Elective Deferrals Must Be Limited

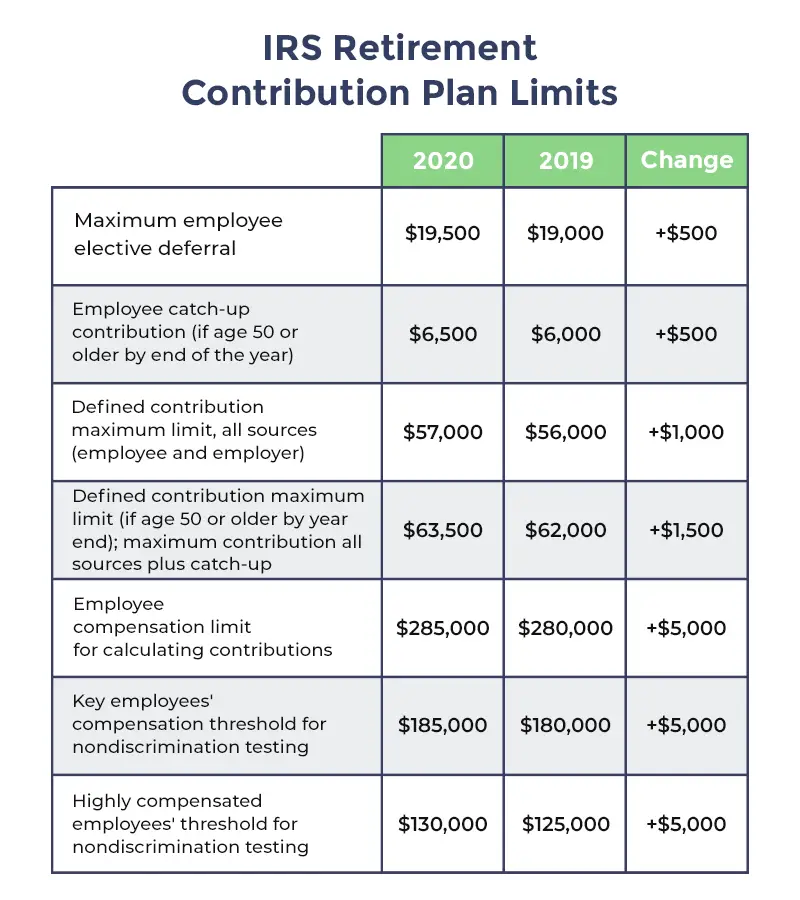

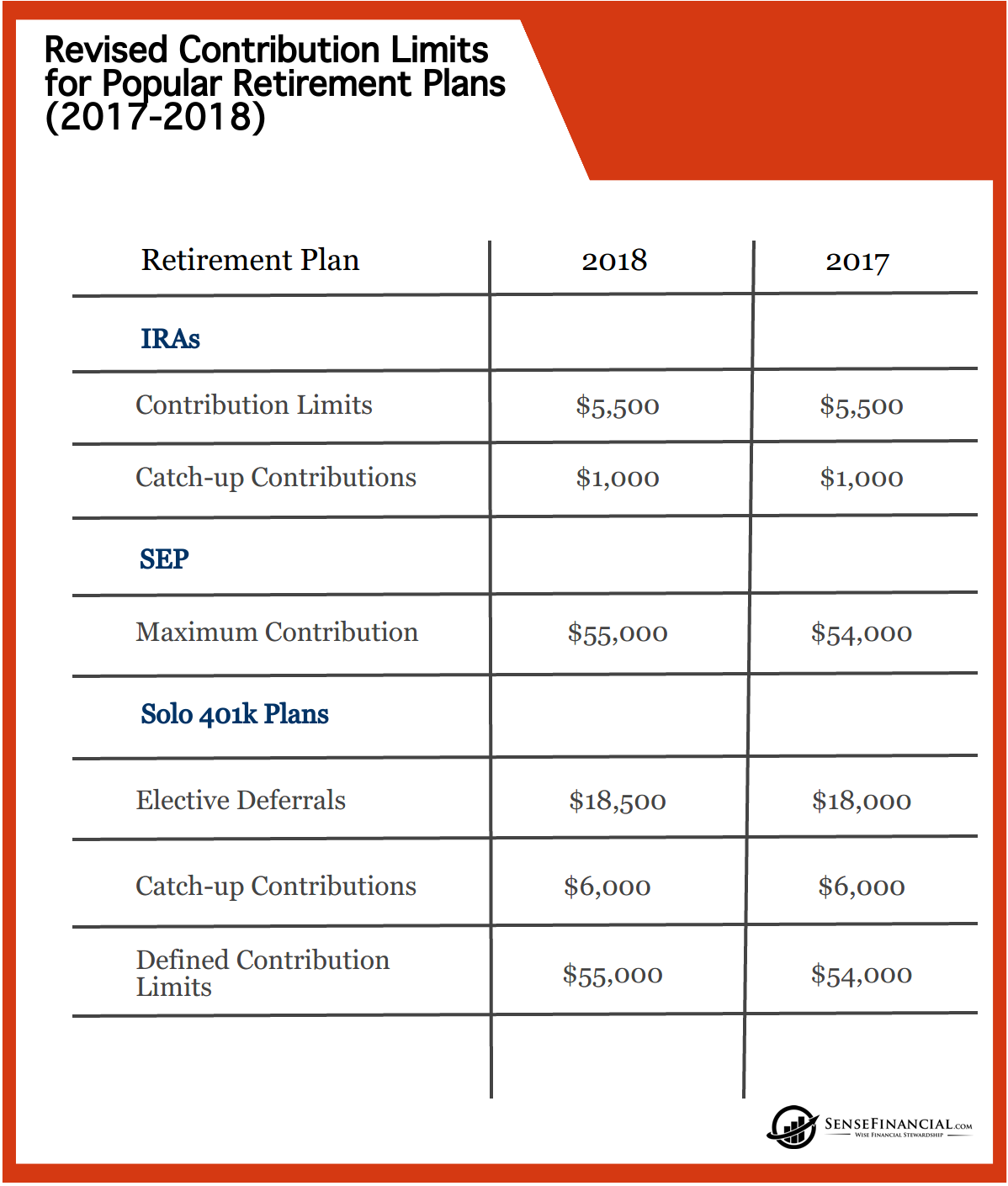

In general, plans must limit 401 elective deferrals to the amount in effect under IRC section 402 for that particular year. The elective deferral limit is $20,500 in 2022 The limit is subject to cost-of-living adjustments. However, a 401 plan might also allow participants age 50 and older to make catch-up contributions in addition to the amounts contributed up to the regular 402 dollar limitation, provided those contributions satisfy the requirements of IRC section 414. These limits apply to the aggregate of all retirement plans in which the employee participates.

What Is A 401 Retirement Savings Plan

A 401 is a retirement savings plan some employers offer their team as a financial benefit for working at the company. The U.S. government established the 401 to incentivize workers to save for their retirement.

Employees volunteer to have a certain amount deducted from their paychecks each pay period to go toward their 401 savings accounts. While employees usually choose how much theyd like to deduct from their paycheck, they often have a limit on how much theyre allowed to contribute.

Employers can offer one of two plans: a traditional 401 plan or a Roth 401 plan. For traditional plans, 401 withdrawals are taxed at the employees current income tax rate. Roth 401 withdrawals arent taxable if the 401 account is five years old or older and the employee is over 59 years old. There are specific regulations to follow regarding how much and how often an employee can withdraw these funds for their 401.

Many employers use 401s as an employee benefit for working at the company and as an incentive to keep long-term employees. Some employers require employees to work at a company for a certain amount of time before they can start depositing their paycheck money toward a 401.

Employees can choose the specific types of investments from a selection their employer offers. Some of these investment types may include stock and bond mutual funds, target-date funds, guaranteed investment contracts or the employers company stock.

Always Contribute Enough To Get The Full Match

If your employer offers matching 401 contributions, make sure you contribute enough to qualify for the full match. If you dont, youre basically losing out on free money. Talk to an HR representative or a plan administrator to find out how much you need to withhold from each paycheck to get the full match.

You May Like: Do I Need A Financial Advisor For My 401k

How Much Can You Contribute To Your 401

If you’re looking for a way to save for retirement beyond the traditional 401 there are multiple benefits to explore with a Roth IRA. That includes the ability to roll over an existing 401.

