Cashing Out Your 401 After Leaving A Job

LAST REVIEWED Feb 18 20219 MIN READ

Based on the amount of money in your 401 account, your employer may allow you to leave the account with them. However, you will not be able to contribute any more to your old account.

Leaving your account with the old employer may not be prudentespecially when you have access to more flexible Individual Retirement Account plans from most brokers. You may roll over your 401 account to your new employer or transfer the funds into an IRA. If you meet the age criteria, you may start taking distributions without having to pay any penalty for early withdrawal.

Options For Borrowing From A 401 While Still Working

If youre still in the workforce and need to access your 401 funds for one reason or another, you may still have options. These pre-retirement withdrawal options include in-service distributions, hardship withdrawals, and plan loans.

In-service distributions allow you to withdraw your vested money before retirement and are sometimes referred to as an early retirement option in the plan. This is generally allowed at age 59 ½ because distributions of your 401 deferrals before that age are subject to a 10 percent penalty tax.

Hardship distributions are allowed for special reasons such as medical care, purchase of your home, tuition, funeral expenses, payments to prevent eviction, and damage to your principal residence. The distribution is limited to the amount you need, and your employer will need to see some proof of the hardship. Hardship distributions are subject to income tax and the 10 percent penalty tax for distribution before 59 ½.

Plan loans occur when you borrow money from your 401 balance, but the amount you can withdraw is limited to the half of your vested balance and cannot be more than $50,000. The loan will have to be paid back to the plan with interest, and the loan period cannot exceed five years in most cases. That being said, loans taken out for principal residence can be longer than five years.

Key Considerations With 401 Loans

- Some plans permit up to two loans at a time, but most plans allow only one and require it be paid off before requesting another one.

- Your plan may also require that you obtain consent from your spouse/domestic partner.

- You will be required to make regularly scheduled repayments consisting of both principal and interest, typically through payroll deduction.

- Loans must be paid back within five years .

- If you leave your job and have an outstanding 401 balance, youll have to pay the loan back within a certain amount of time or be subject to tax and early withdrawal penalties.

- The money you use to pay yourself back is done with after-tax dollars.

Although getting a loan from your 401 is relatively quick and easy, the benefit of paying yourself back with interest will likely not make up for the return on investment you could have earned if your funds had remained invested.

Another risk: If your financial situation does not improve and you fail to pay the loan back, it will likely result in penalties and interest.

Read Also: How Do I Contact Adp 401k

How Do I Avoid Taxes On My 401k Withdrawal

Heres how to minimize 401 and IRA withdrawal taxes in retirement:

Recommended Reading: What To Do With Old 401k Account

Borrowing From A 401k Loan Fees & Cost

Ballpark Estimate: Up to $350 in plan fees for a 5-year loan plus the cost of interest

If you are in need of money for some sudden or unexpected expenses, you may be tempted to borrow from your retirement account. This can be an easy-to-access source of funds to get you through an emergency situation. Yet some experts warn that this loan doesnt come without significant costs and responsibilities. Therefore, you should be prepared to get all of the facts before deciding if this is your best option.

Also Check: Should I Get A 401k

Taking An Early Withdrawal From 401k Can Be A Costly Option

In a perfect scenario with your 401k savings, you wont need to take a distribution until you are ready to leave employment behind for the next chapter of your life, which is retirement. Ideally, this will be at least age 59.5 . Not to be confused with the ages you can generally claim Social Security or Medicare. Those arent arbitrary numbers that we decided to make up. Those are the ages outlined by the IRS at which you can begin withdrawing money from retirement plans without paying the 10 percent additional penalty in most cases. I say most cases because there are exceptions to the rule when it comes to withdrawing retirement money without the costly 10 percent penalty, and the rules can differ depending on whether an employee is currently employed or not. The caveat with any of these exceptions is that it could derail financial plans and projections for the future. It is true that accessing your retirement funds may not be prudent. There is the 10 percent penalty, paying income taxes on the amount taken out above the income you are receiving from your employment, potentially selling holdings when the market is down, no longer contributing to the 401k plan, and missing some potential gain because of a balance decrease. However, it may also be true that you may not have another choice. Lets address the choices you have if you decide to withdraw from retirement assets.

