Roll Over The Old 401 Account Into Your Current Employers Plan

By rolling the old account into your current employers plan, youll be able to keep all your 401 accounts in one place, making it easier to keep track of them. However, most 401 plans have a limited number of investment offerings, so if youre not happy with your current plans options, youre probably better off rolling the old account into an IRA.

Ways Of Finding My Old 401ks Including Using Ssn

If youâve ever left a job and wondered âWhere is my 401?â, youâre not alone. Locating 401âs is complicated. Thus, billions of dollars are left behind each year. Beagle can help track down your money.

Contributing to an employer-sponsored 401 plan is a great way to build wealth for retirement especially if youâre receiving a match from your company. The problem is they are tied to an individual employer. We forget about them, leave that company, and one day we realize âOh yeah! Where is my 401?â

A 401 can be in a few different places. Most commonly it could be with your previous employers, an IRA they transferred your funds to after you left, or mailed to the address they had on file.

Believe it or not, Americans unknowingly abandoned $100 billion worth of unclaimed 401 accounts. According to a US Labor Department study, the average worker will have had about 12 different jobs before they turn 40. So itâs easy to see how we can lose track of so much 401 money.

To find your old 401s, you can contact your former employers, locate an old 401 statement, search unclaimed asset database in different states, query 401 providers using your social security number or better yet, get some help to find your 401 accounts from companies like Beagle.

Check Your 401 Investments

For 401 plans with Fidelity, go to your account and look at your rate of return . Underneath the rate of return click on investment performance and research. Here, there are more details about the performance of each fund.

Some 401 plans offer target date funds which are funds aligned to the assumed year you will retire. If youre enrolled in one of these plans, they tend to come with higher fees but require the least amount of effort from you to maintain. That way, the mix in your portfolio will shift automatically for you as the person who is managing it will change the investments over time. If youd prefer to set it and forget it, you may decide this is worth the higher fees.

If youre not invested in the target date funds, determine how the investments within your 401 plan are performing. While your 401 investments are in it for the long haul, it is always good to look at your investments once or twice or year. Should you be overweight or overweight in certain segments like international, large cap or small cap? Should you change only your future elections or current investments?

Lastly, how many years has it been since youve changed the mix in your portfolio? If you set your portfolio mix 10 years ago, you may be overweight on stocks and need to rebalance your portfolio to include more fixed income.

Read Also: What To Do With 401k When You Retire

What Type Of Ira Should I Open

During the process of opening your new account, you may get asked which type of IRA youd like to open. You might see the following options: Rollover IRA, Traditional IRA, or Roth IRA. Heres how to pick the right one:

- If you had a Traditional 401 pick a Rollover IRA or, if thats not available, Traditional IRA or, if thats not available, just IRA. The only exception would be if youre considering a Roth conversion, but this is an advanced tax planning strategy that most people dont need to worry about.

- If you had a Roth 401 pick a Roth IRA. Youll need to match the Roth 401 to a Roth IRA for tax reasons.

- If your 401 has mixed assets youll need to open two IRAs, one Roth and one Traditional to for their respective assets.

Read Also: Can I Switch My 401k To A Roth Ira

Contact Your Old Employer About Your Old 401

Employers will try to track down a departed employee who left money behind in an old 401, but their efforts are only as good as the information they have on file. Beyond providing 30 to 60 days notice of their intentions, there are no laws that say how hard they have to look or for how long.

If its been a while since youve heard from your former company, or if youve moved or misplaced the notices they sent, start by contacting your former companys human resources department or find an old 401 account statement and contact the plan administrator, the financial firm that held the account and sent you updates.

You may be allowed to leave your money in your old plan, but you might not want to.

If there was more than $5,000 in your retirement account when you left, theres a good chance that your money is still in your workplace account. You may be allowed to leave it there for as long as you like until youre age 72, when the IRS requires you to start taking distributions, but you might not want to. Heres how to decide whether to keep your money in an old 401.

The good news if a new IRA was opened for the rollover: Your money retains its tax-protected status. The bad: You have to find the new trustee.

Also Check: How Can I Look At My 401k

Not A Math Whiz No Worries

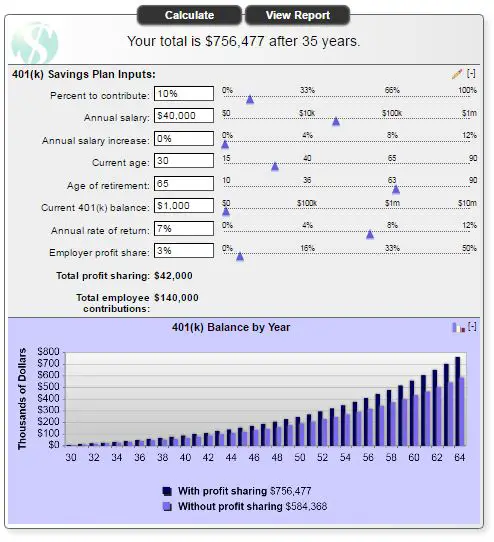

You can find out how much your 401k will grow without the help of a financial wizard. Simply provide the required inputs variables and quickly calculator what your 401k will grow to in the future.

