What Are The Benefits Of A Solo 401

A solo 401 is a great way for someone who is self-employed to open a 401 account with most of the same features and benefits of a 401 offered by companies and employers. These benefits include:

A solo 401 can be an attractive retirement savings option for those who are self-employed. Be sure to consult with your financial or tax adviser to see if this type of plan is right for your situation.

Alternatives To A Solo 401

There are basically two options in addition to the solo 401 for freelancers and independent contractors who want to save for retirement and get the tax advantages that go with these IRS-approved choices:

- The , for Simplified Employee Pension, is designed to be an easy, flexible option for small businesses with employees. It works much like a traditional IRA but has higher contribution limits. The limits are the same as for the Solo 401: $58,000 for 2021 and $61,000 for 2022. However, your contribution cannot exceed 25% of your net adjusted income. You may not find that adequate for your goals. No catch-up contribution is allowed for those age 50 and older. No Roth option is available. A SEP IRA can be opened through any brokerage or bank.

- The Keogh Plan is open to sole proprietors, partnerships, and limited liability companies and is often used as a profit-sharing vehicle for professional practices such as doctors’ and lawyers’ groups. It has the same contribution limits as the SEP IRA and the Simple 401 but poses a greater administrative burden. There is no Roth option.

Another option, the SIMPLE IRA, is designed for businesses with 100 or fewer employees. It is open to sole proprietors but has a lower contribution limit than the Solo 401 or the SEP IRA. The maximum contribution is up to 3% of salary plus $14,000 in 2022. There is no Roth option.

