Maximize Your 401k Returns And Fees

Are you getting the most for your fees? Most people dont know what theyre paying in 401k fees. By some estimates, the average fees for 401k plans are between 1% and 2%, but some outliers can have up to 3.5%. Fees add upeven if your employer is potentially paying the fees, youll have to pay them if you leave the job and keep the 401k.

Essentially, if an investor has $100,000 in a 401 and pays $1,000 or more in fees, the fees could add up to thousands of dollars. Any fees you have to pay can chip away at your retirement savings and reduce your returns.

Its important to ensure youre getting the most for your money in order to maximize your retirement savings. If you are currently working for the company, you could discuss high fees with your HR team. One of the easiest ways to lower your costs is to find more affordable investment options. Typically, the biggest bargains can be index funds, which often charge just 0.3% to 0.5 %

If your employers plan offers an assortment of low-cost index funds or institutional funds, you can invest in these funds to build a diversified portfolio.

If you have a 401 account from a previous employer, you might consider moving your old 401k into a lower fee plan. Its also worth examining what kind of fund youre invested in and if its meeting your financial goals and risk tolerance.

Tax And Investment Benefits Of A 401

The most notable benefit of a 401 is that all contributions are tax-deferred. Your plan is funded directly from your paycheck, with the money coming out before its subject to income taxes. By reducing your taxable income, youre essentially taking a tax deduction, for now. Furthermore, because less of your paycheck is going towards taxes, youre able to contribute more to your retirement funds.

With a 401, youll have a choice of investing in multiple types of investments. These often include some combination of mutual funds, exchange-traded funds , index funds, bond funds and various market capitalization funds. Many 401 plans provide access to investments called target-date funds, which automatically rebalance your portfolio to reduce riskiness as you approach your target retirement age.

General Pros And Cons Of A 401

Pros

Cons

- Few investment optionsGenerally speaking, 401s have few investment options because they normally originate from employers, they are limited to what is offered through employers 401 plans, as compared to a typical, taxable brokerage account.

- High feesCompared to other forms of retirement savings, 401 plans charge higher fees, sometimes as a percentage of funds. This is mainly due to administration costs. Plan participants have little or no control over this, except to choose low-cost index funds or exchange-traded funds to compensate.

- Illiquid 401 funds can only be withdrawn without penalty in rare cases before 59 ½. This includes all contributions and any earnings over time.

- Vesting periodsEmployers may utilize vesting periods, meaning that employer contributions dont fully belong to employees until after a set point in time. For instance, if an employee were to part ways with their employer and a 401 plan that they were 50% vested in, they can only take half of the value of the assets contributed by their employer.

- Waiting periodsSome employers dont allow participation in their 401s until after a waiting period is over, usually to reduce employee turnover. 6 month waiting periods are fairly common, while a one-year waiting period is the longest waiting period permitted by law.

Read Also: How Do I Move My 401k To An Ira

How Often Should I Check My 401 Balance

According to Leanna Devinney, vice president and branch leader at Fidelity, thats an age-old question. Never checking my 401 at all is probably a bad idea, but there’s also danger in checking it too often.

To a degree, I need to monitor my 401 and my individual retirement account , for that matter in order to stay informed. Peeking at my balance can help me determine whether Im on track for retirement, whether fees are eating up too much of my money, whether Im complying with IRS rules about contribution limits, et cetera.

Its critical that we participate in and contribute to our own retirement plans, adds Heather Winston, director of financial planning and advice at Principal. When you’re checking that balance, it gives you the opportunity to get a quick, point-in-time sense of how you’re progressing toward that goal and how your investments are faring.

To that end, Winston recommends checking my 401 balance a minimum of twice a year. Every six months or so, I can go in, review my investments and rebalance my portfolio.

But it doesnt need to be a daily thing.

The markets are constantly shifting due to world events, so my balance is always going to be fluctuating. Volatility is normal, especially when my asset allocation is aggressive .

Its ignorance is bliss in action. I’m 30 years from retirement at minimum, and most upsets will smooth out over time anyway.

How To Check Your 401 Balance

If you already have a 401 and want to check the balance, it’s pretty easy. You should receive statements on your account either on paper or electronically. If not, talk to the Human Resources department at your job and ask who the provider is and how to access your account. Companies dont traditionally handle pensions and retirement accounts themselves. They are outsourced to investment managers.

