Alternative To A 401 And A Roth Ira

If your income is too high for a Roth IRA, you can invest in a traditional IRA instead to supplement your 401 contributions.

You must still have taxable earnings to be eligible for a traditional IRA, but there’s no income limit. You could have both plans, even as a high earner. These accounts work like 401 accounts in that your contribution is either fully or partially deductible in the present. You pay taxes on the money you invest and on earnings upon withdrawal.

You can take a full deduction up to your IRA limit if you don’t also participate in a 401 or another retirement plan at work, or if you have a 401, but your modified AGI is $66,000 or less as a single filer in 2021. This increases to $105,000 or less as a married couple filing jointly when the spouse contributing to the IRA also has a work-related 401. In 2022, these limits increase to $68,000 and $109,000, respectively.

In 2021, you can claim a reduced deduction if your income is more than $66,000 or more than $105,000 for a single filer or couple with a spouse enrolled in a 401 at work.

You don’t qualify for any deduction if you earn $76,000 or more as a single filer or $125,000 or more as a couple with a spouse enrolled in a 401 at work in 2021. These limits increase to $78,000 for single filers and $129,000 for couples in 2022.

Examples Of How You Can Contribute To Both Plans

Lets look at an example of how you can combine the power of a 401 and an IRA to speed up your retirement savings.

Example #1: Consider a 30-year-old earning $55,000 per year. Her first priority should be saving at least enough in her workplace retirement plan to earn the full employer match, which in her case is 50% of the first 6% saved .

In this case, shes saving nearly $5,000 in tax-deferred funds in her 401 . However, perhaps shes anticipating earning far more in the near future and wants to sock away some after-tax money while shes still in a relatively low tax bracket. She could save an additional $6,000 in a Roth IRA. That brings her total annual contributions to $10,500, all of it growing in tax-advantaged accounts.

Example #2: Next, consider a married 55-year-old woman earning $300,000 per year. Say shes maxing out her workplace 401 at her $20,500 yearly contribution limit. Because shes over 50, she also gets to make a catch-up contribution of $6,500 to her 401. Luckily, her work matches contributions dollar-for-dollar up to 6% of her salary which means another $18,000 in her 401, for a total of $45,000 that is pre-tax and will grow tax-deferred.

Benefits Of Contributing To Both A 401 And Roth Ira

Contributing to both a 401 and Roth IRA allows you to maximize your retirement savings and benefit from tax advantages. With a 401 account, you’ll contribute money you haven’t yet paid taxes on. Your employer may also match contributions up to a certain percentage of your annual income.

With your Roth IRA, contributions are made after you’ve paid taxes, but qualified distributions, or withdrawals, are not taxed. Additionally, contributing to these accounts may make you eligible for a tax credit known as the Saver’s Credit, which could be up to 50% of your contributions. When you combine these accounts, you can stack your tax benefits while saving for retirement.

Also Check: Can You Roll A 401k Into A Simple Ira

How A 401 Works

The contributions that you make to your 401 are excluded from your taxable income, which is why this is called a tax-deferred account. So if you earn $40,000 annually and contribute $3,000 to your 401 for the year, the IRS will consider your taxable income to be $37,000 . In some cases, reducing your taxable income could mean less of your income is in a higher tax bracket and save you even more money come tax season.

For the 2022 tax year, you can contribute up to $20,500 to your 401 account. If you are 50 years old or older, some 401 plans will let you add “catch-up contributions” of up to $6,500, allowing for a total of $27,000 in contributions for 2022. Each year, these contribution limits change, so be sure to check the latest IRS publications for updates.

