Should You Roll Over Your 401

To start, its worth knowing that you dont have to make a 401-to-IRA rollover, even if you do leave your job. You have the option of leaving the money youve invested in the plan at your old company. You cant keep contributing to it, but it will stay invested and if your investments go up, youll continue to see your account grow. This is called an orphan account.

Do you like the way your money is invested currently? If so, you may want to consider keeping your money in the existing plan. If you currently arent working but anticipate taking a new job soon, you could leave your money at your old plan temporarily and put it into your new companys plan once you have access to it.

For those who dont think theyll end up in another 401 plan but still want to save more for retirement, it might make sense to do a 401-to-IRA rollover. Remember, even though you still have your account at your old companys 401, you wont have the ability to make more contributions.

Whats The Difference Between A Rollover And An Asset Transfer

The main difference between a rollover and an asset transfer is where the money is held before its moved to Vanguard. If youre moving money to Vanguard from:

- An employer-sponsored plan, such as a 401 or 403, you can initiate a rollovertypically, when you change jobs or retire. When you roll over retirement plan assets, youre moving them from a group plan into an IRA .

- An IRA at another financial institution, you can initiate an asset transfer, tax-free. You can also transfer securities held in a brokerage IRA at another financial institution into a Vanguard Brokerage IRA.

Also Check: How To Get My 401k

What If I Have Employer Stock In My Employer

You can choose to roll company stock into an IRA or a taxable brokerage account. If you decide to roll the stock to an IRA, its full value will be taxed as income at your regular rate if you move the stock to a taxable brokerage account, you might be able to save money by paying capital gains taxes on the difference between the stocks value and the price you paid for it. There are tax benefits to each, so consult your tax advisor and ask about the net unrealized appreciation strategy.

You May Like: When Leaving A Company What To Do With 401k

You Might Want A Roth Account

If your 401 plan doesnt provide a Roth 401 option, you might choose to roll your retirement savings into a Roth IRA. Advantages of a 401-to-Roth IRA rollover include:

Avoiding Roth IRA income restrictions. Even if your annual income is above the thresholds for Roth IRA contributions, youre still allowed to roll your 401 savings into a Roth IRA. This move is commonly referred to as a backdoor Roth IRA conversion, and it can grant you the benefits of tax-free withdrawals in retirement.

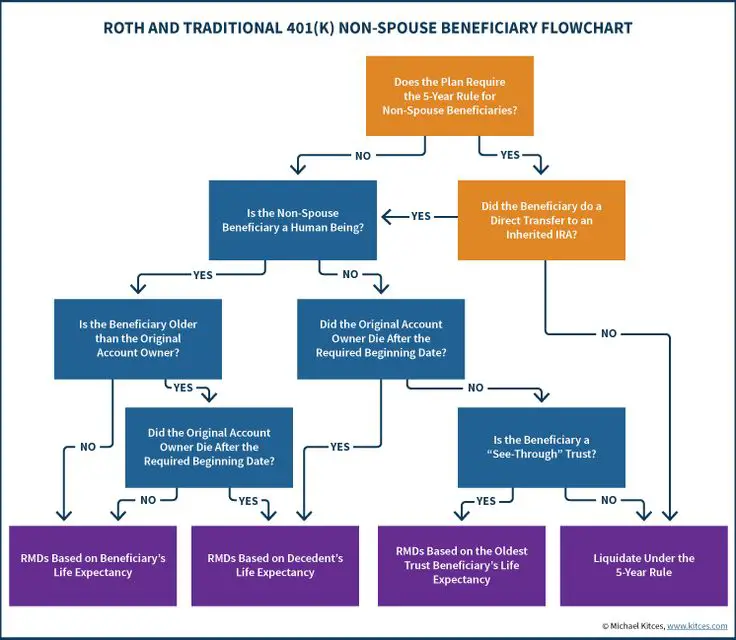

No required minimum distributions . With a 401or even a traditional IRAyoure subject to RMDs, or the mandated annual withdrawals from your retirement savings once you reach age 72. Roth IRAs are free of RMDs, providing you with more control over your retirement savings.

Tax-free withdrawals in retirement. When you roll over a traditional 401 into a Roth IRA, youll probably end up paying some taxes on the amount youre converting. But these taxes may be less than what youd pay if you took regular withdrawals from a traditional 401 in retirement.

Access to additional death benefits. Because there are no lifetime distribution requirements, you can pass down your Roth IRA to your heirsalthough beneficiaries need to draw down the account within 10 years.

