Can You Change 401 Contributions At Any Time

Most employers allow employees to change their 401 contributions at any time. However, some employers only let their employees change the amount of 401 contributions once a year.

Changing the contribution amount is a straightforward process, and you should contact your plan provider to obtain the correct procedure. If allowed, you may be able to change your contribution online on the plan sponsorâs website.

According to the Department of Labor guidelines, employers are required to allow plan participants to change their investment allocation at least quarterly. This period can change to âmore oftenâ where the plan offers volatile investment options like stocks to plan participants.

If you donât know how often your plan lets employees change contributions, you should contact the plan provider to get the correct information. If you donât know who your plan provider is, you should ask the companyâs human resource department to point you in the right direction. You can then call or email the plan provider to know when you can change your 401 contributions.

Move Your Money Into An Individual Retirement Account

This choice gives you maximum control and flexibility. With a 401 plan, the employer chooses the investments and makes the rulesand the rules vary from plan to plan. With an IRA, youre in charge.

Advantages

- Unlimited investment choices instead of a small menu. Every 401 plan has limited investment options by contrast, you have total freedom of choice in an IRA, which can be invested in as many mutual funds, stocks and bonds as you want.

- Greater control over your investment expenses. 401 plan fees are rarely disclosed, and in many cases theyre higher than what youd pay for comparable investments outside the plan. Picking low-cost funds for your IRA can save you tens of thousands of dollars over time.

- Greater freedom to name beneficiaries. The beneficiary of your 401 plan, by law, must be your spouse you have to obtain a signed release from him or her if you want to name anyone else. With an IRA, you can name any beneficiary you wish.

Potential Disadvantage

- Taxes will be withheld unless you move the money from your 401 to an IRA via a trustee-to-trustee transfer. To avoid this issue, first set up a new IRA then ask your old employer to transfer your money directly from the 401 plan into the new account.

Contribute The Max For The Match

If your company ismatching your contributions up to a certain point, contribute as much as you can until they stop matching the funds. Regardless of the quality of your 401 investment options, your company is giving you free money to participate in the program. Never say no to free money.

Once you reach the maximum contribution for the match, you might consider contributing to an IRA to diversify your savings and have more investment choices. Just don’t miss out on the match.

Recommended Reading: What Happens To 401k When You Change Jobs

How To Make Changes To Your 401 Contributions

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey. Read more We develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right. Read less

Whether you just set up your 401 plan or you established one long ago, you may want to change the amount of your contributions or even how theyre invested. Fortunately, changing your 401 contributions is usually straightforward, and you may be able to change your 401 contributions at any time .

After all, the point of a 401 plan is to help you save a substantial amount for your retirement. So its important to keep an eye on your account and your investments within the account, to insure that youre saving and investing according to your goals.

To understand how to maximize this investment opportunity and grow your nest egg, its important to start with the basics.

How To Maximize Your 401 Match

U.S. News & World Report 02/11/2020

Many companies offer a 401 match to employees who save for retirement, but its not always easy to qualify for the match and take it with you when you leave the job. There might be waiting periods before you are eligible for a 401 match and vesting schedules that prevent you from keeping the match if you dont stay at that job for a specific period of time.

How Does 401 Matching Work?

Some companies contribute to a 401 plan on behalf of employees regardless of whether the worker saves in the plan, while other firms offer to make a contribution to the 401 plan only if the employee also saves some of his or her own money in the plan. The exact amount of a 401 match varies by employer, but it is often 50 cents or $1 for each dollar the employee contributes. There is also often a cap on the amount the employer will match, such as 6% of pay. A 401 match does not count against the employees 401 contribution limit for tax deduction purposes, but it is subject to a different IRS annual limit.

Heres how to take advantage of 401 matching contributions:

Find a job with a good 401 match.

Set up automatic 401 withholding.

Watch out for 401 waiting periods.

Follow the 401 match rules.

Dont stick with the 401 default contribution.

Pay attention to the 401 vesting schedule.

Find a Job With a Good 401 Match

Set Up Automatic 401 Withholding

Watch Out for 401 Waiting Periods

Follow the 401 Match Rules

919308.1.0

You May Like: How To Take Out 401k Without Penalty

Roper St Francis Healthcare Retirement Plan

Whether your retirement is five or 50 years away, the Roper St. Francis Healthcare 403 retirement plan is a valuable teammate benefit and one of the most powerful ways to enhance your long-term financial well-being. We encourage you to invest in yourself and your future by participating in this plan through Fidelity Investments.

Your retirement savings plan is an important benefit, so you need the right information, resources, and support to help you make decisions with confidence. With more than 65 years of financial services experience, Fidelity can help you put a plan in place that balances the needs of your life today with your retirement vision for tomorrow.

How Do I Contact Fidelity Investments?

For service needs in addition to your RSFH Retirement Plan, stop by one of the Fidelity Investor Centers. To find the Investor Center nearest you, visit www.fidelity.com/branches/branch-locations.