Dont Miss: How Can I Invest My 401k

Withdrawing From A 401

The IRS allows you to start withdrawing from your 401 account at age 59 1/2. But, you dont have to start taking withdrawals at this time if you dont want to.

Since many people work well into their 60s, its possible to delay your withdrawals.

However, traditional 401 accounts require you to take your first required minimum distribution the year you turn 72. Not taking an RMD can result in penalties.

Roth 401 accounts dont have RMDs, meaning you never need to withdraw the money in the account, and you can pass it on to your dependants as an inheritance if you choose.

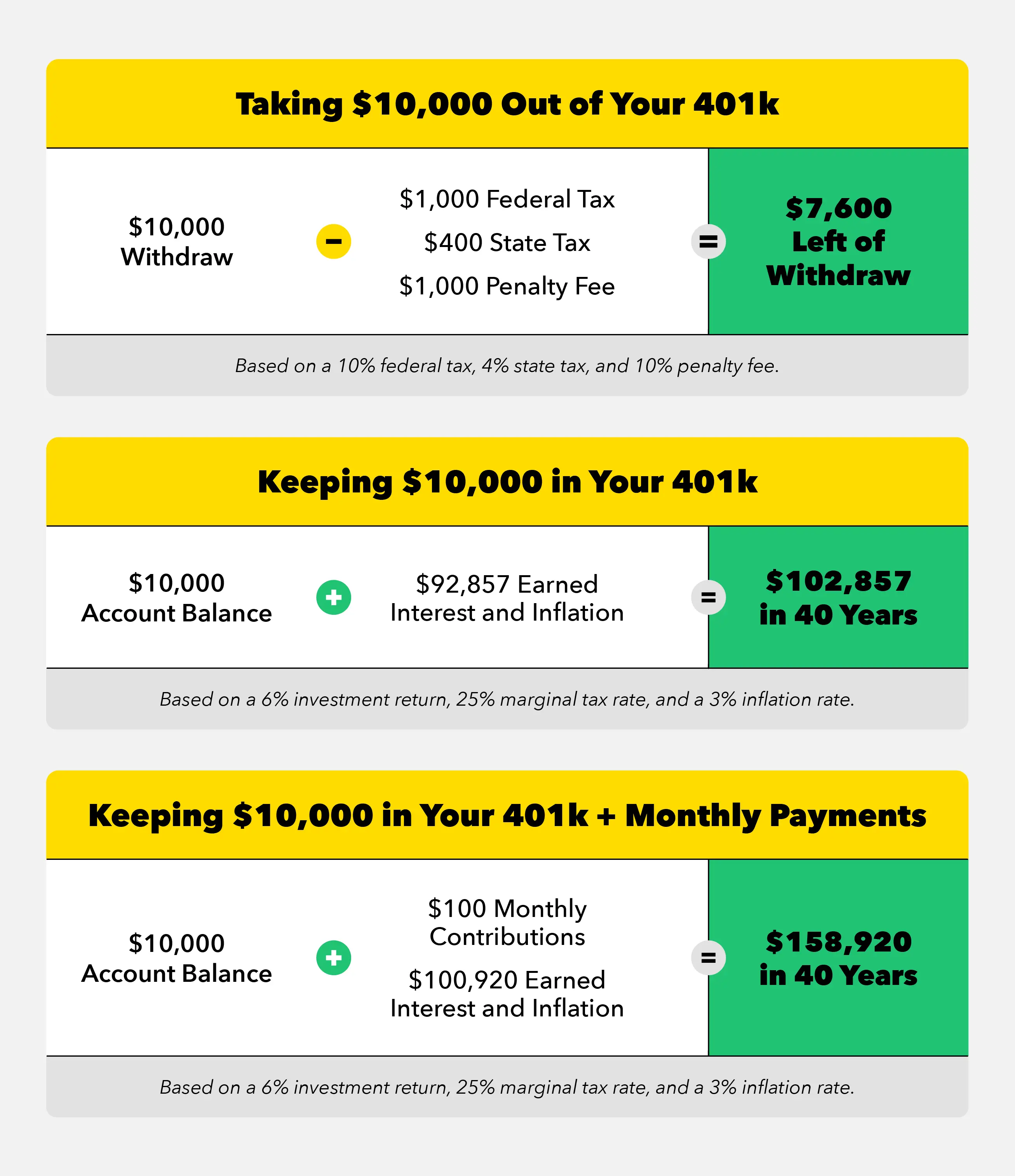

If you want to withdraw money earlier than age 59 1/2, the early withdrawal penalty is 10%. Youll also have to pay regular income taxes on the withdrawn funds.