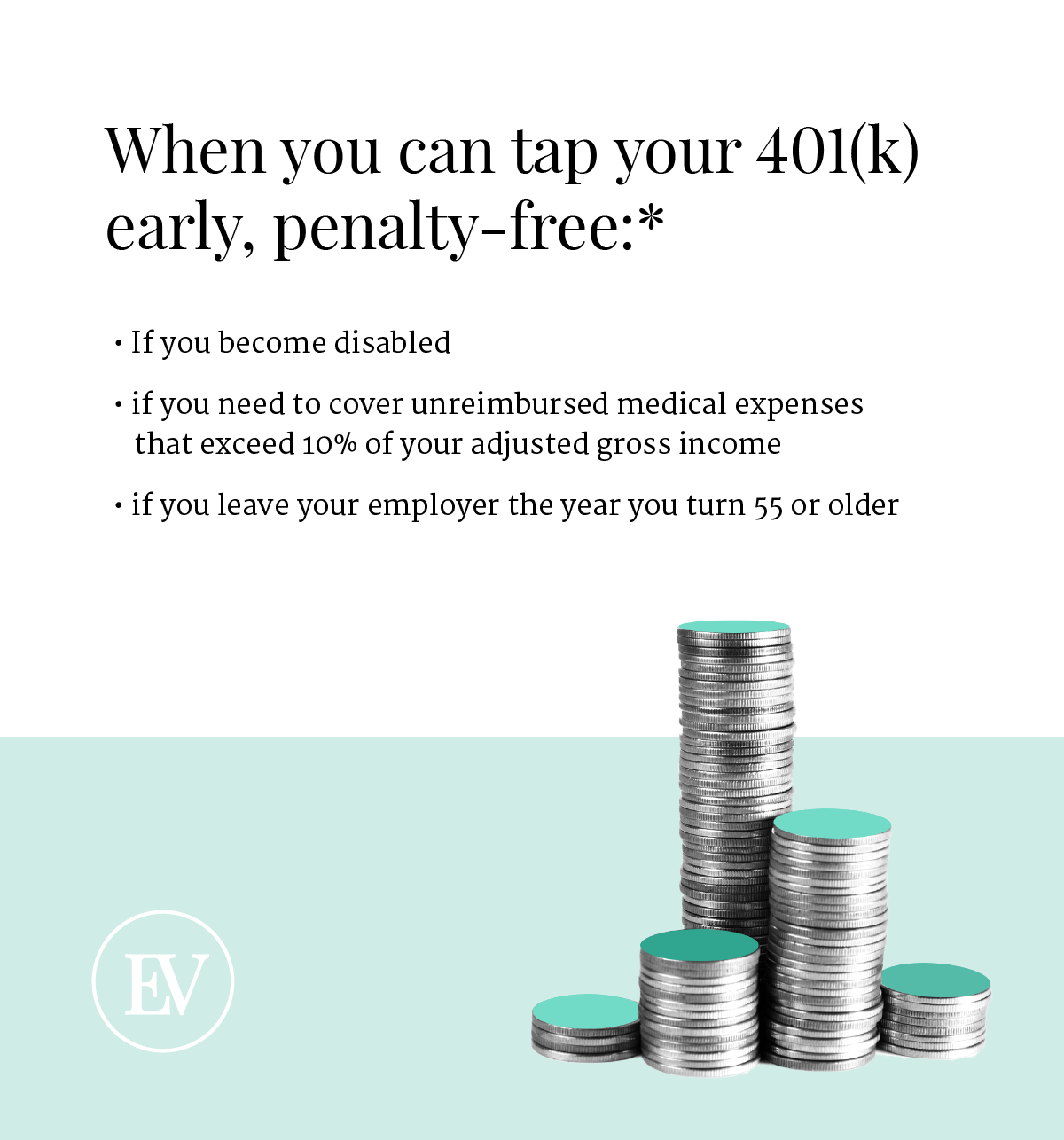

When you invest through your 401 account, your earnings grow tax-free. But once you start withdrawing your 401 account balance, at age 59½ or later, the distributions are taxed as ordinary income. This has benefits if your income is lower in retirement, since you should expect to get taxed at a lower rate. Withdrawing money from your 401 before you’re 59½ years old results in a 20% tax withholding and carries an additional 10% penalty, so it is not advisable.

You Can Roll Over A 401 Account

Workers generally have four options for their 401 when they leave a company: You can take a lump-sum distribution you can leave the money in the 401 you can roll the money into an IRA or, if you are going to a new employer, you may be able to roll the money to the new employers 401.

