Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Compare Your Options For Cash Withdrawals And Loans

Following are overviews of your options for making withdrawals or receiving loans from each plan type. For details, see Eligibility and Procedures for Cash Withdrawals and Loans.

| Cash Withdrawals |

|---|

| Current Employee | At age 59½ or older one-time withdrawal if account is less than $5,000 when specific conditions are met. See below for details. | At any age |

|---|

Letter Form Fidelity Investments Regarding Ubit Question:

I recently went through the process of applying for the ability to trade options in my Fidelity account. Last week I received a letter from Fidelity saying that I will be responsible for filing IRS Form 990T.

Questions:

- Is trading options in my solo 401k allowed?

- Is it a problem if Fidelity requires margin on the account in order to trade options?

- Assuming its allowed, is the Form 990T filing something that you will do for me each year?

Recommended Reading: Can I Take Out From My 401k

Making The Numbers Add Up

Put simply, to cash out all or part of a 401 retirement fund without being subject to penalties, you must reach the age of 59½, pass away, become disabled, or undergo some sort of financial hardship . Whatever the circumstance though, if you choose to withdraw funds early, you should prepare yourself for the possibility of funds becoming subject to income tax, and early distributions being subjected to additional fees or penalties. Be aware as well: Any funds in a 401 plan are protected in the event of bankruptcy, and creditors cannot seize them. Once removed, your money will no longer receive these protections, which may expose you to hidden expenses at a later date.

Read Also: When Can I Set Up A Solo 401k

Eligibility And Procedures For Cash Withdrawals And Loans

Following is information on when you may qualify for a loan from your U-M retirement plans, when you may qualify for a cash withdrawal, and the procedures to request a loan or cash withdrawal.

-

Loans may be available from your retirement accounts as follows:

-

Basic Retirement Plan No loans are available at any time.

-

403 SRA You may borrow from your 403 SRA at any time, for any reason, regardless of whether your employment is active or terminated. However, loans are not available from TIAA once you have retired or terminated employment from U-M.

-

457 Deferred Compensation Plan You may borrow from your 457 Deferred Compensation Plan account at any time, for any reason, regardless of whether your employment is active or terminated. However, loans are not available from TIAA once you have retired or terminated employment from U-M.

To arrange for a 403 SRA or 457 Deferred Compensation Plan loan, contact TIAA or Fidelity and request a loan application. University authorization is not needed to take a loan.

Recommended Reading: How Much Can You Put In 401k A Year

Check If You’re Eligible For A Penalty

If you’ve gone through steps 1 to 3 and you still haven’t found enough cash, you can now start to evaluate the role of your retirement accounts. In this step, you should only consider withdrawals you could take penalty-free. Here’s when that might apply, for 3 of the major account types:

- 401: You’re at least 59½ years old .

- Traditional IRA: You’re at least 59½ years old, you’ve recently become permanently disabled, you’re facing significant unreimbursed medical expenses, or you meet one of the other IRS-specified exceptions.1

- Roth IRA: You only withdraw an amount equal to or less than what you’ve contributedi.e., you don’t withdraw any of the returns you’ve earned on your contributions. Or, if you’ve had the account open for at least 5 years and you meet one of the specific exceptions for penalties on early withdrawals, then you may be able to withdraw earnings as well as contributions penalty-free.2

Of course, all of these choices still entail some additional planning. With a traditional IRA or 401, you may still owe income tax on your withdrawal. Even with a Roth IRA, you may owe tax if you withdraw earnings before you’ve had the account open at least 5 years. And with any of these moves, you may need to boost your retirement savings once your emergency has passed, to recover from the withdrawal.

How To Withdraw From A Fidelity 401k

The Fidelity suite of products offer a wide range of services that help individuals do everything from saving for retirement to investing extra money to trade on the stock market. Fidelity manages employer-sponsored 401 plans and offers its own self-employed and small business 401 plans. Customers with a Fidelity 401 can withdraw money from the account, but they should be aware of the tax implications of early withdrawal.

Don’t Miss: Can I Move 401k To Roth Ira

What Happens If You Leave Your Job

When you take out a loan from a 401, you may have no intention of leaving your current employer. But if you receive a better job offer, or are laid off or otherwise leave, you could be required to pay the loan back in full or face some serious tax consequences.