How Do I Log-In To My Online Retirement Account?

If you already have a username and password with Fidelity, you can use your existing login information.

Why Save in the Roper St. Francis Healthcare Retirement Plan?

Who Is Eligible to Participate in the Retirement Plan?

Looking for More Ways to Boost Your Retirement Savings?

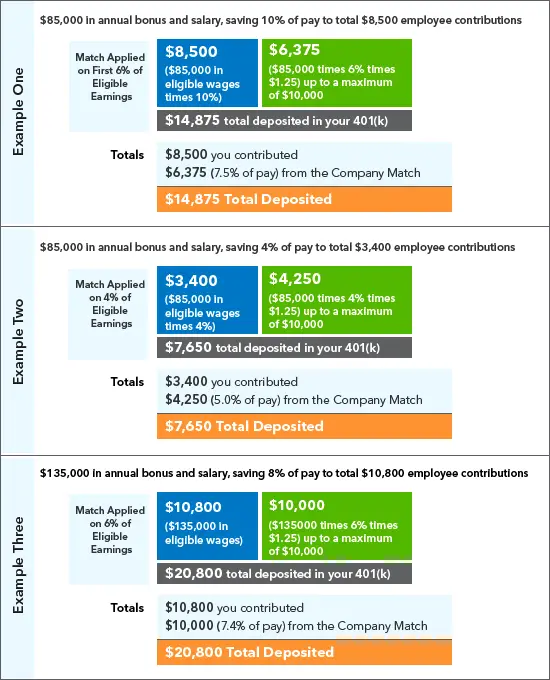

Here are just a few examples: *

How Do I Update My Name or Address on My Fidelity Investments Account?

How Do I Change My Investments?

How Much You Can Afford To Contribute

Despite contribution limits, often times employees will contribute what they can afford to set aside for retirement. Financial experts generally recommend that everyone contribute 10% of their paycheck to a 401, but this may not be doable for all. Plus, often times we think about other ways well need to use that money now.

Your life expenses can play a role in how much of your paycheck you feel comfortable contributing to your 401. If you tend to have high monthly costs or someone who relies on your financial support, you may feel like contributing a higher percentage to your 401 may mean having less in your paycheck to meet your monthly expenses.

If attempting to max out your 401 means putting yourself in a financially stressful situation, its okay to just contribute what you feel comfortable with.

In this case, a good rule of thumb that still has a profound positive impact on your retirement savings is to contribute just enough to receive the full employer match. So if your employer will match up to 7% of your contributions, only contribute 7% so you can take full advantage of that extra money. Your employer match is essentially free money so you dont want to leave any sitting on the table.

Don’t Miss: How To Find Out How Much Is In My 401k

How To Change Your Tsp Investments

There are three ways to change the way money in your TSP account is invested: investment election, reallocation, and fund transfer. You can complete these transactions by logging in to My Account or by using one of the ThriftLine options. If we have a valid email address for you on file, well send you an email confirmation when you change your TSP investments.

Can I Manage My Own 401

Yes, in the sense that you are often responsible for choosing from the among the investment options offered in your company’s 401 plan. These are usually a selection of mutual funds and ETFs, and may also include company stock. You cannot, however, invest in securities not offered by the plan, which means you cannot usually pick single stocks or bonds.

Recommended Reading: How To Get Your 401k From Walmart

Scale Up Contributions Over Time

Once youve picked your investments, the best thing you can do is leave your account alone and let the contributions build.

In addition to low costs and diversity, consistently investing over time i.e., every paycheck will make the biggest difference in the size of your savings. Low-cost funds are only effective if you continuously invest in them and dont try to time the market, or pull money out when it starts to drop, a recent report from Morningstar says.

Experts also advise increasing your contributions each time you get a raise or bonus by a percentage point or two, helping you reach your goals faster.

Finally, remember that while the stock market has historically increased around 10% per year, thats not guaranteed, and there will be periods when it falls. Experts also expect returns to be lower, around 4%, over the next decade than they have been the previous 10 years.

Still, no one knows what will happen, except that the best course of action is typically to invest in low-cost index funds consistently, over many decades. Do that, and youll be on the path to building real wealth.

Will I Have To Pay Taxes If I Rebalance

No, you can buy and sell investments within your 401 without incurring a tax liability. That is not true of investments held outside of retirement accounts, which are subject to capital gains tax on any profits. 401 accounts are tax-deferred, so you don’t have to pay any taxes on them until you take money out.

Read Also: Can You Move Money From 401k To Roth Ira

Keep Cool And Review Your Asset Allocation For Diversification

Now is the perfect time to consider your risk tolerance.

Asset allocation, diversification and periodic rebalancing are just about the most certain protection strategies for your investments, Rob Williams, managing director of financial planning, retirement income and wealth management at Charles Schwab, told Yahoo Money. Of course, developing a long-term strategic asset allocation plan is key to your ability to retire. But sticking to that plan regardless of market swings or recession periods is even more important.

Your age is a factor here.