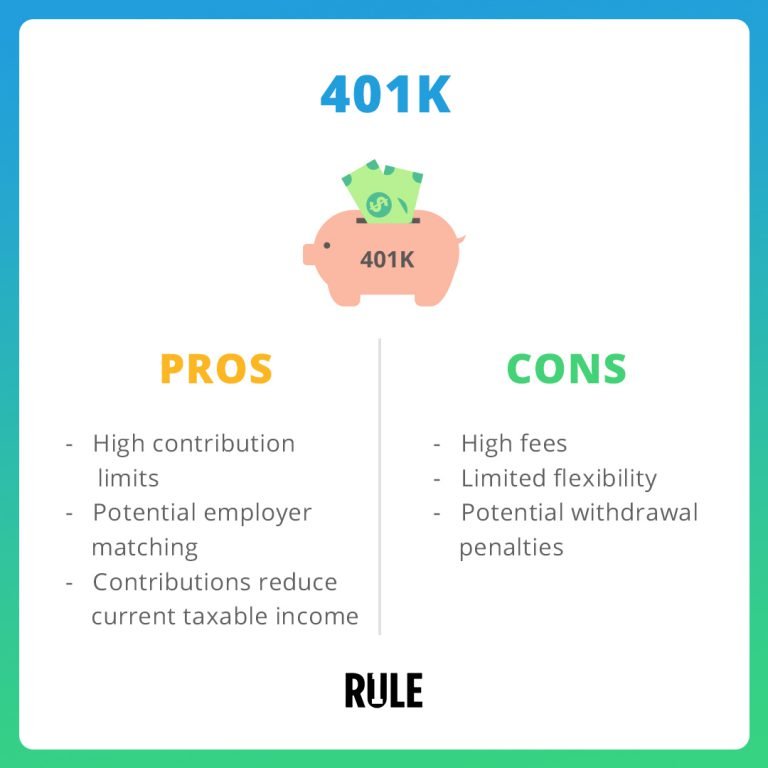

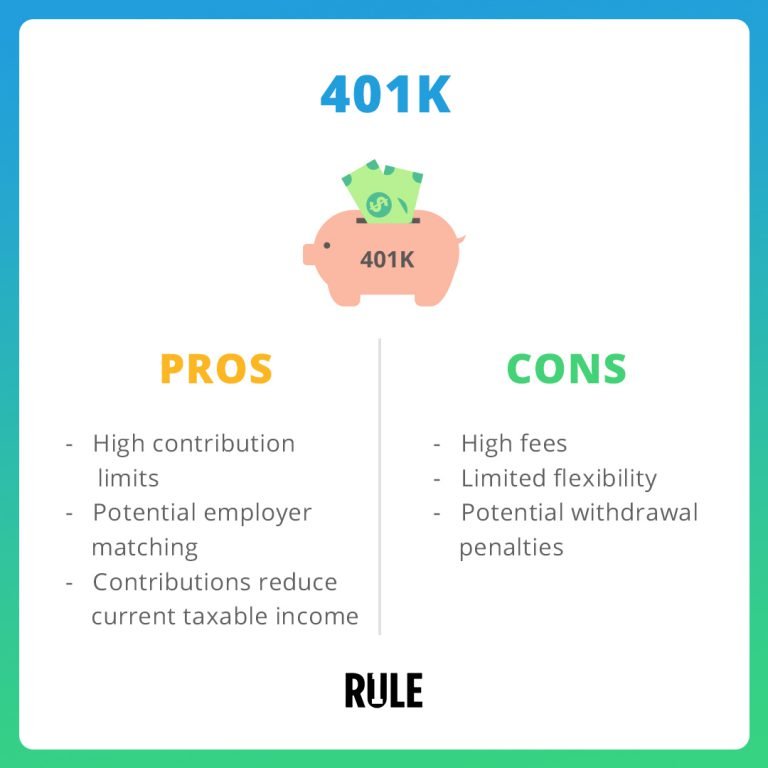

Drawbacks To The Solo 401

The solo 401 has the same drawbacks of typical 401 plans, plus a couple others that are specific to itself. Like other 401 plans, the solo 401 will hit you with taxes and penalties if you withdraw the money before retirement age, currently set at 59½. Yes, you can take out a loan or may be able to access a hardship withdrawal, if needed, but those are last resorts.

In addition, it can take more paperwork to open a solo 401, but its not especially onerous. You usually wont be able to open the account completely online in 15 minutes, as you would a typical brokerage account. Plus, youll need to get a tax ID from the IRS, which you can do online quickly. On top of this, youll have to manage the plan, choose investments and ensure that you dont exceed annual contribution limits.

Another wrinkle: Once you exceed $250,000 in assets in the plan at the end of the year, youll need to start filing a special form with the IRS each year.

These drawbacks arent especially burdensome, but you should be aware of them.

You May Like: How To Pull Money From 401k

Allocating Employee Contributions Question:

In short yes. It is important to first understand the total contribution limit to a solo 401k cannot exceed $58,000 for 2021, not counting the catch-up contributions for those age 50 and over. The contributions made to the Roth solo 401k designated account will reduce the amount of contributions that you can make to the pretax solo 401k designated account. Only employee contribution may be made to the Roth solo 401k therefore, if you make the full $19,500 employee contribution to the Roth solo 401k for 2021, then you wont be able to make any employee contribution to the pretax solo 401k because you will have exhausted the full $19,500 employee contribution on the Roth solo 401k. Note that you can also split up the $19,500 employee contribution between both the pretax solo 401k and Roth solo 401k designated accounts. Lastly, you also have an additional $6,500 of catch-up contributions to work with if you are age 50 or older in 2021 since the catch-up contribution falls under the employee contribution umbrella and can thus be allocate between the Roth solo 401k and the pretax solo 401k designated account.

How To Include Your Spouse In Your Solo 401

If youre a sole proprietorship, your spouse will receive a W2 as an employee. This solution is best if the spouse has minimal duties in the business.

You can also choose to file as a partnership, where each partner receives a K-1 . The partnership bypasses income taxes, passing profits and losses onto each partner. The IRS views this structure as ideal if both partners contribute materially to the business.

A Qualified Joint Venture may be possible if both spouses work and contribute materially to the business and file a joint tax return. Each spouse reports income gains, losses, deductions, and credits separately on Form 1040 Schedule C.

Spouses can also form LLCs, and C or S corporations.

If you have any additional questions about starting a new Solo 401 or adding a spouse to an existing Solo 401, dont hesitate to contact Ubiquity.

Are you ready to retire?

Also Check: How Can I Get My Money From 401k

Mega Backdoor Roth Solo 401k Ban Question:

Since the Build Back Better bill did not pass in 2021, yes the solo 401k participant can still make voluntary after-tax solo 401k contributions for both 2021 and 2022 and subsequently convert the contributions to the Roth IRA or the Roth solo 401k. Since congress was not able to pass the BBB in 2021 which would have banned both the backdoor and the mega backdoor starting in 2022, if the bill is passed in 2022 it would be effective at the earliest starting in 2023 as this is how retirement regulation generally works .