For example, if your ordinal tax income bracket is 24%, youll pay 34% in taxes and fees on your early withdrawal. So, if you withdraw $15,000 early from your 401, youll only receive $9,900.

For this reason, most financial advisors and tax consultants dont advise withdrawing early from any retirement fund if you can avoid it. After all, the IRS enacted the penalty to dissuade people from dipping into their retirement savings.

Also Check: Can You Open 401k Your Own

Risks Of Taking Out A 401 Loan

Before deciding to borrow money from your 401, keep in mind that doing so has its drawbacks.

You may not get one. Having the option to get a 401 loan depends on your employer and the plan they have set up. A 2020 study from retirement data firm BrightScope and the Investment Company Institute says that 78 percent of plans gave participants the option to borrow based on 2017 data. So you may need to seek funds elsewhere.

You have limits. You might not be able to access as much cash as you need. The maximum loan amount is $50,000 or 50 percent of your vested account balance, whichever is less.

Old 401s dont count. If youre planning on tapping into a 401 from a company you no longer work for, youre out of luck. Unless youve rolled that money into your current 401 plan, you wont be able to use it.

You could pay taxes and penalties on it. If you dont repay your loan on time, the loan could turn into a distribution, which means you may end up paying taxes and bonus penalties on it.

Youll have to pay it back more quickly if you leave your job. If you change jobs, quit or get fired by your current employer, youll have to repay your outstanding 401 balance sooner than five years. Under the new tax law, 401 borrowers have until the due date of their federal income tax return to repay in such circumstances.

Also Check: Can I Rollover 401k To Another 401 K

What Type Of Situation Qualifies As A Hardship

The following limited number of situations rise to the level of hardship, as defined by Congress:

- Unreimbursed medical expenses for you, your spouse or dependents

- Payments necessary to prevent eviction from your home or foreclosure on a mortgage of principal residence.

- Funeral or burial expenses for a parent, spouse, child or other dependent

- Purchase of a principal residence or to pay for certain expenses for the repair of damage to a principal residence

- Payment of college tuition and related educational costs for the next 12 months for you, your spouse, dependents or non-dependent children

Your plan may or may not limit withdrawals to the employee contributions only. Some plans exclude income earned and or employer matching contributions from being part of a hardship withdrawal.

In addition, IRS rules state that you can only withdraw what you need to cover your hardship situation, though the total amount requested may include any amounts necessary to pay federal, state or local income taxes or penalties reasonably anticipated to result from the distribution.

A 401 plan even if it allows for hardship withdrawals can require that the employee exhaust all other financial resources, including the availability of 401 loans, before permitting a hardship withdrawal, says Paul Porretta, a compensation and benefits attorney at Troutman Pepper in New York.

Recommended Reading: Can You Move 401k To Ira

Rollover To A Traditional Ira

If you are simply withdrawing funds from a 401 and transferring them to another retirement account, you can opt for a direct rollover. A direct rollover moves retirement money directly from one retirement account to another, and it does not have a tax implication. You can also choose an indirect rollover, where the plan sponsor sends you a check with your 401 balance. You must then deposit the funds to a 401 or IRA within 60 days, failure to which the amount will be considered a distribution for tax purposes.

Other Considerations For Required Minimum Distributions

Your 401k administrator might calculate your RMD, but its your ultimate responsibility to make sure the calculation is accurate. Note that you can withdraw more than your required minimum, but you cant apply the excess funds to your following years RMD.

If you own more than one 401k, you must calculate the RMD amount for each account. You can, however, withdraw your RMD amount from a single account. If you own different types of accounts, such as one IRA and one 401k, you must take RMDs from each one.

You might consider opting for a systematic withdrawal plan. SWPs provide income in the form of monthly, quarterly or annual withdrawals from 401k plans, which you can schedule to meet your RMD obligations.

Recommended Reading: How To Add Money To 401k

Home Equity Loan Or Heloc

If you own a home with equity built up, a home equity loan or home equity line of credit can be a low-interest alternative to a personal loan. This type of loan is often referred to as a second mortgage because the loan is secured by your home. In other words, if you default on the loan, your lender may have a right to foreclose on your home.