Some of the largest 401 investment managers include Fidelity Investments, Bank of America – Get Bank of America Corporation Report, T. Rowe Price – Get T. Rowe Price Group Inc. Report, Vanguard, Charles Schwab – Get Charles Schwab Corporation Report, Edward Jones, and others.

Once you know who the plan sponsor or investment manager is, you can go to their website and log in, or restore your log-in, to see your account balance. Expect to go through some security measures if you do not have a user name and password for the account.

Much of this should be covered when you initiate the 401 when you are hired or when the retirement account option becomes available to you. Details like contributions, company matching, and information on how to check your balance history and current holdings should be provided.

Finding a 401 from a job you are no longer with is a little different.

Read more on TheStreet about how to find an old 401 account.

Read Also: Can I Move My 401k To Gold

Take Your 401 With You

Most people will change jobs more than half-a-dozen times over the course of a lifetime. Some of them may cash out of their 401 plans every time they move, which can be a costly strategy. If you cash out every time, you will have nothing left when you need itespecially given that you’ll pay taxes on the funds, plus a 10% early withdrawal penalty if you’re under 59½. Even if your balance is too low to keep in the plan, you can roll that money over to an IRA and let it keep growing.

If you’re moving to a new job, you may also be able to roll over the money from your old 401 to your new employer’s plan if the company permits this. Whichever choice you make, be sure to make a direct transfer from your 401 to the IRA or to the new company’s 401 to avoid risking tax penalties.

Option : Move The Money To An Ira

If you’re not able to transfer the funds to your current 401 or you don’t want to, you can roll over the funds to an IRA instead. The process is the same as doing a rollover to a new 401, and you still have the choice between a direct or indirect rollover.

You’ll need to set up a new IRA with any broker if you don’t already have one. Make sure you choose an IRA that’s taxed the same way as your old 401 funds. Most 401s are tax-deferred, which means your contributions reduce your taxable income in the year you make them, but you pay taxes on your withdrawals in retirement. You want a traditional IRA in this case because the government taxes these funds the same way.

If you had a Roth 401, you want a Roth IRA. Both of these accounts give you tax-free withdrawals in retirement if you pay taxes on your contributions the year you make them.

In most cases, losing track of your old 401 doesn’t mean the money is gone for good. But finding it is only half the challenge. You must also decide where to keep those funds going forward so they’ll be most useful to you. Think the decision through carefully, then follow the steps above.

Also Check: Where Can I Move My 401k Without Penalty

Reset Your Automatic 401k Contributions

When was the last time you reviewed your 401k? It may be time to check in and make sure your retirement savings goals are still on track. Is the amount you originally set to contribute each paycheck still the correct amount to help you reach those goals?

With the increase in contribution limits this year, it may be worth reviewing your budget to see if you can up your contribution amount to max out your 401k. If you dont have automatic payroll contributions set up, you could set them up.

Its generally easier to save money when its automatically deducted a person is less likely to spend the cash when it never hits their checking account in the first place.

If youre able to max out the full 401 limit but fear the sting of a large decrease in take-home pay, consider a gradual increase such as 1%how often you increase it will depend on your plan rules as well as your budget.

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

Recommended Reading: How To Get Money Out Of Fidelity 401k

Other Benefits Of A 401

Even for employers who do not offer any matching program, every employer with a 401 plan is responsible for administering the plan. That may seem like its no big deal, but it actually saves quite a bit of trouble for the employees. As an employee in a 401 plan, you dont have to worry about the complicated rules and regulations that need to be followed, or about making arrangements with the funds in which you invest your moneyyour employer takes care of all of that for you. Thats quite a bit of saved paperwork.

At the same time, employees who participate in a 401 maintain control over their money. While employers provide a list of possible investment choices, most commonly different sorts of mutual funds, employees have quite a bit of freedom to decide their own strategy. Whether you are willing to take on a little more risk with your investments, or if you would rather play it safe, theres probably an option for you.

K Max Contribution Calculator For Front Loading Each Year

Ive always tried to front load my 401k contributions to reach the annual limit. Front loading refers to contributing more earlier in the year to get money in the market sooner and then dropping the contribution election down for the rest of the year. For my personal situation, for example, I front load heavily in the first 3 months of the year.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links. Read more here.

