What Is The Maximum 401k Contribution For 2022

That depends on your employer’s plan. The maximum the IRS allows for 2022 rose by $1,000 from last year. Currently, the cap sits at $20,500, but your employer may cap the amount below that. For people over 50, the maximum increases to help them “catch up” before their retirement. They can contribute an additional $6,500 a year.

What Does A 401 Or 403 Plan Offer

- Automatic payroll deductions to help you make saving a habit

- Reduced taxable income, through pre-tax contributions

- Matched contributions, up to a certain percent

- Long-term savings and growth potential across a variety of investment options

If your employer offers a 401 , 403, or a governmental 457 plan with services through Principal®, enroll online now.

Beware 401 Balance Minimums

If your account balance is less than $5,000 and youve left the company, your former employer may require you to move it. In this case, consider rolling it over to your new employers plan or to an IRA.

If your previous 401 has a balance of less than $1,000, your employer has the option to cash out your accounts, according to FINRA.

Always keep track of your hard-earned 401 money and make sure that it is invested or maintained in an account that makes sense for you.

Read Also: How To Opt Out Of 401k Fidelity

How To Find An Old 401 And What To Do With It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

There are billions of dollars sitting unclaimed in ghosted workplace retirement plans. And some of it might be yours if youve ever left a job and forgotten to take your vested retirement savings with you.

But no matter how long the cobwebs have been forming on your old 401, that money is still yours. All you have to do is find it.

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

Read Also: How To View Your 401k

What Banks Work With Moneygram

Its one of the best international money transfer options, especially if you need to quickly get cash to someone far away or in a different country. Whether you have a bank account with Wells Fargo, Chase or Bank of America, you can use MoneyGram with any bank account as long as its located in the United States.

How Do I Log In To My Fidelity Account

You can get to the homepage by clicking on the Fidelity logo in the top left. Here you will be asked to enter the username and password you created. If this is the first time you are logging into your account online, you will need to click on the Register for online access button which is also in the top right hand corner of the homepage.

Also Check: How To Check Your 401k Balance

Convert To An Ira To Keep Contributing

You cannot contribute to a 401 after you leave your job, so if you want to continue adding money to your retirement funds, youll need to roll over your account into an IRA. Previously, you could contribute to a Roth IRA indefinitely but could not contribute to a traditional IRA after age 70½. However, under the new Setting Every Community Up for Retirement Enhancement Act, you can now contribute to a traditional IRA for as long as you like.

Keep in mind that you can only contribute earned income, not gross income, to either type of IRA, so this strategy will only work if you have not retired completely and still earn taxable compensation, such as wages, salaries, commissions, tips, bonuses, or net income from self-employment, as the IRS puts it. You cant contribute money earned from either investments or your Social Security check, though certain types of alimony payments may qualify.

To execute a rollover of your 401, you can ask your plan administrator to distribute your savings directly to a new or existing IRA. Alternatively, you can elect to take the distribution yourself. However, in this case, you must deposit the funds into your IRA within 60 days to avoid paying taxes on the income.

Traditional 401 accounts can be rolled over into either a traditional IRA or a Roth IRA, whereas designated Roth 401 accounts must be rolled over into a Roth IRA.

