How Can I Withdraw Money From My 401k Without Penalty

Here are the ways to get free withdrawals from your IRA or 401

- No medical payments.

- The first of the health insurance.

- If you owe the IRS.

- Home buyers for the first time.

- Higher education costs.

- For entry purposes.

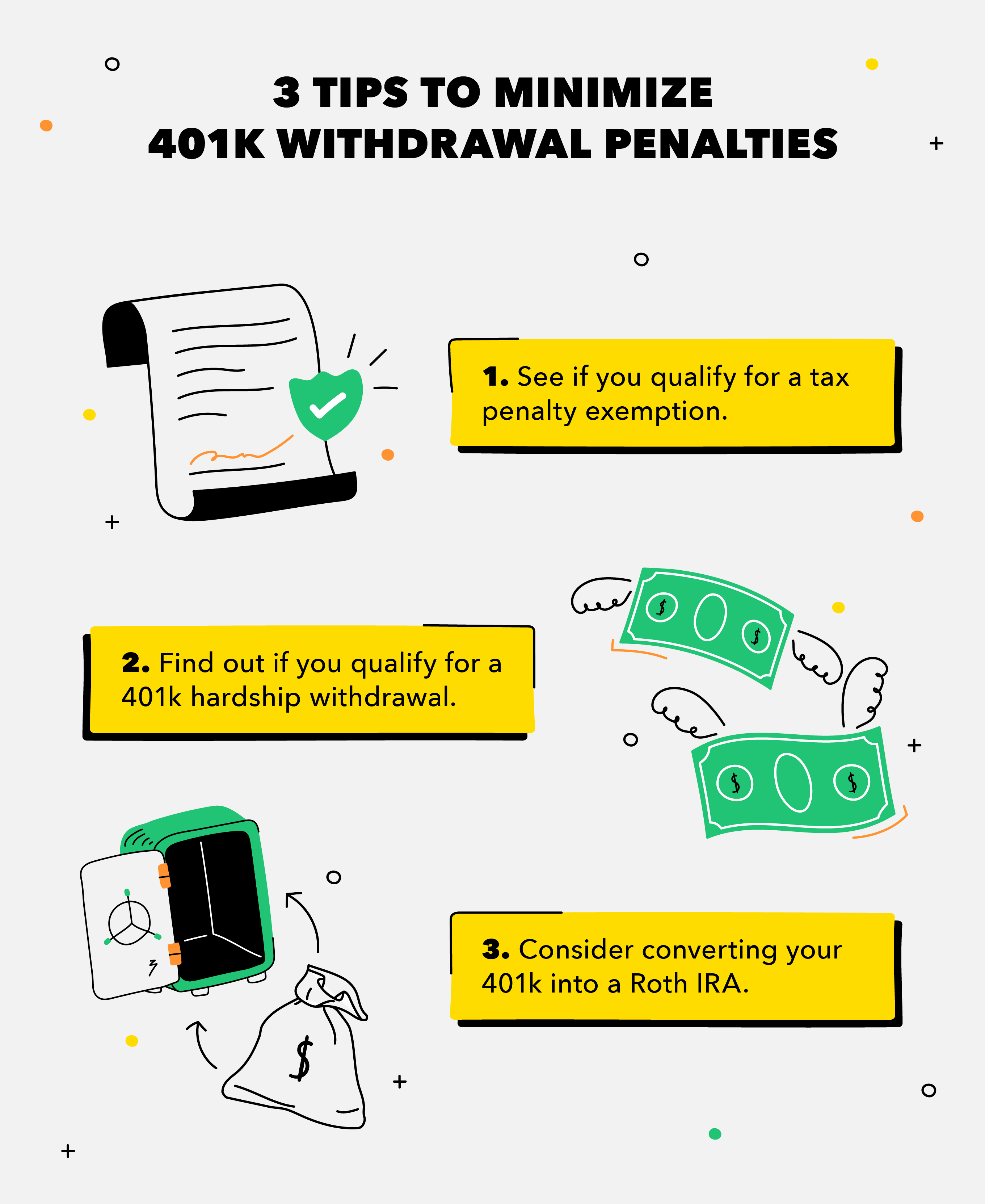

What qualifies as a hardship withdrawal for 401k?