If you have 10 years or more before youre ready to start taking distributions, youre probably in a position to ride out the recession and allow time for your stocks to rebound, Lazetta Braxton, a Certified Financial Planner and co-founder of 2050 Wealth Partners, a fee-only financial planning and wealth management firm, told Yahoo Money.

One simple equation many financial planners recommend is the percentage of retirement money you have invested in equities should be 110 minus your age.

Investing in the stock market does come with a dollop of risk. That said, over time youre generally paid back with higher returns than if you had parked the retirement savings in plain vanilla certificates of deposit, money market accounts, and bonds.

How Often Can You Reallocate 401k

Rebalancing How-To Financial planners recommend you rebalance at least once a year and no more than four times a year. One easy way to do it is to pick the same day each year or each quarter, and make that your day to rebalance. By doing this, you will distance yourself from the emotions of the market, Wray said.

Recommended Reading: Does 401k Count As Income

How Do I Change My 401k Contribution Fidelity

Step 2: To change where your future contributions are invested, click on Future Investments. Step 3: To change your current investment mix, click on the appropriate box. Step 4: Follow the prompts. If you prefer, you can make these changes by phone call Fidelity at 1-800-343-0860/V and 1-800-259-9734/TTY.

You May Like: How Do You Find Out About Your 401k

How Do I Start A 401

If you work for a company that offers a 401 plan, contact the human resources or payroll specialist responsible for employee benefits. You’ll likely be asked to create a brokerage account through the brokerage firm your employee has selected to manage your funds. During the setup process, you’ll get to choose how much you want to invest as well as which types of investments you want your 401 funds invested in.

Read Also: Can I Access My 401k If I Lose My Job

Changes To Your Paystub

As a voluntary participant, you may be accustomed to viewing two contributions on your pay stub: your contribution and the U-M match. Your pay stub will display three contributions once you become a compulsory participant. You will continue to see your Retirement contribution displayed under Before-Tax Deductions. However, you will now see two Retirement contributions under the Employer Paid Benefits section of your pay stub. The first is a 5% university contribution because you are a compulsory participant. The second is another 5% university contribution that matches your contribution you voluntarily make. Learn how to read and review retirement savings deductions and U-M contributions on your paycheck.

I Cant Imagine A Better Financial Service

I have been a very happy Fidelity customer for 35 years. I tried the big brokerage companies that offer personal service. What did I find out? They grew rich and I barely broke even, even in booming markets. Fidelity gives me the tools and the information I need to make the best financial decisions. My money has grown exponentially so that I can withdraw funds to pay big bills and still see huge gains to my portfolio. It isnt rocket science. Research the highest yielding funds over the long and short term at the risk level you are comfortable with. Fidelitys research is sooo darn easy that I can find and print off the research in minutes. I rebalance my funds, drop the dogs, invest in some new winners. It really is that easy. Need money transferred to your bank account? Click, click, you are done. Fees are extremely low too. Need help? Call the 800 number and their very knowledgeable Representatives will assist you quickly and cheerfully. Now I am the one making the money, not my broker. I have taught all of my children to invest with Fidelity and they are light years ahead of their peers financially.

You May Like: How To Find Lost 401k

Also Check: How To Find My 401k Contributions

Keep Your Hands Out Of The Cookie Jar

Taking out loans on a 401 or cashing it out altogether is generally a terrible idea, for a number of reasons. Loans from a 401 not only require you to repay yourself with interest, but in many cases, youll also have to halt any contributions until the loan is repaid. That reduces your retirement savings in two ways. Even worse is cashing out a 401, which will incur taxes, plus a 10% early withdrawal penalty.

These mistakes not only bring hefty fees, but raid the very retirement savings that are your precious safety net in your golden years. Dont think of your 401 as a piggy bank thats what savings and brokerage accounts are for. If you switch jobs, dont cash out your 401 instead, roll it over into your new plan or into an individual retirement account.

Investing In You And Your Future

After one year of service American will provide you with an employer contribution to your 401 account. The amount contributed will depend on your workgroup.

Team members with prior service or who transfer to American from one of its wholly owned subsidiaries will have their prior service at the subsidiary credited towards the one-year eligibility requirement and toward the service requirement for vesting full ownership of your 401 account balance.

American will contribute 16% of your eligible compensation to your 401 account up to the IRS limits. Participation is automatic, and you will be eligible for this nonelective company contribution* after completing one year of service.

If you do not have an investment election on file, your nonelective company contributions will be made to the Target Date Fund closest to the year you will turn age 65.

You are always 100% vested in your contributions, the nonelective company contributions and any associated earnings.

*A nonelective company contribution is a contribution to your 401 account that the company makes regardless of whether you are making your own contributions.

Flight Attendants receive a nonelective company contribution*, plus you are eligible to receive matching company contributions based on your eligible compensation. You become eligible to receive the following employer contributions after completing one year of service:

TWU-designated team members

Also Check: Do You Get Your 401k When You Quit

Read Also: How Do I Get A Loan On My 401k