Can An Account Owner Just Take A Rmd From One Account Instead Of Separately From Each Account

An IRA owner must calculate the RMD separately for each IRA that he or she owns, but can withdraw the total amount from one or more of the IRAs. Similarly, a 403 contract owner must calculate the RMD separately for each 403 contract that he or she owns, but can take the total amount from one or more of the 403 contracts.

However, RMDs required from other types of retirement plans, such as 401 and 457 plans have to be taken separately from each of those plan accounts.

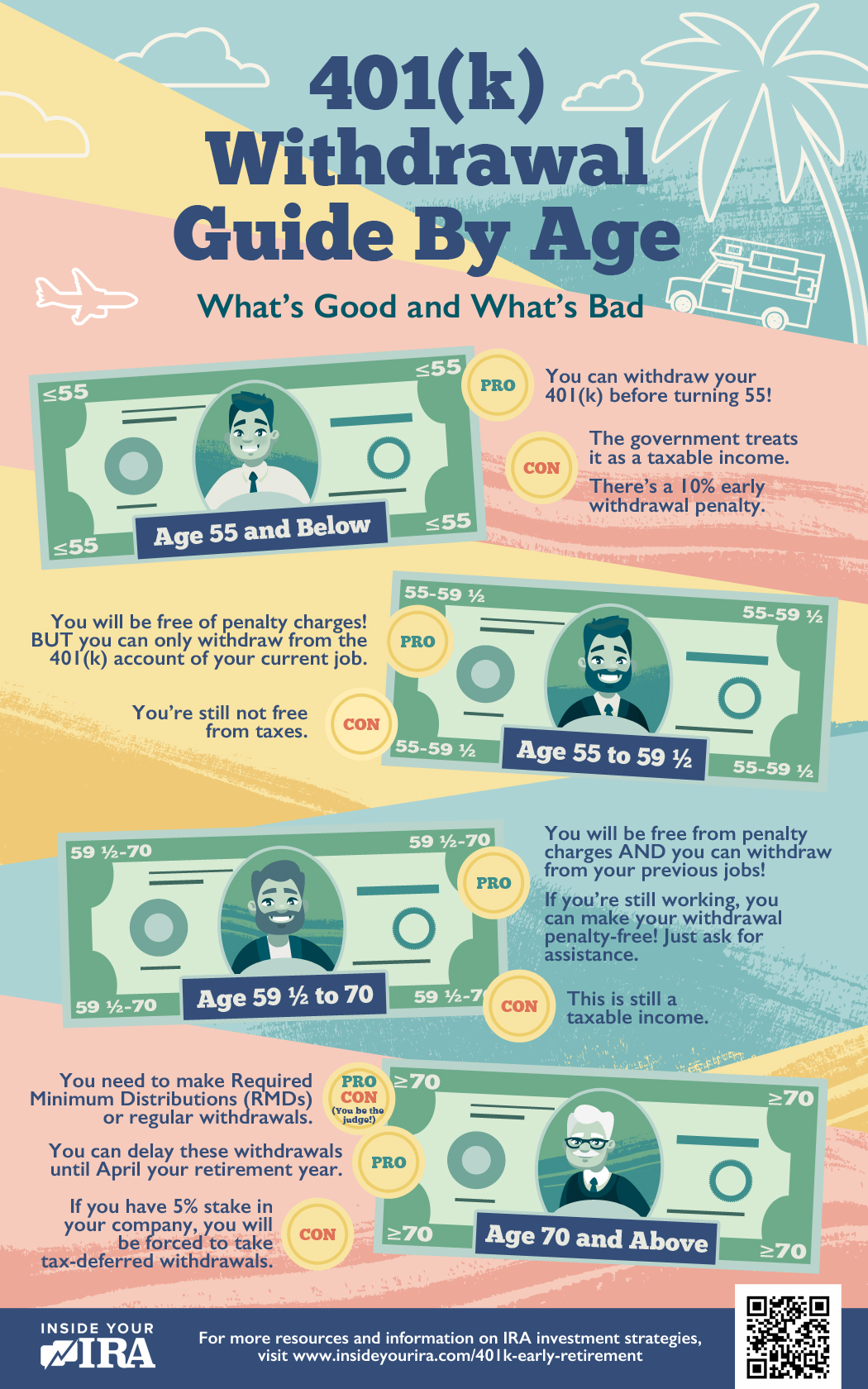

Can I Withdraw From My 401 At 55 Without A Penalty

If you leave your job at age 55 or older and want to access your 401 funds, the Rule of 55 allows you to do so without penalty. Whether you’ve been laid off, fired or simply quit doesn’t matteronly the timing does. Per the IRS rule, you must leave your employer in the calendar year you turn 55 or later to get a penalty-free distribution. So, for example, if you lost your job before the eligible age, you would not be able to withdraw from that employer’s 401 early you’d need to wait until you turned 59½.

