Roth Ira Versus Traditional Ira For Kids

This strategy works with a traditional IRA but when it involves a child, the Roth IRA makes much better sense for at least four good reasons.

Because there are no RMDs, a Roth IRA can be an ideal wealth-transfer vehicle to create legacy wealth.

Withdraw From Your 401

All 401 accounts give you the option to withdraw your funds and receive the proceeds as cash. This option is typically best saved as a last resort, since youll have to pay federal, state, and local taxes plus penalties if you havent yet reached retirement age. Youll also potentially give up the benefit of additional tax-advantaged investment returns.

However, if you need access to the funds for non-retirement purposes or financial hardship, withdrawing from your 401 is something you can consider.

Roth Ira Eligibility Contribution Rules

Roth IRAs were not designed for wealthy savers. In fact, there is an income cap on Roth IRA eligibility. The IRS income rules for Roth IRAs use your adjusted gross income as a guide. Your AGI is simply the total of all your taxable income, minus certain qualified deductions such as those for medical expenses and unreimbursed business expenses.

The IRS sets an income eligibility range that tells you whether you can make:

In 2023, the AGI phase-out range for a married couple filing jointly is $218,000 to $228,000 . For a single filer it is $138,000 to $153,000

For 2022, the AGI phase-out range for a married couple filing jointly is $204,000-$214,000. For those filing single, the range is $129,000 to $144,000.

If your income falls below the bottom of the range, you can contribute the full $7,000 to a Roth IRA. If its within the range, you are subject to contribution phase-out rules, meaning that you wont be able to contribute the full $6,000. If your income is above the top of the phase-out range, IRS rules prohibit you from contributing to a Roth IRA.

Don’t Miss: What Does A Financial Advisor Do For A 401k Plan

Roth Rollovers With No Tax Consequences

First, there are some Roth IRA rollovers that don’t have any tax consequences if done correctly. The simplest is moving money from one Roth IRA to another. There is only a risk of tax consequences if the rollover isn’t completed in a timely manner.

In addition, if you have access to a Roth 401 account at work, then rolling over that money into a Roth IRA also avoids any tax consequences. The tax-free nature of the Roth assets is preserved, and you have the full range of investment alternatives your Roth IRA offers. You still may receive a tax reporting form , but the movement of assets from one Roth to another should result in zero additional tax.

Invest The Money In Your Roth Ira

A common pitfall for people that go through this process is that theyll see the funds arrive in their Roth IRA, and think that the process is complete. It is not.

Youll need to go into the account and actively invest the money, ideally in the context of all of the accounts you have.

When youve completed this step, youre done! You now have a tax-exempt Roth IRA growing in perpetuity all with a zero tax liability .

Read Also: How To Use 401k To Buy Stock

Roth Ira Conversions Explained

Anthony Battle is a CERTIFIED FINANCIAL PLANNER professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling and both the Retirement Income Certified Professional®, and Certified Retirement Counselor designations for advance retirement planning.