Employees who leave their jobs with an outstanding 401 loan have until the tax-return-filing due date for that tax year, including any extensions, to repay the outstanding balance of the loan, or to roll it over into another eligible retirement account. That means if you left your job in January 2020, you would have until April 15, 2021 when your 2020 federal tax return is due to roll over or repay the loan amount. Prior to the Tax Cuts and Jobs Act of 2017, the deadline was 60 days.

If you cant repay the loan, your employer will treat the remaining unpaid balance as a distribution and issue Form 1099-R to the IRS. That amount is typically considered taxable income and may be subject to a 10% penalty on the amount of the distribution for early withdrawal if youre younger than 59½ or dont otherwise qualify for an exemption.

Unfortunately, this worst-case scenario isnt rare. A 2014 study from the Pension Research Council at the Wharton School of the University of Pennsylvania found that 86% of workers in the sample who left their jobs with a loan outstanding eventually defaulted on the loan.

You May Like: How Do I Start My Own 401k

Hardship And Loan Distributions

Hardship and loan distributions are only available through Fidelity. You may request a hardship distribution from the contributions you have through Fidelity provided that certain IRS requirements are met for this type of distribution. Please reference the Instructions for requesting a Hardship Distribution.

You may also be eligible to take out a loan against your contributions to the plan. When you take out a loan, you are simply borrowing money from your retirement plan account. You will repay the loan amount and interest to Fidelity on a monthly basis. The interest you pay on the loan is not tax deductible. However, there are no taxes or penalties unless you default on the loan. If you default on your repayments, you will be taxed as if the outstanding balance of your loan was distributed to you and might possibly include a 10 percent penalty, if you are under the age of 59 ½. Contact Fidelity to apply for a loan. Learn more about the Duke loan program.

Read Also: How Much Should I Pay Into My 401k

How Much Can You Borrow From Your 401

In general, you can borrow the greater of $10,000 or 50% of your vested account balance up to $50,000. You are limited to the balance in your current companyâs 401, not the collective balance of all of your retirement accounts. You may, however, be able to roll over funds into your current 401 to increase the amount you can borrow. You are limited to borrowing from the assets in your current employerâs 401 plan.

Loans To Purchase A Home

Regulations require 401 plan loans to be repaid on an amortizing basis over not more than five years unless the loan is used to purchase a primary residence. Longer payback periods are allowed for these particular loans. The IRS doesn’t specify how long, though, so it’s something to work out with your plan administrator. And ask whether you get an extra year because of the CARES bill.

Also, remember that CARES extended the amount participants can borrow from their plans to $100,000. Previously, the maximum amount that participants may borrow from their plan is 50% of the vested account balance or $50,000, whichever is less. If the vested account balance is less than $10,000, you can still borrow up to $10,000.

Borrowing from a 401 to completely finance a residential purchase may not be as attractive as taking out a mortgage loan. Plan loans do not offer tax deductions for interest payments, as do most types of mortgages. And, while withdrawing and repaying within five years is fine in the usual scheme of 401 things, the impact on your retirement progress for a loan that has to be paid back over many years can be significant.

If you do need a sizable sum to purchase a house and want to use 401 funds, you might consider a hardship withdrawal instead of, or in addition to, the loan. But you will owe income tax on the withdrawal and, if the amount is more than $10,000, a 10% penalty as well.

Don’t Miss: Will I Lose My 401k If I Quit

Placing Real Estate Investment Question:

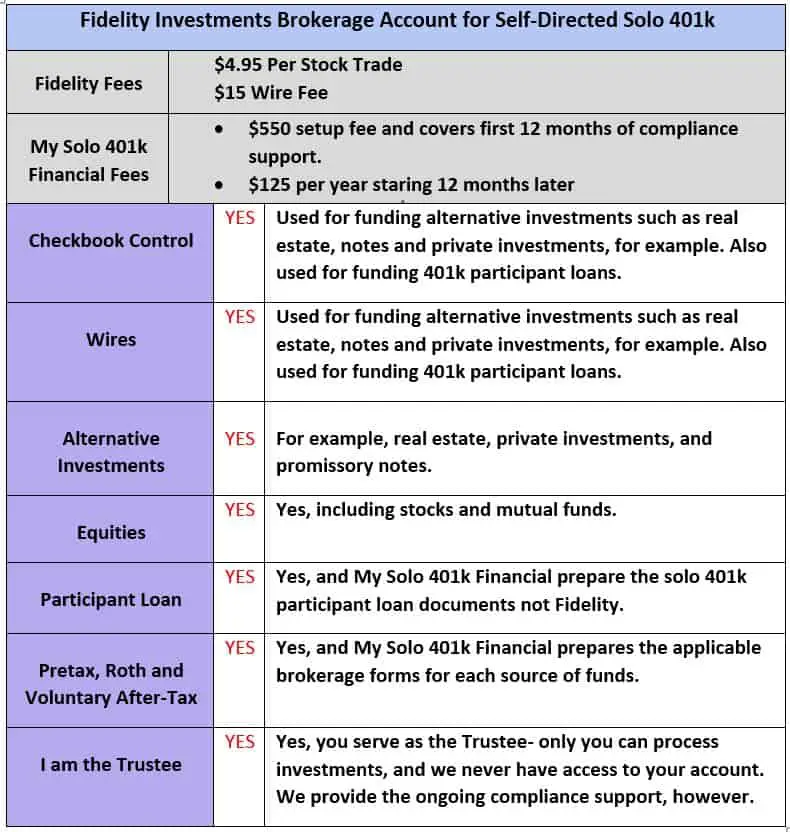

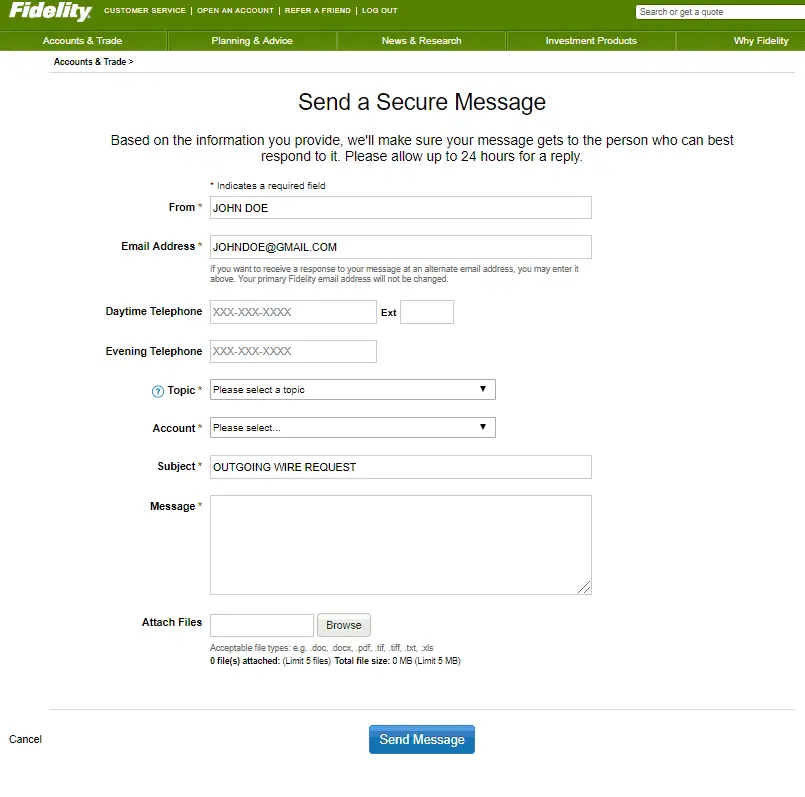

That is good news, and it sounds like the Fidelity brokerage account set up up process went smoothly and now you can start placing investments in alternative investments such as real estate. You can either place the investments by writing a check or by filling out the Fidelity outgoing wire directive, which we can fill out for you. for more information regarding investing in real estate.

Early Withdrawal Calculator Terms & Definitions:

- 401k â A tax-qualified, defined-contribution pension account as defined in subsection 401 of the Internal Revenue Taxation Code.

- Federal Income Tax Bracket â The division at which tax rates change in the federal income tax system .

- State Income Tax Rate â The percentage of taxes an individual has to pay on their income according to the laws of their state.

- Lump-sum Distribution â The withdrawal of funds from a 401k.

- Rollover â Moving the 401k contribution to another retirement fund option, often an IRA.

- Penalties â The payment demanded for not adhering to set rules.

- Future Value Before Taxes â The value of oneâs asset at the end of the term before taxes are paid.

- Future Taxes to be Paid â The taxes that are required to be paid at the end of the term.

- Future Net Available â The amount left after taxes and penalties are deducted.

- Annual Rate of Return â The percentage earned every year by having funds in an account.

