Compensation Limit For Contributions

Remember that annual contributions to all of your accounts maintained by one employer – this includes elective deferrals, employee contributions, employer matching and discretionary contributions and allocations of forfeitures, to your accounts, but not including catch-up contributions – may not exceed the lesser of 100% of your compensation or $61,000 for 2022 . This limit increases to $67,500 for 2022 $64,500 for 2021 $63,500 for 2020 if you include catch-up contributions. In addition, the amount of your compensation that can be taken into account when determining employer and employee contributions is limited to $305,000 for 2022 $290,000 in 2021 .

Workers Saving For Retirement Have A Reason To Rejoice Over The 401 Contribution Limits For 2022

Getty Images

Saving for retirement, at times, can seem like a daunting task. But using a 401 account, if your employer offers one, is one of the best and most tax-friendly ways to build a nest egg. You should start saving in a 401 account as soon as possible, though the IRS limits how much you can contribute each year.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: What Is A Pension Vs 401k

Next Steps To Figuring Out How Much To Put In Your 401

If youre unsure about how much you can afford to contribute to your 401, check out our paycheck impact tool that can help you calculate an exact number based off your salary and employer match options. If your employer doesnt offer a 401 matching plan, dont fret. There are still many ways you can save for retirement.

This website contains hyperlinks to other websites that are not associated with this site. Such unassociated websites may contain links to other unassociated sites as well. We make no endorsement, expressed or implied, about any of these linked sites, are not responsible for materials posted or activities that occur on such linked sites, and do not review content or advertisements posted on or activities occurring on these linked sites.

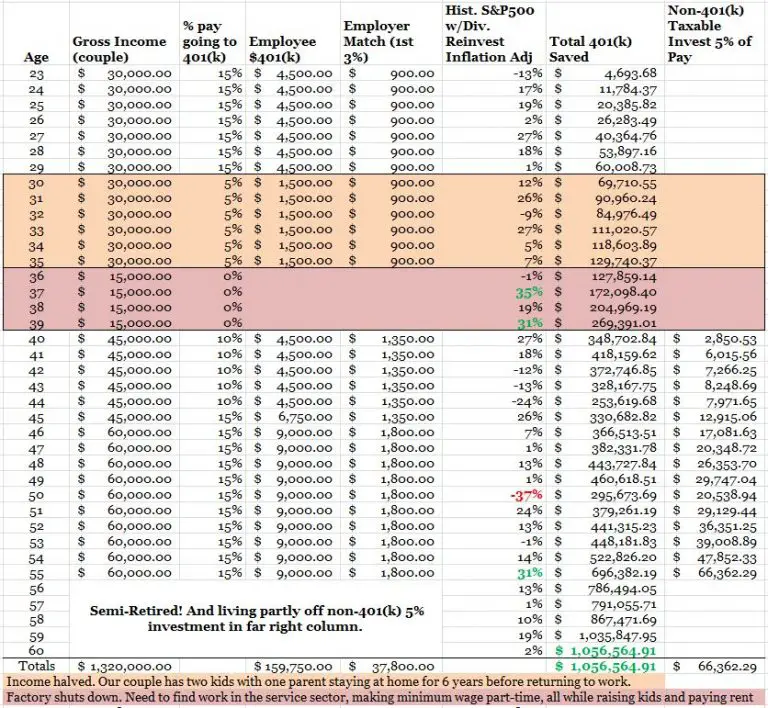

How Much Should I Have Saved So I Can Retire Early

The general rule of thumb for whatever age you plan on retiring is to have 80% of your pre-retirement income replaced. Create a careful budget of your expected total expenses per year in retirement and multiply that by how many years you wish to be in retirement. Suppose you plan on retiring around 40 or shortly after. In that case, you need to consider things like waiting to qualify for Medicare or Social Security benefits when considering how much your expenses will be.

Read Also: Can I Create My Own 401k

Periodic Distributions From 401

Instead of cashing out the entire 401, you may choose to receive regular distributions of income from your 401. Usually, you can choose to receive monthly or quarterly distributions, especially if inflation increases your living expenses. If the 401 is your main source of income, you should budget properly so that the distributions are enough to meet your expenses.