shapecharge / Getty Images

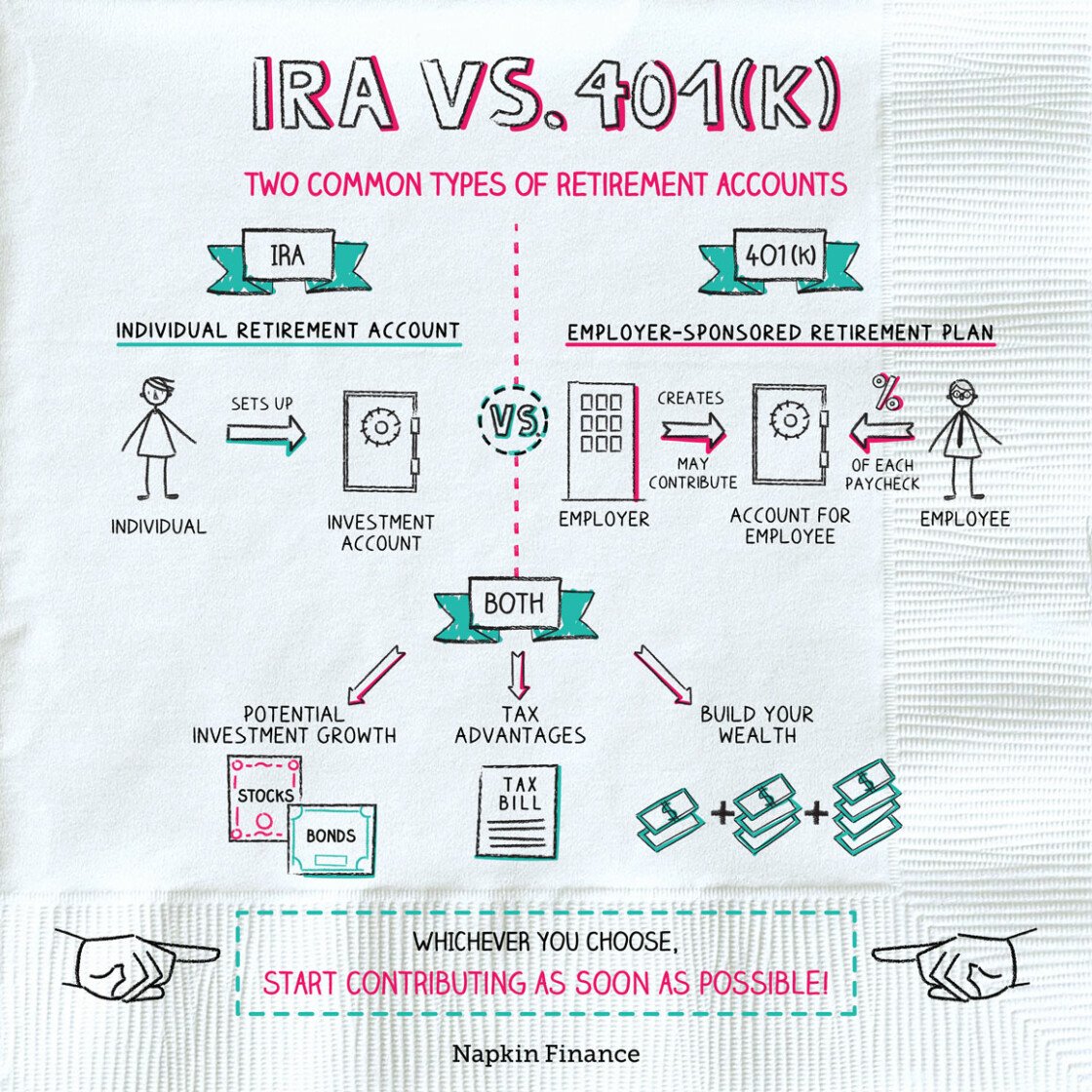

A rollover of a 401 to a Roth IRA is the movement of funds from a 401 into a new or existing Roth IRA account. Many people consider making a Roth IRA conversion after they leave an employer to consolidate retirement accounts and take advantage of the benefits of a Roth IRA, which include tax-free investment growth and no required minimum distributions.

Additionally, if you are in a period of earning less income than usual or believe your income will be higher in the future, there are tax benefits to converting an old 401 to a Roth IRA in a low-income year. Converting a 401 to a Roth IRA involves a few, easy steps between your former workplace 401 administrator and the financial institution where your Roth IRA account is located.

With the information below, youll have a better understanding of what a Roth IRA rollover is, what advantages it provides, the steps it takes, and alternative rollover options.

Transferring A 401 Plan And Ira To A Canadian Rrsp

Investment Insight

If youve been living and working in the United States, youd have likely accumulated retirement savings while employed. Now that youve returned to Canada, youre probably considering transferring the retirement savings you accumulated abroad to a Canadian registered retirement savings plan ¹ but are concerned about the tax implications and the logistics associated with such a transfer.

Read Also: Whats The Best Percentage For 401k

Recommended Reading: How Much Can I Put In Solo 401k

Should You Convert To A Roth 401

If your company allows conversions to a Roth 401, you’ll want to consider two factors before making a decision:

Transfer Money Directly Into The Tsp

Transfers or direct rollovers occur when the eligible plan sends your money to the TSP.