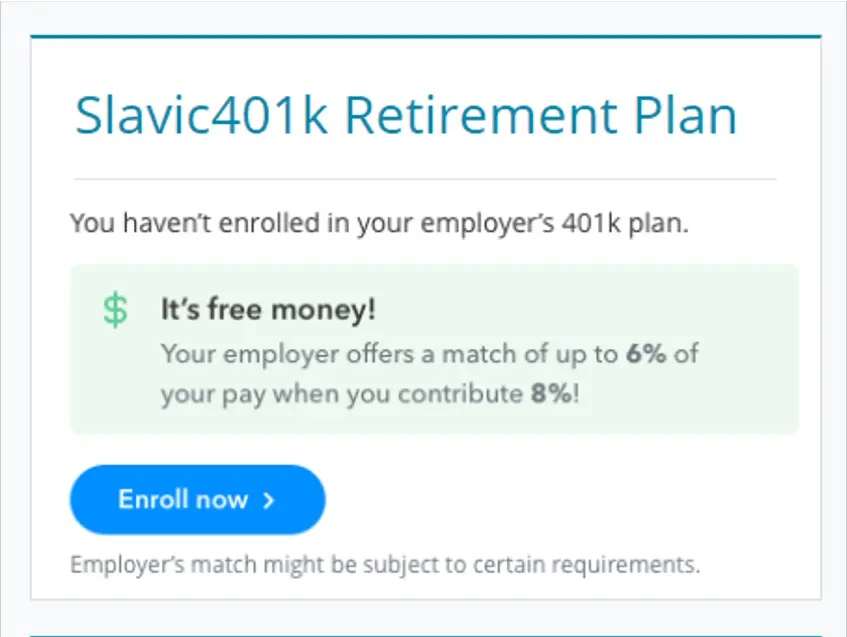

How Do You Get A 401

401 plans are only offered by employers if you dont have access to a 401 at your workplace, you cant participate in one. Talk to your human resources department to find out whether your company offers a 401 plan and, if so, how you can join.

If your company doesnt offer a 401, that doesnt mean you cant reap 401-style retirement and tax benefits. You can still open an IRA on your own. IRAs offer the same opportunity to save for retirement with tax advantages.

You May Like: How To Withdraw Money From My Fidelity 401k

Roll Your Money To An Ira

Transfer your money into an Individual Retirement Account .

- Your savings stay invested, with similar tax advantages

- You have access to a wide range of investment options

- You can roll in retirement savings from other jobs

- You can keep contributing money to the account

- Loans aren’t allowed, but you may be able to withdraw money before you retire under certain circumstances