Its usually best to keep the money in a tax shelter, so it can continue to grow tax-deferred. Whether you roll the money into an IRA or a new 401, be sure to ask for a direct transfer from one account to the other. If the company cuts you a check, it will have to withhold 20% for taxes. And whatever money isnt back in a retirement account within 60 days will become taxable. So if you dont want that 20% to be considered a taxable distribution, youll have to use other assets to make up the difference.

Recommended Reading: Can I Move 401k To Roth Ira

Benefits And Drawbacks Of A 401

The prospect of employer matches and large contribution limits can give the 401 an edge, but it does have its limitations. For instance, companies typically place stricter restrictions around your funds. No law states they must allow hardship withdrawals, for example.

And some plans can involve hefty administration fees and fund expenses that can add up, taking a chunk out of your retirement savings. Thats why you should learn everything you need to know about 401 fees. Generally speaking, though, the larger the company, the lower the fees.

Read Also: When Can I Get Money From 401k

Can You Roll Over Your 401 Or Ira Into A Bank On Yourself Plan

One common question we get is

Can I roll over funds from my 401/IRA/403/TSA into a Bank On Yourself policy and what are the tax consequences?

Moving money from a conventional tax-deferred retirement account into a Bank On Yourself policy is a common method people use to fund a policy. Its not technically a rollover, since you can only do that from one 401 or IRA to another. Heres how it works

Theres no getting around paying income taxes on money you withdraw from a tax-deferred plan like a 401, IRA, 403 or TSA. But there are ways to potentially reduce your lifetime tax bite, as well as avoid paying the 10% early withdrawal penalty. The specifics of how this is done depend on whether or not youve turned age 59-1/2 yet.

Don’t Miss: What Happens If I Quit My Job With A 401k

Whats The Maximum Contribution For A 401 And Iras In 2020

- Contributions to a traditional IRA may be tax-deductible meaning you might be able to lower your taxable income and, in turn, reduce your tax bill.

- Roth IRAs, funded with after-tax dollars, grow tax-free & you pay zero taxes when you make withdrawals in retirement.

- Contributions to a traditional IRA may be tax-deductible meaning you might be able to lower your taxable income and, in turn, reduce your tax bill.

- Roth IRAs, funded with after-tax dollars, grow tax-free & you pay zero taxes when you make withdrawals in retirement.

The journey to retirement is anything but a straight and narrow path. As pensions gradually become a thing of the past , many workers are looking for ways to grow their money ahead of retirement.

There are multiple ways to save for your golden years, like investing in a regular brokerage account to build your nest egg over the long term. But taking advantage of tax-friendly investment accounts is what puts real muscle behind your efforts.

There are, of course, contribution limits. Heres how much you can kick into an Individual Retirement Account and a 401 in 2020.

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

Also Check: How Do I Find Out Who My 401k Is With

What Is A Spousal Ira

Now listen up, married people, because this is important. Even if you or your spouse doesnt have an earned income, you can still have two Roth IRAs between both of you thanks to the spousal IRA. For most single-income families, fully funding two Roth IRAs will be enough to reach the goal of investing 15% of their income for retirement.

Do I Have To Report A 60 Day Rollover

The IRS doesn’t require taxes or impose penalties on rollovers made from one retirement account to another eligible retirement account. … The IRS doesn’t tax and penalize the account right away. They allow 60 days to deposit the funds into an eligible retirement account in order to avoid any taxes and penalties.

Read Also: What Do You Do With 401k When You Retire

Rules And Options For Distribution When Inheriting An Account From A Non

Non-spousal beneficiaries have three choices, with the associated withdrawal rules below:

- Transfer funds directly from the 401 account into an inherited IRA: In an inherited IRA all money must be withdrawn within 10 years. If the money was in a pre-tax 401, youll owe tax on any withdrawals from the inherited traditional IRA. If you are withdrawing from a Roth 401 or converting it into a Roth IRA, there will be no tax implications as the money was contributed on an after-tax basis. If you convert a pre-tax 401 into a Roth IRA, youll generally owe taxes on the conversion.

- Take a lump sum distribution: This action provides you with immediate access to the money. If you take a lump sum distribution, you may incur hefty taxes, if you realize a significant income or the money may push you into a higher tax bracket. If the inherited 401 is pre-tax, youll pay taxes at ordinary income rates. If the account is a Roth 401, then you wont owe any income taxes on the withdrawal.