For example, if you have accumulated $1 million in retirement savings, you can choose to receive $3,330 every month, which amounts to approximately $40,000 annually. You can adjust the amount once a year or every few months if your 401 plan allows it. This option allows the remaining savings to continue growing over time as you take periodic distributions.

Read Also: How Long Will My 401k Last When I Retire

How Much Can I Contribute To My Self

Updated: by Financial Samurai

A self-employed 401k plan is a great way to save for retirement if you are an entrepreneur or solopreneur. A self-employed 401k plan is also know as a Solo 401k plan. This article will discuss how much you can contribute to your self-employed 401k plan.

For 2021, the IRS says you can contribute up to $61,000 in your self-employed 401k plan. The amount should go up by $500 $1,000 every one or two years.

The $61,000 self-employed 401k plan limit consists of $20,500 from the employe and $40,500 from the employer. Therefore, to contribute the maximum to your self-employed 401k plan, you must pay yourself enough and have high enough operating profits.

The employer can generally contribute roughly 20% of its operating profits to the employer portion of the 401 plan. Therefore, in order to contribute the maximum employer contribution of $40,500, the company would need an operating profit of at least $202,500.

If youre at least age 50, then you can make an additional $6,500 catch-up contribution.

Here is the 401k maximum contribution limit chart for employee and employer for 2022 and 2021.

Don’t Miss: How Do I Find Out Who My 401k Is With

Tips For Contributing To Your 401

- If youre struggling to get started or stay on track, consider working with a financial advisor. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If you switch jobs, you can no longer contribute to a previous employers 401 plan. You dont want to lose the hard work you did to save that money, so you should look to make a direct 401 rollover to your new employers plan.

- A traditional IRA and a 401 offer similar tax benefits. You might wonder whether one is a better option for you. Heres an article to help you think about an IRA vs. a 401.

- You should always avoid early withdrawals from your 401. Not only will you have to pay the income tax, youll have to a pay 10% penalty. There are a couple of ways you could avoid that big penalty though. If you really think you need to withdraw money early, heres more information on 401 withdrawals.

Contributions: How Much Is Enough

Please fill out all required fields

Email addresses provided will be used only to let the recipient know who sent the web content. The information will not be used for any other purpose by Securian Financial.

Thank you for sharing

Your message has been sent.

When you land your first full-time job, chances are your employer will offer you the chance to contribute to a 401. Should you participate? And, if so, how much should you contribute?

If youre lucky enough to work for a company that offers a 401, most financial experts will recommend that you participate in the plan and that you do so as soon as possible. Heres why.

You May Like: How Should I Invest My 401k

Save Early Often And Aggressively

Yes, saving is hard. Its hard when you are young and not making a large salary, and its hard when youre older and big life expenses get in the way. However, the biggest threat to your retirement is inaction. Even if its uncomfortable to max out your 401k, do it if you can. If you get a salary raise, immediately put 50% of it towards savings if youre able. The earlier and more aggressively you can save, the better off you will be, and you may even surprise yourself with how much you are able to put away. Compounding can do wonders when there is a positive annual return as you can see from the high end of the potential savings chart, so the earlier you can save more, the farther your money will go.

What Is A Systematic Withdrawal Plan

In a systematic withdrawal plan, you only withdraw the income created by the underlying investments in your portfolio. Because your principal remains intact, this is designed to prevent you from running out of money and may afford you the potential to grow your investments over time, while still providing retirement income. However, the amount of income you receive in any given year will vary, since it depends on market performance. Theres also the risk that the amount youre able to withdraw wont keep pace with inflation.

Potential advantages: This approach only touches the income not your principal so your portfolio maintains the potential to grow.

Potential disadvantages: You wont withdraw the same amount of money every year, and you might get outpaced by inflation.

For illustrative purposes only.

Don’t Miss: Can I Convert My 401k To Gold

New 401 Contribution Limits For 2022

Retirement savers are eligible to put $1,000 more in a 401 plan next year. The 401 contribution limit will increase to $20,500 in 2022. Some of the income limits for 401 plans will also increase.

Heres how the 401 plan limits will change in 2022:

The 401 contribution limit is $20,500.