It’s also important to remember that while you can avoid the 10% penalty, the rule doesn’t free you from your IRS obligations. Distributions from your 401 are considered income and are subject to federal taxes.

How Much Can You Take Out Of 401k At Age 59 1 2

There is no limit to the number of deductions you can make. After you turn 59 ½, you can withdraw your money without having to pay the first withdrawal penalty.

What is the 59.5 rule?

Most Americans who are fortunate enough to have a retirement savings in the Individual Retirement Account are likely to be aware of the 59.5-year law, where dividends from IRA before that age began not only on tax deductions, but. a 10% penalty on initial distribution.

How much can you withdraw from your 401k at one time?

Generally, you can borrow up to 50% of your closed bar account or $ 50,000, whichever is less. The Senate Bill also doubles the amount you can borrow: $ 100,000. Generally, if you lose your job with a 401 credit book, the loan is treated as a deduction and you are at the tax office.

Recommended Reading: Should I Move My 401k To Bonds 2020

Options For Borrowing From A 401 While Still Working

If youre still in the workforce and need to access your 401 funds for one reason or another, you may still have options. These pre-retirement withdrawal options include in-service distributions, hardship withdrawals, and plan loans.

In-service distributions allow you to withdraw your vested money before retirement and are sometimes referred to as an early retirement option in the plan. This is generally allowed at age 59 ½ because distributions of your 401 deferrals before that age are subject to a 10 percent penalty tax.

Hardship distributions are allowed for special reasons such as medical care, purchase of your home, tuition, funeral expenses, payments to prevent eviction, and damage to your principal residence. The distribution is limited to the amount you need, and your employer will need to see some proof of the hardship. Hardship distributions are subject to income tax and the 10 percent penalty tax for distribution before 59 ½.

Plan loans occur when you borrow money from your 401 balance, but the amount you can withdraw is limited to the half of your vested balance and cannot be more than $50,000. The loan will have to be paid back to the plan with interest, and the loan period cannot exceed five years in most cases. That being said, loans taken out for principal residence can be longer than five years.

You May Like: How Do I Roll Over My 401k

How Long Does It Take To Get Money Out Of My 401k

May 3, 2011 It usually takes a week or two to get money out of your 401, although it can take much longer. The countdown begins when you request payment and ends when you actually receive the money in the form of a check or wire transfer.

Principal 401k phone number What is your 401k plan based on your retirement count?Your 401 is qualified retirement plan Although your donation has been reported in field 12 code D in format W2. You dont need to report them again in TurboTax. If youre going to bring up another issue, youll only answer yes to this question, such as BT IRA or Roth IRA. June 4, 2019 at 11:51 a

Recommended Reading: How Much Do You Have To Withdraw From 401k

You May Like: What Is A Simple 401k

Can You Withdraw Money From A 401 Early

Yes, if your employer allows it.

However, there are financial consequences for doing so.

You also will owe a 10% tax penalty on the amount you withdraw, except in special cases:

- If it qualifies as a hardship withdrawal under IRS rules

- If it qualifies as an exception to the penalty under IRS rules

- If you need it for COVID-19-related costs

In any case, the person making the early withdrawal will owe regular income taxes year on the money withdrawn. If it’s a traditional IRA, the entire balance is taxable. If it’s a Roth IRA, any money withdrawn early that has not already been taxed will be taxed.

If the money does not qualify for any of these exceptions, the taxpayer will owe an additional 10% penalty on the money withdrawn.

Compound Interest Only Works If You Leave The Money Alone

We talk a lot at Money Under 30 about compound interest. Its what makes a comfortable retirement possible for most of us. When you cash out your 401 early, youre not just subtracting that balance from your eventual retirement fund. Rather, youre deducting your balance, plus any interest your balance will earn over the next few decades, plus the interest the interest would earn! Taking a few hundred bucks now could cost you thousands down the road. Not to mention that you immediately lose almost 30% of your balance to taxes and fees.