Play around with the actuals and the extras to model various what if scenarios to reach your financial goals. This Simple 401k Calculator can be your best tool for creating a secure retirement. The following step-by-step procedure will show you how

Calculating the compound interest growth and future value of your monthly contributions is as simple as entering your beginning balance, the combined contributions , an estimate of your return on investment, and the number of years until retirement.

Dont Miss: Which 401k Fund To Choose

Don’t Leave Your 401 Behind Here’s How To Reclaim Your Hard

Switching jobs pulls your mind in several directions at once, and it’s easy for your old 401 to get lost in the shuffle. But you can’t afford to forget about it for good. Building a nest egg to sustain you for decades is tough, so you can’t afford to leave any old retirement accounts behind. If you’ve lost track of your old 401, take these steps to find it and put that money to good use.

Recommended Reading: What Is The Minimum 401k Distribution

Locate An Old 401 Statement

If youâre having trouble getting a hold of your former employerâs HR department, refer to an account statement of your old 401.

If youâre still living at the same address, you should have yearly or quarterly statements mailed to you. Check your statement for information on where your account is held and any contact information.

The information on your statements will come in handy in identifying how much money youâll be transferring over to make sure nothing is left behind.

Make Sure You Actually Contributed

Before you go through the hassle and process of calling the HR department at your old employer, or searching through databases, its a good idea to verify that you contributed to the plan.

If you are unsure if you contributed to a 401 plan, you can check your previous year tax return and old W-2. Any contribution will be in Box 12 of the W-2.

ERISA, or the Employee Retirement Income Security Act of 1974, sets minimum standards for retirement plans, and protects retirement savings from abuse or mismanagement.

Among other things, employees are required to make annual reports

Recommended Reading: What Age Can I Withdraw From 401k

Read Also: Can I Use 401k To Invest In Real Estate

Balances Hit A New All

- Retirement account balances are at new highs, according to Fidelity Investments.

- Thanks to the markets recent run-up and increased savings, the number of 401 and IRA millionaires also hit all-time records in the second quarter of 2021.

Although many Americans continue to face financial uncertainty due to the pandemic, the outlook for retirement savers is only improving.

Retirement account balances, which took a sharp nosedive in 2020 when the coronavirus outbreak caused economic shock waves, are now at new highs, according to the latest data from Fidelity Investments, the nationâs largest provider of 401 savings plans.

The overall average 401 balance hit $129,300 as of June 30, up 24% from the same time last year, according to Fidelity.

Individual retirement account balances were also higher reaching $134,900, on average, in the second quarter, up 21% from a year ago.

Despite Covid case numbers rising in the U.S. and around the world, the yearâs market highs have been a boon for savers. In the second quarter, the S& P 500 ended up 8.2%, before retreating more recently.

Nearly 12% of workers increased their contributions during this time, while a record 37% of employers also automatically enrolled new workers in their 401 plans.

As a result, the number of 401 and IRA millionaires hit fresh highs, as well.

Together, the total number of retirement millionaires has nearly doubled from one year ago.

Read Also: Should I Pay Someone To Manage My 401k

See How Your Savings Stack Up

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

You May Like: How To Rollover 401k To New Employer

Search Databases For Unclaimed Assets

If you still cant find information on your lost 401 plans, you can also try searching one of the publicly available databases for unclaimed assets. The National Registry of Unclaimed Retirement Benefits is a good place to start. By entering your Social Security number, you can quickly see if there are any unclaimed retirement funds that belong to you. The money may still be held in the employers plan, or the company may have opened a special IRA account in your name to hold the funds.

You can also search using the National Association of Unclaimed Property Administrators site, which will help you track down unclaimed money you may be owed, not limited to retirement assets. Be sure to check in each state you have lived or worked. The site processes tens of millions of requests each year and has helped return more than $3 billion in unclaimed assets annually.

What Do Average 401 Balances Tell Us

According to Mike Shamrell, vice president of thought leadership at Fidelity Investments, the latest data shows that despite economic uncertainty, retirement savers stayed the course and didnt make significant changes to their retirement savings habits.

Shamrell said that the total savings rate across all Fidelity managed 401 plans, including contributions from both employees and employers, reached a record 14% in the first quarter of 2022.

Individuals did not make significant changes to their asset allocation, he says. Only 5.6% of 401 savers made a change to the asset allocation within their account, and of those people that made a change, more than 80% made only one.