Tax-deferred amounts should be transferred into the TSP using TSP rollover Form TSP-60, Request for a Transfer Into the TSP. You can transfer Roth money into the TSP by completing Form TSP-60-R, Request for a Roth Transfer.

Don’t Miss: How To Withdraw From Merrill Lynch 401k

Need To Open A Roth Ira

My favorite online broker is Ally Invest but you can check out our recap on the best places to open a Roth IRA and the best online stock broker sign-up bonuses. There are many good options out there, but I have had the best overall experience with Ally Invest. No matter which option you choose the most important thing with any investment is to get started.

How To Roll Over A Roth 401 To A Roth Ira

Saving through a Roth 401 can help you grow a nest egg that you can then tap into in retirement without having to pay taxes. If you leave your job or youre ready to retire, you may be wondering what to do with the funds in your 401. Rolling your Roth 401 over to a Roth IRA is just one possibility. But make sure you know how this process works to avoid triggering an IRS tax penalty. A financial advisor can walk you through a rollover if youre new to it.

Don’t Miss: How Do Employer Contributions To 401k Work

The Penalty If You Deposit To The Wrong Account

You have 60 days to deposit the funds into the appropriate account when you receive a rollover check. Your rollover won’t count as a rollover if you miss the 60-day deadline. It will become taxable.

Exceptions to the 60-day rollover time frame are hard to come by unless your financial services company makes a gross error. It’s important to have a clear plan for where your rollover funds are going and to make sure your financial advisor or plan administrator knows exactly where to put the money.

Should You Roll Over Your 401 Into Another 401

There are some situations that might make an IRA rollover the wrong move for you. Heres what to consider before completing a 401 rollover.

Retirement account protection. In general, 401 accounts offer better protections from creditors than IRAs.

Rule of 55. With a 401, you can actually start withdrawing funds at age 55 penalty-free if you leave your job. You dont have that advantage when you roll your 401 to an IRA, though you can emulate it by taking subsequently equal periodic payments from your IRA.

Performance. If you like your current plan, and its performing well, theres no reason to complete a rollover.

You can always choose to roll your old 401 balance into your new employers 401 plan. If you value the simplicity of having everything in one place, you like the features of the plan at your new job or you want to maintain the legal protections of a 401, it may make more sense to roll your old 401 into a new 401.

Don’t Miss: How To Roll Over 401k To New Job

Rollovers From Traditional 401 And Other Retirement Plans To Roth Iras

For a long time, rollovers from 401 plans or other employer-sponsored retirement accounts like a 403 or 457 directly to a Roth IRA weren’t allowed. You first had to roll over employer retirement money to a regular IRA and then convert the regular IRA to a Roth IRA.

Now the government has recognized that extra step shouldn’t be necessary and has allowed direct rollovers from traditional 401s to Roth IRAs.

The tax consequences for such a move are the same as a conversion from a traditional IRA to a Roth IRA. You’ll have to treat pre-tax contributions as taxable income in the year in which you convert to the Roth IRA, but any after-tax contributions aren’t required to be included in taxable income.

You Expect To Earn More Money In The Future

If you plan to earn lots of money in the future or earn a high income now you should consider rolling your funds into a Roth IRA instead of a traditional IRA. For single filers in 2016, the maximum income allowable for contributions to a Roth IRA starts at $117,000 and ends at $133,000. Learn more about Roth IRA rules and contribution limits here. For married filers, on the other hand, the ability to contribute to a Roth IRA begins phasing out at $184,000 and halts completely at $194,000 for 2016. The more you earn in the future, the harder it will become to contribute to a Roth IRA and secure the benefits that come with it.

Don’t Miss: Can We Borrow Money From 401k

How To Convert To A Roth 401

Here’s a general overview of the process of converting your traditional 401 to a Roth 401:

Not every company allows employees to convert an existing 401 balance to a Roth 401. If you can’t convert, consider making your future 401 contributions to a Roth account rather than a traditional one. You are allowed to have both types.

