What Happens If You Withdraw Money From Your 401 After Age 59

Once you reach retirement age, you can start withdrawing money from your 401 without paying any penalties. However, you will still have to pay taxes on the money you withdraw.

The amount of taxes that you will owe will depend on your tax bracket. If you are in a higher tax bracket, you will owe more taxes on the money you withdraw from your 401.

Impact Of A 401 Loan Vs Hardship Withdrawal

A 401participant with a $38,000 account balance who borrows $15,000 will have $23,000 left in their account. If that same participant takes a hardship withdrawal for $15,000 instead, they would have to take out $23,810 to cover taxes and penalties, leaving only $14,190 in their account, according to a scenario developed by 401 plan sponsor Fidelity. Also, due to the time value of money and the loss of compounding opportunities, taking out $23,810 now could result in tens of thousands less at retirement, maybe even hundreds of thousands, depending on how long you could let the money compound.

Required Minimum Distributions Or Rmds In 2023

Currently, Americans must start receiving required minimum distributions from their 401 and IRA accounts starting at age 72 . The Secure 2.0 Act of 2022 raises the age for RMDs to 73, starting on Jan. 1, 2023, and then further to 75, starting on Jan. 1, 2033.

The new rules also reduce the penalty for failing to take RMDs. The previously steep 50% excise penalty will be reduced to 25%, and lowered further to 10% if the error is corrected “in a timely manner.” The penalty reductions take effect immediately, now that Biden has signed the law.

Read Also: When Can I Take 401k Without Penalty

When Must I Start Taking Required Minimum Distributions

Many taxpayers wont have to take their first RMDs until April 1 of the year after they reach age 72, but the rule wasnt always this generous.

It was age 70½ before the passage of the Setting Up Every Community for Retirement Enhancement Act in December 2019. Anyone who is covered by the old rules has already begun paying RMDs and must continue to do so. Everyone else can wait until April 1 of the year following the year in which they reach age 72.

If you wait until the last minute for your first RMD, you will effectively have to take two RMDs in the same calendar year. Thats because the deadline for your first RMD is April 1, but all subsequent RMDs are due December 31. Therefore, if you turn 72 in 2021 wait until March 31, 2022 to make your first RMD, youll have to take another RMD in December 2022.

Can I Leave My Money In My 401 Plan After I Terminate Employment

It depends upon your account balance and the terms of your 401 plan. The IRS allows 401 plans to automatically cash-out small account balances defined as less than $5,000 without the owners consent upon their termination of employment. Under these rules, account balances between $1,000 and $5,000 must be rolled over into a personal IRA for the benefit of the employee. Amounts below $1,000 can be paid out by check.

To find the cash-out limit applicable to your 401 plan, check your plans Summary Plan Description . If your account exceeds this limit, you can postpone withdrawals until the date you must start taking Required Minimum Distributions.

Don’t Miss: What Is A 401k Audit

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

|

no promotion available at this time |

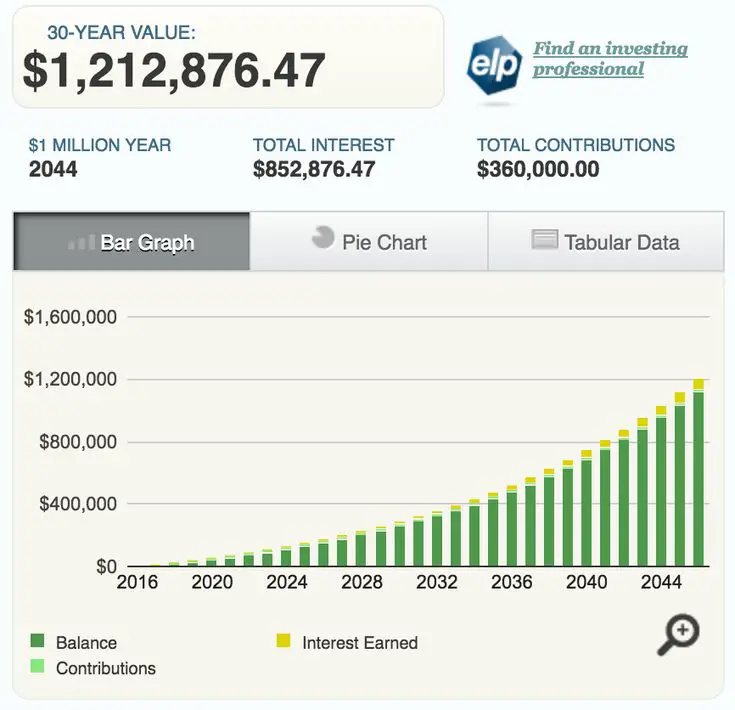

Breaking It Down: Where Do You Fit In

There are many reasons you might think this chart seems totally reasonable, or, conversely, totally unreasonable. And thats understandable. Life presents us all with different challenges. We have unexpected medical expenses, decide to go back to school, or have kids and want to pay their college tuitions. These are all perfectly valid excuses as to why you might be falling behind where this chart says you should, or could, be.