It might feel like a small windfall now, but over the long term, youre taking yourself to the cleaners.

Most retirement funds are set up to allow your money to grow with few interruptions: Hence why the money you put into a 401 isnt taxed, why the interest you earn while your money is in the 401 isnt taxed, and why its relatively hard to remove money from your account until youre close to retirement age.

While we know its tempting to take that small pot of cash, we urge you to resist. And once youve gotten a new job, you should roll your old 401 into your new employers plan. Thatll take away the temptation entirely.

You May Like: How Do I Rollover My 401k To My New Job

Don’t Miss: What Is A Good 401k Contribution

What Is A Systematic Withdrawal Plan

In a systematic withdrawal plan, you only withdraw the income created by the underlying investments in your portfolio. Because your principal remains intact, this is designed to prevent you from running out of money and may afford you the potential to grow your investments over time, while still providing retirement income. However, the amount of income you receive in any given year will vary, since it depends on market performance. Theres also the risk that the amount youre able to withdraw wont keep pace with inflation.

Potential advantages: This approach only touches the income not your principal so your portfolio maintains the potential to grow.

Potential disadvantages: You wont withdraw the same amount of money every year, and you might get outpaced by inflation.

For illustrative purposes only.

You Can Still Withdraw Early Even If You Get Another Job

You arent locked in to early retirement if you choose to take early withdrawals at age 55. If you decide to return to part-time or even full-time work, you can still keep taking withdrawals without paying the 401 penaltyjust as long as they only come from the retirement account you began withdrawing from.

Recommended Reading: Can I Move My 401k

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

A Word About Roth Iras

Roth IRAs do not require RMD withdrawals until after the death of the owner. If you have a Roth account in an employer-sponsored plan, the IRS recommends that you contact your plan sponsor or plan administrator regarding RMD information.

7. What happens if a retirement plan account owner or IRA owner dies before RMDs have begun?

8. Do I have to take an RMD if I own an annuity?

The answer depends on the type of annuity you own. If you own a variable annuity, and it is held in an IRA, the answer is yes. This is referred to as a qualified annuity by the IRS, meaning that it likely was funded with pre-tax money that requires you to pay taxes on your withdrawals, as well as take RMDs. Non-qualified annuity contracts offer tax-deferred growth of after-tax funds they are taxed when annuitized, but as a general rule are not subject to RMDs. , see the IRSs Form 1098-Q info page.)

9. What reporting obligations does my brokerage firm have with respect to RMDs?

10. What if a mistake is made?

All is not lost if you or someone you entrust to do your RMD calculations makes a mistake. In one of its FAQs, the IRS states that penalties may be waived if the account owner establishes that the shortfall in distributions was due to reasonable error and that reasonable steps are being taken to remedy the shortfall. In order to qualify for this relief, you must file Form 5329 and attach a letter of explanation.

Don’t Miss: What Happens To My 401k If I Get Fired

Additional Partial Roth Conversions Can Be Made During The Bonus Rmd Gap Years

Traditionally, so-called Gap Years have been generally understood to represent the years between when an individual retired and when they began receiving Social Security benefits and taking RMDs. For those who could afford to delay IRAs and Social Security until required to do so , Gap Years would end when income from both Social Security and RMDs began to flow in often at around the same time, as Social Security would begin at age 70, and RMDs in the year an individual reached 70 ½.

These Gap Years can be some of the lowest taxable income years of an individuals adult life, and as such, they often make prime years for accelerating income that would otherwise be taxable in a future, higher-income year . More often than not, this income acceleration is best accomplished via partial Roth IRA conversions, both because it is easy to generate the income , and because it also provides further tax benefits in the form of future tax-free distributions of earnings .

The SECURE Acts changes will potentially give an additional year or two where Social Security benefits may begin but before the onset of RMDs stacked on top that can substantially increase income , in essence creating one or two Semi-Gap Years where it may still be appealing to do a partial Roth conversion on top of Social Security benefits to fill the void of not-yet-required-to-be-taken RMDs.

Consider All Of Your Financial Options

When you need cash in a crunch, ideally you have options: using money saved, dipping into emergency savings, getting a loan, or possibly as a last resort withdrawing money saved for retirement. Consider the relief available if youve been impacted by a FEMA declared disaster , and talk to your plan sponsor and/or retirement services provider before taking any next steps.