Henderson cautions that you must be aware of the immediate tax consequences when you roll your money from a 401 to a Roth account, however.

What To Consider Before A Pension Rollover To An Ira

According to the IRS, you can roll over a qualified pension plan to any type of retirement account. But, even if your rollover meets the considerations of being a qualified plan and if you are leaving the company or the company is closing its pension plan, there are other factors you should consider when deciding whether to roll over your pension plan to an IRA.

First, you generally have a wider variety of investment options in an IRA than in a company pension plan. You can choose your own investments, taking into consideration your individual risk tolerance, investment goals and time horizon. Types of investments would include stocks, bonds and mutual funds, but youre not limited to just those.

When do you plan to retire? Under a company pension plan, you can take a distribution from your retirement account at age 55. If you do a pension rollover to an IRA, you will have to wait until you are 59.5 to take a penalty-free distribution. The penalty is 10% if you take a distribution before 59.5. There are exceptions to this rule. If you have qualified education expenses, medical expenses or if you are a first-time homebuyer, you may be able to make a withdrawal without a penalty

You can avoid paying taxes on the rollover if your pension is going to a traditional IRA. You only pay taxes when you make a withdrawal if the withdrawal is going to the traditional IRA. This is different for a Roth IRA. If you set up a Roth IRA, you pay taxes when the pension is rolled over.

You May Like: Who Offers Roth Solo 401k

What’s The Difference Between A Rollover And An Asset Transfer

The main difference between a rollover and an asset transfer is where the money is held before it’s moved to Vanguard. If you’re moving money to Vanguard from:

- An employer-sponsored plan, such as a 401 or 403, you can initiate a rollovertypically, when you change jobs or retire. When you roll over retirement plan assets, you’re moving them from a group plan into an IRA .

- An IRA at another financial institution, you can initiate an asset transfer, tax-free. You can also transfer securities held in a brokerage IRA at another financial institution into a Vanguard Brokerage IRA.

What Is A Qualified Charitable Distribution

Generally, a qualified charitable distribution is an otherwise taxable distribution from an IRA owned by an individual who is age 70½ or over that is paid directly from the IRA to a qualified charity. See Publication 590-B, Distributions from Individual Retirement Arrangements for additional information.

You May Like: How To Avoid Penalty On 401k Withdrawal

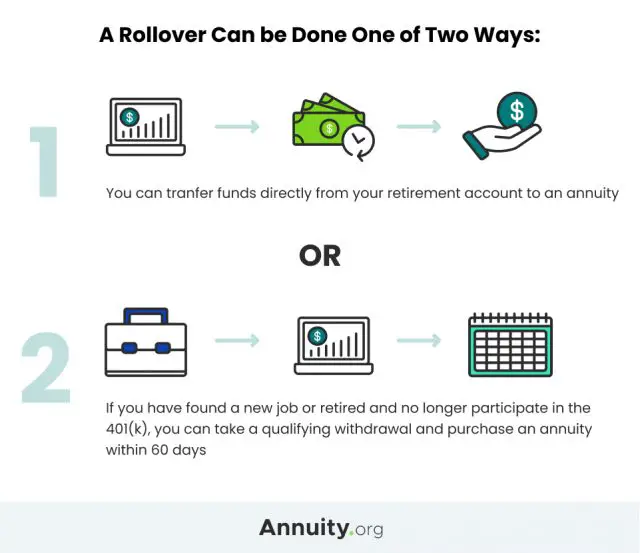

Direct Vs Indirect Rollovers

A direct rollover is when your money is transferred electronically from one account to another, or the plan administrator may cut you a check made out to your account, which you deposit. The direct rollover is the best approach.

In an indirect rollover, the funds come to you to re-deposit. If you take the money in cash instead of transferring it directly to the new account, you have only 60 days to deposit the funds into a new plan. If you miss the deadline, you will be subject to withholding taxes and penalties. Some people do an indirect rollover if they want to take a 60-day loan from their retirement account.

Because of this deadline, direct rollovers are strongly recommended. In many cases, you can shift assets directly from one custodian to another, without selling anything. This is known as a trustee-to-trustee or in-kind transfer.

Otherwise, the IRS makes your previous employer withhold 20% of your funds if you receive a check made out to you. It’s important to note that if you have the check made out directly to you, taxes will be withheld, and you’ll need to come up with other funds to roll over the full amount of your distribution within 60 days.

To learn more about the safest ways to do IRA rollovers and transfers, download IRS publications 575 and 590-A and 590-B.