The 401 catch-up contribution limit is $6,500 for those age 50 and older.

The limit for employer and employee contributions will be $61,000.

The 401 compensation limit will climb to $305,000.

The income limits for the savers credit will increase to $34,000 for individuals and $68,000 for couples.

Pay attention to these new 401 rules when making retirement savings decisions for 2022.

The 2022 401 Contribution Limit

The contribution limit for 401s, 403s, most 457 plans and the federal governments Thrift Savings Plan is $20,500 in 2022, up from $19,500 in 2021. You can take advantage of the higher contribution limit by contributing up to about $83 more per month to your 401 plan beginning in 2022.

The main thing for employees to know at the beginning of the year is what their maximum allowable contribution is, says Eric Maldonado, a certified financial planner for Aquila Wealth Advisors in San Luis Obispo, California. Then update your percentage or dollar-based employee deferrals to automatically fund your 401 each pay period.

The 2022 401 Catch-Up Contribution Limit

The 2022 401 Limit for Employer Contributions

The 2022 401 Compensation Limit

More from U.S. News

Which Account Is Right For You

Traditional 401

- Taxes: You make pre-tax contributions and pay tax on withdrawals in retirement

- Salary deferral limits for 2022: $20,500

- Employer match: Funds are added directly to your 401 account

- Total contribution limits for 2022: $61,000 , includes salary deferral amount and employer matches

- You must take RMDs starting at age 72

- Heirs are subject to RMDs and taxed on distributions

Roth 401

- Taxes: You make after-tax contributions and donât pay tax on qualified withdrawals in retirement

- Salary deferral limits for 2022: $20,500

- Employer match: Funds are deposited into a separate tax-deferred account

- Total contribution limits for 2022: $61,000 , includes salary deferral amount and employer matches

- You must take RMDs starting at age 72 however, you could roll over funds to a Roth IRA to avoid RMDs

- Heirs are subject to RMDs but not taxed on distributions

Now that you have a better understanding of a Roth 401, you might be wondering how it differs from a Roth IRA. Contributions to either account type are made with after-tax dollars, and you wonât pay taxes on qualified distributions. The differences between the two types of Roth accounts come down to contribution limits, income limits, and RMDs.

Recommended Reading: Can You Move A 401k Into A Roth Ira

Recommended Reading: How Do I Pull Money From My 401k

What Kind Of Investments Are In A 401

401 accounts often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your company match, and then direct any additional retirement savings contributions for the year into an IRA.

Achieve Financial Freedom Through Real Estate

Real estate is my favorite way to achieving financial freedom because it is a tangible asset that is less volatile, provides utility, and generates income.

In 2016, I started diversifying into the Sunbelt to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms.

Take a look at my two favorite real estate crowdfunding platforms. Both are free to sign up and explore:

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio.

For more nuanced personal finance content, join 50,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

Also Check: What Is The Average Rate Of Return On A 401k

Two Annual Limits Apply To Contributions:

Think About How Much You’ll Need In Retirement

Contributing the maximum to your 401 requires a lot of money especially as an ongoing, year-after-year commitment. It may or may not be enough to fund your retirement, or it could be even more than you need. Your 401 contribution amount should be guided by your retirement savings goal.

How much money you’ll need in retirement depends on when you plan to retire, how much of your current income youd like to replace and how much you want to rely on Social Security.

Most experts recommend saving 10% to 15% of your income, but our suggestion is to get a more detailed goal from a retirement calculator.

If you need to start at a lower contribution and work your way up, that’s fine. Aim to contribute at least enough to grab the match, then bump up the percent you contribute by 1% or 2% each year.

Also Check: How To Close Vanguard 401k Account

How Much Money Should You Have In Your 401k

At IWT, we talk about 401ks a lot.

And, thats with good reason. If you want to be rich, the 401k is one of the most powerful investment tools at your disposal, especially for retirement planning. It is also one of the most misunderstood money-maximizing vehicles, starting with how much you should have in your 401k.

That is a solid question, but it doesnt have a simple answer. To answer that burning question How much should I have in my 401k? we need more details. How much to invest in 401k investments will depend on your age and a few other considerations.