You May Like: What Is 401k In Usa

Read Also: How Do You Find Your 401k

Given All This What Is The Best Age To Take Money Out Of Your 401

For those with no pension or other guaranteed sources of income, it often makes sense to take money out in years when you are in a low tax rate rather than waiting until age 72.

On the other hand, for those with pensions or other income sources, it often makes sense to delay and only withdraw when you are required to do so at age 72. The right age depends on many factors, and no one can recommend the best option for you without a complete analysis.

What Information Do I Need To Give To My Employees

Before the beginning of each annual election period, you must notify each employee of:

If you havent timely given your employees the notice, find out how you can correct this mistake.

The election period is generally the 60-day period immediately preceding January 1 of a calendar year . However, the dates of this period are modified if you set up a SIMPLE IRA plan in mid-year or if the 60-day period falls before the first day an employee becomes eligible to participate in the SIMPLE IRA plan.

If you set up your SIMPLE IRA plan using either Form 5304-SIMPLE or Form 5305-SIMPLE, you can give each employee a copy of the signed forms to satisfy the notification requirement.

If the deferral limitations arent released timely and you normally include the deferral amount for the upcoming year in your notice, you can mention the current limit and advise participants to check the COLA Increase table for next years amount. The notice isnt required to include the salary deferral limitation for the upcoming year.

Read Also: How Does 401k Retirement Work

You May Like: What Happens To 401k When You Get Fired

Will My Credit Score Be Impacted If I Withdraw Early

Withdrawing funds from your 401 early won’t impact your credit directly since the credit bureaus don’t track activity on your retirement accounts.

Making an early withdrawal can indirectly affect your credit when you use the money to pay down outstanding debt. It may seem like an easy way to ease a debt burden or boost your credit, but in most cases, this shouldn’t be the only reason to withdraw funds from your 401. Such a move should only be considered in a financial emergency when you have exhausted all other options.

Roth 401 And Roth Ira Withdrawal Rules

Roth accounts are funded with after-tax dollars, so taking money from them isn’t treated the same as taking it from regular IRAs and 401s. Distributions are tax-free, provided that you’re at least age 59 1/2, and you’ve held the Roth account for at least five years. The age rule doesn’t apply if the account owner is disabled or dies.

There’s still a 10% tax penalty for taking money early, but that’s only on earnings. You can withdraw the amount of your original contributions tax-free before age 59 1/2, because you’ve already paid tax on that money.

Recommended Reading: How To Rollover 401k When You Change Jobs

Target Unexpected Funds Toward Retirement

Another way to save more money for retirement is to put any unexpected money into your retirement accounts. This might mean the $50 you get for your birthday from grandma or the $3,000 tax refund you got this year.

If its not money thats a normal part of your income and expenses, commit to putting it into retirement accounts. Dont be tempted to use it to splurge on vacations or big-ticket purchases. Instead, invest it in your future.

When Is It A Good Idea

Withdrawing funds from your 401 prior to retirement is a serious decision that you should only consider as a last resort. If youre taking a hardship withdrawal, you could avoid the 10% penalty. But taking this penalty is not usually worth it.

For example, if youd like to use a 401 disbursement to pay off debt, the withdrawal might be worthwhile if the interest rate on your debt is higher than the penalties you incur on the withdrawal.

Also Check: How To Find Out Where Your 401k Is

What Do I Do With My 401 If I Leave My Job

If you’re older than 55 and are no longer employed, you can start withdrawals from your 401 without penalties. If you’re under age 55, you may be able to keep the 401 with your previous employer or move it to a new employer’s plan when you start working again. Talk to the plan administrator about your options. No matter what, don’t abandon your 401 when you change employers.

How To Roll Over A 401 While Still Working

Some 401 plans allow you to roll them over while still employed with your company.

Anyone can roll over a 401 to an IRA or to a new employers 401 plan when leaving a job. Depending on your plans policies, you might be able to make the rollover while youre still with the company. Unlike a post-job rollover, your plan doesnt have to allow in-service rollovers, but many companies do. However, there are usually significant restrictions.

Dont Miss: Is It Better To Rollover 401k To Ira

Don’t Miss: What Is The Difference Between An Annuity And A 401k