When Leaving Your Job You Can Typically Cash Out Your 401 Or Roll It Over Into A Different Retirement Account

Both a 401 and IRA are tax-advantaged retirement accounts, but they work differently. 401s are sponsored by employers and often offer limited investment options. IRAs aren’t linked to employment. They can be opened with any brokerage firm or other financial institutions and have a wider variety of investment selections, but require more hands-on management.

Because 401s are offered through employers, you’ll need to determine what to do with yours when you leave your job. Your options include:

- Leave it invested

- Rollover to a new 401

- Rollover to an IRA

There are plenty of pros and cons to these options, but let’s take a close look at when rolling your workplace 401 into an IRA may make sense for you.

Also Check: Can I Transfer Roth 401k To Roth Ira

Can You Transfer A 401 To An Ira While Youre Still Employed

Written by John Rothans

Thousands of Americans wonder the same thing: Can I transfer my 401 to an IRA if Im still with my current employer? Yes, theres a good chance you can.

While most people think about transferring their 401 after they leave a job, its actually something you might be able to do while youre still in that joband doing so could offer some attractive asset options. Learn when it makes sense to roll some of your 401 into an IRA while still employed, along with the advantages.

Fund Selection And Fees

Ideally, you want low-cost fund options with no administrative fees. Consider the choices available with different brokerages to minimize the administrative or brokerage fees you may pay.

When it comes to fund selection, the sheer volume of choices can feel overwhelming. Beginner or hands-off investors may benefit from target date funds or robo-advisors that manage retirement funds for you based on your risk profile.

If you prefer to manage investment choices on your own, most advisors recommend beginners start with a simple portfolio of a broad U.S. stock index fund, a broad international stock fund and a U.S. bond fund. For more on how to invest for retirement, check out our guide.

Also Check: How Can I Apply For 401k

When Does A Roth Conversion Make Sense

A Roth conversion, which happens when you roll over money from a traditional 401 into a Roth IRA, comes with good news and bad news.

The good news is that from now on, that money will grow inside your Roth IRA tax-free and you wont pay any taxes on that money when youre ready to withdraw from the account in retirement.

But when you transfer that pretax money from your traditional 401 into a Roth IRA, which is funded with after-tax dollars, youll have to pay taxes on that money now. Thats the bad news.

A Roth conversion might feel like ripping off a Band-Aid now, but itll feel great once you retire. You might want to seriously consider a Roth conversion only if you can afford to pay the tax bill with cash you have saved up. But be careful, because a conversion could add thousands of dollars to your tax bill. If thats just too much for you to stomach, then stick with a traditional IRA rollover.

You May Like: What Does It Mean To Roll Over Your 401k

Current Situation And Future Goals

If youre happy with your company and dont have plans to leave, rolling over your 401k probably isnt a good option. Only if youre getting ready to change companies or retire should you consider a rollover. Similarly, if youre happy with your 401k, theres little need to perform a rollover, even if you do leave your company.

If you are planning to retire shortly, a rollover might not be necessary, as youll probably begin taking distributions. If youre not retiring for some time, though, a rollover can make investing simpler by consolidating your savings.

Read Also: How To Know If You Have A 401k

Should You Roll Over Your 401 Into Another 401

There are some situations that might make an IRA rollover the wrong move for you. Heres what to consider before completing a 401 rollover.

Retirement account protection. In general, 401 accounts offer better protections from creditors than IRAs.

Rule of 55. With a 401, you can actually start withdrawing funds at age 55 penalty-free if you leave your job. You dont have that advantage when you roll your 401 to an IRA, though you can emulate it by taking subsequently equal periodic payments from your IRA

Performance. If you like your current plan, and its performing well, theres no reason to complete a rollover.

You can always choose to roll your old 401 balance into your new employers 401 plan. If you value the simplicity of having everything in one place, you like the features of the plan at your new job or you want to maintain the legal protections of a 401, it may make more sense to roll your old 401 into a new 401.

How Do I Report My Us Investments On My T1135

Generally speaking Canadian taxpayers have 2 options when filing form T1135 to report foreign assets, the simplified method and the detailed method. The simplified method of reporting US investments , which would only be available to taxpayers with US investments in Canadian brokerage account is not available to Canadian taxpayers with US investments with US brokers.