Eligibility for Retirement Difficulty Certain medical expenses. Home purchase expenses for a main residence. Up to 12 months of schooling and expenses. Expenses to prevent them from being foreclosed on or expelled.

When can you withdraw from 401k tax free?

Stashing pre-tax cash on your 401 also allows you to grow it tax-free until you pick it up. There is no limit to the number of withdrawals you can make. After you turn 59, you can withdraw your money without having to pay an early retirement penalty.

When To Begin Taking Rmds

You are generally allowed to take penalty-free distributions starting at age 59½. However, by April 1 of the year after you reach age 72, you are required to begin taking RMDs from your IRAs.

Depending upon the terms of your 401 or other employer plan, you may be able to delay taking RMDs until April 1 of the year following the later of the year you attain age 72 or the year you retire, provided you are not a 5% or greater owner of the business. Check with your plan administrator for details.

For subsequent years, you must withdraw your RMD amount from your plans by Dec. 31 of each year. This includes the year after you turn age 72, even if you take your first withdrawal that year. NOTE: If you were born on June 30, 1949 or earlier, you were required to begin taking RMDs by April 1 following the year you reached age 70½.

For example, if you turn 72 in October 2021, your first RMD must be taken by April 1, 2022 and your second RMD must be taken by Dec. 31, 2022. Most IRA owners will take their first RMD in the year they turn 72 rather than delaying until April 1 of the next year to avoid having two taxable distributions in one year.

What you do with RMDs is generally up to you you may be able to take distributions in cash or in kind which you can then move to a non-qualified brokerage account. The amount of each years RMD depends on your age and the account balance at the end of the previous year.

Required Minimum Distribution Method

This will result in an annual payment to the recipient. The account balance is divided by the life expectancy factor of the recipient to arrive at the annual amount. The amount is recalculated each year based on the new account balance, but the life table used in the original calculation is used for the duration of the payments.

Also Check: Can A Small Business Set Up A 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

The 401 Withdrawal Rules For People Older Than 59

Most 401s offer employer contributions. You can get extra money for your retirement, and you can keep this benefit after you change jobs as long as you meet any vesting requirements. Thats an important advantage that an IRA doesnt have. Stashing pre-tax cash in your 401 also allows it to grow tax-free until you take it out. Theres no limit for the number of withdrawals you can make. After you become 59 ½ years old, you can take your money out without needing to pay an early withdrawal penalty.

You can choose a traditional or a Roth 401 plan. Traditional 401s offer tax-deferred savings, but youll still have to pay taxes when you take the money out. For example, if you withdraw $15,000 from your 401 plan, youll have an additional $15,000 in taxable income that year. With a Roth 401, your contributions come from post-tax dollars. As long as youve had the account for five years, Roth 401 withdrawals are tax-free.

Don’t Miss: How To Use 401k Money To Start A Business

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Taking Normal 401 Distributions

But first, a quick review of the rules. The IRS dictates you can withdraw funds from your 401 account without penalty only after you reach age 59½, become permanently disabled, or are otherwise unable to work. Depending on the terms of your employer’s plan, you may elect to take a series of regular distributions, such as monthly or annual payments, or receive a lump-sum amount upfront.

If you have a traditional 401, you will have to pay income tax on any distributions you take at your current ordinary tax rate . However, if you have a Roth 401 account, you’ve already paid tax on the money you put into it, so your withdrawals will be tax-free. That also includes any earnings on your Roth account.

After you reach age 72, you must generally take required minimum distributions from your 401 each year, using an IRS formula based on your age at the time. If you are still actively employed at the same workplace, some plans do allow you to postpone RMDs until the year you actually retire.

In general, any distribution you take from your 401 before you reach age 59½ is subject to an additional 10% tax penalty on top of the income tax you’ll owe.

You May Like: How Do You Withdraw From 401k

What Is A 401 Cares Act Withdrawal

Normally, participants who withdraw money from a tax-deferred retirement account before reaching age 59½, must pay a 10% early withdrawal penalty in addition to including the distribution in their taxable income for the year.

