of Felton & Peel Wealth Management. Most employers plans have Roth 401s, but a lot of people dont know to ask for it or to look for it, he said, calling the Roth 401 a hidden gem.

As nice as it is to get a tax break today, tax-free retirement income is tempting, especially if youre planning to reach a higher tax bracket by the time you get there. plans.)

Read Also: Do I Have To Split My 401k In A Divorce

The Bottom Line: Save If You Can

Do your homework and shop around for all of your available options for saving for retirement. When evaluating whether or not to contribute to your employer-sponsored 401, use your level of income, target annual expense ratio, and desired list of investment funds. The sooner that you start saving for retirement, the closer youll be to your nest eggs target.

If you want to set up or switch to a 401 that’s great for employees and employers, let your company know about .

What Happens To Your 401k When You Quit Or Fired

Shawn Plummer

CEO, The Annuity Expert

If you are considering quitting your job or have been recently fired, its important to know what will happen to your 401k. What happens to your 401k when you quit? What should you do with it? Can I cash out my 401k if I quit? What if I dont have a 401k account at all? Well answer these questions and more in this guide!

Don’t Miss: When I Leave My Job What Happens To 401k

Ira Or Solo 401k Question:

They both allow for investing in alternative investments including real estate, but the solo 401k is generally more advantageous. For example, the contributions limits are higher for a solo 4o1k plan, you can borrow from a solo 4o1k plan, and the ongoing fees are also generally much less. See the following link for more on this.

When 401 Plans Without A Match Dont Make Sense

While it generally makes sense to save for retirement through your 401 even if your employer wont match your contributions, there are a couple of exceptions.

The first exception is if the 401 that your company offers is not ideal for you. Some 401 plans come with high fees. Others have extremely limited investment options. Still others may be incompetently run. Even these less ideal plans might be worth participating in if they have a really good employer match. Without a match, you may consider investing in an IRA, a mutual fund, or a brokerage account. You wont get the same tax breaks but will have more low-fee investment choices.

The second exception is if you are not earning enough income for a large cash flow and are changing jobs frequently. In this circumstance, which is common among younger people at the beginning of their careers, you either may not earn enough to save more than $6,000 toward your retirement or may not want the hassle of transferring a 401 when you switch jobs. So an IRA could make more sense in these cases, and youll only have one retirement account to manage.

Also Check: What Is A 401k And How Does It Work