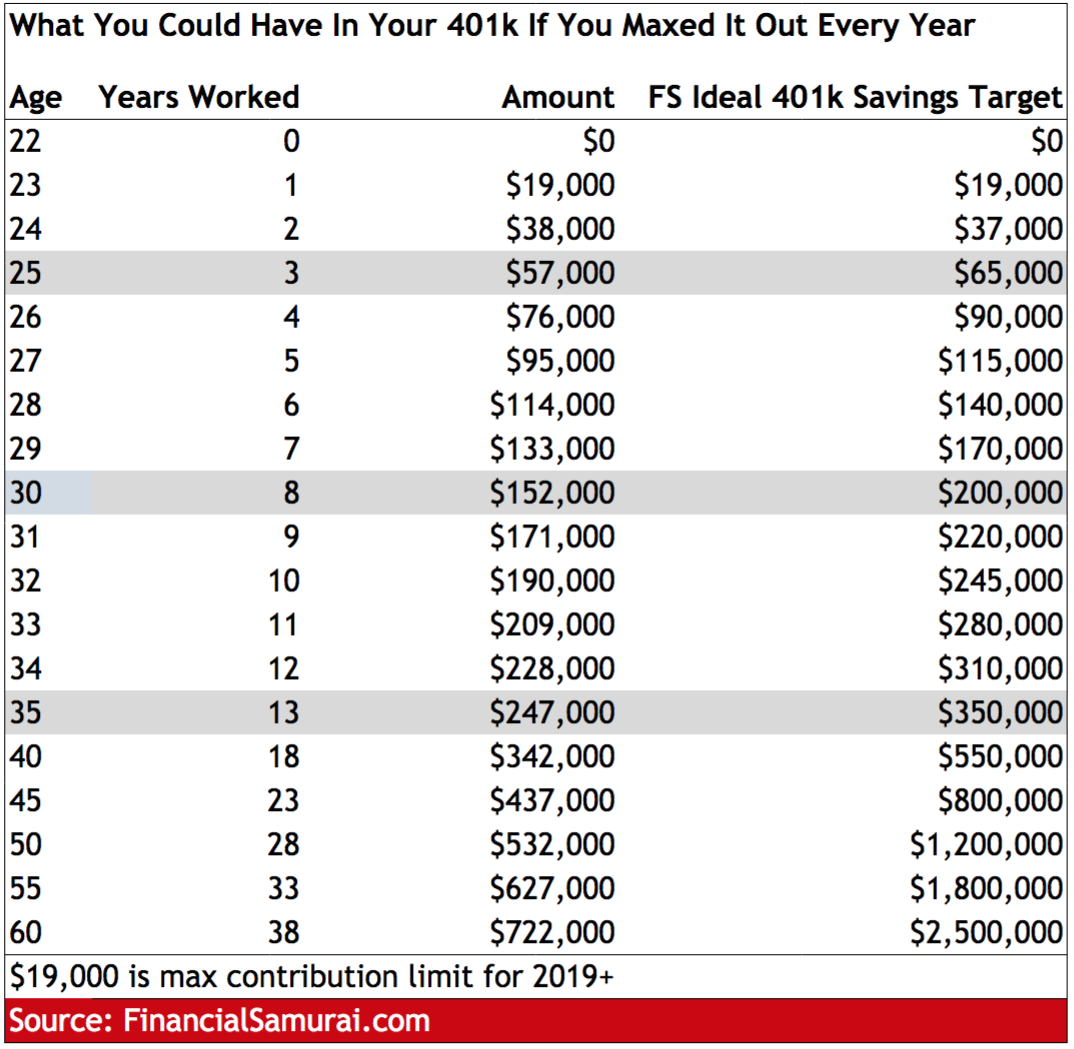

How Much Should I Be Putting Into My 401k

A piece of general advice from experts is to put all of those funds into your 401k up until your employer’s matching contribution amount.

Where to invest after getting all the benefits of your employers matching funds depends on your individual financial plan. Your community bank or credit union may be the best place to turn for real-life recommendations to meet your long-term goals they should already have a good picture of your finances.

Tip: You should aim for a retirement income of roughly 80% of your current salary.

Read Also: How Do I Transfer My 401k To An Ira

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Option : Transfer The Money From Your Old 401 Plan Into Your New Employers Plan

Moving your old 401 into your new employers qualified retirement plan is also an option when you change jobs. The new plan may have lower fees or investment options that better support your financial goals. Rolling over your old 401 into your new companys plan can also make it easier to track your retirement savings, since youll have everything in one place. Its worthwhile to talk with an Ameriprise advisor who will compare the investments and features of both plans.

Some things to think about if youre considering rolling over a 401 into a new employers plan:

You May Like: How Do I Find Out What’s In My 401k

Adp Is Transforming The Way People Save For Retirement

Every employees vision for retirement is different. Each will have questions to answer and decisions to make. At ADP we provide resources to help them get started and take control of their plan.

From financial education to useful tools like the MyADP Retirement Snapshot®1, we help participants understand how to think about the future and design a path to get there.

We make enrollment easy and provide a dashboard that gives each participant a clear view of their plan. Add targeted messaging that provides important information and employees find themselves both more connected to their plan and able to see the benefits of having it.

Types Of 401s And Retirement Accounts

Investing and saving for retirement is not a straightforward, easy task. There are endless variables such as life stages, personal goals, varying living costs, and different types of investment vehicles that can become overwhelming.

In addition to 401 options, there is a broad range of retirement investment vehicles:

Recommended Reading: What Should I Invest In 401k

Potentially Gain More Investing Options

While leaving money behind in a former employers 401 might be the easiest thing to do, its not always the best option. One of the main benefits of a 401 plan is an employer match if the company offers one.

Once you leave a job where you have a 401, you no longer receive the companys contribution or match. 401 plans tend to have high fees, limited investment options, and strict withdrawal rules. If the old 401 was rolled over to a different vehicle like a traditional or Roth IRA, you may have more control over the investment strategy.

What Is The Difference Between A Traditional And Roth 401 Plan

There are two common kinds of 401 plans: traditional and Roth. These plans have some similarities: They are subject to the same annual contribution limit and may offer the same investment options. However, traditional and Roth 401 plans differ in terms of the tax benefits they offer.

|

Traditional |

|

|

Subject to income tax |

Tax-free after age 59 ½* |

*Only if the distribution satisfies certain conditions, for example that it has been at least five years since the first Roth contribution, or that the participant is disabled.

IRS.gov. Data as of Dec. 2020.

A traditional 401 plan is sometimes referred to as a pre-tax 401 plan. You contribute to the plan with before-tax dollars. Because you dont pay taxes on the money you put into the plan, you must pay taxes when you withdraw it. This structure could be an advantage if youre in a high tax bracket today but expect to be in a lower one when retired.