Recommended Reading: How To Find Out What You Have In Your 401k

Make A 401 Withdrawal

Your second option would be to make a direct withdrawal from your 401 account. As mentioned above, this is the less desirable of the two options.

An early withdrawal would be classified as a hardship withdrawal. The IRS considers any emergency removal of funds from a 401 to cover an immediate and heavy financial need as a hardship withdrawal. Whether or not the purchase of a home using your 401 counts as a hardship withdrawal is a determination that falls to your employer, and you will need to present evidence of hardship before the withdrawal can be approved.

Regardless, you will still likely incur the 10% early withdrawal penalty. There are exemptions in place for specific circumstances, including home buying expenses for a principal residence. Qualifying for such exemptions is difficult by design, however. If you possess other assets that could be used for your home purchase, then you likely wont qualify for an exemption. Even if you do, your withdrawal will still be taxed as income.

You May Like: What Will My 401k Be Worth At Retirement

Why Do People Get 401 Loans

As long as a plan allows it, participants generally can borrow from their 401 for any reason that they deem necessary. Some plans may only allow loans for specific reasons, so be sure to check your plans rules before trying to borrow.

Since youre borrowing your own money, and no credit check is involved, it may be easier to get approved for a 401 loan as long as you meet the plans requirements for borrowing. In some cases, a requirement may be getting approval from your spouse , because your spouse may be entitled to half of your retirement assets if you divorce.

Here are some potential uses for a 401 loan.

- Paying household bills and expenses

- Funding a down payment on a house

- Paying off high-interest debt

- Paying back taxes, or money owed to the IRS

- Funding necessary home repairs

- Paying education expenses

But that doesnt mean 401 loans are always a good idea. In fact, there are some major risks that come with borrowing from your retirement savings. Here are two.

Read Also: Where Should I Put My 401k Money After Retirement

Considering A Loan From Your 401 Plan

Your 401 plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan from your 401.

If you dont repay the loan, including interest, according to the loans terms, any unpaid amounts become a plan distribution to you. Your plan may even require you to repay the loan in full if you leave your job.

Generally, you have to include any previously untaxed amount of the distribution in your gross income in the year in which the distribution occurs. You may also have to pay an additional 10% tax on the amount of the taxable distribution, unless you:

- are at least age 59 ½, or

- qualify for another exception.

Early Withdrawals Less Attractive Than Loans

One alternative to a 401 loan is a hardship distribution as part of an early withdrawal, but that comes with all kinds of taxes and penalties. If you withdraw the funds before retirement age youll typically be hit with income taxes on any gains and may be assessed a 10 percent bonus penalty, depending on the nature of the hardship.

You can also claim a hardship distribution with an early withdrawal.

The IRS defines a hardship distribution as an immediate and heavy financial need of the employee, adding that the amount must be necessary to satisfy the financial need. This type of early withdrawal doesnt require you to pay it back, nor does it come with any penalties.

A hardship distribution through an early withdrawal covers a few different circumstances, including:

- Certain medical expenses

- Some costs for buying a principal home

- Tuition, fees and education expenses

- Costs to prevent getting evicted or foreclosed

- Funeral or burial expenses

Also Check: Who Is The Best 401k Provider

What Are The Pros And Cons Of Cashing Out A 401k

- Access to money. The biggest benefit of retiring from your 401 is having money. Everyone would like to have more money in their pocket.

- taxes. Regardless of how you use your 401 withdrawal, you will have to pay withdrawal tax.

- To punish. Even if you qualify to be fired for difficult working conditions before you turn 59 1/2, the IRS will penalize you for doing so.

Alternatives To Cashing Out

If you want to make a more conservative decision, you can leave your money in your 401 k when you change to a different company or employer. Cashing out your 401 k isnt a requirement, after all. If youre happy with your old employers 401 k, we recommend that you leave the money where it is. You can withdraw it once you retire. This is also a great way to avoid paying excessive income tax.

You can also stretch out the time that you withdraw money from your 401 k. The funds dont have to come out in a lump payment. A plan participant leaving an employer typically has four options , each choice offering advantages and disadvantages. You can leave the money in the former employers plan, if permitted Roll over the assets to your new employer plan if one is available and rollovers are permitted Roll over the funds to an IRA or cash out the account value. The more time between your payments, the easier it is to avoid paying extra tax on the money. This is because funds from your 401 k are considered part of your taxable estate.

Read Also: How Do I Transfer My 401k To An Ira