Based on this chart, you would think that most Americans should be retiring as multi-millionaires at age 65. This probably seems way off-base, and in reality, it is most people retire with very little in the way of savings and investments. The point is that this chart shows what is possible if you are disciplined and strategic about your 401k savings.

If you are on the younger end of the ages shown on the chart, you may be daunted at the prospect of contributing $8,000 per year to your 401k, not to mention $19,500. Where you live, what your first-year salary is, or what loans you may be paying can make it difficult for this contribution to seem realistic. Its crucial, however, to recognize the importance of saving as much as you can for retirement as early as you can.

So, lets determine, based on the two scenarios in the potential savings chart, whether these figures would be sufficient to support your lifestyle for the rest of your retirement.The average life expectancy for men is around 84 years old, and 86.5 years old for women.

Recommended Reading: How To Do Your Own 401k

When Must I Receive My Required Minimum Distribution From My Ira

You must take your first required minimum distribution for the year in which you turn age 72 . However, the first payment can be delayed until April 1 of 2020 if you turn 70½ in 2019. If you reach 70½ in 2020, you have to take your first RMD by April 1 of the year after you reach the age of 72. For all subsequent years, including the year in which you were paid the first RMD by April 1, you must take the RMD by December 31 of the year.

A different deadline may apply to RMDs from pre-1987 contributions to a 403 plan .

Do You Have To Pay Taxes On 401k After 60

A withdrawal you make from a 401 after you retire is officially known as a distribution. While you’ve deferred taxes until now, these distributions are now taxed as regular income. That means you will pay the regular income tax rates on your distributions. You pay taxes only on the money you withdraw.

Read Also: How To Find My Fidelity 401k Account Number

New Rules For Early Withdrawal

The Secure 2.0 Act of 2022 includes several rule changes that will benefit Americans who need to withdraw money early from their retirement accounts. Normally, withdrawals from retirement accounts made before the owner of the account reaches 59 and a half years old are subject to a 10% penalty tax.

First, Congress added a basic exception for emergencies. Account holders who are younger than 59 and a half can withdraw up to $1,000 per year for emergencies and have three years to repay the distribution if they want. No further emergency withdrawals can be made within that three-year period unless repayment occurs.

The new law also specifies that employees will be allowed to self-certify their emergencies — that is, no documentation is required beyond personal testimony. The law will also eliminate the penalty completely for people who are terminally ill.

Americans impacted by natural disasters will also get some relief with the changes. The new rules will allow up to $22,000 to be distributed from employer plans or IRAs in the case of a federally declared disaster. The withdrawals won’t be penalized and will be treated as gross income over three years. The rule will apply to all Americans affected by natural disasters after Jan. 26, 2021.

Can I Withdraw From My 401 At 55 Without A Penalty

If you leave your job at age 55 or older and want to access your 401 funds, the Rule of 55 allows you to do so without penalty. Whether youve been laid off, fired or simply quit doesnt matteronly the timing does. Per the IRS rule, you must leave your employer in the calendar year you turn 55 or later to get a penalty-free distribution. So, for example, if you lost your job before the eligible age, you would not be able to withdraw from that employers 401 early youd need to wait until you turned 59½.

Its also important to remember that while you can avoid the 10% penalty, the rule doesnt free you from your IRS obligations. Distributions from your 401 are considered income and are subject to federal taxes.

Recommended Reading: Can I Withdraw From My 401k Fidelity

Withdrawing From 401 Before Age 55

If you are younger than 55 and still work for your employer, you have two options to access your retirement savings. If your employer allows 401 loans, you may be allowed to borrow against your retirement savings to meet emergency financial needs or pay for college education. An alternative to 401 loans is a hardship withdrawal, which involves withdrawing money for immediate financial needs such as medical expenses, funeral expenses, or to prevent foreclosure on your primary residence.

If you lost your job and you need money for a financial emergency, you could consider taking a withdrawal from your 401 account. However, withdrawing 401 money should be your last resort since this decision could have a huge impact on your retirement. Early withdrawals are taxed as income and you could pay an additional 10% penalty for early withdrawals. Depending on why you are withdrawing retirement money prematurely, you may be exempted from the 10% early withdrawal penalty.

Make Sure You Don’t Miss The Deadline For Required Minimum Distributions

For most of your life, your focus will be on putting money into retirement accounts. But when you retire, you’ll have to start taking money out. The amount you withdraw from your accounts is largely determined by financial need, but this isn’t the only factor affecting your withdrawal rate. For certain types of retirement investment accounts, you’re actually required to take money out once you reach a certain age or you can face steep tax penalties.