- Leave the money in the 401 and withdraw it over 10 years: You can also leave the money in the 401 account, but youll still need to withdraw it within 10 years, to meet the 401s 10-year rule.

Should You Roll Over Your 401

To start, its worth knowing that you dont have to make a 401-to-IRA rollover, even if you do leave your job. You have the option of leaving the money youve invested in the plan at your old company. You cant keep contributing to it, but it will stay invested and if your investments go up, youll continue to see your account grow. This is called an orphan account.

Do you like the way your money is invested currently? If so, you may want to consider keeping your money in the existing plan. If you currently arent working but anticipate taking a new job soon, you could leave your money at your old plan temporarily and put it into your new companys plan once you have access to it.

For those who dont think theyll end up in another 401 plan but still want to save more for retirement, it might make sense to do a 401-to-IRA rollover. Remember, even though you still have your account at your old companys 401, you wont have the ability to make more contributions.

Also Check: How Much Percentage Should I Contribute To My 401k

Transferring Your 401 To Your Bank Account

You can also skip the IRA and just transfer your 401 savings to a bank account. For example, you might prefer to move funds directly to a checking or savings account with your bank or credit union. Thats typically an option when you stop working, but be aware that moving money to your checking or savings account may be considered a taxable distribution. As a result, you could owe income taxes, additional penalty taxes, and other complications could arise.

IRA first? If you need to spend all of the money soon, transferring from your 401 to a bank account could make sense. But theres another option: Move the funds to an IRA, and then transfer only what you need to your bank account. The transfer to an IRA is generally not a taxable event, and banks often offer IRAs, although the investment options may be limited. If you only need to spend a portion of your savings, you can leave the rest of your retirement money in the IRA, and you only pay taxes on the amount you distribute .

Again, moving funds directly to a checking or savings account typically means you pay 20% mandatory tax withholding. That might be more than you need or want. Most IRAs, even if theyre not at your bank, allow you to establish an electronic link and transfer funds to your bank easily.

Employer Matching Contributions To A 401

Many employers provide a matching contribution for some or all of an employees 401 contribution, incentivizing employees to participate in the plan. Matching contributions are considered to be traditional 401 deposits, even if the employee contributes to a Roth 401.

For example, some employers may match 50 percent of an employees contributions up to 8 percent of their salary each year. If the employee contributed 8 percent, the employer would add another 4 percent, and the employee would effectively enjoy a total of 12 percent saved. But if the employee contributed 10 percent, the employer would still add a maximum of 4 percent.

Employers offer different matching amounts, and some employers may offer no match at all.

Many employers require matching contributions to vest over time. For example, if the employer requires three years of vesting, employees must remain with the company for at least three years before any matching funds become fully theirs. However, once the employee has surpassed the vesting period, any subsequent matching funds immediately become theirs.

Matching funds may partially vest, depending on the employees length of service. For example, with a three-year vesting schedule, an employee who stays two full years may be able to keep two-thirds of any matching funds. But the rules depend on the details in the employers plan.