One of the major benefits of a home equity loan or HELOC over a personal loan is the interest rate. Loans that are secured by homes including mortgages, home equity loans, and HELOCs often have some of the lowest interest rates on the market. As a result, the loan will cost you less money over the long term.

Its important to proceed with caution if youre considering a home equity loan or HELOC. As we mentioned, these loans are secured by your home. If you cant make your monthly payments, you risk having the lender take your home. As a result, you should avoid this option if you think for any reason you may not be able to repay the loan on time.

What Proof Do You Need For A Hardship Withdrawal

Difficulty request or application documentation, including review and / or approval of the request. Financial information or documentation proving the serious and immediate economic need of the employee. This includes insurance bills, bond paperwork, funeral expenses, bank statements, etc.

What are the requirements for removing difficulties from 401k? 401 provides for IRS codes governing the plan for withdrawals of difficulties if: withdrawal is due to a high immediate financial need withdrawal must be necessary to meet that need and the removal must not exceed the required amount

Recommended Reading: Can I Borrow Against My 401k To Buy A House

Don’t Miss: What Is A Hardship Loan From 401k

Withdrawing Funds Between Ages 55 And 59 1/2

Most 401 plans allow for penalty-free withdrawals starting at age 55. You must have left your job no earlier than the year in which you turn age 55 to use this option. You must leave your funds in the 401 plan to access them penalty-free, but there are a few exceptions to this rule. This option makes funds accessible as early as age 50 for many police officers, firefighters, and EMTs.

Make sure to understand the rules around the age requirement for penalty-free withdrawals. For example, the age 55 rule won’t apply if you retire in the year before you reach age 55, and your withdrawal would be subject to a 10% early withdrawal penalty tax in that case.

The age-55-and-up retirement rule won’t apply if you roll your 401 plan over to an IRA. The earliest age to withdraw funds from a traditional IRA account without a penalty tax is 59 1/2.

You might retire at age 54, thinking that you can access funds penalty-free in one year, but doesn’t work that way. You must wait one more year to retire for this age rule to take effect.

Tapping Your 401 Early

If you need money but are trying to avoid high-interest credit cards or loans, an early withdrawal from your 401 plan is a possibility. However, before you consider this option, be forewarned that there are often tax consequences for doing so.