It’s important to understand the rules for mandatory withdrawals, called required minimum distributions, so you don’t end up losing a big chunk of money to the government just because you didn’t take it out on time.

Image source: Getty Images.

Recommended Reading: Can I Receive My 401k After Quitting

Do You Have To Withdraw From 401k At 72 If You Are Still Working

If you are still working for a company when you reach the age for starting RMDs from your company’s 401, generally, you can delay taking the RMDs until you retire. … If you own more than 5% of the business for which you are working, you cannot delay 401 RMDs. You have to start your RMDs at age 72.

Decide How Much To Withdraw

All early withdrawals from your 401 are taxed as ordinary income. Thats the case even if the withdrawal was covered by an exception. The IRS typically withholds 20% of an early withdrawal to cover taxes, and that is in addition to the 10% penalty for a non-hardship withdrawal. Youll need to account for these amounts when you calculate how much to withdraw. For example, if you withdrew $10,000 from your 401, you might only receive $7,000 after the 20% IRS tax withholding and a 10% penalty.

Also Check: How To Check My Walmart 401k

Here Are The 401 Rmd Rules For 2021 And 2022

401 accounts are workplace retirement savings plans that employees can contribute to with pre-tax dollars, sometimes receiving matching contributions from employers.

Those who contribute to workplace 401s must know the rules for 401 required minimum distributions, or RMDs, since RMD rules mandate that accountholders begin withdrawing money at age 72 or face substantial IRS penalties equal to 50% of the amount that should have been withdrawn.

This guide will explain why RMDs exist, what the RMD rules are for 401 plans, what exceptions exist, how RMDs can be avoided, and how RMDs affect you if you inherit a 401.

Read Also: How To Calculate 401k Minimum Distribution

How To Calculate Required Minimum Distribution

Required minimum distributions are withdrawals you have to make from most retirement plans when you reach the age of 72 . The amount you must withdraw depends on the balance in your account and your life expectancy as defined by the IRS. If you have more than one retirement account, you can take a distribution from each account or you can total your RMD amounts and take the distribution from one or more of the accounts. RMDs for a given year must be taken by December 31 of that year, though you get more time the first year you are required to take an RMD. If youre not sure whether to return the RMD or you need help with other retirement decisions, a financial advisor could help you figure out the best choices for your needs and goals.

Also Check: How Does A 401k Retirement Plan Work

Don’t Miss: What Is A 401k Loan

Substantially Equal Periodic Paymets

Another rule that lets you withdraw from your 401k at any age without incurring the 10% early withdrawal penalty is the 72 disribution.

You can use this rule to avoid the penalty if you take substantially equal periodic payments from your plan. The substantially equal part means you cant change the amount you withdraw each year, and periodic means you have to continue to take the distributions.

Be careful with this one. If you start taking substantially equal periodic payments you have to continue them for AT LEAST five years, or until you turn 59 & 1/2, whichever is later. If you start taking payments and stop before you satisfy this rule youll have to pay the 10% penalty on the withdrawals youve made up to that point. Youll also owe interest on the penalty since the time it was originally incurred.

The practical side to this is to realize that anything you withdraw from your 401k now isnt there anymore to earn a return, and wont be there later in retirement. If you use this rule to take distributions for 10 years, for example, you are really taking a bite out of your retirement savings. Make sure you have a solid plan in place for the money youll need later in life.

Recommended Reading: How Do I Look At My 401k

What Is The Rule Of 55

Your 401 account is likely one of the most valuable assets you have, so it’s essential to know when and how you can access it. These accounts are intended to fund your retirement, and as such you can access them penalty-free when you reach age 59½. In most cases, taking money out of your 401 before then will cost you a pretty penny: Early withdrawals come with a 10% penalty.

There are a few exceptions, however, and one of them could help you if you want or need to retire early. The Rule of 55 is an IRS provision that allows you to withdraw funds from your 401 or 403 without a penalty at age 55 or older. Read on to find out how it works.

Don’t Miss: How Can I Withdraw My 401k

What Happens If You Fail To Take Out Money When Required

If you don’t take money out of your retirement account when required, the penalties are harsh. You’ll owe a 50% excise tax on the amount you should have withdrawn. If you were required to take out $5,000 and failed to do so, this would mean you’d lose $2,500 to the IRS. You definitely don’t want that to happen, as this would mean giving up a huge chunk of your retirement funds for nothing.

Can You Withdraw Money From A 401 Early

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available to you.

If the answer is yes, you will need to determine the type of withdrawal that you want to make, fill out the necessary paperwork, and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but when all the paperwork has been submitted, you will receive a check for the requested funds, hopefully without having to pay the 10% penalty.

Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It really should be a last resort.

Also Check: Should I Use My 401k To Pay Off Debt