As for the traditional 401, the Internal Revenue Service sets the contribution limit annually. This limit varies based on your age, but for 2022, most Americans can contribute up to $20,500 across the entire year. If you’re 50 or older, the limit goes up to $27,000 .

That is just your personal contribution limit, though. You can technically exceed these amounts – up to 100% of your compensation or $61,000, whichever is lower – if your employer also contributes to the account. Some employers offer a matching contribution, meaning for each dollar you contribute to your account, they’ll contribute a matching amount up to a certain threshold.

According to a report from investment management group Vanguard, most employers with matching benefits will contribute 50 cents on the dollar for up to 6% of the employee’s pay. So if you made $50,000, your employer would contribute up to $1,500 per year, provided you contributed at least $3,000 yourself .

Matching Contributions What Employers Need To Know

Eric Droblyen

One of most effective ways an employer can persuade their employees to participate in a 401 plan is by matching a portion of their pre-tax or Roth 401 salary deferrals. This is unsurprising when you consider matching contributions are like a guaranteed return on salary deferrals – or free money.

Yet, despite their indisputable benefit to employees, matching contributions are not the best fit for every 401 plan. Sometimes, nonelective contributions like profit sharing which dont require employees to do anything to receive a contribution – are the better alternative. If youre a 401 plan sponsor, you want to understand your companys matching contribution options. To meet certain 401 goals, they can be tough to beat.

Recommended Reading: How To Setup Your Own 401k Plan

Contributions And Allocations Are Limited

Contributions to a 401 plan must not exceed certain limits described in the Internal Revenue Code. The limits apply to the total amount of employer contributions, employee elective deferrals and forfeitures credited to the participant’s account during the year. See 401 and Profit-Sharing Plan Contribution Limits.

Sign Up For Automatic 401 Contributions

Enroll in automatic payroll deductions, so contributions are deposited in your 401 each pay period without any further action by you.

One of the advantages of these plans is the power of payroll deduction, said Young. You pay yourself first, automatically, every paycheck, making retirement savings easy.

Use Vanguards plan savings calculator to find out how a given level of contributions will impact your paycheck, and how much you could be earning for your retirement with an employers match.

Read Also: Can You Open 401k Your Own

Do Employer Contributions Affect The 401 Contribution Limit

If both an employee and an employer contribute to a 401 plan, this boosts the employeeâs saving efforts. But does that free money from an employer count toward oneâs annual contribution limit?

In short, the answer is no. An employerâs 401 plan contributions donât count toward the employeeâs contribution limit. So, even if an employee younger than 50 puts $20,500 into their 401 one year, their employer can still contribute funds.

Still, there is a total contribution limit to note.

All plan contributionsâmeaning the total of elective deferrals , employer match funds, employer non-elective contributions, and allocations of forfeituresâcannot surpass the IRSâs overall limit on contributions. For tax year 2022, this limit is the lesser of:

- $61,000 or $67,500 for those over 50

- 100% of an individualâs annual compensation

This limit is designed for employees who have more than one retirement savings account that is managed by the same employer, or a related employer.

High-earning employees may face another hurdle when it comes to salary deferrals: contribution cut-offs. While most plans will allow high-earners to continue making contributions until they reach their annual contribution limit, some will cut off contributions early if their income hits a certain threshold.

What Is The Optimal Amount To Contribute To Your 401 Plan

There are many types of retirement accounts out there, but the 401 may just be the most convenient.

An employer-sponsored 401 plan allows you to automatically contribute to your account from each paycheck, invest in professionally-vetted funds, and, in most cases, put off income tax on that income until later in life.

Many employers have a matching contribution to 401s as an employee benefit – as long as you put in some cash yourself. But how much should you put in, and what can you do to get the most from your 401 in the long haul? Here’s what you need to know.

Recommended Reading: Does It Make Sense To Rollover 401k

How Does Employer Match Count Toward 401 Limits

Some employers offer a 401 employer matching plan, which means they match the amount of pay an employee contributes toward their 401. The amount an employer matches can vary, depending on the company and IRS limits. Some employers match a portion of the employees contribution, while others match the full amount.