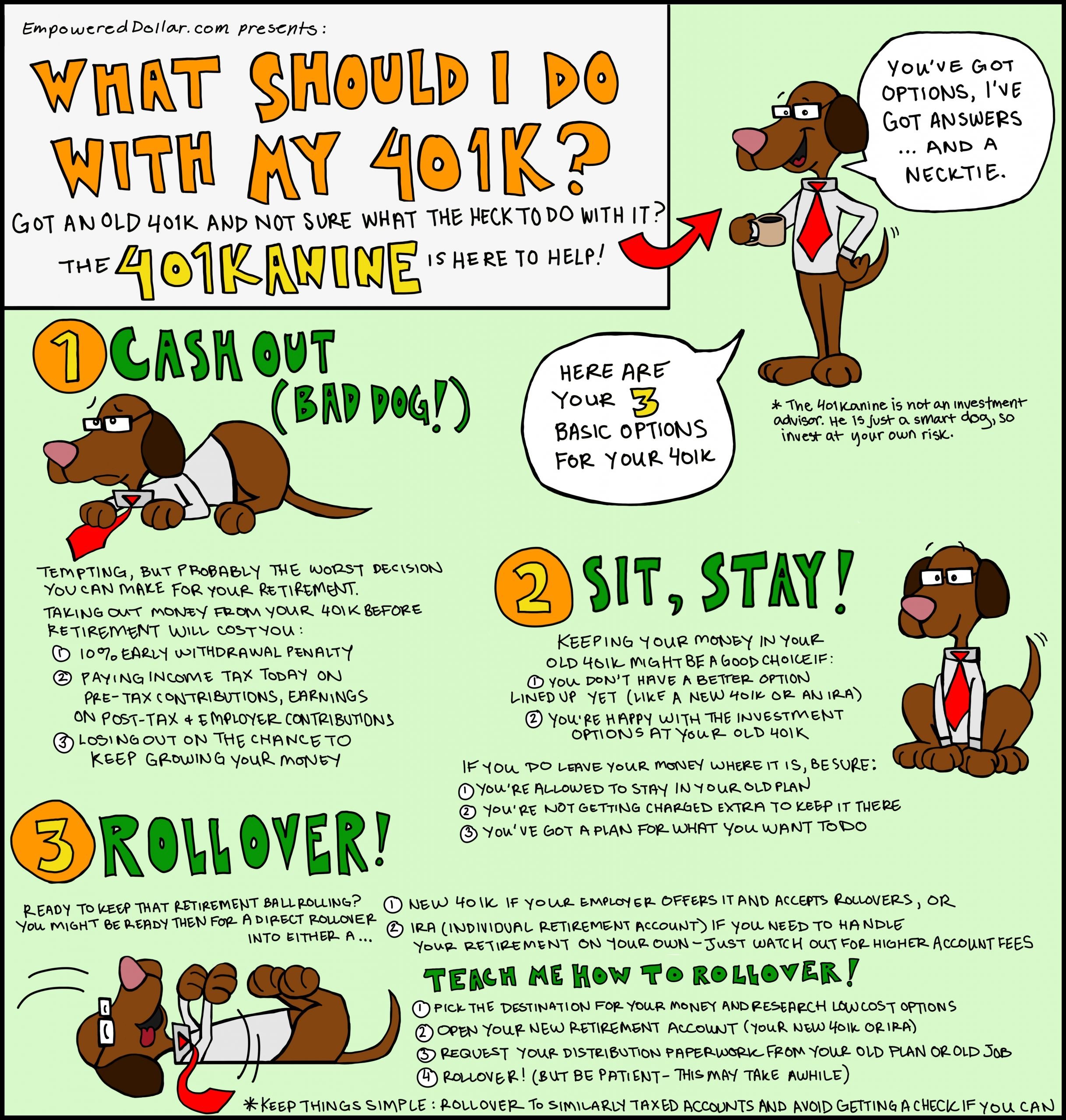

If you understand the impact it will have on your finances and would like to continue with an early withdrawal, there are two ways to go about it cashing out or taking a loan. But how do you know which is right for you? And what are the tax consequences you should be expecting?

Read Also: Should I Transfer 401k To Ira

Special Rules Resulting From The Coronavirus Pandemic

It should be noted that the CARES Act of 2020 gave employers the option to amend their 401 plans only if they so choose to allow investors who are impacted by the coronavirus to gain access to of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe on the amounts they withdraw per The Security and Exchange Commissions Office of Investor Education and Advocacy .

An employer could amend their plan by allowing coronavirus-related distributions but not increasing the 401 loan limit, according to Porretta.

The SECs OIEA guidance on the CARES Act allowed qualified individuals impacted by the coronavirus pandemic to pay back funds withdrawn over a three-year period , and without having the amount recognized as income for tax purposes.

For income taxes already filed for 2020, an amended return can be filed. The 10 percent early withdrawal penalty was also waived for withdrawals made between Jan. 1 and Dec. 31, 2020. It also waived the mandatory 20 percent withholding that typically applied.

The Act also allowed plan participants with outstanding loans taken before the Act was passed but with repayment due dates between March 27 and Dec. 31, 2020 to delay loan repayments for up to one year. .

An Early Withdrawal From Your : Understanding The Consequences

OVERVIEW

Cashing out or taking a loan on your 401 are two viable options if youre in need of funds. But, before you do so, heres a few things to know about the possible impacts on your taxes of an early withdrawal from your 401.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

You May Like: What Is The Phone Number For Fidelity 401k

Withdrawal Rules Frequently Asked Questions

If you participate in a 401 plan, you should understand the rules around separation of service, and the rules for withdrawing money from your account otherwise known as taking a withdrawal. 401 plans have restrictive withdrawal rules that are tied to your age and employment status. If you dont understand your plans rules, or misinterpret them, you can pay unnecessary taxes or miss withdrawal opportunities.

We get a lot of questions about withdrawals from 401 participants. Below is a FAQ with answers to the most common questions we receive. If you are a 401 participant, you can use our FAQ to understand when you can take a withdrawal from your account and how to avoid penalties.

Making A Hardship Withdrawal

Don’t Miss: Can 401k Be Used For Home Purchase