Contents

Also Check: How To Open A 401k Plan

Don’t Miss: Where To Open A 401k Account

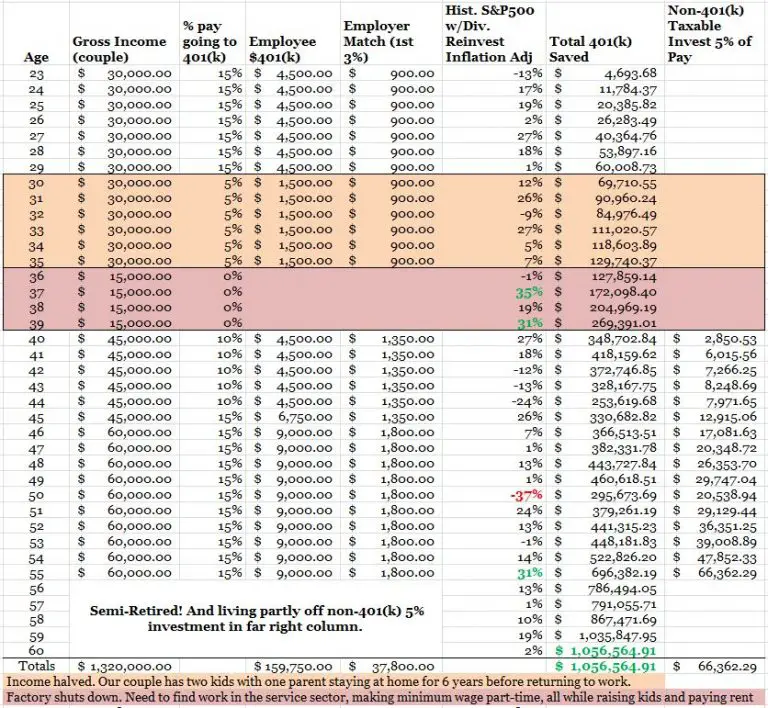

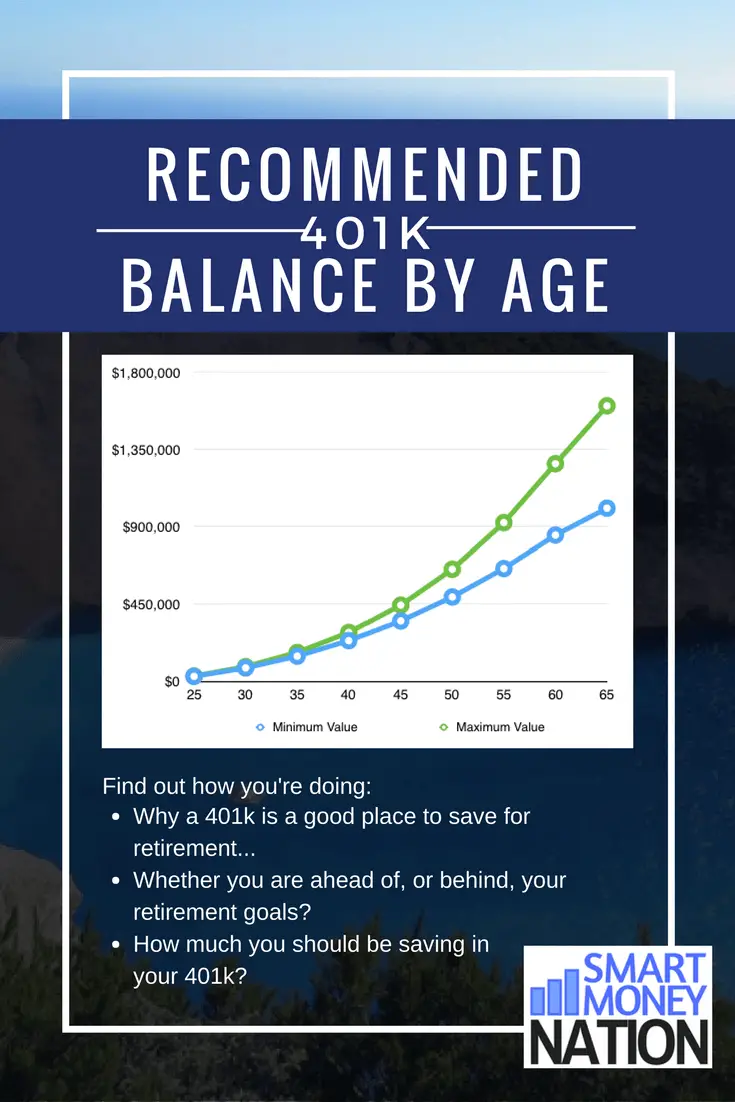

Is Your 401k Savings On Track

Have you met your mark? If you arent there yet, dont panic. These are just rules of thumb. That means they only give you a rough estimate of what you should ideally have by the time you hit these ages. They do not take into account your individual income and experiences or other investments you might have in play.

In reality, theres no one hard answer to how much you should have in your 401k and anyone who tells you otherwise is either lying to you or just doesnt know much about finance. We could pull up a bunch of figures and show you how much someone in their 20s or 30s is saving but that would be a complete waste of time for two reasons:

1. Its impossible to compare two investors fairly. Everyone has their own unique savings situation. Thats why itd just be dumb to compare the Ph.D. student saddled with thousands in student loan debt with the trust fund baby who just snagged a cushy six-figure corporate gig the first month out of college. Theyre both going to save very differently, so its not worth comparing.

2. Most people arent financially prepared for retirement. The American Institute of CPAs recently released a study that found that nearly half of all Americans arent sure if theyll be able to afford retirement. Thats even scarier when you consider the fact that many people underestimate how much theyll need for a comfortable retirement.

Contribution Effects On Your Paycheck

An employer-sponsored retirement savings account could be one of your best tools for creating a secure retirement. It provides two important advantages:

- All contributions and earnings are tax-deferred. You only pay taxes on contributions and earnings when the money is withdrawn.

- Many employers provide matching contributions to your account, which can range from 0% to 100% of your contributions.

Use this calculator to see how increasing your contributions to a 401 can affect your paycheck as well as your retirement savings.

This calculator uses the latest withholding schedules, rules and rates .

Don’t Miss: How To Close 401k Fidelity

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

Nice Jobcongratulations On Taking Advantage Of Your Companys Employer Match To See How Your Money Is Going To Grow Over Time Try Out Our Compounding Calculator