You can make the same contribution for all employees, or it can vary according to much each employee makes and change annually based on their earnings. For example, if an employee receives a raise at the end of the year, their employer may also increase their match amount. The most popular matching plan employers use is matching up to 6% of their employees annual income.

Is Backdoor Roth Still Allowed In 2021

In 2021, single taxpayers can’t save in one if their income exceeds $140,000. … High-income individuals can skirt the income limits via a backdoor contribution. Investors who save in a traditional, pre-tax IRA can convert that money to Roth they pay tax on the conversion, but shield earnings from future tax.

Read Also: Can I Transfer Part Of My 401k To An Ira

What If I Have A Roth 401

If you have a Roth 401, you pay income taxes on your contributions now, rather than when you take that money out during your retirement. But your employer isnt likely to pay the taxes on matching contributions , so if you have a Roth, their matching contributions usually go into a separate, traditional 401. Youll pay the taxes on the traditional when you withdraw the money.

Why Are States Mandating These Retirement Plans

Some states have begun mandating retirement plans as a way to address the retirement savings gap in this country. Their response is based on research that shows:

- The average working household has virtually no retirement savings1

- Employees are more likely to save when they have access to a 401 or similar plan by their employer2

- Only four in 10 businesses with less than 100 employees offer retirement benefits3

Also Check: When You Quit Your Job Do You Get Your 401k

Timing Payments For The Most Money

Some employers will pay their match no matter how many paychecks it takes for you to reach your allowed amount for the year. But many companies will make a contribution only during the pay periods when 401 money is taken from your paycheck. You can avoid leaving employer money on the table by putting in smaller amounts each pay period. That way, your employer will put money into your account in every period.

Letâs say youâre paid twice a month, and your employer will only add money into your 401 when you do. If you reach your $19,500 limit at the end of November, youâve missed out on two chances for your employer to make its match. In this case, youâd be earning much more than $50,000 a year, but this issue could apply no matter how much you earn if you put too much money into your 401 too soon.

Your plan manager can help you manage your 401 account to make the most of your employer match. You can also use an online calculator to figure out how much you should put in from each paycheck.

Perks For Older Investors

If you happen to be at least 50 years old, youre entitled to make catch-up contributions by adding an additional $6,500 for a total contribution of $27,000 in 2022. The total maximum that can be tucked away in your 401 plan, including employer contributions and allocations of forfeiture, is $67,500 in 2022, or $6,500 more than the $61,000 maximum for everyone else. Forfeitures come from an account in which company contributions accumulate from departing employees who werent vested in the plan.

Also Check: Can I Make My Own 401k

Contribution Effects On Your Paycheck

An employer-sponsored retirement savings account could be one of your best tools for creating a secure retirement. It provides two important advantages:

- All contributions and earnings are tax-deferred. You only pay taxes on contributions and earnings when the money is withdrawn.

- Many employers provide matching contributions to your account, which can range from 0% to 100% of your contributions.

Use this calculator to see how increasing your contributions to a 401 can affect your paycheck as well as your retirement savings.

This calculator uses the latest withholding schedules, rules and rates .

Is A 401 Plan Mandatory For Employers To Offer

The short answer is, not quite . In lieu of federal law requiring private-sector employers to provide a retirement plan, states are taking things into their own hands. Many states have passed laws that require businesses to provide retirement plansand some have important upcoming registration deadlines.

So far, these states havent required businesses to offer traditional 401 plans. Instead, many states require most businesses to enroll eligible workers in a state-sponsored Roth individual retirement account planor offer employees a qualified retirement savings plan. This means that the state-sponsored plan is not mandatory in most states. Although businesses are legally required to offer some kind of retirement plan, many business owners have optionsand in many cases, that may include offering a 401 as a type of qualified retirement plan. Read more about state-mandated retirement laws and how state-provided plans compare to a 401.

You May Like: Can You Open A 401k Without An Employer

Is Charles Schwab Good For Roth Ira

Charles Schwab Schwab shines all around, and it remains an excellent choice for a Roth IRA. Schwab charges nothing for stock and ETF trades, while options trades cost $0.65 per contract. And mutual fund investors can find something to love in the broker’s offering of more than 4,000 no-load, no-transaction-fee funds.