With a Roth 401 plan, the opposite is true. You save after-tax dollars in the account. Because youve already paid taxes on what youre saving, your withdrawals are considered qualified distributions and wont be taxed as long as you meet both of the following criteria:

- Youve had the account for at least five years.

- You begin to make withdrawals either after youve turned 59½ or due to disability.

You May Like: What Can I Use My 401k For

What To Do When You Find Your Old 401 Plan

If find your lost 401, congratulations! However, its not time to celebrate by blowing it all on a fancy vacation or a shopping spree. You invested that money to build a retirement nest egg and thats exactly where those funds should stay.

To invest your old 401, you can do whats known as a rollover to avoid early withdrawal penalties. You can roll over the funds into an individual retirement account or into another retirement plan, such as your current employers 401.

In both cases, you can avoid withholding taxes if you roll over the funds directly via the plan administrator. If a distribution is made directly to you, you have 60 days to deposit it into your new retirement account in order to avoid taxes and penalties.

Check The National Registry Of Unclaimed Retirement Benefits

The National Registry is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

It is essentially a search engine of lost 401 plans.

The only thing you need to search the database is your social security number. No additional information is needed, and there is no cost to search the database.

Recommended Reading: How Do I Find My 401k

How To Set Up A 401k For A Small Business

Setting up a 401 for your small business includes some crucial steps, some of which can be outsourced. It’s important to remember that the employer maintains a fiduciary duty to ensure that the plan is providing a benefit to participants. The U.S. Department of Labor provides in-depth details of the process:

1. Create a 401 plan document

Create a plan document that complies with IRS Code and outlines the details of your retirement plan. Set up procedures to ensure the document is followed.

2. Set up a trust to hold the plan assets

A plan’s assets must be held in trust to assure its assets are used solely to benefit the participants and their beneficiaries. At least one trustee must handle the plan’s activities regarding contributions, plan investments, and distributions. Given that these decisions affect the plan’s financial integrity, selecting a trustee is a critically important decision. Another fiduciary, such as the employer who sponsors the qualified retirement plan, will generally assign the trustee.

3. Maintain records of 401 employee contributions and values

Maintain accurate records that track employee contributions and current plan values. Many small businesses choose to work with a 401 recordkeeper to help them manage plan setup and ongoing record management.

4. Provide information to plan participants

How To Open A 401k Without An Employer

How do you open a 401 account without an employer plan? Many companies donât offer a 401. But there are many alternatives to save for retirement.

The 401 retirement plan is the most common way in which Americans save for retirement. However, according to a study by the US Census Bureau, only 14% of US employers offer a 401 through their company. That still results in over 70% of Americans contributing to a 401 plan. But if you find yourself working for a company that doesn’t offer a 401 plan, you might not know how to open a 401 without an employer plan.

If your company doesnât offer a 401 plan or you are self-employed, youâll need to join a separate financial institution. There youâll be able to open a 401, IRA, or any other retirement plan you choose.

In addition to these alternatives to 401s, you’ll want to rollover your old 401s to these accounts. Consolidating your 401s will help keep your retirement properly managed and accounted for.

Read Also: Is There A Maximum You Can Contribute To A 401k

Are There Other Kinds Of Retirement Accounts

401k and IRAs are the two main retirement accounts. There are a couple of other types available to small business owners or the self-employed: SEP IRAs and Simple IRAs.

Simple IRAs are ideal for small business owners with a handful of employees who want to set up retirement accounts for those employees.

Other Alternatives To Taking A Hardship Withdrawal Or Loan From Your 401

- Temporarily stop contributing to your employers 401 to free up some additional cash each pay period. Be sure to start contributing again as soon as you can, since foregoing the employer match can be extremely costly in the long run.

- Transfer higher interest rate credit card balances to a lower rate card to free up some cash or take advantage of a new credit card offer with a low interest rate for purchases .

- Take out a home equity line of credit, home equity loan or personal loan.

- Borrow from your whole life or universal life insurance policy some permanent life insurance policies allow you to access funds on a tax-advantaged basis through a loan or withdrawal, generally taken after your first policy anniversary.

- Take on a second job to temporarily increase cash flow or tap into family or community resources, such as a non-profit credit counseling service, if debt is a big issue.

- Downsize to reduce expenses, get a roommate and/or sell unneeded items.

Recommended Reading: Can You Withdraw From Your 401k