Where Did This Answer Come From

With a solo 401, you are allowed to make contributions in the role of employee and the role of employer. Specifically, you are allowed to make:

In this case, your net earnings from self-employment is defined as your businesss profit , minus the deduction for one half of your self-employment tax .

However, there are an assortment of limitations to the above contributions.

Important notes:

- Various amounts in this explanation may be off slightly due to rounding of cents.

- Solo 401 plans are complicated, so its likely a good idea to consult with your tax professional.

Welcome

to read more, or enter your email address in the blue form to the left to receive free updates.

My Latest Book

Dont Miss: What Happens To My 401k After I Quit

You May Like: How To Pull 401k Early

Solo 401 Contribution Limits

The total solo 401 contribution limit is up to $58,000 in 2021 and $61,000 in 2022. There is a catch-up contribution of an extra $6,500 for those 50 or older.

To understand solo 401 contribution rules, you want to think of yourself as two people: an employer and an employee . Within that overall $58,000 contribution limit in 2021 and $61,000 in 2022, your contributions are subject to additional limits in each role:

-

As the employee, you can contribute up to $19,500 in 2021 and $20,500 in 2022, or 100% of compensation, whichever is less. Those 50 or older get to contribute an additional $6,500 here.

-

As the employer, you can make an additional profit-sharing contribution of up to 25% of your compensation or net self-employment income, which is your net profit less half your self-employment tax and the plan contributions you made for yourself. The limit on compensation that can be used to factor your contribution is $290,000 in 2021 and $305,000 in 2022.

Keep in mind that if youre side-gigging, employee 401 limits apply by person, rather than by plan. That means if youre also participating in a 401 at your day job, the limit applies to contributions across all plans, not each individual plan.

What Is A Solo 401

A solo 401 is a type of retirement savings account for self-employed individuals, or for employers with no employees besides themselves and their spouses.

To be eligible to open a solo 401, you need to claim some self-employment income on your tax return. It’s important to keep in mind that self-employment doesn’t need to be your only source of income. For example, if you work a full-time job for an employer and do some consulting work on the side, you can use a solo 401 to set aside some of that extra income.

The only real requirement, other than making self-employment income, is not having any full-time employees other than yourself and your spouse. If you operate a small business with part-time workers , you can still open a solo 401 account.

You May Like: How Do I Get A 401k Account

How To Open A Solo 401k

The next step is to set up your Solo 401k with Nabers Group. After you complete our short online application we will get your documents back to you within 2-4 hours. Next you can set up your holding accounts at the bank and/or brokerage of your choice. Then make new contributions and/or roll over funds from other qualified plans and IRAs. Select your investments and simply invest your funds how you want.

Regarding the calculator usage you write: For the unincorporated sole proprietorship you would enter your net income after deductions. For a single owner corporation you would enter your W2 wages paid from the corporation.

Do we need to use net income after deductions for general partnerships too and if so:1) which form do we find that in?2) and is the employer contribution a deduction?

Covering Your Spouse Under Your Solo 401

The IRS allows one exception to the no-employees rule on the solo 401: your spouse, if he or she earns income from your business.

That could effectively double the amount you can contribute as a family, depending on your income. Your spouse would make elective deferrals as your employee, up to the $19,500 employee contribution limit . As the employer, you can then make the plans profit-sharing contribution for your spouse, of up to 25% of compensation.

You May Like: How Do I Move My 401k To An Ira

Guaranteed Retirement Income For Life

You can choose to annuitize your annuity to receive annuity payments over a period of time or for life or add an optional income rider to generate a paycheck you can never outlive. Sometimes the insurance company will provide a paycheck that increases to help with inflation and the cost of living.

Use our 401 calculator to estimate how much guaranteed income an annuity can generate.

Is A Solo 401k Right For You

You probably wont miss much when you say goodbye to your traditional 9-to-5, but one of the things that you might regret leaving behind is your 401k. You could struggle to save enough for your future if all you have is an IRA. But there is another option: a solo 401k. These accounts are similar to traditional 401ks, but theyre specifically designed for self-employed workers with no employees.

You May Like: Can A 401k Be Transferred To A Roth Ira

What Is The Benefit Of Adding A Spouse To A Solo 401

A married couple with a Solo 401 can contribute a maximum of $114,000 per year for retirement as both employer and employees. If you and your spouse are over 50 years of age, total contributions can reach $127,000. Once the plan reaches $250,000 or more in assets, Form 5500-SF will need to be submitted to the IRS.