There are a few exceptions to the rule, including one for hardships, such as avoiding foreclosures, repairing your home after a disaster, or covering out-of-pocket medical expenses. However, these hardship withdrawals are normally limited to the amount needed to meet a limited list of hardships.

The CARES Act provided more flexibility for making emergency withdrawals from a tax-deferred retirement account by eliminating the 10% early withdrawal penalty. Participants are allowed to withdraw up to $100,000 per person without being subject to a tax penalty. Any early withdrawals above that amount dont qualify for special tax treatment.

Similar to figuring out PPP loan tax implications, it is important to note that there are tax implications for this type of loan as well and that the withdrawal is taxable income the special tax treatment waives the tax penalty but not the taxable event. However, the CARES Act allows people who take hardship distributions to elect to pay federal income taxes on the distribution over a three-year period or repay the distribution amount over a three-year period and avoid tax consequences entirely. The three-year repayment period starts on the day of the distribution.

Alternatives To The Rule Of 55

The rule of 55 is not the only way to take penalty-free distributions from a retirement plan. There’s another way to take money out of 401, 403, and even IRA retirement accounts if you leave a job before the age of 59 1/2. It’s known as the Substantially Equal Periodic Payment exemption, or an IRS Section 72 distribution.

A SEPP plan has a twist. You start by estimating your life expectancy. Then use that to calculate five similar size payments from a retirement plan for five years in a row before the age of 59 1/2. What’s different is that these distributions can occur at any agethey’re not bound by the same age threshold as the Rule of 55.

Read Also: How To Roll Your 401k Into A Self Directed Ira

What Are The Pros And Cons Of Withdrawal Vs A 401k Loan

| Pros and Cons of 401k Withdrawal vs. 401k Loan | ||

|---|---|---|

| 401k Withdrawal | ||

|

|

|

| Cons |

|

|

How Much Can I Withdraw From My 401k After 59 1 2

There is no limit to the number of deductions you can make. After you turn 59 ½, you can withdraw your money without having to pay the first withdrawal penalty.

At what age 401k deduct tax free? The IRS allows for the removal of the penalty-exempt from retirement accounts after the age of 59 ½ and requires removal after 72 years .

Also Check: How To Sell 401k Plans

How Covid Retirement Plan Withdrawals Affect Your Taxes

Though you dont have to pay the 10% penalty on these withdrawals, youll still owe taxes on the money you withdraw. To make things a bit easier, though, the CARES Act allows you to spread the income over three different tax years.

For example, if you borrowed $30,000, you can apply $10,000 to your 2020 taxable income, $10,000 in 2021 and the last $10,000 in 2022. You must take at least one-third of the money in each year, though. You can also opt to take more in any year, including up to all of the money if you so choose.

If, in a later year, youve made back the money you withdrew, that is allowed. Youll have to file an amended return for any years with withdrawal money to get a refund. Again, the same rules apply for IRAs and 401s.

Also Check: How To Check My 401k Balance

What Type Of Situation Qualifies As A Hardship

The following limited number of situations rise to the level of hardship, as defined by Congress:

- Unreimbursed medical expenses for you, your spouse or dependents

- Payments necessary to prevent eviction from your home or foreclosure on a mortgage of principal residence.

- Funeral or burial expenses for a parent, spouse, child or other dependent

- Purchase of a principal residence or to pay for certain expenses for the repair of damage to a principal residence

- Payment of college tuition and related educational costs for the next 12 months for you, your spouse, dependents or non-dependent children

Your plan may or may not limit withdrawals to the employee contributions only. Some plans exclude income earned and or employer matching contributions from being part of a hardship withdrawal.

In addition, IRS rules state that you can only withdraw what you need to cover your hardship situation, though the total amount requested may include any amounts necessary to pay federal, state or local income taxes or penalties reasonably anticipated to result from the distribution.

A 401 plan even if it allows for hardship withdrawals can require that the employee exhaust all other financial resources, including the availability of 401 loans, before permitting a hardship withdrawal, says Paul Porretta, a compensation and benefits attorney at Troutman Pepper in New York.