Lets start at the beginning.

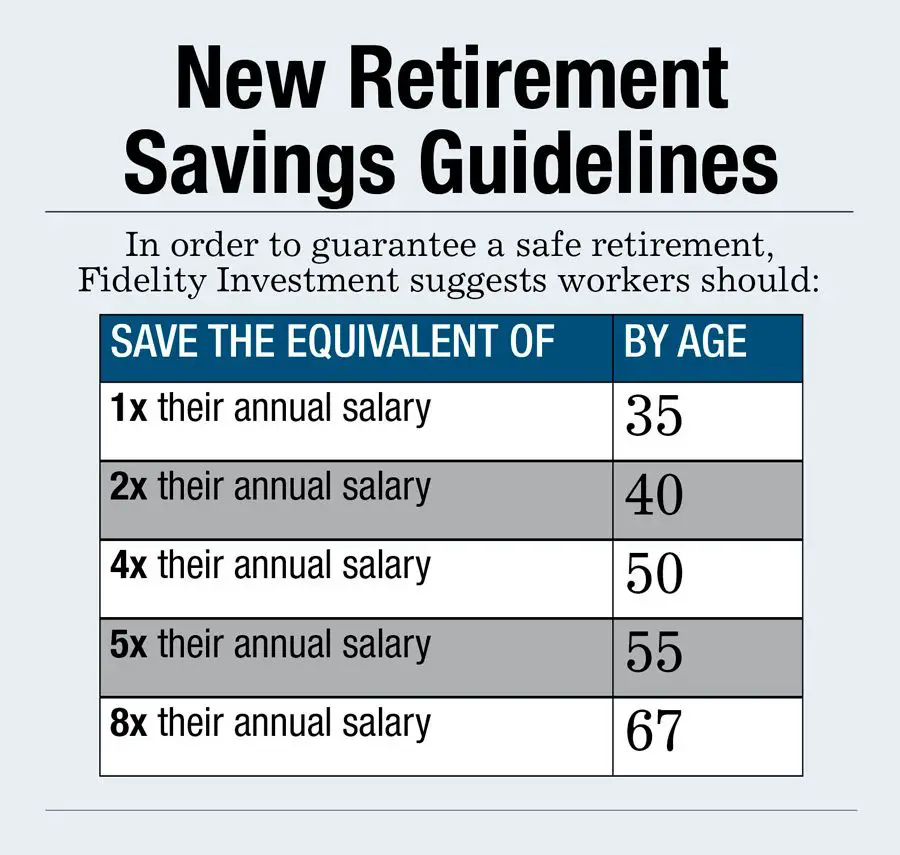

How Much Should I Have In My 401k Based On My Age

There are a few different schools of thought on how much a person should have saved in their 401k based on their age.

Every financial expert has a different opinion. When deciding what the right number is for you, I think one thing to keep in mind is that its better to have more saved than less.

Creating a potential post-retirement budget as a guideline will help you determine how much money youll spend after youre retired.

In an ideal world, you will be completely debt free by the time you retire and have minimal housing and other expenses.

Youll want to be prepare for these costs:

A persons income and expenses can make a difference when it comes to how much they should have saved at each interval age, but here are some general guidelines.

Use these guidelines in conjunction with your projected post-retirement budget to find out if you should have more or less saved by the time you retire than what is suggest ed here.

Do you have a 401k from an old employer that you need to rollover? Check out Capitalize which is free and will help take out the hassle of rolling over your 401k!

Don’t Miss: How To Sell 401k Investments

Where To Invest If You Don’t Have A 401

Don’t worry if your employer doesn’t offer a 401 there are still ways you can save for retirement on your own.

Many big banks and brokerages offer Individual Retirement Accounts, or IRAs, that allow you to put your retirement money into a range of investments, such as individual stocks, bonds, index funds, mutual funds and CDs. Just like with a 401, you can set up automatic contributions into your IRA from a checking or savings account.

When shopping around for an IRA, choose an account that has no minimum deposits, offers commission-free trading and provides a variety of investment options. Taking these factors into account, Select narrowed down our favorites for every type of retirement saver.