You May Like: Can I Borrow Against My 401k

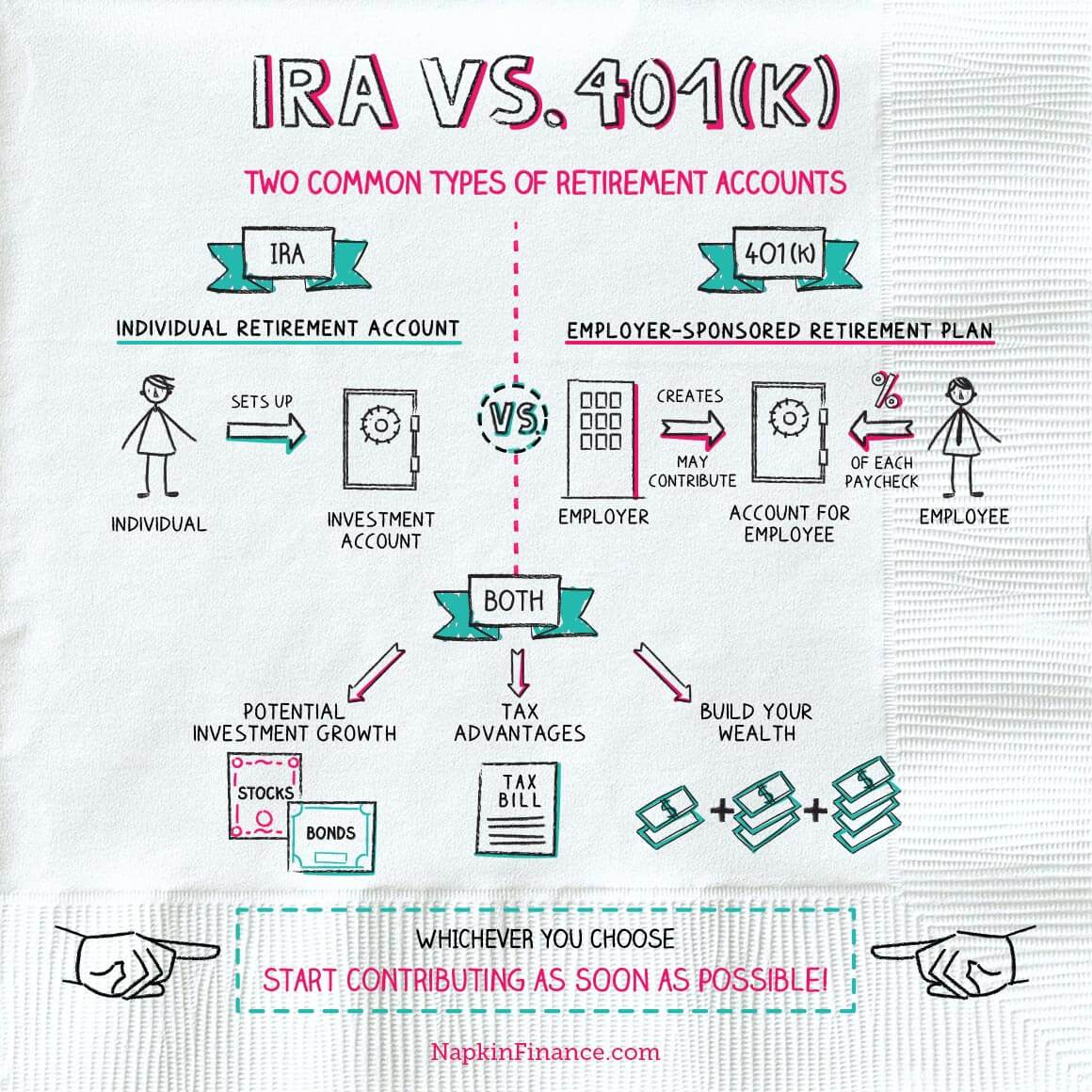

Whats The Difference Between An Ira And A 401

IRAs let you save for retirement outside of an employer plan. With an IRA, investors under 50 can put up to $6,000 per year in an IRA . Those 50 and over can put in an additional $1,000 each year, commonly called a catch-up contribution.

IRAs can also offer other tax advantages and benefits. With a traditional IRA, withdrawals after age 59½ are taxed as current income, although you can generally deduct your contribution on your income taxes. With a Roth IRA, you can contribute after-tax income, but all withdrawals after age 59½ are tax free if youve had a Roth IRA for at least five years.

There are IRS-determined income limits for deductible IRA contributions if you also have a 401 plan through your employer. Thats why its important to consider your household income and likely contributions when deciding between a traditional or Roth IRA.

You can also open an IRA by rolling over a 401 account from a previous employer instead of letting it sit with your old company. Youll face no tax penalties if you transfer that plan to an IRA. You may also enjoy greater flexibility with your IRA transactions.

Can You Roll An Ira Into A 401

Yes, you can roll an IRA into 401 if the 401 provider will allow it.

Rollovers generally occur in one direction, from an employer plan like a 401 or 403 to an Individual Retirement Account when you leave a previous employer.

A reverse rollover occurs when an IRA holder rolls over money from their retirement account into a 401.

Read Also: How Much Can I Put In A Solo 401k

Read Also: How To Find Old 401k Funds