As mentioned, you’ll owe income tax on the amount you convert. So after you calculate the tax cost of converting, figure out how you can set aside enough cash from outside your retirement accountto cover it. Remember that you have until the date you file your taxes to pay the bill. For example, if you convert in January, you’ll have until April of the following year to save up the money.

Don’t rob your retirement account to pay the tax bill for converting. Try to save up for it or find the cash elsewhere.

Rolling A 401 Into A Traditional Ira

In the same way that one can roll over a 401 into a Roth IRA, one can also roll it over into a traditional IRA. Well, it isnât exactly the same the process is much simpler, and the options differ in regard to taxes.

Like a 401 itself, a traditional IRA is funded with pre-tax dollars. Should you choose to roll over one into the other, you will owe no additional taxes but, like always when it comes to traditional IRAs, you will owe taxes once it comes time to withdraw the money.

Recommended Reading: Can I Roll Over A 403b To A 401k

How Much Can I Roll Over Into A Roth Ira

A rollover is considered a balance transfer from one retirement plan to another retirement plan and does not count toward the annual Roth IRA contribution limits.

Want to read more content like this? for The Balances newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Should I Convert My 401 To A Roth

You might consider converting your 401 account into a Roth IRA in the following situations:

-

If your tax liabilities are likely to increase in the future: You might want to make Roth contributions and pay taxes now, so you can make tax-free withdrawals later.

-

If you want to make withdrawals at any time: Roth IRAs give you the flexibility to withdraw money whenever you want. They do not bind you with RMDs when you reach 70 ½ years.

-

If you want to diversify your taxation: If you are not sure how your tax liability will impact your income in the future, you might want to set up a Roth IRA in addition to a traditional retirement account, so you can make both taxable and tax-free withdrawals after.

Recommended Reading: How Much Can You Contribute 401k

You May Like: How To Change 401k Contribution On Fidelity

Our Results Stand On Our Strategic Investing Approach

While all investment managers crunch numbers, we don’t stop at surface-level analysis. Instead, our strategic investing approach takes us beyond the numbers to find the best potential investments for your portfolio.

-

Rigorous Field ResearchOver 525 of our investment professionals go into the field to see firsthand how companies are performing.3

-

Prudent Risk ManagementWe carefully manage risk and seek to maximize value for our clients over longer time horizons.

-

Experienced ManagersOur skilled portfolio managers have deep experienceaveraging 22 years in the industry and 17 years with T. Rowe Price.4

Should I Rollover To An Ira Or A 401k

Generally, the money from the old 401 has to be deposited into the new IRA within 60 days in order to roll it over to an IRA.

Heres how to start and finish a 401 IRA rollover in 4 steps:

- Compared to your old 401, an IRA may offer you more investment choices and lower fees.

- Rollovers to Roth IRAs are taxed on the rolled amount.

- Taxes are deferred when you roll over to a traditional IRA.

- You wont have to pay a rollover tax if you move from a Roth 401 to a Roth IRA.

There are generally two options for getting an IRA: online brokers or Robo-advisors.

- A Robo-advisor can do all the work for you if you dont want to pick individual investments.

- An online broker lets you buy and sell investments yourself to build and manage your portfolio. Providers should offer low-cost investments, offer no account fees, and have an excellent reputation for customer service.

401 plans may offer direct rollovers, or you can use the 60-day rule.

You May Like: How Do I Move My 401k To An Ira

Decide Which Type Of Conversion You Want

There are two types of rollovers you can make before retirement: a direct or indirect rollover.

For a direct rollover, your old 401 plan administrator will be able to deposit your 401 money directly into your new Roth IRA account once it is opened.

If a direct rollover is not an option, or if you want an indirect rollover, this means the 401 plan administrator will have a check made out to you.

With an indirect rollover, taxes will be automatically withheld and be counted toward taxes paid for that year. You will have to use other funds you have on hand to replace the tax amount lost. If you do not replace the money that was sent to the IRS, it will be considered taxable income on which you will pay regular income taxes plus an additional 10% tax penalty.