Maximize Employer 401 Match Calculator

Contribution percentages that are too low or too high may not take full advantage of employer matches. If the percentage is too high, contributions may reach the IRS limit before the end of the year. As a result, employers will not match for the rest of the year. This calculation can show the contribution percentage window in order to take full advantage of the employerâs matching contributions.

You May Like: How To Create Your Own 401k

Most Employers Will Contribute To Your 401 But Its Generally Optional

As a benefit to employees, employers often offer matching contributions up to a limit to the contributions that employees make to their 401 plans. For example, an employer may match your contributions for up to 3% of your salary. However, employers arent required to make contributions to your retirement account, and some 401 plans have no employer match.

In this article, well look at how employer matches work and what to do if you are among the employees who dont benefit from one.

What Is A Partial 401 Match

With a partial 401 match, an employers contribution is a fraction of an employees contribution, and the employers total contribution is capped as a percentage of the employees salary. According to Jean Young, a senior research associate with Vanguard Investment Strategy Group, partial matching is the most commonly used matching formula in Vanguard 401 plans.

Matching structures vary by plan, said Young. In fact, we keep records on over 150 unique match formulas. But the most commonly offered match is $0.50 on the dollar, on the first 6% of pay. About one in five Vanguard plans provided this exact matching formula in 2018.

Lets say you earn $40,000 per year and contribute $2,400 to your 4016% of your salary. If your employer offers to match $0.50 of each dollar you contribute up to 6% of your pay, they would add $1,200 each year to your 401 account, boosting your total annual contributions to $3,600.

You May Like: Can I Start My Own 401k Plan

Know Your Retirement Provider Options

It can take some time to find a new provider and review the ins and outs of their administrative offerings. But because you have a fiduciary responsibility to your plan participants, its essential to take the process seriously. Youre responsible for due diligencealthough the right providers can help ease administrative burdens and lower your overall costs in the process.

Human Interest offers an affordable, full-service 401 thats meant to streamline much of the manual work of plan administration. By integrating with more than 200 leading payroll providers, were able to automate things to cut costs and save you time. And by selecting an service level that makes Human Interest a 3 fiduciary for select plan administrative functions, you can both reduce your fiduciary liability and the amount of time you spend on plan administration.

Minimum Vesting Standard Must Be Met

A 401 plan must satisfy certain requirements regarding when benefits vest. To “vest” means to acquire ownership. The vested percentage is the participant’s percentage of ownership in his or her account. All participants must be fully vested in their 401 elective deferrals. A traditional 401 plan may require completion of a specific number of years of service for vesting in employer discretionary or matching contributions. For example, a plan may require 2 years of service for a 20% vested interest in employer contributions and additional years of service for increases in the vested percentage. Matching contributions must vest at least as rapidly as a 6-year graded vesting schedule. A safe harbor and SIMPLE 401 plan must provide for 100% vesting in employer and employee contributions at all times.

Recommended Reading: Is A 401k A Defined Contribution Plan

What Are The Requirements For Employers And Employees

The requirements for state-mandated retirement benefits largely depend on individual jurisdictions, the size of the organization and how long it has been in business. Generally, employers must enroll their employees in the state-sponsored program if they dont offer another retirement plan and perform the detailed administrative and reporting work necessary under state law. These tasks can be daunting, which is why many employers choose one of ADPs easy-to-manage plans instead.

Employee requirements also may vary. In states that sponsor Roth IRAs, participants must not earn more than the IRS maximum to be eligible for such plans.

Your 2022 Guide To Employer Match And 401 Contribution Limits

Offering a matching 401 plan to your team is a great way to attract high-quality employees to your company. An employer-matched 401 can also help reduce employee churn as individuals recognize the financial significance of this benefit.

Many companies now opt for a 401 employer match program, rather than the traditional pension plan. Employer-matched 401 contributions allow for tax deductions for the employer. For this reason, there are 401 matching limits for how much employers can contribute to their employees 401 savings plans.

Learn more about what a 401 plan is, how employer matching works and the max 401 contribution company match limits over the past few years, including 2022 limits.

Recommended Reading: Should I Rollover Old 401k To Ira