Also Check: How To Roll 401k Into Another 401k

What Is An Early Withdrawal From A 401

An early withdrawal from a 401 happens when you take distributions from your account before the age of 59 ½.

The accounts are designed to provide you with an additional source of income during retirement, hence, the age requirement on distributions. If you decide to make an early withdrawal from your 401, the IRS will charge you a penalty.

Understanding Early Withdrawal From A 401

A 401 is a retirement plan that allows you to make tax-deferred contributions into the plan and lets the investments grow tax-free until retirement age. Since this money is supposed to be for retirement, then it needs to remain in the account until you retire. Withdrawing money from your account should only be done in emergency situations. Removing the money early will result in payment of income taxes and a penalty.

Since a 401 is an employer sponsored plan, then your employer sets some of the rules regarding early withdrawal. Not every plan allows for early withdrawals. You should first check your plan documentation to determine whether an early withdrawal will be allowed from your plan. You can also view the details of what qualifies for an early withdrawal and any documentation that may be required.

You should think long and hard before taking any early withdrawals from your plan. You could consider other options such as a personal loan or borrowing from friends or family. Once you pay the income tax and early withdrawal penalty on your funds, you are likely to only be left with about 60% of the money that you removed from your account. This can put a huge dent in your account and set you way back in your retirement planning goals.

Also Check: Should I Roll Over 401k From Previous Employer

How To Withdraw 401k Money

As with any decision involving taxes, consult with your tax professional on considerations and impacts to your specific situation. An Edward Jones financial advisor can partner with them to provide additional financial information that can help in the decision-making process. When considering withdrawing money from your 401 plan, you can withdraw in a lump sum, roll it over or purchase an annuity. Your financial advisor or 401 plan administrator can help you with this.

Series Of Substantially Equal Periodic Payments

This is the classic Section 72t ) method for early withdrawal exceptions to the penalty. Essentially you agree to continue taking the same amount from your plan for the greater of five years or until you reach age 59½. There are three methods of SOSEPP:

7. Required Minimum Distribution method uses the IRS RMD table to determine your Equal Payments.

8. Fixed Amortization method in this method, you calculate your Equal Payment based on one of three life expectancy tables published by the IRS.

9. Fixed Annuitization method this method uses an annuitization factor published by the IRS to determine your Equal Payments.

Section 72 provides additional methods for premature distribution exceptions which can occur before leaving employment :

10. High Unreimbursed Medical Expenses for yourself, your spouse, or your qualified dependent. If you face these expenses, you may be allowed to withdraw a limited amount without penalty.

11. Corrective Distributions of Excess Contributions under certain conditions, when excess contributions are made to an account these can be returned without penalty.

12. IRS Levy when the IRS levies an account for unpaid taxes and/or penalties, this distribution is generally not subject to penalty.

And lastly, here are a few additional ways that you can withdraw your 401k funds without penalty:

Originally by Financial Ducks In A Row, 1/20/20

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM

Don’t Miss: Do Employers Match Roth 401k

How Much Tax Do You Pay On Retirement Withdrawals

There is a mandatory withholding of 20% of a 401 withdrawal to cover federal income tax, whether you will ultimately owe 20% of your income or not. Rolling over the portion of your 401 that you would like to withdraw into an IRA is a way to access the funds without being subject to that 20% mandatory withdrawal.

Making A Hardship Withdrawal

Depending on the terms of your plan, however, you may be eligible to take early distributions from your 401 without incurring a penalty, as long as you meet certain criteria. This type of penalty-free withdrawal is called a hardship distribution, and it requires that you have an immediate and heavy financial burden that you otherwise couldn’t afford to pay.

The practical necessity of the expense is taken into account, as are your other assets, such as savings or investment account balances and cash-value insurance policies, as well as the possible availability of other financing sources.

What qualifies as “hardship”? Certainly not discretionary expenses like buying a new boat or getting a nose job. Instead, think along the lines of the following:

- Essential medical expenses for treatment and care

- Home-buying expenses for a principal residence

- Up to 12 months worth of educational tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence

The home-buying expenses part is a bit of a gray area. But generally, it qualifies if the money is for a down payment or for closing costs.

Also Check: How To Transfer My 401k To My Bank Account