This calculator is intended as an educational tool only. John Hancock will not be liable for any damages arising from the use or misuse of this calculator or from any errors or omission in the same.

Employer match is not available for all plans. See your Summary Plan Description for availability and information about your employers vesting schedule.

John Hancock Retirement Plan Services ⢠200 Berkeley Street ⢠Boston, MA 02116

NOT FDIC INSURED. MAY LOSE VALUE. NOT BANK GUARANTEED

Read Also: How Does 401k Show On Paycheck

How Do I Receive Money From Moneygram To My Bank Account

MoneyGram allows you to send money directly to a bank account or mobile wallet in select countries. To find out if you can send money to your receivers bank account or mobile wallet, start sending money or estimate fees from the homepage, and select Direct to Bank Account or Account Deposit as your receive option.

You May Like: How Do You Withdraw From 401k

How Do I Close My Merrill Lynch 401k Account

4.6/5closeMerrill Lynch accountcloseaccount

Also know, how do I close my Merrill Lynch account?

You should send a closure request to the broker by logging into the Merrill Edge site and using the internal messaging system. You could also call the broker at 1-877-653-4732 and speak with a live agent. If youre outside the United States, you should call 1-609-818-8900 instead.

Furthermore, how do I contact Merrill Lynch 401k? If you do not receive your User ID, or have any questions, please the Merrill Lynch Retirement and Benefits Contact Center at 1-866-820-1492 or 609-818-8894 .

Also know, how do I withdraw my 401k early from Merrill Lynch?

To start your withdrawal youll need a One Time Distribution form from Merrill Lynch. You must fill it out with your personal information, including your name, date of birth, phone number and Merrill Lynch retirement account number. This information must be accurate to avoid delays in getting your funds.

How long can an employer hold your 401k after termination?

If you get terminated from your job, you have the ability to cash out the money in your 401 even if you havent reached 59 1/2 years of age. This includes any money youve contributed and any vested contributions from your employer plus any investment profits your account has generated.

Read Also: How Do I Withdraw Money From My 401k