Get Your Complimentary Guide to Solo 401 plans

What Is A Brokerage Firm

A brokerage firm is a company that helps buyers and sellers complete financial transactions. They earn money based on fees, or in some cases commissions, involved with the transaction. In many cases, special licensing is required to buy and sell financial products, which is where brokers are necessary and helpful. You might also find individual brokers who work independently, but typically brokers are connected to a larger team that can collaborate to help with transactions.

Recommended Reading: How Long Do You Have To Transfer 401k

Looking To Reduce Excessive 401k Fees

Sign up for Personal Capital for free and use their Portfolio Fee Analyzer tool. The tool will show you how much in fees youre paying. I had no idea I was paying $1,700 in 401 fees four years ago until I ran the tool.

Now Im only paying about $300 a year in fees. Excessive fees is one of the biggest drags on making more money and retiring earlier.

You can also use Personal Capital to track your net worth, track your cash flow, and optimize your investments.

Who Can Have A Solo 401 Plan

According to Allec, there are three categories of people who can have solo 401 plans:

You May Like: What 401k Funds Should I Invest In

Contribute To Solo 401k And Day

Your wifes ability to contribute to a solo 401 depends on the self employment income that she receives from the partnership. Specifically, in order to determine how much she could contribute to the solo 401 she would take the amount reported on line 14 of her K-1 and reduce it by one half of the self-employment tax. Of that number, she could contribute for 2021: up to $26,000 as an employee contribution plan sponsored by her daytime employer) and a profit-sharing contribution to the solo 401 equal to 20% of that same number provided that her overall contribution to the solo 401 cannot exceed $64,500 for 2021. For 2022, the overall limit is $67,500.

Contribution Limits For Self

You must make a special computation to figure the maximum amount of elective deferrals and nonelective contributions you can make for yourself. When figuring the contribution, compensation is your earned income, which is defined as net earnings from self-employment after deducting both:

- one-half of your self-employment tax, and

- contributions for yourself.

Use the rate table or worksheets in Chapter 5 of IRS Publication 560, Retirement Plans for Small Business, for figuring your allowable contribution rate and tax deduction for your 401 plan contributions. See also Calculating Your Own Retirement Plan Contribution.

Don’t Miss: How Do You Take A Loan Out Of Your 401k

What Are The Types Of Solo 401s

There are two types of solo 401s: traditional and Roth. Employee contributions to traditional plan are made on a pre-tax basis, and money in the account grows on a tax-deferred basis until withdrawn. At that time, it is subject to taxes.

Many custodians also offer a Roth solo 401 account. This works like a Roth account in an employer 401. Contributions are made on an after-tax basis but the money in the account grows tax free. Withdrawals can be made on a tax-free basis as long as certain rules are followed.

Most major custodians offer solo 401 accounts. Investment options include stocks, bonds, mutual funds, ETFs closed-end funds and many others. There are a few items that are prohibited investments in 401 accounts, and these would be prohibited in a solo 401 as well.

There are also custodians who offer self-directed retirement plans that include solo 401 accounts. Self-directed accounts typically offer the opportunity to invest in non-traditional investments such as precious metals, real estate, crowdfunding, structured settlements, private debt and equity and a host of other alternative assets. In choosing one of these custodians be sure to find one with experience with these types of accounts. Also, be sure to consult your tax and financial adviser before going this route.

When Do You Have To Take Distributions

Where you were required to take Required Minimum Distributions at age 70 ½ until 2019, the recent passage of the Setting Every Community Up for Retirement Enhancement Act bumped that figure up to age 72.

In short, this means youre required to begin taking distributions once you reach that age. This is unlike the Roth IRA, which doesnt require distributions at any age.

Note that you can take distributions without a penalty any time after you reach the age 59 ½.

Recommended Reading: How To Open A 401k Self Employed

How Much Can I Contribute Into A Solo 401k Sep Ira Defined Benefit Plan Or Simple Ira

Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. Enter your name, age and income and then click Calculate.

The result will show a comparison of how much could be contributed into a Solo 401k, SEP IRA, Defined Benefit Plan or SIMPLE IRA based on your income and age.

Note: If you are taxed as a sole proprietorship use your NET income when using the calculator. If you are incorporated, then only use your W-2 wages when using the calculator. For example, S corporation K-1 distributions are not included when making the contribution limit calculation.