Also Check: How Much Do I Need In My 401k To Retire

Read Also: Does Fidelity Offer Solo 401k

Start The Process Early

If you feel that a 401k rollover might be a good choice in your future, start the process as early as possible. Open an IRA and let your plan administrator know what youre thinking of doing. Once the process has started, dont wait to complete it. Instead, make sure the funds are transferred as soon as possible so theyre in your new IRA well before the 60-day deadline.

Transfer Of An Ira To An Rrsp

Under Canadian tax law, an IRA is considered to be a foreign retirement arrangement. The rules and consequences for transferring an IRA to an RRSP are very similar to the 401 plan transfer rules. One important distinction, however, involves the concept of an eligible amount. For the purpose of transferring an amount from an IRA to an RRSP, an eligible amount is an amount included in income, received as a lump sum, and derived from contributions made to the plan by either you or your spouse or former spouse. Any contributions made to the plan by your employer wouldnt qualify as an eligible amount and consequently wouldnt be eligible to be transferred to an RRSP and deducted from your income.

It should also be noted that theres no requirement for you to be a non-resident for your IRA contributions to be considered as an eligible amount. As was the case with the transfer from the 401 plan to an RRSP, the taxable amount transferred from an IRA to an RRSP will be subject to withholding taxes that will be eligible for the foreign tax credit or similar deduction when filing your Canadian income tax return. Similarly, the early withdrawal tax is eligible for purposes of computing your foreign tax credit.

Don’t Miss: How To Take Out From Your 401k

How Does A Roth Ira Grow

A Roth IRA grows like every other investment accountthrough the magic of compounding. Your contributions in a Roth IRA are invested to earn interest and that interest helps to increase your overall portfolio balance, thereby helping earn more interest. The more time your money has in the market, the better the opportunity for greater returns over time. The money in a Roth IRA can continue to grow even after you stop making contributions as the ongoing returns continue to add to the balance and get reinvested. The financial institutions reviewed for this article all provide resources and guidance on diversifying a portfolio to ensure the right balance of risk and reward to intelligently grow your retirement savings in a Roth IRA.

Also Check: Do I Need To Rollover My 401k To New Employer

How To Roll Over A 401 To An Ira In 4 Steps

If you decide to do a 401 rollover to an IRA, typically the money from an old 401 must go into the new IRA account within 60 days. There are four steps to do a 401 rollover into an IRA.

Choose which type of IRA account to open

Open your new IRA account

Ask your 401 plan for a direct rollover or remember the 60-day rule

Choose your investments

Donât Miss: How To Diversify 401k Portfolio

Read Also: How Much Should I Have In My 401k At 60

What Happens If I Dont Make Any Election Regarding My Retirement Plan Distribution

The plan administrator must give you a written explanation of your rollover options for the distribution, including your right to have the distribution transferred directly to another retirement plan or to an IRA.

If youre no longer employed by the employer maintaining your retirement plan and your plan account is between $1,000 and $5,000, the plan administrator may deposit the money into an IRA in your name if you dont elect to receive the money or roll it over. If your plan account is $1,000 or less, the plan administrator may pay it to you, less, in most cases, 20% income tax withholding, without your consent. You can still roll over the distribution within 60 days.

Reasons Why You Might Roll Over Your 401 To An Ira

There are five main reasons why you might consider a 401 to IRA Rollover once you have moved from your previous employer. They include the following:

- To have more investment options.

- To consolidate multiple retirement accounts and better manage your investments.

- To prevent complexities for beneficiaries.

- To ensure your investments are actively managed and not frozen.

- To provide estate planning benefits.

IMPROVE INVESTMENT OPTIONS

You might rollover your 401 because you find that the investment options with your 401 are limited. For example, the options to take the money out of company plans for beneficiaries may be more limited with a 401. Speak to the plan administrator before you make any decisions.

CONSOLIDATE INVESTMENT ACCOUNTS

If you live in Canada and still have your 401 in the US, you may consider rolling over your 401 to consolidate your accounts rather than having multiple 401s from previous employers. By consolidating your accounts, you have fewer account statements to keep track of and fewer beneficiary forms to update. It can be much easier to manage and rebalance investments when youve consolidated your accounts.

REDUCE COMPLEXITY FOR BENEFICIARIES

Doing this will also reduce the complexity for beneficiaries when you pass. Imagine how difficult it would be for your children or other beneficiaries to figure out which accounts are active from multiple employer-sponsored retirement plans.

ENSURE YOUR ACCOUNTS ARE ACTIVELY MANAGED

PROVIDE ESTATE PLANNING BENEFITS

You May Like: How Do I Locate My 401k