This trend aligns with expert advice that long-term investors should always resist the temptation to let market conditions impact their investing strategy. Instead, they should focus on the things they can control, such as their individual contribution rate.

Recommended Reading: How To Calculate 401k Minimum Distribution

What Happens When I Leave Before Being Fully Vested

If an employee leaves his job before being fully vested, he is forfeiting the unvested percentage of money that the employer contributed. The amount is contingent on the vesting schedule and how long the employee was with the company. For example, assume an employee is on a six-year vesting schedule, with 20% vested after year two. If the employee leaves, he forfeits 80% of the employerâs contribution.

Tip: Maximize the money an employer gives by contributing enough to hit their contribution cap. This is free money once an employee meets the vesting schedule.

Search Unclaimed Assets Databases

If your search is still coming up empty, your former employer has folded or was bought by another company, youâre not out of luck yet.

It may take a little more effort and research but there are many national databases that can help you track down your old 401 accounts:

- The Department of Laborâs Abandoned Plan database can help you identify what happened to your old plan and the contact information of the current administrator

- The National Registry of Unclaimed Retirement Benefits allows you to do a free search for any unclaimed retirement money using just your Social Security number

- FreeERISA is another free resource to search for any old account information that has been filed with the federal government

- The Securities and Exchange Commissionâs website or your stateâs Secretary of State can provide more information on your previous employer

You May Like: How To Set Up 401k On Adp

Check Your 401 Beneficiary

While youre in your online account dont forget to check that youve named a beneficiary for your 401 account. Typically, a spouse must be the beneficiary unless they sign a waiver. If youre not married its important to name a beneficiary in your account. The Motley Fool shares additional tips on when someone inherits a 401.

Us Department Of Labor

Even if your former employer abandoned its retirement plan, your money isnt lost forever. The U.S. Department of Labor maintains records for plans that have been abandoned or are in the process of being terminated. Search their database to find the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Read Also: How Much Can An Employer Contribute To A Solo 401k

Locate Where Your 401s Are

Before you can check how much is in your 401 account, you need to know where your 401s are.

The first place to look is the company with whom you’re currently working. Many companies have implemented auto-enrollment into their 401 plans, ensuring that most of their employees contribute to their retirement. Otherwise, participation may drop because they simply forgot or didn’t know it was available.

Contact your human resources department to get information on if you’re contributing to their 401 and your account information.

Additionally, if you’ve changed jobs a few times in your career, you may have old 401 outstanding in different places. Locating old 401s can be a tricky process as it requires much coordination and hunting down various entities and contacts.

If you’re unsure if you have outstanding 401s with old companies, we can help. Beagle will find any old 401s you have, identify any hidden fees, and provide options to consolidate into one, easy-to-manage account. Sign-up only takes a couple of minutes and Beagle will help you find all your 401 accounts!

Even misplacing one 401 from a previous employer could cost you thousands in potential retirement funds.

How Much Should You Save For Retirement

Everyone has different retirement goals and different retirement income needs.

There are a variety of factors that could impact whether a persons retirement savings efforts are on track, says Shamrell. For example, what your goals are in retirement, where you plan to live, and how long you plan to wait to retire would all factor in.

While median and average 401 balances can be interesting points of reference, comparing yourself to them isnt the best way to determine if youre on track for retirement.

Instead, look at your own personal situation to set retirement goals.

Each participant will have their own unique income needs in retirement, so wed encourage them to focus less on their balances and more on their target savings rate, Stinnett says.

Stinnett notes that studies suggest that retirement savers should aim to replace between 70% and 85% of pre-retirement income to maintain their current lifestyle once they stop working.

Recommended Reading: When Can You Start To Withdraw From 401k

Cant I Just Write A Check

For most workers, the answer is no. Your regular contributions to your 401 account typically only happen through salary deferral. In other words, the Payroll department needs to send money, and you cant just write a personal check if youre hoping to invest a large chunk or reach the maximum contribution limit by the end of the year.

Why not? For starters, the law does not allow you to defer funds that you already received. If the money is in your checking account, you received it. Also, your 401 plan might have specific rules saying you cant make your own payments into the plan.

Catch-up contributions: Those over age 50 can make additional catch-up contributions to retirement accounts. But 401 catch-up contributions, like other employee contributions, generally must go in through payroll deduction.

Dont Miss: Can I Rollover My 401k

According To 401k Statistics 58% Of 401k Participants See Themselves As Savers

Interestingly, the remaining 42% of 401k plan participants think of themselves as investors. Whats more, 72% believe its more important to save now so you could have a comfortable retirement. These attitudes show a changing dynamic towards savings. Hopefully, it will prompt more Americans to choose a retirement plan as soon as possible.

Donât Miss: What Is The 401k Retirement Plan

You May Like: Can I Transfer Rollover Ira To 401k